Gas Cleaning Technologies Market Share, Size, Trends, Industry Analysis Report

By Product (Scrubbers, Dry Sorbent Injection, Particulate/Dust Collection), By End-use (Chemical, Cement), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3775

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

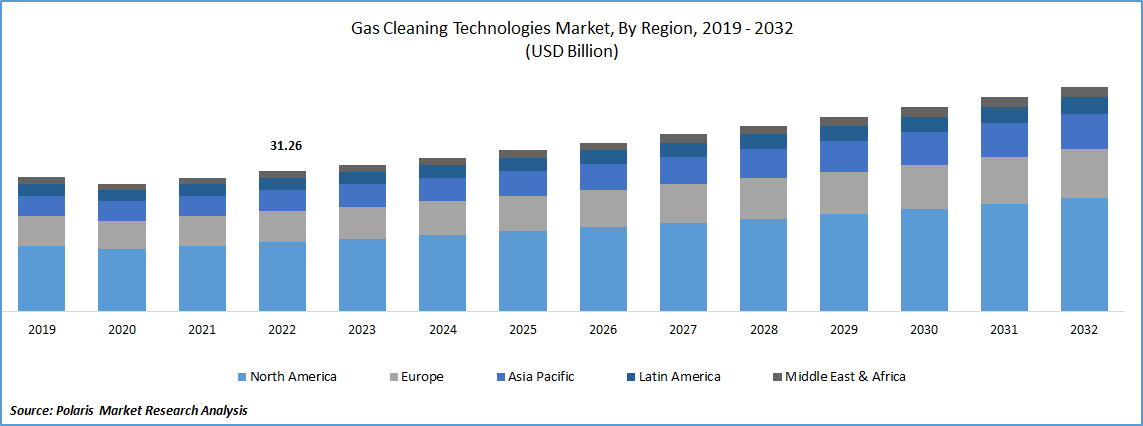

The global gas cleaning technologies market was valued at USD 31.26 billion in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period.

The increasing oil & gas production and power generation activities are expected to lead to higher levels of air pollution due to emissions of pollutants such as SO2, NOx, & particulate matter. To address environmental concerns and comply with stringent air quality regulations, industries are likely to adopt air pollution control devices. These devices, such as scrubbers, catalytic converters, & electrostatic precipitators, help in removing harmful pollutants from industrial exhaust gases before they are released into the atmosphere, thereby reducing air pollution.

To Understand More About this Research: Request a Free Sample Report

The implementation of the Inflation Reduction Act, The CHIPS Act, and Science Act, which allocate substantial funds for enhancing domestic semiconductor production and improving vehicle supply chains, is expected to bolster the automotive manufacturing sector in the country. With the rising demand for electric vehicles (EVs) and the push towards cleaner and greener transportation, the automotive industry is rapidly transitioning towards electric mobility. As a result, there will be an increased need for air pollution control devices in the automotive manufacturing process, particularly in the production of EVs.

As automotive manufacturers strive to meet emission standards and produce more environmentally friendly vehicles, the adoption of air pollution control devices becomes crucial. These devices can help reduce emissions from various manufacturing processes, including painting, welding, and material handling, ensuring compliance with environmental regulations and contributing to a cleaner manufacturing environment.

Industry Dynamics

Growth Drivers

Technological Advancements

The market's expansion can be credited to the continuous increase in energy and power plant establishments, including coal & gas-fired power plants. This growth is further driven by the implementation of strict air pollution regulations, such as the Clean Air Act (CAA) & National Ambient Air Quality Standards. With industrial activities on the rise globally, governments and environmental authorities are facing mounting pressure to regulate and curb emissions effectively. To address this concern, many governments have introduced stringent regulations pertaining to gas emissions in industrial sectors, which are anticipated to propel the market's growth throughout the forecast period.

Key governmental agencies, such as the European Environment Agency (EEA), Environmental Protection Agency (EPA), & Central Pollution Control Board (CPCB), are playing crucial roles in shaping policies and initiatives to improve air quality and combat air pollution. These efforts are expected to drive the adoption of gas cleaning technologies in the coming years. Notably, the U.S. Energy Information Administration reports that crude oil production in the U.S. was 11.9 Mn barrels per day in 2023 and is projected to reach 12.6 Mn barrels per day in 2023 and 12.7 Mn barrels per day in 2024.

Report Segmentation

The market is primarily segmented based on product, end use, and region.

|

By Product |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Particulate segment accounted for the largest share in 2022

Particulate segment accounted for major global share. Among the various types of wet scrubbers, particle dust scrubbers stand out for their ability to effectively remove particulates like 10 and 2.5 particulate matter. These specialized scrubbers are particularly valuable in industries dealing with fine dust, such as food manufacturing, where they play a crucial role in preventing the accumulation of biological matter during the production process. Dust collectors are widely employed across diverse industries.

Dry sorbent segment is likely to register highest growth rate. Dry sorbent injection stands out among other gas cleaning technologies due to several key advantages it offers. Notably, it boasts low capital costs and occupies a small footprint, making it an attractive choice for industries seeking cost-effective and space-efficient solutions. The reduced capital costs associated with dry sorbent injection can be attributed to its efficient reagent utilization, resulting in lower operational expenses. This cost-effectiveness has become a driving force behind the increasing adoption of dry sorbent injection in various industrial applications.

By End-Use Analysis

Power generation expected to hold substantial market share during forecast period

Power generation segment is projected to hold significant market share. Gas cleaning technologies, including wet scrubbers and dry scrubbers, play a crucial role in the power generation industry. Among these technologies, wet scrubbers are particularly prevalent in this sector due to the significant release of air contaminants from fossil fuel-based power plants, especially coal-fired ones.

Wet scrubbers are highly effective in controlling and reducing emissions of pollutants like SO2 and NO2 from fossil fuel-based power plants. The increasing adoption of wet scrubbers in power generation plants is expected to drive the growth of the gas cleaning technologies market over the forecast period. As power plants continue to prioritize environmental regulations and emission reduction, the demand for efficient gas cleaning solutions like wet scrubbers is projected to rise significantly.

Chemical segment witnessed steady growth. Wet scrubbers play a vital role in chemical plants, fertilizer plants, and acid manufacturing facilities. The chemicals industry is expected to witness significant expansion and rapid industrialization during this period. Moreover, the growing demand for chemicals from various manufacturing industries, coupled with continuous advancements in product technologies, is anticipated to drive the chemicals sector's progress.

Regional Insights

APAC region dominated the global market in 2022

APAC region dominated the global market with considerable revenue share. This was primarily attributed to the alarming rise in air pollution levels, primarily caused by the agriculture and industrial sectors in the region. Many countries in Asia Pacific have established themselves as major manufacturing hubs for global companies, leading to a surge in contract manufacturing practices.

The increasing trend of contract manufacturing has prompted a greater focus on reducing air pollution levels by adopting advanced technologies. To combat this issue, cutting-edge solutions such as selective catalytic reduction, wet scrubbers, filtration, and dust collectors are being widely deployed. These advanced technologies are playing a vital role in mitigating the concentration of air-polluting substances in the atmosphere, thus contributing positively to the overall market growth in the region.

Europe is likely to emerge as fastest growing region. This growth can be attributed to the expansion of industrial activities in the region, coupled with recent reforms in the regulatory framework. One notable regulatory reform is the introduction of a new environmental norm in January 2023, specifically targeted at the chemical and textile industries. Under the EU Industrial Emission Directive, approximately 3,000 chemical & 300 textile plants in the region will be required to adhere to these new legal norms.

Key Market Players & Competitive Insights

The cleaning technologies market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ALFA LAVALCECO Environmental

- ANDRITZ

- Babcock & Wilcox

- DuconEnv.com

- Elessent Clean Technologies

- Evoqua Water Technologies

- FLSmidth

- Fuji Electric

- GEA Group

- Hitachi Zosen Inova

- John Cockerill.

- KCH Services

- Nederman Holding

- Tri-Mer Corp.

- Verantis Environmental Solutions

- Yara Marine

Recent Developments

- In June 2023, Tri-Mer Corporation has introduced a new standard line of packed tower scrubbers designed to effectively handle fumes released from vents of bulk storage tanks and manage the off gases emitted during tank filling processes. Product line ensures maximum surface contact between the scrubbing liquid and gas, resulting in optimized scrubbing efficiency. By achieving this enhanced contact, the product line minimizes the packing depth needed for effective operations, making it a highly efficient and space-saving solution.

Gas Cleaning Technologies Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 32.73 billion |

|

Revenue forecast in 2032 |

USD 49.97 billion |

|

CAGR |

4.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Babcock & Wilcox, ALFA LAVALCECO Environmental, Evoqua Water Technologies, Fuji Electric, GEA Group, Hitachi Zosen Inova, KCH Services, Nederman Holding, Tri-Mer Corp., Verantis Environmental Solutions, Yara Marine, Elessent Clean Technologies, DuconEnv.com, FLSmidth, ANDRITZ, and John Cockerill |

FAQ's

The gas cleaning technologies market report covering key segments are product, end use, and region.

The global gas cleaning technologies market size is expected to reach USD 49.97 billion by 2032.

The global gas cleaning technologies market is expected to grow at a CAGR of 4.8% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in gas cleaning technologies market are governments have introduced stringent regulations pertaining to gas emissions in industrial sectors