France Immunoassay Market Size, Share, Trends, Industry Analysis Report

By Product (Reagents & Kits, Analyzers/Instruments), By Technology, By Specimen, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6161

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

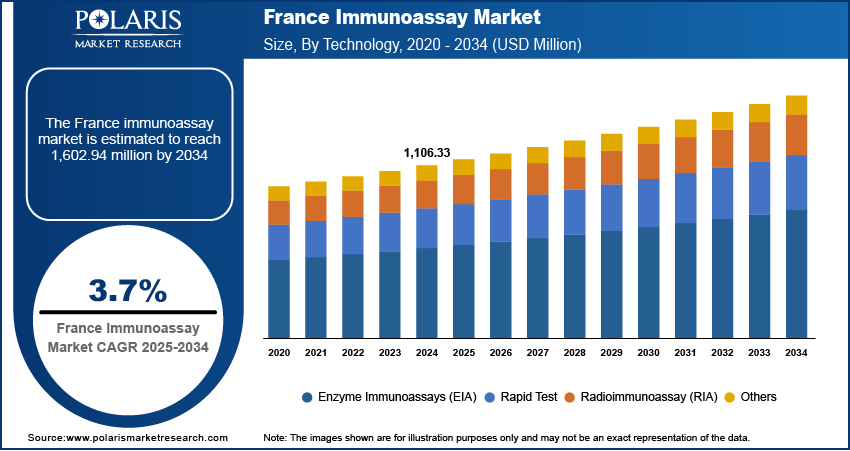

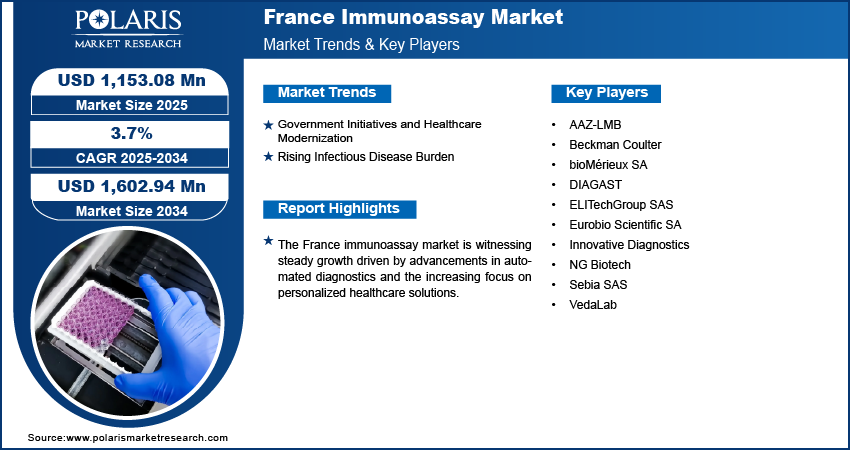

The France immunoassay market size was valued at USD 1,106.33 million in 2024, growing at a CAGR of 3.7% from 2025 to 2034. Key drivers of market growth include rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders; government-led healthcare modernization; and the increasing burden of infectious diseases.

Key Insights

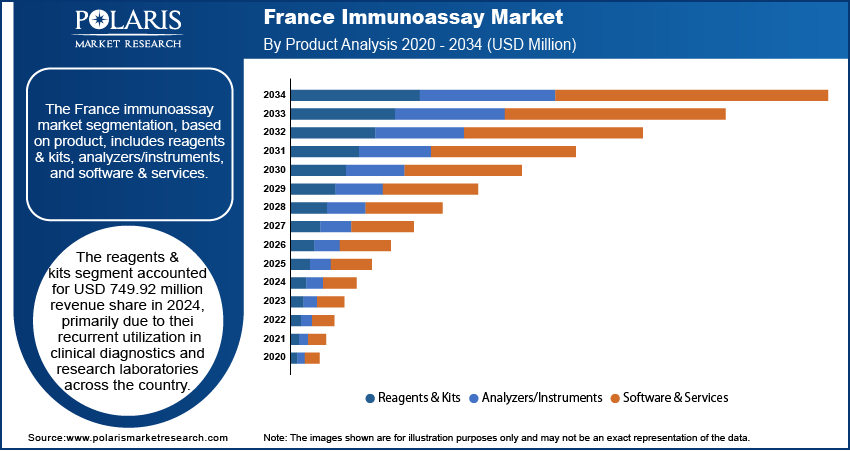

- The reagents & kits segment accounted for USD 749.92 million revenue share in 2024, primarily due to their recurrent utilization in clinical diagnostics and research laboratories across the country.

- The rapid test segment is projected to register a CAGR of 3.3% during the forecast period, supported by the country’s increasing focus on decentralized diagnostics and preventive healthcare strategies, especially in light of the country’s aging population and rising healthcare demands outside traditional hospital environments.

Industry Dynamics

- France's healthcare infrastructure upgrades and equitable access programs are driving the integration of immunoassays in labs nationwide.

- Recurrent outbreaks highlight the need for high-sensitivity assays to facilitate timely clinical decision-making.

- Strict EU regulations and lengthy reimbursement processes delay product commercialization, increasing costs for manufacturers and limiting the rapid market entry of innovative immunoassays.

- France’s lab modernization plan creates demand for automated, high-throughput immunoassay systems, particularly for infectious disease and oncology testing in decentralized environments.

Market Statistics

- 2024 Market Size: USD 1,106.33 Million

- 2034 Projected Market Size: USD 1,602.94 Million

- CAGR (2025–2034): 3.7%

To Understand More About this Research: Request a Free Sample Report

Immunoassay is a biochemical technique used to detect or quantify specific proteins, hormones, or pathogens by leveraging the binding specificity of antibodies. In France, the growing reliance on immunoassay-based diagnostics reflects a broader shift toward early disease detection and personalized healthcare. The market is driven by the rising incidence of chronic conditions such as cancer, diabetes, and autoimmune disorders. For instance, the International Diabetes Federation reported 4.1 million adults (20–79 years) in France were diabetic in 2024. These diseases often require regular monitoring of biomarkers and immune responses, making immunoassays essential tools in both initial diagnosis and ongoing disease management. The demand for accurate, sensitive, and high-throughput immunoassay platforms has grown steadily across hospital laboratories and specialized diagnostic centers as healthcare systems aim to reduce long-term treatment costs through early intervention.

Drivers & Opportunities

Government Initiatives and Healthcare Modernization: Government-led initiatives and ongoing efforts to modernize healthcare infrastructure are driving the expansion opportunities. The country’s focus on improving diagnostic accuracy, enhancing laboratory capabilities, and ensuring equitable access to healthcare services has created a strong foundation for the adoption of advanced immunoassay technologies. Public health strategies increasingly emphasize preventive care, early detection, and digital integration, all of which align well with the capabilities of immunoassay platforms. Investments in upgrading diagnostic laboratories, expanding automation, and integrating electronic health records have streamlined testing workflows, thereby increasing the efficiency and scalability of immunoassay applications. A 2025 WHO report stated that AIS allocated USD 185 million in 2024 to preventive health innovations, prioritizing digital and AI-driven solutions for elderly care, chronic disease management, and mental health. These government-backed improvements continue to support the widespread adoption of immunoassays across public and private healthcare sectors.

Rising Infectious Disease Burden: The growing burden of infectious diseases in France propels the need for rapid, sensitive, and scalable diagnostic solutions, driving demand for immunoassays. Outbreaks of viral, bacterial, and respiratory infections have reinforced the importance of early detection and timely clinical response, both of which immunoassay technologies effectively address. According to a December 2024 NLM report, France recorded 4,074 dengue cases in 2024. These tests enable quick identification of disease-specific antigens or antibodies, allowing for prompt treatment decisions and better disease containment. Additionally, immunoassays play a crucial role in epidemiological surveillance and high-throughput screening programs, supporting national efforts to monitor and control infectious threats. Therefore, as new and re-emerging pathogens continue to pose public health challenges, the role of immunoassays in diagnostic workflows becomes increasingly critical across France’s healthcare ecosystem.

Segmental Insights

Product Analysis

Based on product, the France immunoassay market segmentation includes reagents & kits, analyzers/instruments, and software & services. The reagents & kits segment accounted for USD 749.92 million revenue share in 2024, primarily due to their recurrent utilization in clinical diagnostics and research laboratories across the country. These consumables are essential for conducting various immunoassay methodologies, such as ELISA, chemiluminescent immunoassays, and lateral flow tests. The growing prevalence of infectious and chronic diseases such as diabetes, cardiovascular conditions, and respiratory infections in France continues to drive routine diagnostic testing, reinforcing the consistent demand for reagents and kits. Furthermore, the development of advanced reagent chemistries and the introduction of disease-specific diagnostic kits tailored to France’s epidemiological profile have strengthened their indispensability in routine laboratory operations.

Technology Analysis

In terms of technology, the France immunoassay market segmentation includes enzyme immunoassays (EIA), rapid test, radioimmunoassay (RIA), and others. The rapid test segment is projected to register a CAGR of 3.3% during the forecast period, supported by France’s increasing focus on decentralized diagnostics and preventive healthcare strategies, especially in light of the country’s aging population and rising healthcare demands outside traditional hospital environments. Rapid immunoassays offer simplified workflows, require minimal infrastructure, and deliver near-instantaneous results, making them highly suitable for point-of-care testing in general practice clinics, eldercare facilities, and emergency medical situations. The adoption of rapid diagnostic technologies is expected to increase steadily across both urban and rural healthcare networks as healthcare systems in France aim for more accessible and patient-centric testing approaches.

Key Players & Competitive Analysis

The France immunoassay market is being transformed by strategic investments from companies, working alongside agile small and medium-sized enterprises that specialize in targeted diagnostic solutions. The industry is advancing through forward-looking development strategies that prioritize automation and AI-enhanced platforms, especially for managing chronic diseases, while simultaneously facing hurdles from economic uncertainties and strict EU regulatory requirements that challenge market newcomers. Market intelligence indicates a growing emphasis on sustainable supply chains, with increased focus on domestic reagent manufacturing to ensure stability. This evolution is further propelled by strong underlying demand for advanced oncology and infectious disease testing solutions. Leading companies are capitalizing on growth opportunities through strategic collaborations, though they must navigate pricing competition and the continuous need for technological innovation to maintain testing accuracy at scale. Industry experts highlight France's position as an innovation center in immunoassay technology, where breakthrough developments such as digital ELISA systems are expected to revolutionize diagnostic capabilities and set new industry benchmarks.

A few major companies operating in the France immunoassay market include AAZ-LMB, Beckman Coulter, bioMérieux SA, DIAGAST, ELITechGroup SAS, Eurobio Scientific SA, Innovative Diagnostics, NG Biotech, Sebia SAS, and VedaLab.

Key Players

- AAZ-LMB

- Beckman Coulter

- bioMérieux SA

- DIAGAST

- ELITechGroup SAS

- Eurobio Scientific SA

- Innovative Diagnostics

- NG Biotech

- Sebia SAS

- VedaLab

France Immunoassay Industry Developments

April 2025: Tecan Group acquired ELISA immunoassay assets from Revvity's Cisbio Bioassays SAS (France), including manufacturing processes for 2 IVD (specialty diagnostics) and 2 RUO kits, expanding its immunoassay portfolio.

January 2025: BioMérieux announced its acquisition of Norway's SpinChip Diagnostics, developer of a rapid (10-minute) benchtop immunoassay platform for near-patient testing.

France Immunoassay Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Reagents & Kits

- ELISA Reagents & Kits

- Rapid Test Reagents & Kits

- Western Blot Reagents & Kits

- ELISPOT Reagents & Kits

- Other Reagents & Kits

- Analyzers/Instruments

- Open Ended Systems

- Closed Ended Systems

- Software & Services

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Enzyme Immunoassays (EIA)

- Chemiluminescence Immunoassays (CLIA)

- Fluorescence Immunoassays (FIA)

- Rapid Test

- Radioimmunoassay (RIA)

- Others

By Specimen Outlook (Revenue, USD Million, 2020–2034)

- Blood

- Urine

- Saliva

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Infectious Disease Testing

- Cardiology

- Oncology

- Endocrinology

- Autoimmune Diseases

- Therapeutic Drug Monitoring

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Laboratories

- Others

France Immunoassay Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,106.33 Million |

|

Market Size in 2025 |

USD 1,153.08 Million |

|

Revenue Forecast by 2034 |

USD 1,602.94 Million |

|

CAGR |

3.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1,106.33 million in 2024 and is projected to grow to USD 1,602.94 million by 2034.

The market is projected to register a CAGR of 3.7% during the forecast period.

A few of the key players in the market are AAZ-LMB, Beckman Coulter, bioMérieux SA, DIAGAST, ELITechGroup SAS, Eurobio Scientific SA, Innovative Diagnostics, NG Biotech, Sebia SAS, and VedaLab.

The reagents & kits segment accounted for USD 749.92 million revenue share in 2024.

The rapid test segment is projected to register a CAGR of 3.3% during the forecast period.