Gas Engines Market Share, Size, Trends, Industry Analysis Report

By Fuel Type (Natural, Special, Others); By Power Output; By Application (Power Generation, Mechanical Drive, Cogeneration, Others); By End-User; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 118

- Format: PDF

- Report ID: PM2433

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

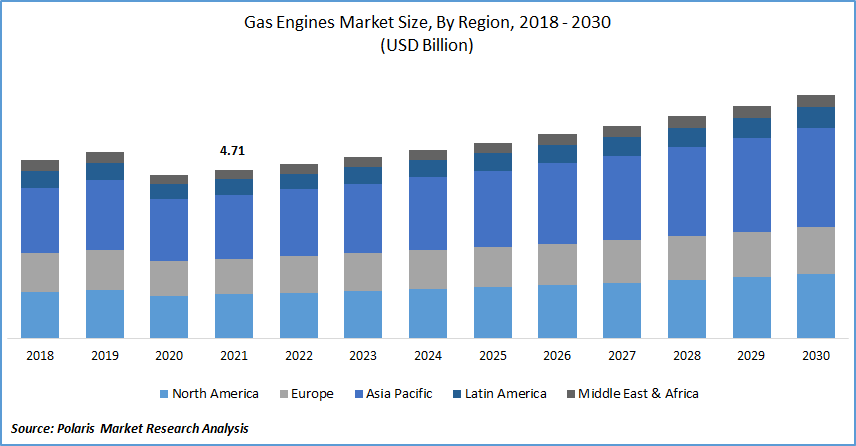

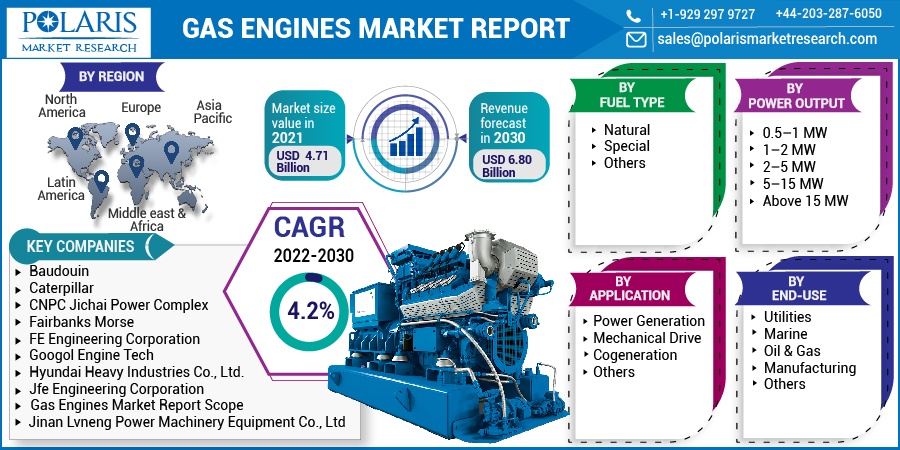

The global gas engines market was valued at USD 4.71 billion in 2021 and is expected to grow at a CAGR of 4.2% during the forecast period. One of the primary factors driving the gas engines market's growth is the rapid increase in demand for power production technology that is effective, efficient, and does not negatively impact the environment. Furthermore, the rising use of engine in the utility sector has dramatically raised the demand for these engines when there is insufficient power plant supply.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

In emerging countries like India and China, fast urbanization, industrialization, and economic expansion have resulted in a surge in electricity demand. The demand for these engine is predicted to rise due to this reason. Another element that favorably influences the market for gas engine is the cheap price in numerous nations.

Furthermore, acquisitions and partnerships among the significant players are aiding the market growth. In May 2021, Clarke and Innio Jenbacher installed an engine in Douala, to power its pasta business. The J320 engine, which runs on natural gas, supplies the facility with dependable onsite electricity. A combined heat and power (CHP) plant will be created in two phases. However, the market's expansion is projected to be hampered by the inconsistencies in natural gas reserves and their variable pricing. Another factor that is predicted to stifle market growth is the rising use of electric vehicles. Furthermore, these engine heats up quickly, potentially resulting in negative market growth for the gas engines market.

Industry Dynamics

Growth Drivers

The expanding demand for gas-fired power generation technology and the increased focus on lowering carbon emissions drive the global gas engines market's expansion. These engines are widely employed in power plants to provide power to operate generators that produce electricity and distribute it to various utilities. They also have a high operational rate, a quick start-up, and a load efficiency that varies according to the power demand. Natural gas-based engines for power are predicted to grow in popularity due to these considerations. Because of expanding awareness of climate change and rising greenhouse emissions, industrialized and emerging countries focus more on reducing carbon emissions.

Environmental regulations such as the Kyoto Protocol and the Paris Agreement will assist in focusing attention on their carbon footprint. The primary goal of growing countries is to lower pollution levels and mitigate the detrimental effects of global warming. Although the effect will not be immediate, the difference will gradually emerge. Many countries, including Canada, India, and Germany, are concentrating on building natural gas-based engines for power plants. For example, Canada's Intended Nationally Determined Contributions (INDC) call for a 30% reduction in greenhouse emissions by 2030 compared to 2005 levels. As a result of these considerations, more of these engines will be installed in power plants, as they emit less carbon than coal and diesel engines.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on fuel type, application, power output, end-use, and region.

|

By Fuel Type |

By Application |

By Power Output |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Power Output

Based on the power output segment, the 15MW segment is expected to be the most significant revenue contributor. The gas engines with more than 15 MW are primarily employed for diesel generators' power generation. These engines are typically used in island-type arrangements to supplement significant power plants and are utilized by companies as a power plant to supply the grid. During the projected period, declining natural gas costs, the availability of renewable fuel sources, and an enhanced gas distribution network are likely to foster growth in the above 15 MW category.

Besides, the mechanical drive segment holds the highest growth rate over the study period. These engines are employed in the oil & gas and manufacturing industries. In the oil & gas industry, these engines help gather and transfer natural gas, particularly in LNG facilities. Further, the utility segment holds the highest share based on the end-use industry. Utilities can use their energy to power local facilities or export it to local electrical grids. Utilities use these engines to satisfy peak load requirements and provide emergency backup options if the main power plant fails. To comply with carbon and emission laws, there is a growing transition away from coal-fired power plants and gas-fired power plants.

Geographic Overview

In terms of geography, Europe had the largest revenue share. The European continent has the most significant potential for high gas engine implementation in various applications. As hydrogen and natural-gas-based technologies provide an emission-free environment, government policies to achieve a greener energy transition operate as a spur for market growth. Many firms have developed and improved engine systems that are more adaptable to new uses.

Cummins announced its plans in September 2021 to start creating medium duty 6.7 l hydrogen-based combustion engine and a 15-liter hydrogen engine under its hydrogen-fueled internal combustion engine (H2-ICE) program. The UK government will fund a portion of the work at Cummins' Darlington location in the United Kingdom. The initiative is part of a larger effort to decarbonize the transportation industry by 2025. As a result of these changes, Europe is likely to dominate the gas engines market over the forecast period.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. The region's growth is likely to be fueled by rising electricity demand. For example, emerging countries are continually focused on embracing clean energy resources. Such pivotal factors are anticipated to fuel market expansion across the region during the projected period.

Competitive Insight

Some of the major players operating in the global market include Baudouin, Caterpillar, CNPC Jichai Power Complex, Fairbanks Morse, FE Engineering Corporation, Googol Engine Tech, Hyundai Heavy Industries Co., Ltd., Jfe Engineering Corporation, Jinan Lvneng Power Machinery Equipment Co., Ltd., Kawasaki Heavy Industries, Ltd., Liebherr, Mitsubishi Heavy Industries, Ltd., Ningbo C.S.I Power & Machinery Group Co. Ltd., R Schmitt Enertec, Siemens Energy, and Volkswagen (Man Energy Solutions).

Gas Engines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.71 Billion |

|

Revenue forecast in 2030 |

USD 6.80 Billion |

|

CAGR |

4.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Fuel Type, By Application, By Power Output, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Baudouin, Caterpillar, CNPC Jichai Power Complex, Fairbanks Morse, FE Engineering Corporation, Googol Engine Tech, Hyundai Heavy Industries Co., Ltd., Jfe Engineering Corporation, Jinan Lvneng Power Machinery Equipment Co., Ltd., Kawasaki Heavy Industries, Ltd., Liebherr, Mitsubishi Heavy Industries, Ltd., Ningbo C.S.I Power & Machinery Group Co. Ltd., R Schmitt Enertec, Siemens Energy, and Volkswagen (Man Energy Solutions). |