Gene Therapy Platform Market Size, Share, & Trends Analysis Report

: By Platform Type, By Application, By Delivery Mode (In Vivo, Ex Vivo, and Other), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5712

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

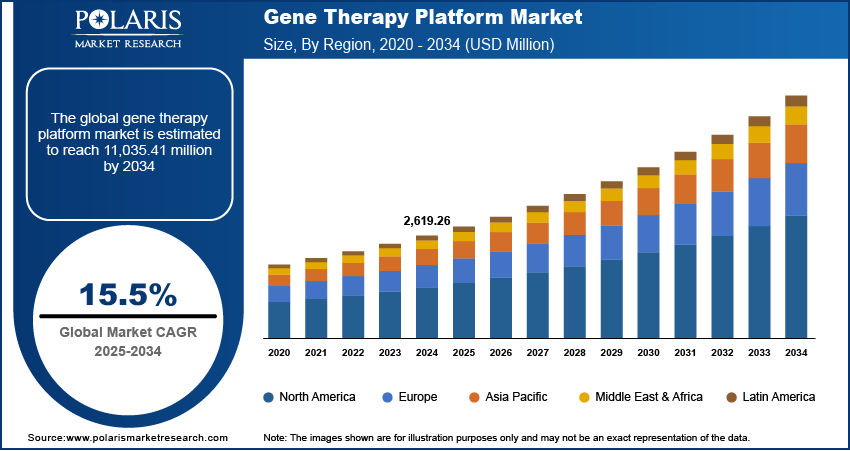

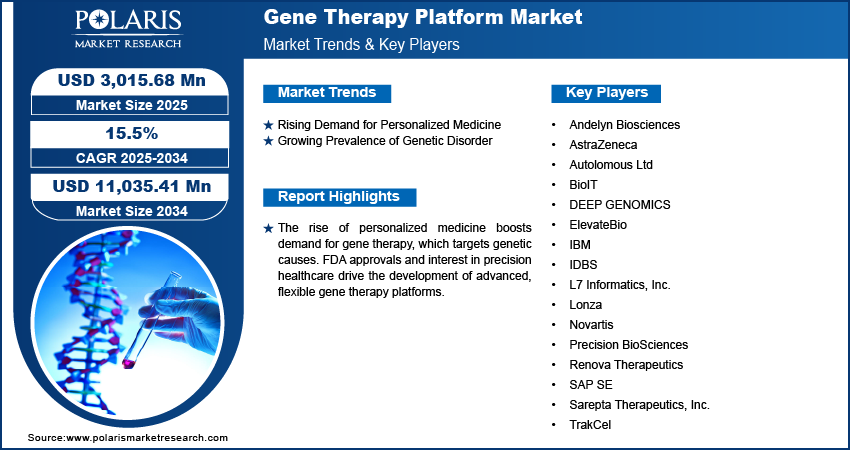

The global gene therapy platform market size was valued at USD 2,619.26 million in 2024, growing at a CAGR of 15.5% during 2025–2034. The demand is driven by rising investments in biotechnology and pharmaceutical companies and the increasing prevalence of chronic disorders.

A gene therapy platform is a technological framework or system used to deliver therapeutic genes into a patient’s cells to treat or prevent diseases, often using vectors such as viruses or nanoparticles. These platforms enable precise genetic modifications and are being developed to address a wide range of genetic disorders, cancers, and rare diseases.

The US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other government agencies are playing a major role in supporting gene therapy development. They have introduced faster approval pathways, special designations (such as orphan drug or breakthrough therapy status), and clearer guidelines for gene therapy products. These regulatory supports make it easier and quicker for companies to bring gene therapy products to consumers. A faster and more efficient regulatory environment is encouraging more investments and innovation, which is driving the demand for these platforms.

To Understand More About this Research: Request a Free Sample Report

Recent advancements in delivery technologies such as AAV, lentivirus, and lipid nanoparticles have significantly boosted the efficiency and safety of gene delivery. These technologies help ensure that the genetic material reaches its target without causing harmful immune reactions or off-target effects. These methods enable more companies and researchers to develop new gene therapies as they become more reliable and scalable, driving growth in the gene therapy platform market.

Industry Dynamics

Growing Prevalence of Genetic Disorder

Genetic disorders such as cystic fibrosis, sickle cell anemia, and hemophilia are becoming more commonly diagnosed due to better genetic testing and awareness. According to the Cystic Fibrosis Foundation, nearly 105,000 people have been diagnosed with CF across 94 countries. Many of these conditions currently have limited treatment options, making gene therapy an attractive solution. Gene therapy offers the potential to fix the root cause of these diseases by correcting or replacing faulty genes. This increase in the number of diagnosed cases is driving the need for more effective and long-term treatments. This growing patient population is driving demand for gene therapy platforms that can develop and deliver these life-changing therapies.

Growing Demand for Personalized Medicine

The demand for personalized medicine is rising as it offers treatments designed specifically for an individual’s genetic makeup. According to the Personalized Medicine Coalition, in 2023, personalized medicines had the most approvals for the fourth time in a row by US FDA. Gene therapy fits perfectly into this trend as it targets the root genetic cause of a disease. The therapy is becoming more relevant and valuable as more people are seeking out treatments that are tailored to their unique biology. This growing interest in precision healthcare is encouraging researchers and companies to develop platforms that deliver customized gene therapies, thereby increasing demand for advanced and flexible gene therapy platforms.

Segmental Insights

By Platform Type

The viral vector platforms segment dominated with the largest share in 2024 due to their high efficiency in delivering genetic material into cells. Viruses such as adeno-associated virus (AAV), lentivirus, and retrovirus are commonly engineered to carry therapeutic genes safely. These platforms have been widely researched, tested, and used in many approved gene therapy products, making them a trusted and preferred choice. Their ability to target specific cell types and achieve long-term gene expression supports their leading position. Ongoing improvements in safety and manufacturing are expected to maintain viral vector platforms' dominance in the gene therapy platform industry.

By Application

The neurological disorders segment is expected to experience significant growth as it is a major application area for gene therapy, with significant potential to transform treatment for diseases such as Parkinson’s, spinal muscular atrophy (SMA), and Huntington’s disease. These disorders stem from genetic mutations that traditional drugs cannot effectively address. Gene therapy offers a promising solution by directly correcting or replacing the faulty genes in nerve cells. Since many neurological conditions are chronic and currently untreatable, there is strong demand for innovative therapies, thereby driving the segmental growth.

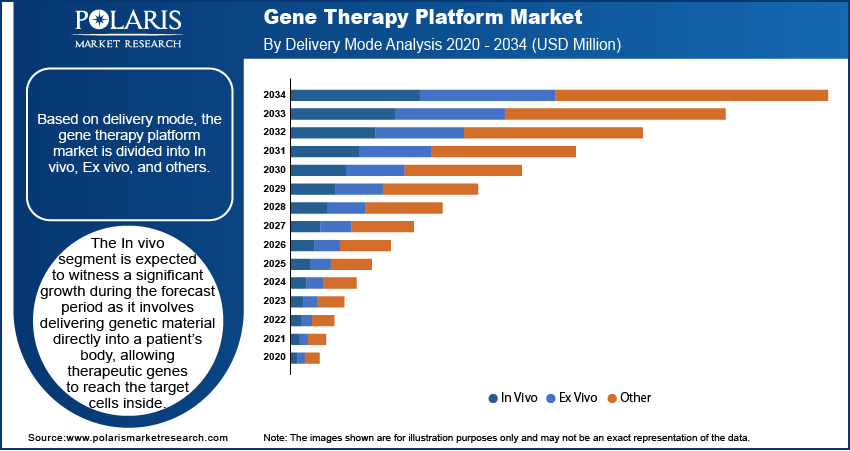

By Delivery Mode

In vivo gene therapy involves delivering genetic material directly into a patient's body, allowing therapeutic genes to reach the target cells inside. This approach is gaining traction as it enables precise treatment of genetic disorders at their source, without needing to remove and modify cells outside the body. In vivo techniques use viral vectors such as AAV and lentiviruses, which are engineered to carry and insert genes safely. The segment’s growth is driven by its use in treating rare diseases, neurological conditions, and cancers. Ongoing clinical trials and regulatory approvals are further boosting the segmental growth.

By End Use

The pharmaceutical and biotechnology companies segment dominated with the largest share in 2024, as they are at the forefront of research, development, and commercialization of gene-based treatments. These firms invest heavily in R&D, clinical trials, and strategic collaborations to launch innovative therapies. Their advanced infrastructure and expertise allow them to scale up production and meet global demand efficiently. Moreover, partnerships with academic institutions and technology providers further strengthen their pipeline. The growing number of FDA-approved gene therapies and the increasing focus on personalized medicine are driving the segmental growth.

Regional Analysis

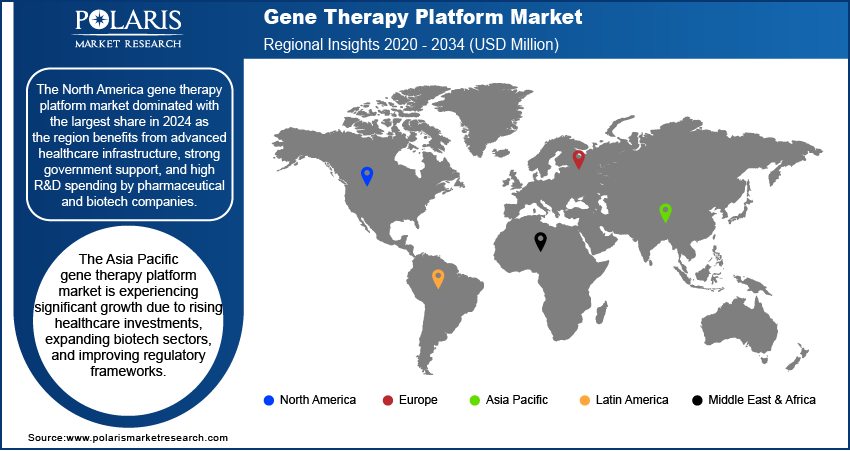

The North America gene therapy platform market dominated with the largest share in 2024 as the region benefits from advanced healthcare infrastructure, strong government support, and high R&D spending by pharmaceutical and biotech companies. Numerous FDA approvals for gene therapies and a large number of clinical trials highlight the region’s leadership. Key players are headquartered here, and there is a strong presence of academic and research institutions. High awareness of genetic disorders and early adoption of innovative treatments contribute to the industry growth, making North America a hub for gene therapy advancements and commercialization.

The Asia Pacific gene therapy platform market is experiencing significant growth due to rising healthcare investments, expanding biotech sectors, and improving regulatory frameworks. Countries such as China, Japan, and South Korea are increasing funding for gene therapy research and opening clinical trial opportunities. The large patient population and unmet medical needs, particularly for rare diseases and genetic conditions, make the region attractive for global companies. Growing government support and strategic collaborations are accelerating innovation, thereby driving the demand for these platforms in Asia Pacific.

The India gene therapy platform market is driven by its expanding biotech industry and cost-effective manufacturing capabilities. Increased investments in genetic research and government initiatives are helping to build the necessary ecosystem. Indian biotech firms and academic institutions are exploring gene-editing technologies such as CRISPR, while regulatory reforms are gradually easing the path for clinical trials. India’s large population, growing burden of genetic disorders, and rising demand for advanced therapies further drive the demand for this platform.

The Europe gene therapy platform market is driven by strong R&D capabilities, favorable regulatory pathways, and government funding. Countries such as Germany, the UK, and France are leading in clinical trials and approvals for gene-based treatments. The European Medicines Agency (EMA) provides centralized approval, simplifying market access across member states. There is a high level of collaboration between academia, biotech firms, and healthcare providers, fostering innovation. Public awareness and support for personalized medicine further aid adoption. The demand for this platform is rising due to the increasing focus on rare and chronic diseases.

Key Players and Competitive Analysis Report

The gene therapy platform market is highly dynamic and competitive, driven by innovation in vector production, data analytics, and clinical scalability. Companies such as Andelyn Biosciences, Lonza, and ElevateBio lead in manufacturing capabilities and CDMO services, offering end-to-end solutions for gene therapy developers. AstraZeneca, Novartis, and Sarepta Therapeutics are key pharmaceutical players advancing in-house gene therapy pipelines with strategic acquisitions and proprietary platforms. Technology innovators such as Autolomous Ltd, L7 Informatics, IDBS, and TrakCel provide digital and automation platforms to optimize manufacturing and supply chain workflows. Meanwhile, firms such as DEEP GENOMICS, BioIT, IBM, and SAP SE bring powerful AI, bioinformatics, and data integration tools that support precision therapy design and analytics. Precision BioSciences and Renova Therapeutics contribute through novel gene editing and delivery approaches, enhancing therapeutic efficacy and patient outcomes. Collectively, these companies form a diverse and evolving ecosystem shaping the future of gene therapy development and commercialization.

International Business Machines Corporation (IBM) is a multinational technology company headquartered in Armonk, New York, US. Established in 1911, IBM has undergone significant transformation over its history, shifting from its origins in hardware manufacturing to a focus on software, cloud computing, and consulting services. The company’s operations are organized into four main segments: Software, Consulting, Infrastructure, and Financing. The Software segment includes hybrid cloud platforms and enterprise software, such as Red Hat, automation, artificial intelligence, data management, and security solutions. The Consulting segment provides business transformation, technology consulting, and application management services, supporting clients in integrating and optimizing their IT systems. The infrastructure segment is responsible for on-premises and cloud-based servers, storage solutions, and mainframe systems, as well as quantum computing initiatives. The Financing segment offers leasing and loan financing for clients purchasing IBM products and services. IBM’s products and services are used across a range of industries, including finance, healthcare, manufacturing, and retail. IBM’s research and development activities are conducted globally, with research labs and offices in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. This broad geographic presence enables IBM to serve clients in more than 170 countries. The company has major operational centers in the US, India, and several European countries. IBM offers a blockchain-enabled Personalized Medicine Platform, which streamlines and secures the complex supply chain for cell and gene therapies such as CAR-T, enabling real-time collaboration, tracking, and data privacy for healthcare providers, manufacturers, and patients throughout the treatment journey.

Novartis AG is a healthcare company that specializes in the development and manufacture of generic pharmaceuticals and eye care products. With a global presence in 140 countries, it offers a wide range of products for the treatment of various medical conditions, including cancer, neurological disorders, cardiovascular diseases, respiratory diseases, hematologic diseases, immune disorders, infections, and dermatological conditions. The company has a strong focus on therapeutic areas such as renal, metabolic, cardiovascular, neuroscience, immunology, and oncology, as well as ophthalmology and hematology. It has a collaboration and license agreement with Alnylam Pharmaceuticals to develop, manufacture, and commercialize inclisiran, a therapy to reduce LDL cholesterol. The Innovative Medicines division is responsible for researching, developing, manufacturing, distributing, and selling patented pharmaceuticals. This segment comprises two business units: Novartis Pharmaceuticals and Novartis Oncology. These units are dedicated to bringing new and innovative treatments to patients suffering from various diseases, including cancer, cardiovascular diseases, and neurological disorders. Novartis offers advanced technology platforms, including gene therapy, cell therapy, radioligand therapy, and targeted protein degradation to discover new drug targets and develop innovative treatments for diseases with significant unmet medical needs.

Key Players

- Andelyn Biosciences

- AstraZeneca

- Autolomous Ltd

- BioIT

- DEEP GENOMICS

- ElevateBio

- IBM

- IDBS

- L7 Informatics, Inc.

- Lonza

- Novartis

- Precision BioSciences

- Renova Therapeutics

- SAP SE

- Sarepta Therapeutics, Inc.

- TrakCel

Industry Developments

In March 2025, AstraZeneca acquired EsoBiotec for up to $1 million to advance in vivo cell therapies using the ENaBL platform, enabling faster, IV-delivered treatments without immune cell depletion, potentially transforming cell therapy manufacturing and accessibility globally.

In November 2024, NewBiologix launched its Xcell rAAV Production and Analytics Platform to accelerate gene therapy development, enabling efficient rAAV candidate screening and production using its engineered Eng-HEK293 cell line, enhancing quality, reducing timelines, and supporting regulatory-compliant therapeutic vector analysis.

Gene Therapy Platform Market Segmentation

By Platform Type Outlook (Revenue, USD Million, 2020–2034)

- Viral Vector Platforms

- Adeno-Associated Virus (AAV)

- Lentivirus

- Retrovirus

- Adenovirus

- Herpes Simplex Virus (HSV)

- Non-Viral Vector Platforms

- Lipid Nanoparticles (LNPs)

- Electroporation & Microinjection Platforms

- Polymer-Based Delivery Systems

- Naked DNA/RNA Delivery

- Gene Editing Platforms

- CRISPR-Cas Systems

- TALENs

- ZFNs

By Application Outlook (Revenue, USD Million, 2020–2034)

- Oncology

- Rare Genetic Disorders

- Cardiovascular Diseases

- Neurological Disorders

- Ophthalmic Diseases

- Hematological Disorders

- Musculoskeletal Disorders

- Infectious Diseases

By Delivery Mode Outlook (Revenue, USD Million, 2020–2034)

- In Vivo

- Ex Vivo

- Other

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Contract Development & Manufacturing Organizations (CDMOs)

- Hospitals & Gene Therapy Centers

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Gene Therapy Platform Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,619.26 Million |

|

Market Size Value in 2025 |

USD 3,015.68 Million |

|

Revenue Forecast by 2034 |

USD 11,035.41 Million |

|

CAGR |

15.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2,619.26 million in 2024 and is projected to grow to USD 11,035.41 million by 2034.

The global market is projected to register a CAGR of 15.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Andelyn Biosciences; AstraZeneca; Autolomous Ltd; BioIT; DEEP GENOMICS; ElevateBio; IBM; IDBS; L7 Informatics, Inc.; Lonza; Novartis; Precision BioSciences; Renova Therapeutics; SAP SE; Sarepta Therapeutics, Inc.; and TrakCel.

The viral vector platform segment dominated the market share in 2024.

The neurology segment is expected to witness significant growth during the forecast period.