Germany Recycled PET Flakes Market Size, Share, Trends, Industry Analysis Report

By Product (Clear, Colored), By End Use (Fiber, Sheet & Film, Strapping) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6155

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

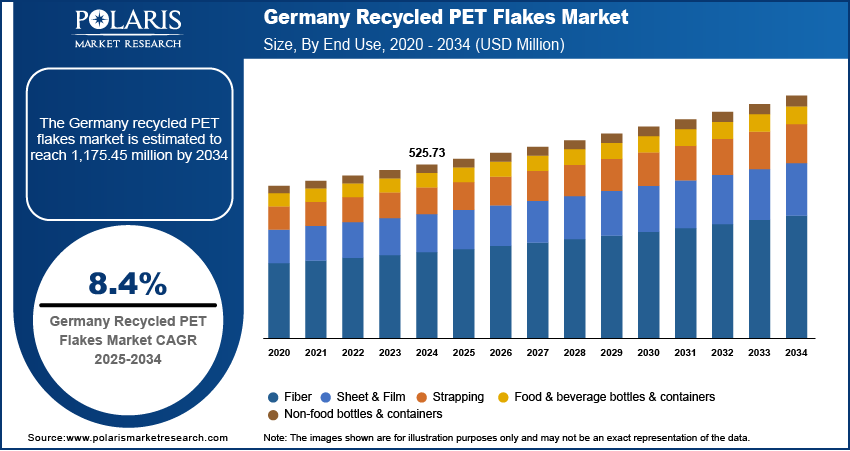

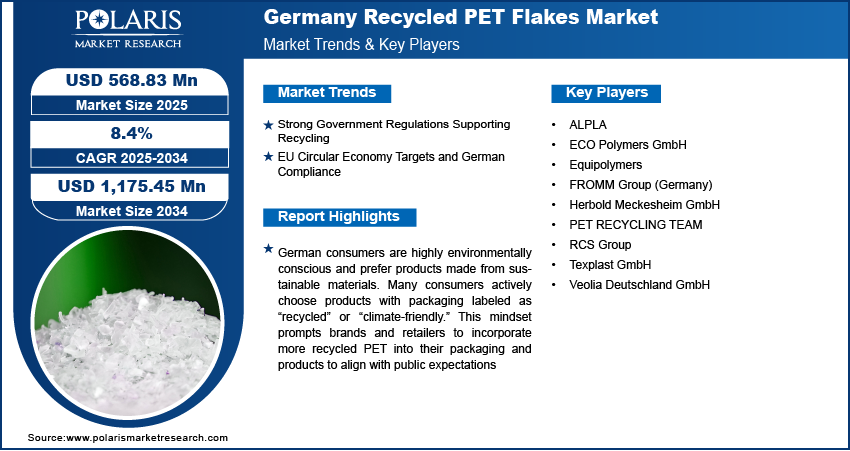

The Germany recycled PET flakes market was valued at USD 525.73 million in 2024 and is expected to register a CAGR of 8.4% from 2025 to 2034. The growth is driven by strong government regulations supporting recycling, and EU circular economy targets and German compliance.

Key Insights

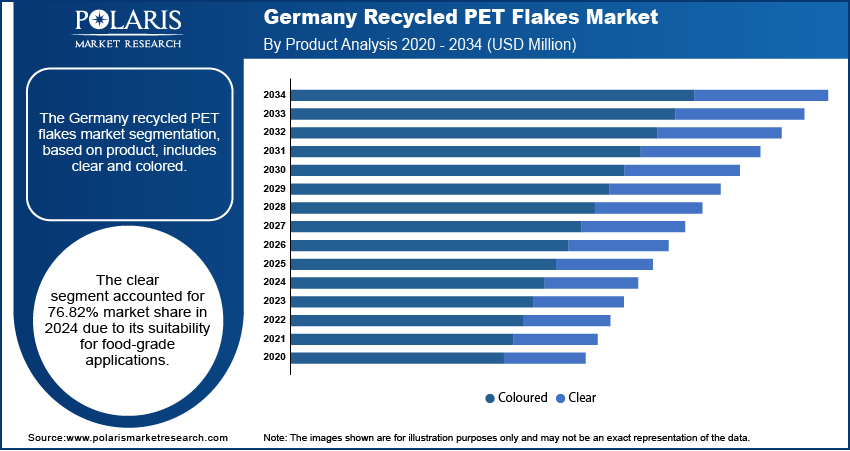

- The clear segment accounted for 76.82% regional share in 2024 owing to their compatibility with food-grade standards and applications.

- The fiber segment accounted for 13.45% regional market share in 2024 fueled by robust demand from the textile and automotive sectors.

Industry Dynamics

- Strong government regulations supporting recycling are fueling the industry growth.

- EU circular economy targets and German compliance fueling the adoption of recycled PET flakes.

- Rising Focus on environmental sustainability is boosting the growth

- Inconsistent quality and contamination of collected PET waste hampers efficient recycling and limits end-use applications.

Market Statistics

- 2024 Market Size: USD 525.73 million

- 2034 Projected Market Size: USD 1,175.45 million

- CAGR (2025–2034): 8.4%

To Understand More About this Research: Request a Free Sample Report

The Germany recycled PET flakes market represents a significant segment of the evolving landscape within the global plastics sector. Polyethylene terephthalate (PET) is a highly versatile thermoplastic polymer widely utilized in the manufacture of a variety of products, including bottles, packaging materials, textiles, carpets, automotive components, and consumer goods. There has been a marked increase in the demand for recycled PET flakes as a viable substitute for virgin PET resin with the escalating emphasis on environmental sustainability and effective plastic waste management.

German consumers are highly environmentally conscious and prefer products made from sustainable materials. Many consumers in the country actively choose products with packaging labeled as “recycled” or “climate-friendly.” This mindset pushes brands and retailers to incorporate more recycled PET into their packaging and products to align with public expectations. The demand for transparency and sustainability in Germany is encouraging manufacturers to use more rPET flakes to meet these expectations. Demand for recycled PET flakes remains strong and growing across the country as consumers continue to prioritize low-waste and circular economy solutions, thereby driving the growth.

Germany’s recycling industry is highly advanced, with advance facilities using the latest technologies in sorting, washing, and extrusion. Companies such as TOMRA and Starlinger supply advance machinery to German recyclers, enabling the production of food-grade rPET flakes that meet both EU and international safety standards. These innovations increase efficiency, reduce contamination, and lower processing costs. Consequently, recycled PET becomes more competitive with virgin plastic. Moreover, Germany’s focus on technological innovation in recycling infrastructure ensures the consistent production of high-quality rPET flakes, thereby fueling the growth.

Drivers & Opportunities

Strong Government Regulations Supporting Recycling: Germany is known for having some of the most stringent recycling laws in the world. The country’s Packaging Act (“VerpackG”) requires manufacturers to meet high recycling quotas and encourages the use of recycled materials in packaging. Additionally, Germany’s Deposit Return System (DRS) ensures extremely high PET bottle collection rates, which is ~90%. This creates a consistent supply of post-consumer PET for recycling. These strong regulations boost recycling efforts and create steady demand for high-quality rPET flakes across industries such as food packaging, thereby positively influencing the Germany rPET flakes market growth.

EU Circular Economy Targets and German Compliance: Germany adheres to ambitious circular economy goals as a member of the European Union, including the European Plastics Strategy and the Single-Use Plastics Directive. These policies push for reduced plastic waste, improved recycling rates, and greater use of recycled materials especially in packaging. Germany has implemented these policies proactively. This has led to increased investments in rPET recycling facilities and encouraged industries to use recycled flakes to meet EU recycling content standards. Compliance with these frameworks drives the growth of the industry.

Segmental Insights

Product Analysis

The clear segment accounted for 76.82% share of the Germany recycled PET flakes market in 2024 due to its suitability for food-grade applications. These flakes are primarily used in the production of new beverage bottles, food containers, and transparent packaging. With strict EU and German food safety standards, only high-purity clear rPET can be used in such sensitive applications. The country’s strong deposit return system ensures a steady supply of high-quality clear PET bottles for recycling. Demand is further driven by sustainability commitments from beverage brands and supermarkets, making clear rPET flakes a critical component of Germany’s circular economy and packaging industry.

By End Use Analysis

The fiber segment accounted for 13.45% regional market share in 2024, driven by strong demand from the textile and automotive industries. rPET flakes are converted into polyester fibers used in clothing, upholstery, insulation, and car interiors. German manufacturers are increasingly turning to recycled fibers to meet both environmental standards and consumer demand for sustainable products. Fashion brands and automotive suppliers alike are integrating more rPET into their production lines. The fiber segment continues to be a reliable and growing outlet for recycled PET flakes in the country with Germany’s focus on eco-design and circular production.

Key Players & Competitive Analysis

The Germany recycled PET flakes market is highly competitive, with a strong presence of both domestic and international players driving innovation and sustainability. Key companies such as ALPLA, PET Recycling Team, and ECO Polymers GmbH lead the market with integrated recycling and packaging solutions focused on closed-loop systems. Equipolymers and Veolia Deutschland GmbH contribute through large-scale operations and advanced recycling technologies. Companies such as Herbold Meckesheim GmbH and Texplast GmbH specialize in mechanical recycling and supply high-purity flakes for food-grade and industrial applications. FROMM Group (Germany) and RCS Group focus on converting rPET into strapping bands and textiles, respectively, reinforcing downstream integration. Germany’s strong environmental regulations, coupled with high-quality recycling infrastructure, encourage continuous investment in plant upgrades and partnerships. Innovation, compliance with EU circular economy goals, and focus on food-grade rPET production remain key strategies for maintaining a competitive edge in this dynamic and growing market.

Key Players

- ALPLA

- ECO Polymers GmbH

- Equipolymers

- FROMM Group (Germany)

- Herbold Meckesheim GmbH

- PET RECYCLING TEAM

- RCS Group

- Texplast GmbH

- Veolia Deutschland GmbH

Germany Recycled PET Flakes Industry Developments

February 2025: Equipolymers maximized utilization of its Sckhopau, Germany PET plant in Q1 2024, achieving full capacity of 335,000 tons per year to meet rising market demand and optimize operational efficiency.

Germany Recycled PET Flakes Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Clear

- Colored

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Fiber

- Sheet & Film

- Strapping

- Food & Beverage Bottles & Containers

- Non-food Bottles & Containers

- Other

Germany Recycled PET Flakes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 525.73 Million |

|

Market Size in 2025 |

USD 568.83 Million |

|

Revenue Forecast by 2034 |

USD 1,175.45 Million |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 525.73 million in 2024 and is projected to grow to USD 1,175.45 million by 2034.

The market is projected to register a CAGR of 8.4% during the forecast period.

A few of the key players in the market are ALPLA; ECO Polymers GmbH; Equipolymers; FROMM Group (Germany); Herbold Meckesheim GmbH; PET RECYCLING TEAM; RCS Group; Texplast GmbH; and Veolia Deutschland GmbH.

The clear segment dominated the market share in 2024.

The fiber segment is expected to witness the fastest growth during the forecast period.