Fruit and Vegetable Wash Market Share, Size, Trends, Industry Analysis Report

By Product (Liquid & Sprays, Powder, Others), By Type (Synthetic, Natural), By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4265

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

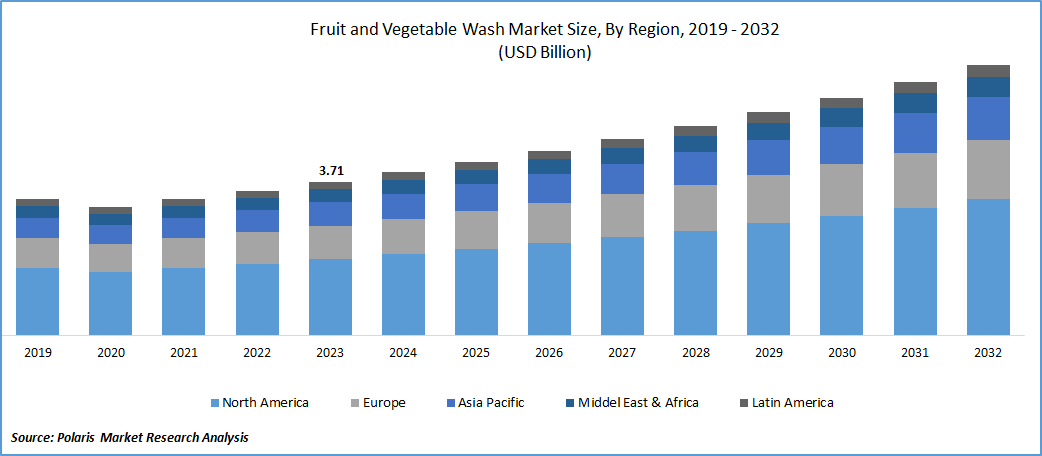

The global fruit and vegetable wash market was valued at USD 3.71 billion in 2023 and is expected to grow at a CAGR of 6.5% during the forecast period.

Factors driving the adoption of fruit & vegetable wash include increasing consumer awareness regarding potential health risks associated with pesticide residues on produce, a growing emphasis on healthy eating habits, and heightened spending on sanitizers and hygiene products due to the COVID-19 outbreak. According to a 2022 survey conducted by the FDA, pesticide residues were found in 77% of domestically grown fruits, 60% of US vegetables, and 53% of US grains sampled.

To Understand More About this Research: Request a Free Sample Report

Consumers, faced with increasingly busy lifestyles, are seeking convenient and user-friendly products. The growing awareness among consumers about the significance of food safety, coupled with rising disposable incomes in developing countries and emerging markets, has prompted manufacturers to innovate and expand into new markets. Marico Limited introduced the new brand Veggie Clean to tap into the vegetable and fruit hygiene category, aligning with heightened consumer awareness and the demand for hygiene products in the Indian market. The availability of the product in various forms such as liquid & spray, powder, wipes, and others is expected to further enhance its adoption globally.

With an increasing number of women joining the workforce and encountering extended working hours and unbalanced work-life demands, the utilization of fruit & vegetable cleaners is expected to rise in the coming years. Furthermore, continuous investments in research and development play a crucial role in the fruit & vegetable wash industry, driving innovation, the development of advanced formulations, and enhanced product performance, thereby shaping market competitiveness, and fostering growth.

Industry Dynamics

Growth Drivers

Increasing Consumer Awareness

Consumers are increasingly choosing organic and natural fruit & vegetable cleaners, driven by apprehensions regarding potential health and environmental hazards linked to synthetic chemicals. Manufacturers are responding to this trend by prioritizing the development of sustainable cleaners crafted from natural, biodegradable ingredients. Furthermore, consumers are expressing a heightened interest in organic food, recognizing its potential benefits and reduced risks. BiOWiSH Fruit & Vegetable Wash, approved for use in certified organic food production and handling, serves as a complement to banana wash process systems and management practices.

Amway India has launched a novel product named Amway Home Fruit & Veggie Wash, featuring naturally-derived cleansing agents that do not leave any harmful residue. The heightened awareness among consumers about food safety and the potential risks linked to consuming contaminated produce has resulted in an increased demand for safer food options.

Report Segmentation

The market is primarily segmented based on product, type, distribution channel, end use, and region.

|

By Product |

By Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Liquid & sprays segment accounted for the largest market share in 2023

Liquid & sprays segment accounted for the largest share. This is attributed to factors such as the high versatility, effectiveness, and convenience provided by liquid & spray products, making them highly favored among both consumers and manufacturers. Liquid and spray cleaners are known for their superior ability to effectively remove dirt, pesticides, and bacteria from fruits and vegetables, surpassing the performance of powdered cleaners.

Powder products segment will grow rapidly. The increasing adoption of powder cleaners for washing fruits and vegetables can be attributed to key benefits such as cost-effectiveness, environmental friendliness, and easy preparation methods. Powder cleaners often come in biodegradable packaging and can be effortlessly mixed with water during the cleaning of fresh produce. For instance, Grow Green Industries, Inc. has introduced eatCleaner fruit and vegetable wash powder, which is laboratory-proven as an all-natural wash capable of eliminating 99.99% of unwanted residues, including wax, germs, and pesticides

By Type Analysis

Synthetic segment held the significant market share in 2023

Synthetic segment held the significant market share. Synthetic cleaners are commonly regarded as highly efficient in eliminating stubborn contaminants, such as bacteria and pesticides, owing to their potent chemical formulations. They are a preferred option for budget-conscious consumers due to their extended shelf life and lower cost compared to natural cleaners. Manufacturers are presently dedicating resources to research and development (R&D) to produce novel and innovative synthetic ingredients capable of effectively cleaning and prolonging the shelf life of fruits and vegetables.

Natural segment is expected to gain substantial growth rate. The rising awareness regarding the potential environmental impacts and residual effects of synthetic chemicals on produce is anticipated to boost the demand for natural and bio-based products. Moreover, natural fruit and vegetable wash market cleaners are gaining popularity among consumers who prioritize eco-friendly and health-conscious options.

By End Use Analysis

Household segment held the significant market share in 2023

Household segment held the significant market share. Modern consumers are increasingly focused on the safety of their food, seeking cleaners that can efficiently eliminate pesticides, bacteria, and other contaminants from their produce. When choosing cleaners, consumers prioritize convenience and ease of use, opting for products that are easy to apply and require minimal effort.

Commercial segment is expected to gain substantial growth rate. Commercial establishments demand cleaners capable of efficiently handling substantial volumes of produce while ensuring consistent performance. Stringent regulatory requirements regarding food handling and storage are anticipated to contribute to the demand for cleaners made from environmentally friendly ingredients. The FDA recommends the cleaning and washing of fruits and vegetables, even if they are organic or purchased at a farmer's market.

Regional Insights

North America dominated the global market in 2023

The region hosts a substantial consumer base that prioritizes products crafted from natural ingredients, driven by concerns regarding potential health and environmental risks associated with synthetic chemicals. Consumers in the region are willing to pay a premium for products made with natural ingredients. The 2023 EWG Shopper's Guide to Pesticides in Produce reveals that nearly 75% of non-organic fresh produce sold in the U.S. contains residues of potentially harmful pesticides, contributing to the growth of the regional industry.

The Asia Pacific will grow with substantial pace. This growth can be attributed to the region's substantial and varied consumer base, rapid urbanization, and rising disposable income, all of which have contributed to an increased demand for fruit and vegetable wash products. To stay competitive and enhance their market presence, companies within the industry are actively expanding their footprint in the region. Moreover, in response to the COVID-19 pandemic, government authorities have encouraged the public to adopt hygiene practices, including the cleaning of fruits and vegetables before consumption, further driving the demand for these products in the market.

Key Market Players & Competitive Insights

The sector features a multitude of well-established players and emerging entrants. Participants in the market are engaging in diversification and expansion of their operations, employing strategies such as product launches and other initiatives to sustain and enhance their market share.

Some of the major players operating in the global market include:

- Procter & Gamble

- ITC

- Wipro

- Grow Green Industries, Inc.

- Marico Limited

- Unilever

- Diversey, Inc

- Maclin Group

- Hebei Baiyun Daily Chemical Co., Ltd.

- Dabur

Recent Developments

- In May 2023, Grow Green Industries has declared that their eatCleaner Fruit and Veggie Wash items have obtained certification from the U.S. EPA Safer Choice program and are now authorized to bear the Safer Choice label. This EPA initiative thoroughly evaluates ingredients, assertions, and product legitimacy, fostering considerable confidence among both customers and vendors.

- In June 2021, ITAP-NSTDA assisted Chiwadi Products in introducing a range of fruit and vegetable wash products as part of the country's safe food initiative.

Fruit and Vegetable Wash Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.95 billion |

|

Revenue forecast in 2032 |

USD 6.54 billion |

|

CAGR |

6.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Type, By Distribution Channel, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global fruit and vegetable wash market size is expected to reach USD 6.54 billion by 2032

Procter & Gamble, ITC, Wipro, Grow Green Industries, Marico, Unilever, Diversey, Maclin, Hebei Baiyun Daily Chemical are the top market players in the market.

North America region contribute notably towards the global Fruit and Vegetable Wash Market.

The global fruit and vegetable wash market is expected to grow at a CAGR of 6.5% during the forecast period.

The Fruit and Vegetable Wash Market report covering key segments are product, type, distribution channel, end use, and region.