Goat Milk Products Market Share, Size, Trends, Industry Analysis Report

By Product Type (Liquid Milk, Powdered Milk); By Distribution Channel, By Region; Segment Forecasts, 2022 - 2030

- Published Date:Jul-2022

- Pages: 114

- Format: PDF

- Report ID: PM2503

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

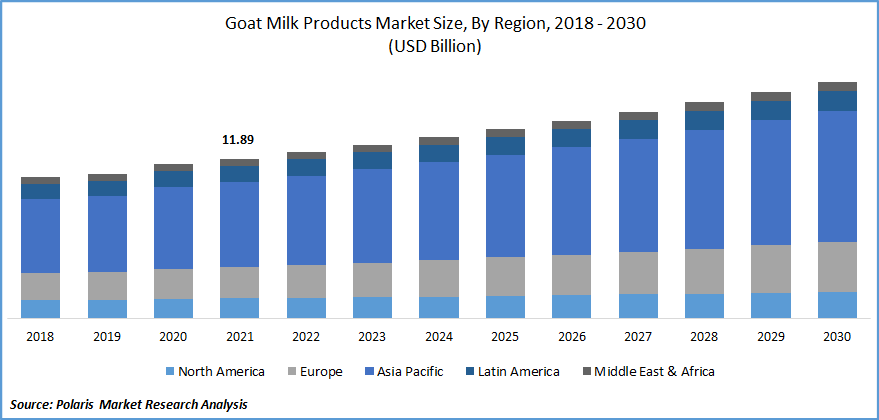

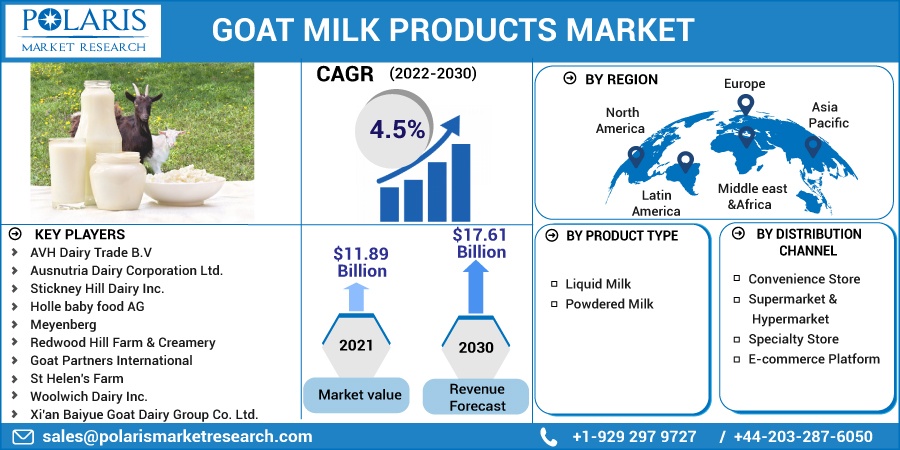

The global goat milk products market was valued at USD 11.89 billion in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period. The incidence of lactose intolerance, digestion problems, and allergies associated with conventional dairy products is rising rapidly due to most people's acceptance of unhealthy lifestyles.

Know more about this report: Request for sample pages

Moreover, the use of goat dairy products is increasing as it is easy to digest and contains various nutrients like potassium, vitamin A, calcium, etc., which are helpful for bone health. These factors are anticipated to drive the global goat milk products market growth.

After the Coronavirus outbreak (COVID), most people have started eating healthy and nutrient-rich dairy products to boost their immunity. This factor is estimated to have a favorable impact on the revenue growth of the target industry.

Most shops and grocery stores began storing goat dairy products during the pandemic's peak, resulting in a shortage of these foodstuffs. Producers could not source raw materials and create foodstuffs to meet demand owing to restricted supply chain activities.

However, due to the dairy industry's broken supply chain and restrictions on worker movement, production activities got hampered. Following the pandemic, it is expected that demand for dairy will increase globally due to consuming healthy and nutrients rich dairy foods.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing incidence of lactose intolerance is anticipated to boost the demand as these products contain a lower amount of lactose than traditional cow dairy foods. As per the data published by NIH (National Institutes of Health), Lactose intolerance is most common in East Asia, affecting more than 70% of the population. Moreover, according to Encyclopedia Britannica, the disorder affects 75 to 90% of Native Americans. All these factors are anticipated to augment the revenue growth of the target market.

Rising awareness regarding benefits associated with the consumption of dairy and increasing consumer spending on healthy dairy foods are anticipated to drive the revenue growth of the global goat milk products market. Moreover, these dairy foods are getting easier to find in small and big stores. These foods’ easy availability is anticipated to impact the target industry growth positively.

The use of goat milk-based infant formulae is increasing at a rapid rate. This infant formula is easy to digest and does not develop any digestion-related problems in babies. In 2021, Hochdorf launched the 'Bimbosan' goat milk-based infant formula. Bimbosan formula does not contain palm oil, and it is gluten-free.

In addition, the demand for dairy food is increasing in beauty and personal care product manufacturing companies. It is used in products like soaps, creams, lotions, etc. And these factors are expected to drive the growth of this industry in the years to come.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, and region.

|

By Product Type |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

The liquid milk segment is estimated to garner the largest revenue share.

Goat milk is considered to be more easily digestible than other options. According to several studies, foods derived from this animal improves the body's ability to absorb critical nutrients from meals, whereas cow's milk interferes with absorbing key elements like copper, iron, etc.

Hence, the demand for liquid goat milk is rising rapidly. Consumers and end-product manufacturers, such as cheese-makers, buy liquid milk, which is anticipated to impact this segment's growth positively.

The powdered milk segment is anticipated to grow at a high CAGR during the forecast period. The powdered form is easy to transport and use in several end products. The demand for powdered goat milk in infant formula and baby foods has increased recently.

As per the report published by NCBI (National Center for Biotechnology Information), China is the world's biggest importer of dairy foods and powdered dairy for its use in infant formulae. Moreover, the powered product has a longer shelf life as compared to its counterparts.

The supermarket & hypermarket segment is estimated to account largest revenue share over the forecast period.

Among all the distribution channels, the supermarket and hypermarket segments account for the largest share over the forecast period. This is because it provides easy access to a wide range of goat dairy products under one roof. As a result, customers may easily choose products from a wide selection of possibilities as a result of this.

Seasonal displays of these dairy foods are becoming more common, resulting in the promotion of new goods and the expansion of the sector. Furthermore, most producers profit handsomely from supermarkets & hypermarket chains. As a result, dairy products producers aim to offer their products to this segment.

Among all regions, Asia-Pacific is estimated to capture the highest revenue share

Most goat dairy-producing countries, like India, China, Pakistan, etc., are only part of this region. As per a report published by the NCBI, Asia-Pacific is home to over 60% of the world's this animal count. Also, the increasing inclination of consumers present in this region toward easy-to-digest and nutrients rich dairy products.

Moreover, governments present in this region provide various subsidies for animal farming. For example, the government of India offers more than a 25% subsidy on the overall cost of animal farms. All these factors together are anticipated to have a favorable impact on the growth of the target market in this particular region.

The North American region is estimated to register a higher CAGR in the coming years as the number of farms is rising rapidly in the United States. Also, people in this region spend a lot on several dairy products. People are consuming the product as an alternative to traditional cow milk products as they contain high protein and lower fats. Hence the shift towards healthy eating is expected to positively impact the growth of the regret market present in the North American region.

Competitive Insight

Some major players operating in the global market include AVH Dairy Trade B.V, Ausnutria Dairy Corporation, Stickney Hill Dairy, Holle baby food AG, Meyenberg, Redwood Hill Farm, Goat Partners, St Helen's Farm, Woolwich Dairy, and Xi'an Baiyue Goat Dairy.

Recent Developments

- In April 2022, CRM (Canada Royal Milk) announced a strategic partnership with the ODGC (Ontario Goat Dairy Cooperative) and PLCQ (Producteurs de lait de chevre du Quebec), both together accounted for around 120 goat dairy farms.

- In June 2022, Atalanta, the cheese producer, introduced its unique cheddar cheese that comes under the Table One brand. This product is made with the milk of Canadian goats.

- In March 2021, Hochdorf launched goat milk-based baby or infant formula. This product mainly comes under the Bimbosan brand. This can be given immediately after the birth of a child. This formula does not contain starch or palm oil.

Goat Milk Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 11.89 billion |

|

Revenue forecast in 2030 |

USD 17.61 billion |

|

CAGR |

4.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AVH Dairy Trade B.V, Ausnutria Dairy Corporation Ltd., Stickney Hill Dairy Inc., Holle baby food AG, Meyenberg, Redwood Hill Farm & Creamery, Goat Partners International, St Helen's Farm, Woolwich Dairy Inc., Xi'an Baiyue Goat Dairy Group Co. Ltd., and other players. |