Liver Cancer Market Share, Size, Trends, Industry Analysis Report

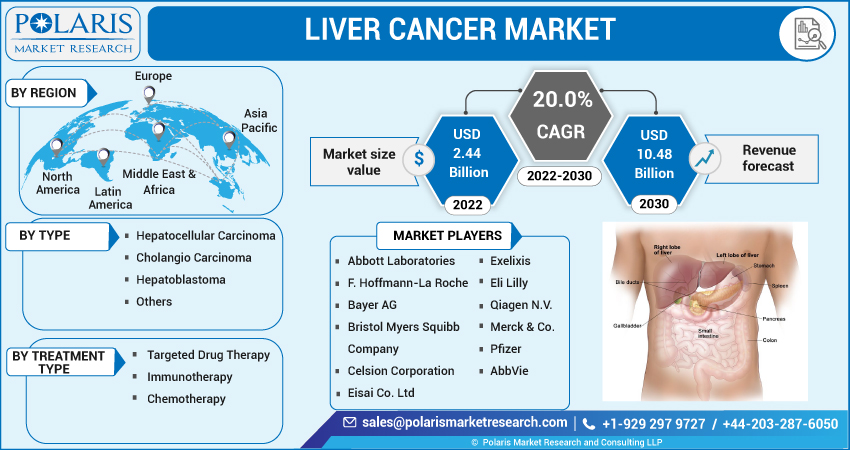

By Type (Cholangio Carcinoma, Hepatocellular Carcinoma, Hepatoblastoma, Others); By Treatment Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 116

- Format: PDF

- Report ID: PM1342

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

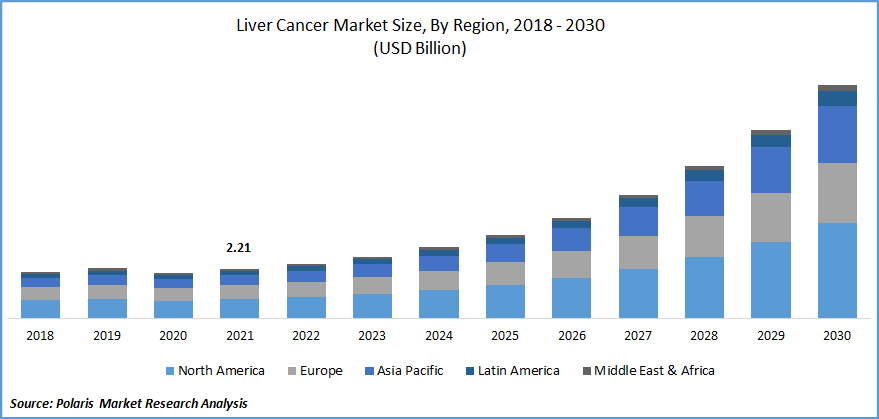

The global liver cancer market was valued at USD 2.21 billion in 2021 and is expected to grow at a CAGR of 20.0% during the forecast period. Liver cancer is among the primary cause of cancer-related fatalities worldwide. The rising incidence of liver diseases such as non-alcoholic fatty liver disease, liver cirrhosis, hepatitis, and liver cancer is primarily due to alcohol intake and an unhealthy lifestyle.

Know more about this report: Request for sample pages

Around the world, there are more older adults, which results in a dysfunction in the disease. Hospital admissions have increased due to the proliferation of the liver disorders indicated above and a number of hereditary conditions that run in families.

In terms of prevalence, it ranks ninth among cancers in women and fifth among cancers in males. In 2020, there were about 900,000 brand-new cases of liver cancer. The American Cancer Society has predicted that in the U.S. alone, there would be around 41,260 new cases of liver-associated cancer and intra-hepatic bile duct cancer (28,600 in men and 12,660 in women), and it is expected that expected deaths would be around 30,520 persons (20,420 males and 10,100 women).

As a result, all of these variables offer opportunities for investments in R&D efforts to create liver disease treatment solutions for improved therapeutic efficacy and safe therapy for already available drugs as well as future novel molecular entities, which further propels the growth of the liver disease treatment market.

For instance, On September 15, 2022, a clinical analysis by the Eastern Hepatobiliary Surgery Hospital concluded that Microvascular Invasion (MVI) identifies the biological malignancy of early HCC and may aid in determining the most appropriate course of treatment. This work aims to investigate preoperative MVI prediction based on MVI-related genetic markers of cell-free circulating tumor DNA to build a re-staging of early HCC (ctDNA). The researchers have discovered 37 mutated genes associated with MVI in HCC tumor tissues.

The COVID-19 pandemic has benefited the global market for liver cancer therapy by increasing sales of products related to the COVID-19 emergency. To maintain their sales during the epidemic, pharmaceutical companies have worked hard to keep the balance between supply and demand in check.

There is a demand for therapeutic medications since, throughout the COVID-19 period, medical organizations published crucial recommendations and guidelines for managing patients with hepatocellular carcinoma. For instance, recommendations have been made by groups like the National Institute of Health and Care Excellence and the American Society of Clinical Oncology. Furthermore, numerous studies have demonstrated that people with HCC are more likely to develop the illness. As a result, during the epidemic, these patients were regarded as emergencies.

The COVID-19 pandemic also affected persons with liver cancer because it delayed or rescheduled diagnostic and treatment processes and people with comorbidities were more likely to develop the virus. These factors reduce the number of people visiting hospitals for treatment and new case diagnoses. Nevertheless, with fewer COVID-19 instances and large-scale vaccination campaigns, the liver cancer treatments market will likely reach its full growth potential throughout the forecast period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The main drivers influencing the market growth are the rising incidence of liver cancer, increased investments in research & development to create novel medicines, and government programmers to raise cancer awareness. The leading causes of its prevalence include environmental factors, alcohol intake, smoking, and rising urbanization. For instance, based on the GLOBOCAN 2020 estimates of cancer incidence and mortality from the International Agency for Research on Cancer.

Worldwide, 19.3 million new cancer cases are anticipated (excluding melanoma skin cancer), whereas 10 million people are expected to die from the disease (9.9 million excluding no melanoma skin cancer). Primary liver cancer will be the sixth most often diagnosed malignancy in 2020, with about 906,000 new cases and 830,000 cancer-related deaths worldwide. In most regions, male rates are 2 to 3 times higher than female rates of incidence and mortality.

Report Segmentation

The market is primarily segmented based on type, treatment type, and region.

|

By Type |

By Treatment Type |

By Region |

|

|

|

Know more about this report: Request for sample pages

Hepatocellular carcinoma projected the garner largest revenue share

Hepatocellular carcinoma garnered revenue share and is anticipated to retain its dominance over the study period. Hepatocellular carcinoma is a frequent type of liver cancer that develops in patients with cirrhosis and other chronic liver disorders. According to studies published in 2021 by Josep Llovet, liver cancer will impact more than a million individuals annually by 2025.

Hepatocellular carcinoma (HCC) accounted for 90% of the cases. It is mainly brought on by hepatitis B virus (HBV) infection, which accounts for about 50% of cases. Moreover, according to a study by Cyriac A. Philips et al. published in 2021, varying incidences of HCC are seen worldwide due to the frequency of linked etiologies. In contrast, 5% of cases occur in North America, whereas 72% occur in Asia, with >50% occurring in China alone.

Other factors projected to support the growth of the global market for hepatocellular carcinoma treatments include technological innovation, individualized medicine, and affordable treatment alternatives. For instance, Zymeworks Inc. received FDA breakthrough treatment designation in November 2020 for zanidatamab in patients with previously treated HER2-amplified biliary tract cancer. Therefore, the rising incidence of cancer and the considerable unmet medical needs would be the primary factors propelling the category expansion during the forecast time.

Targeted segment will account for a higher share of the market

The targeted drug therapy category will hold the most significant proportion of the market in 2021. In various malignancies, targeted therapy is a promising potential treatment with promising therapeutic results. Drugs used in targeted therapy stop the growth and proliferation of cancer by interfering with particular molecules involved in the development of malignant cells. The expansion of the market for targeted treatments is anticipated to be hampered by the high cost of these pharmaceuticals and the rising expense of molecular diagnostic tests to detect cancer.

The demand in North America is expected to witness significant growth

The North American market accounted for the largest share in 2021. The region's increased prevalence of liver cancer, significant market participants, and the introduction of novel products are the primary drivers of market expansion in North America. The discovery of innovative liver treatments is another area where the United States' growing research and development efforts are anticipated to fuel market expansion.

Additionally, it is anticipated that increased research and development efforts in the US to create novel liver treatments will fuel market expansion. For instance, on September 21, 2022, the University of Texas Southwestern Medical Center and Genentech, Inc. collaborated to conduct a Phase 2 clinical study comparing the efficacy and safety of two medicines regarded as the standard of care for people with hepatocellular carcinoma.

In this trial, transarterial chemoembolization (TACE) or transarterial radioembolization (TAR) locoregional therapy is contrasted with atezolizumab/bevacizumab (TARE). As a result, throughout the projection period, the market will be driven by both the rising demand for liver cancer treatment and the increasing incidence of liver cancer in the United States.

Competitive Insight

Some of the major players operating in the global market include Abbott Laboratories, Roche, Bayer AG, Bristol Myers Squibb Company, Celsion Corporation, Eisai Co., Exelixis, Eli Lilly, Qiagen N.V., Merck, Pfizer, AbbVie, Amgen, Thermo Fisher Scientific, AstraZeneca, Johnson & Johnson, Sanofi SA, and Novartis AG.

Recent Developments

- Based on the results of its second confirmatory study, Merck's medicine Keytruda was granted conditional approval as a treatment for liver cancer in January 2022. In Asian patients with hepatocellular carcinoma, Keytruda reduced the chance of death by 21% compared to placebo.

- Roche Ltd., evaluated the improved overall survival rates of liver cancer patients treated with Tecentriq plus Avastin in the Phase III IMbrave150 research. The results were presented, in January 2021.

Liver Cancer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.44 billion |

|

Revenue forecast in 2030 |

USD 10.48 billion |

|

CAGR |

20.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Treatment Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Abbott Laboratories, F. Hoffmann-La Roche, Bayer AG, Bristol Myers Squibb Company, Celsion Corporation, Eisai Co. Ltd, Exelixis, Eli Lilly, Qiagen N.V., Merck & Co., Pfizer, AbbVie, Amgen, Thermo Fisher Scientific, AstraZeneca PLC, Johnson & Johnson, Sanofi SA, and Novartis AG. |