Graphite Coatings Market Share, Size, Trends, Industry Analysis Report

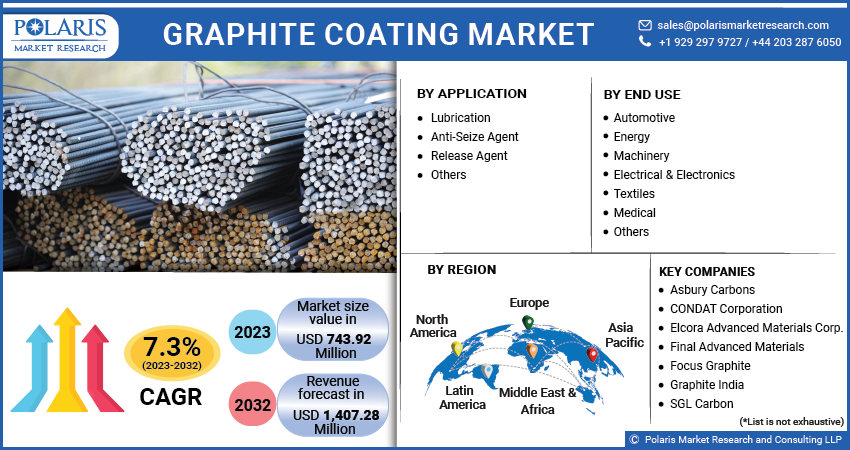

By Application (Lubrication, Anti-Seize Agent, Release Agent, and Others); By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 116

- Format: PDF

- Report ID: PM3682

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

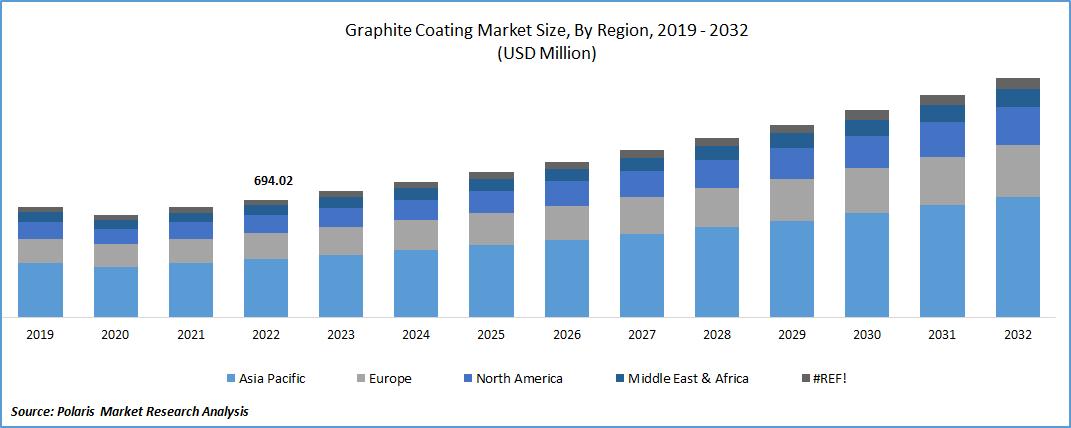

The global graphite coatings market was valued at USD 694.02 million in 2022 and is expected to grow at a CAGR of 7.3% during the forecast period.

The growing focus on key market companies on introducing graphite coatings with enhanced and improved functional characteristics which is quite harder or difficult to find in traditional ceramic coatings and their ability to operate at very higher temperature for longer period of time compared to many other bearing and seal materials available in the market, making them a perfect option to be used in various applications particularly in airplanes, which are among the major factors driving the market growth.

To Understand More About this Research: Request a Free Sample Report

In addition, the growing popularity and penetration for these coatings globally due to numerous beneficial properties like ease of application, electrical conductivity, and anti-repellant characteristics, thereby influencing the graphite coatings market growth in a positive way.

- For instance, in June 2021, Oerlikon Balzers, introduced new “Baldia” portfolio of the diamond coatings, which is extremely wear-resistant and offers excellent thermal conductivity. The new range of coating portfolio fulfill the spectrum of the demanding machining applications and is being divided into 2 different base materials.

Moreover, increasing environmental regulations and a shift toward eco-friendly coatings have encouraged industries to seek alternatives to traditional solvent-based coatings, thus the demand for coatings with their lower volatile organic compound content and reduced environmental impact, are gaining prominence as sustainable coating solutions all over the world. However, the high cost of raw materials, complex production processes, and specialized application techniques which contributes to the higher price of graphite coatings is likely to limit their adoption, especially in cost-sensitive industries or applications where alternative coating options are available.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the graphite coatings market. The spread of the deadly coronavirus has drastically impacted the global economy as major manufacturing facilities were temporarily closed and had significant delays projects and investments. The pandemic has also resulted in huge disruptions in global supply chains as many countries have imposed restrictions on international trade and logistics, thereby negatively influenced the market.

For Specific Research Requirements, Speak With Research Analyst

Industry Dynamics

Growth Drivers

High penetration of product from various end use industries

The rapidly increased product demand from various end-use industries including metal processing, aerospace, energy, and electronics and continuous growth in the demand for corrosion-resistance coatings across the globe in order to boost the lifespan of equipment and infrastructure along with the growing prevalence for various favorable properties of these coatings like low friction and excellent lubrication, are the primary factors fostering the demand and growth of the global market.

Furthermore, the surging focus on sustainability and environmental regulations and rising emphasis of environmentally friendly coatings worldwide and rapid rate of industrialization and infrastructure development especially in emerging economies like China, India, Indonesia, and South Korea, leading to higher demand for protective and advanced coatings, is further likely to enhance the market growth and push the market forward over the years.

Report Segmentation

The market is primarily segmented based on application, end use, and region.

|

By Application |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

Lubrication segment accounted for the largest market share in 2022

The growth of the segment market can be mainly attributed to widespread use of lubrication across different sectors including space & aviation, railway, automotive, and medical among others due to its ability to reduce friction, improve surface rollover qualities, and wears compressibility. In addition, ongoing advancements in nanotechnology have led to the development of enhanced graphite coatings with improved lubricating properties and these advanced coatings offer superior performance in terms of reduced friction, enhanced wear resistance, and prolonged lubrication intervals, thereby influencing the segment’s growth at the rapid pace.

The anti-seize agent segment is anticipated to grow at fastest growth rate over the coming years, mainly attributable to its range of beneficial properties including better resistance to corrosion, glazing, seizing, and enhanced thermal expansion along with the surging trend of using the product in metallic concrete supports and plates mainly to resist the thermal expansion.

By End Use Analysis

Automotive segment held the significant market revenue share in 2022

The automotive segment held the maximum market share in terms of revenue in 2022, which is highly attributable to numerous beneficial features and properties graphite coatings provides to automotive industry such as corrosion protection, lubrication and wear resistance, efficient thermal management, and fuel efficiency, leading to higher product adoption.

Additionally, graphite coatings also offer visually appealing finish to various automotive component including wheels, trim, and interior components coupled with this, they are solvent-free and contain low or no volatile organic compounds (VOCs), which minimizes their impact on air quality and human health, thereby increasing automobile production and sales is positively impacting the market growth. For instance, according to a report published in 2023, the total number of motor vehicles produced in 2022 was stood at around 85.4 million, with an increase of approx. 5.7% compared to 2021. The Greater China accounts for leading number of automobiles produced followed by Europe and North America in 2022.

The machinery segment is likely to grow at fastest growth rate in the next coming years, on account of its excellent corrosion resistance properties, which makes them suitable for machinery components that come into regular contact with various corrosive substances or environment along with the ability to provide chemical inertness, making them resistant to large range of chemicals and solvents.

Regional Insights

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market for graphite coatings with substantial share in 2022, and is projected to maintain its dominance throughout the forecast period. The regional market growth can be largely accelerated to increased production of steel and various types of consumer electronics and significant expansion of automotive sector with growing number of consumers demanding for automobiles with advanced coatings and characteristics. Moreover, increasing utilization of graphite coatings in lithium-ion batteries, which are being widely adopted in electric vehicles, renewable energy storage, and consumer electronics and emergence of the region as major producer of lithium-ion batteries is propelling the demand and growth at exponential pace. According to the Indian Government, India has been producing approx. 81% of lithium-ion batteries for the country demand for electric vehicles and the country is likely to investment heavily in producing new production facilities for lithium-ion batteries in the next coming years to meet the rising demand for electric vehicles.

The North America region is anticipated to emerge as fastest growing region with a health CAGR over the study period, mainly due to emerging trend of shifting towards electric vehicles mainly in countries like US and Canada to reduce the dependence on fossil fuels and minimize carbon emissions coupled with the rising number of infrastructure development and construction projects like commercial buildings, tunnels, pipelines, and bridges.

Key Players & Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Asbury Carbons

- CONDAT Corporation

- Elcora Advanced Materials Corp.

- Final Advanced Materials

- Focus Graphite

- Graphite India

- Hexagon Energy Materials Limited

- Imerys Graphite & Carbon

- NextSource Materials

- SGL Carbon

- Tokai Carbon Co. Ltd.

- Toyo Tanso

- Triton Materials

- Van Sickle Paint

Recent Developments

- In February 2023, Heubach Group announced that they company is launching a new range of products and tools at ECS in Nuremberg. The company also announced the launch of Hostatint UV 100, a new reformulated and reimagined range of preparations mainly developed for radiation-cured coatings.

- In August 2022, SGL Carbon announced the expansion of the production capacities of graphite products for semiconductor industry, as part of their investment budget. The graphite production expansion plan will take place in various steps over the next two coming years at Chinese site in Shanghai and further expansion is being planned at various other locations.

Graphite Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 743.92 million |

|

Revenue forecast in 2032 |

USD 1,407.28 million |

|

CAGR |

7.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of Graphite Coating Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

Graphite Coatings Market Size Worth $1,407.28 million By 2032.

Key players in the graphite coatings market are Asbury Carbons, CONDAT Corporation, Elcora Advanced Materials Corp., Final Advanced Materials, Focus Graphite.

Asia Pacific contribute notably towards the global graphite coatings market.

The global graphite coatings market is expected to grow at a CAGR of 7.3% during the forecast period.

The graphite coatings market report covering key segments are application, end use, and region.