Golf Simulator Market Size, Share, Trends, Industry Analysis Report

: By Technology Type, Screen Technology (LED, LCD, Projectors), Course Availability, and Application, and Region– Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5637

- Base Year: 2024

- Historical Data: 2020-2023

Golf Simulator Market Overview

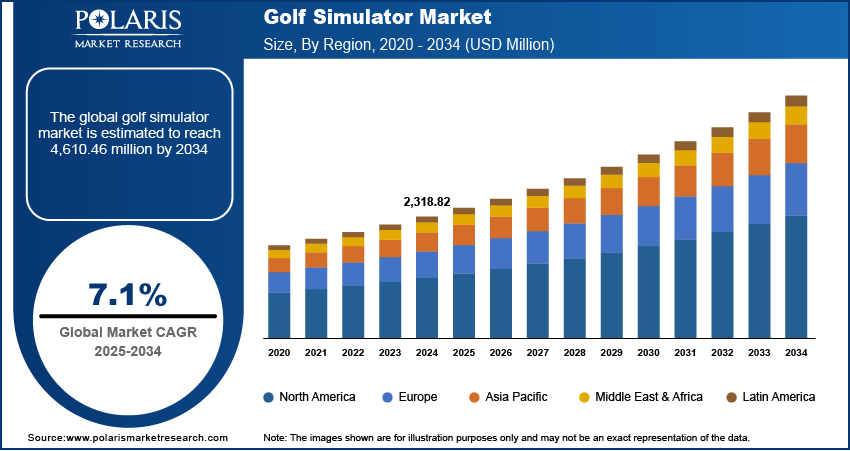

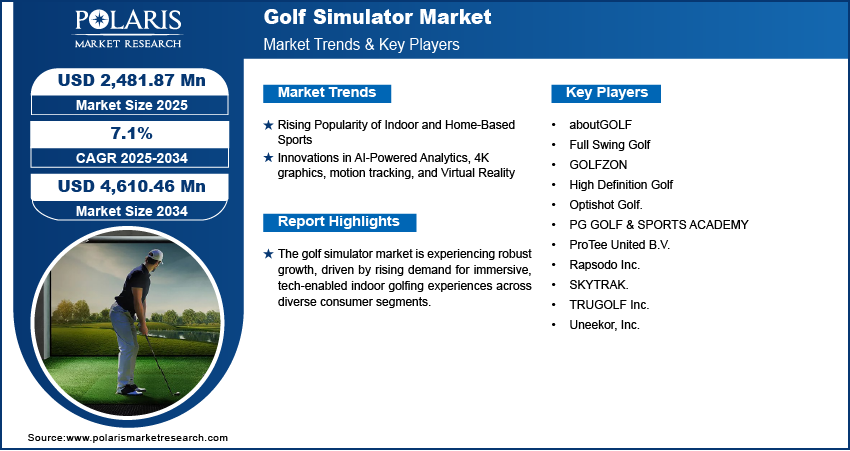

The global golf simulator market was valued at USD 2,318.82 million in 2024. It is expected to grow from USD 2,481.87 million in 2025 to USD 4,610.46 million by 2034, at a CAGR of 7.1% during the forecast period. Key drivers include technological innovation (AI, VR, 4K graphics, dual‑radar sensors), rising demand for indoor and home-based play year-round, growing entertainment venues and bars, affordability of portable systems, and widening appeal among younger and nontraditional players.

Key Insights

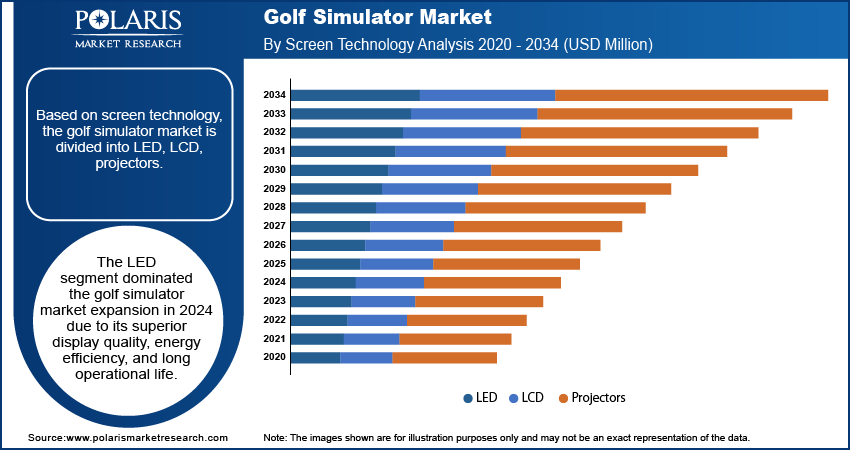

- The LED segment led the market in 2024, driven by its superior display quality, energy efficiency, and durability, meeting consumer demand for realistic visuals and low maintenance in golf simulation technology.

- The residential homes segment is expected to see strong growth during the forecast period, fueled by rising interest in convenient in-home entertainment, growing health awareness, and the need for personal fitness solutions amid lifestyle changes.

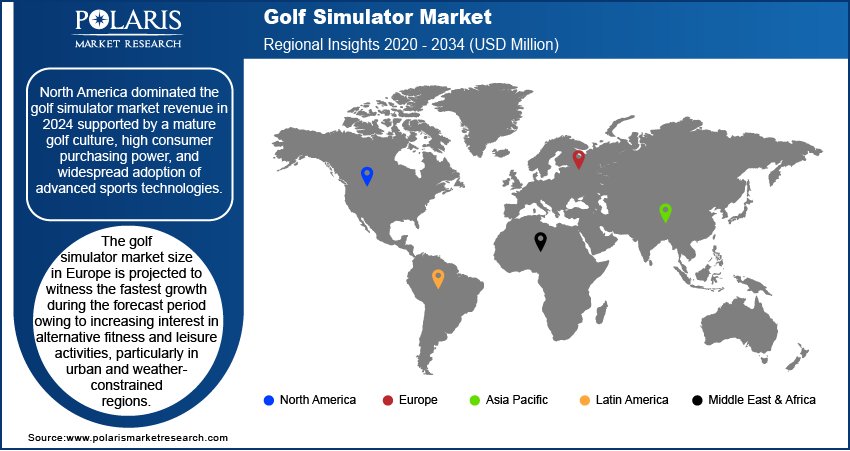

- North America dominated in 2024, supported by a well-established golf culture, high disposable incomes, and widespread adoption of cutting-edge sports and simulation technologies that enhance training and recreational experiences.

- Europe is projected to experience the fastest growth, driven by increasing popularity of alternative fitness and leisure activities, urbanization, and the need for weather-independent sports options, especially in regions with limited outdoor golf opportunities.

Industry Dynamics

- Growing demand for immersive and convenient golf training solutions is driving the golf simulator market, as enthusiasts and professionals seek realistic, year-round practice options beyond traditional outdoor play.

- Expanding adoption of advanced simulation technologies, including high-definition displays and motion sensors, is creating new opportunities, supported by rising interest in indoor sports, home fitness trends, and virtual coaching.

- High installation costs, space requirements, and limited consumer awareness restrict broader adoption, especially in emerging regions with less-developed recreational infrastructure and lower disposable incomes.

- Innovations in 3D imaging, AI-driven swing analysis, and interactive software are revolutionizing the golf simulator market, delivering enhanced accuracy, personalized feedback, and engaging user experiences for both casual and competitive players.

Market Statistics

- 2024 Market Size: USD 2,318.82 million

- 2034 Projected Market Size: USD 4,610.46 million

- CAGR (2025-2034): 7.1%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A golf simulator is a digital system that allows players to practice and play golf in a virtual environment using real golf equipment. The golf simulator market has seen substantial traction in recent years, primarily driven by the rising need for cost-effective golfing solutions. Traditional golf can be an expensive sport, involving club memberships, green fees, and travel costs. According to a July 2022 Pfeiffer University report, quality golf clubs cost at least USD 500, green fees start at USD 50, and private lessons range from USD 80 to USD 100. Weeklong camps cost USD 250-USD 400, while overnight camps can reach USD 1,200-USD 2,000, further boosting the market demand. Golf simulators eliminate these expenses by providing an affordable, one-time investment for long-term use. As a result, they have become a viable option for both enthusiasts and professional players seeking consistent practice without the ongoing cost burden. This affordability factor makes simulators particularly appealing to younger demographics and individuals living in urban settings where access to golf courses may be limited.

The golf simulator market is benefiting from both technological advancements and the sport’s rising global popularity. According to the NGF, 2023 saw a record 531 million rounds played in the US, surpassing 2021’s peak and trending 10% above the five-year average, highlighting sustained demand. In addition to cost efficiency, this growth highlights how golf’s expanding appeal across age groups and regions is driving the market opportunity. Simulators serve this shift by enabling users to experience international courses and dynamic conditions indoors, aligning with modern preferences for convenience and innovation. Simulators bridge traditional play with digital engagement, offering an immersive platform that reinforces the market’s long-term potential as golf gains traction in emerging markets and among tech-savvy players. This synergy between rising participation and simulator adoption positions the industry for continued expansion.

Driver Dynamics

Rising Popularity of Indoor and Home-Based Sports

The rising popularity of indoor and home-based sports is a key driver of the market, as it reflects a broader shift in consumer behavior toward convenient, space-efficient recreational activities. Golf simulators offer a compelling alternative to traditional outdoor golfing with growing interest in personalized fitness and entertainment solutions that can be accessed within the comfort of one’s home. They cater to users seeking consistent practice regardless of weather or location constraints, aligning with urban lifestyles and time-conscious consumers. This indoor adaptability has positioned golf simulators as an attractive solution for both casual users and professionals

Innovations in AI-Powered Analytics, 4K graphics, motion tracking, and Virtual Reality

Innovations in AI-powered analytics, 4K graphics, motion tracking, and virtual reality are further accelerating market growth by enhancing the realism, accuracy, and overall user experience of golf simulators. For instance, in January 2025, SMARTGOLF launched its ball-less golf system featuring AIX, an AI coach that analyzes swing mechanics using IoT technology. The system provides physics-based swing analysis and personalized training recommendations, with endorsement from PGA professionals. These advanced technologies provide detailed performance feedback, simulate real-world golf environments with exceptional visual fidelity, and offer immersive gameplay that replicates the nuances of on-course conditions. Consumers increasingly seek data-driven insights and lifelike experiences, such technological advancements are elevating the value proposition of golf simulators. This continuous innovation is expanding the appeal of simulators across skill levels but also fostering deeper engagement through interactive and personalized play.

Segment Assessment

Golf Simulator Market Assessment by Screen Technology Outlook

The segmentation based on screen technology, includes LED, LCD, projectors. The LED segment dominated in 2024 due to its superior display quality, energy efficiency, and long operational life. LED screens offer improved brightness, sharp contrast, and vivid color representation, which greatly improve the realism and immersive experience in simulated golf environments. These features make LED displays especially appealing for users seeking high-performance setups, whether for professional training or entertainment. Additionally, LED technology supports thinner and more compact designs, contributing to space optimization, an essential factor for indoor setups. Its durability and lower maintenance requirements further add to its value proposition in commercial and residential installations alike.

Golf Simulator Market Evaluation by Application Outlook

The segmentation based on application, includes residential homes, golf clubs, indoor entertainment centers. The residential homes segment is expected to witness significant growth during the forecast period driven by the increasing demand for in-home recreational solutions and personal fitness alternatives. Golf simulators provide a convenient and space-efficient option that can deliver both entertainment and skill development as consumers look for ways to integrate leisure activities into their living spaces. Technological advancements have made simulators more accessible and user-friendly, encouraging adoption among amateur golfers. The rise in homeownership and urban lifestyles further supports this trend, with homeowners investing in premium indoor experiences that align with their interests and convenience.

Regional Analysis

By region, the report provide insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated in 2024 supported by a mature golf culture, high consumer purchasing power, and widespread adoption of advanced sports technologies. The Federal Reserve Economic Data (FRED) reported in March 2025 that US real disposable personal income stood at USD 17,756.2 million, highlighting the robust economic conditions enabling spending on premium golf technologies. The region is home to a large base of recreational and professional golfers, along with a well-established network of golf training facilities and indoor sports centers. Additionally, the integration of golf simulators in luxury residential developments and commercial venues such as entertainment hubs and sports bars has fueled regional demand. Strong infrastructure, a favorable climate for indoor sports, and an early embrace of immersive technologies have collectively strengthened North America's leadership position in the global market.

Europe is projected to witness the fastest growth during the forecast period owing to increasing interest in alternative fitness and leisure activities, particularly in urban and weather-constrained regions. A 2024 Europe active analysis revealed a 7.5% membership increase, with active members growing by 4.7 million from 62.9 million in 2022 to 67.6 million at the end of 2023, further contributing to the market expansion. Golf simulators are emerging as a practical solution for year-round training and entertainment as space and climate limitations restrict outdoor play. The growing emphasis on sports technology, coupled with rising disposable incomes and digital adoption across key European economies, is accelerating market potential. Furthermore, golf’s expanding appeal among younger demographics and the rise of multipurpose indoor sports centers are reinforcing the region’s rapid growth trajectory in this space.

Golf Simulator Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are aboutGOLF; Full Swing Golf; GOLFZON; High Definition Golf; Optishot Golf; PG GOLF & SPORTS ACADEMY; ProTee United B.V.; Rapsodo Inc.; SKYTRAK; TRUGOLF Inc.; Uneekor, Inc.

Full Swing Golf, founded in 1986 by Floyd Arnold, is an innovator in sports technology and the largest US-based producer of multi-sport simulators. Headquartered in Carlsbad, California, the company is renowned for its patented tri-tracking technology, which combines high-speed cameras and infrared light wave technology to deliver unmatched accuracy in ball flight simulation. Full Swing Simulators are the Official Licensed Simulator of the PGA TOUR and are trusted by professional athletes such as Tiger Woods, Jordan Spieth, and Steph Curry. The company offers a wide range of products, such as premium indoor simulators and the Full Swing KIT portable launch monitor, which provides 16 points of club and ball data with high-resolution video. These innovations cater to various market segments, such as commercial spaces, golf clubhouses, and residential installations. Full Swing products redefine how enthusiasts practice and enjoy golf indoors, with access to over 84 championship golf courses and interactive sports experiences. Their strategic partnerships with organizations such as TGL, Golf Channel, and Topgolf further cement their position as industry leaders. Full Swing continues to push boundaries with advanced software and hardware solutions, making golf simulation accessible to players of all levels while driving innovation in sports technology globally.

Rapsodo Inc., founded in 2010 and headquartered in Chesterfield, Missouri, is an innovator in sports analytics technology, specializing in data-driven tools for athletes and coaches. The company gained prominence in the golf sector by introducing affordable and professional-grade launch monitors, such as the Mobile Launch Monitor (MLM) and MLM2PRO. Rapsodo's products are designed to provide detailed analytics, such as ball speed, club head speed, launch angle, spin rate, shot shape, and distance. These features make their devices indispensable for golfers seeking actionable insights to improve their performance. The MLM2PRO, which combines advanced radar and dual-camera technology, doubles as a golf simulator, offering access to over 30,000 virtual courses and a dynamic virtual range. It provides real-time feedback and visual shot analysis, enabling players to refine their skills effectively. Rapsodo has partnered with major platforms like E6 CONNECT to enhance simulation capabilities and integrate its devices with top-tier software solutions. The MLM2PRO has set a new standard for accuracy and accessibility in golf technology.

Key Companies in Golf Simulator Market

- aboutGOLF

- Full Swing Golf

- GOLFZON

- High Definition Golf

- Optishot Golf.

- PG GOLF & SPORTS ACADEMY

- ProTee United B.V.

- Rapsodo Inc.

- SKYTRAK.

- TRUGOLF Inc.

- Uneekor, Inc.

Golf Simulator Market Development

May 2025: IdeasLab launched XView AI, a markerless app offering real-time, offline analysis of the full golf swing by tracking body, shaft, and club movements. The app is available on the iPhone App Store.

April 2025: Uneekor launched three new golf tech products: EYE XR launch monitor, AI Trainer, and GameDay software. Developed over seven years, these innovations aim to enhance simulation accuracy and training capabilities for golfers of all levels through advanced performance tracking.

November 2024: GolfIn launched IDRA II, an AI-powered overhead launch monitor with dual high-speed cameras and putting analytics. Integrated with GSPro software, it offers real-time swing data, video playback, and enhanced realism for indoor golf, catering to both amateurs and professionals seeking precision feedback.

Golf Simulator Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020 - 2034)

- Optical Camera Systems

- Radar Technology

- Laser Rangefinders

By Type Outlook (Revenue, USD Million, 2020 - 2034)

- Single-player simulators

- Multi-player simulators

By Screen Technology Outlook (Revenue, USD Million, 2020 - 2034)

- LED

- LCD

- Projectors

By Course Availability Outlook (Revenue, USD Million, 2020 - 2034)

- Built-in courses

- Subscription- based courses

By Application Outlook (Revenue, USD Million, 2020 - 2034)

- Residential Homes

- Golf Clubs

- Indoor Entertainment Centers

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Golf Simulator Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,318.82 million |

|

Market Size Value in 2025 |

USD 2,481.87 million |

|

Revenue Forecast in 2034 |

USD 4,610.46 million |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global golf simulator market size was valued at USD 2,318.82 million in 2024 and is projected to grow to USD 4,610.46 million by 2034.

The global market is projected to grow at a CAGR of 7.1% during the forecast period.

North America dominated in 2024.

Some of the key players in the market are aboutGOLF; Full Swing Golf; GOLFZON; High Definition Golf; Optishot Golf; PG GOLF & SPORTS ACADEMY; ProTee United B.V.; Rapsodo Inc.; SKYTRAK; TRUGOLF Inc.; Uneekor, Inc.

The LED segment dominated in 2024.

The residential homes segment is expected to witness significant growth during the forecast period.