Green Coatings Market Share, Size, Trends, Industry Analysis Report

By Technology (Waterborne, Powder, High-solids, and Radiation-cure); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3118

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

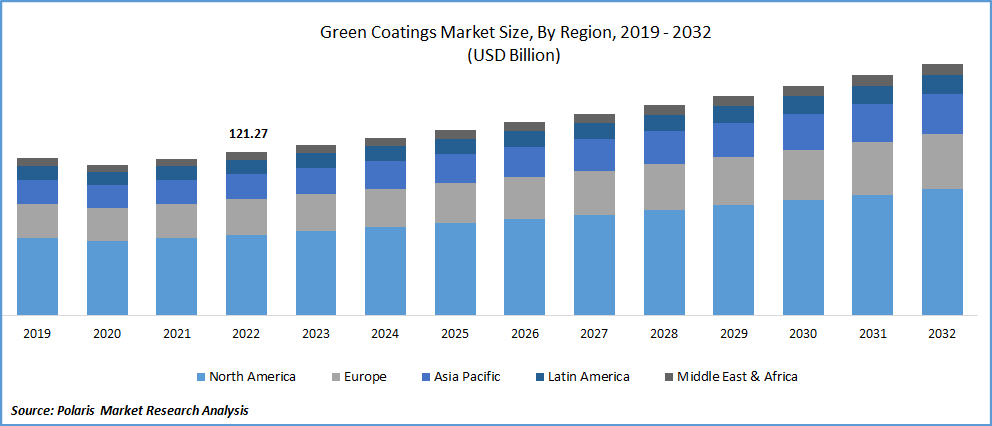

The global green coatings market was valued at USD 126.36 billion in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period. The continuously growing environmental awareness across developing regions, increasing demand for water borne and powder coatings to replace solvent-borne coatings mainly in automotive and industrial applications, and rapid growth in the architectural sector in countries like China, Japan, and India are among the prominent factors fueling market growth during the forecast period.

Know more about this report: Request for sample pages

In addition, rising advancements and development in coating technology and highly influencing demand from several end-user industries along with the several stringent regulations imposed by governments from both developed and developing regions, are likely to create new growth opportunities for the market soon.

For instance, in May 2022, British Coatings Federations announced the launch of Trace VOC Globe, which allows decorative paint manufacturers to improve their communication with customers by highlighting the lowest levels of VOCs. The VOC Globe scheme is basically a part of an initiative from coating industry to increase consumer awareness regarding the amount of VOC being used in paint products.

Several manufacturers across the globe are focused on the production of high-performance coatings having non-solvent borne technology and minimum or zero VOC with good durability, as it forms ground-level ozone and urban smog resulting in several kinds of health hazards like headache, dizziness, and kidney damage.

In addition, significant growth in the construction industry around the world is also projected to create a positive outlook for the green coatings markets, as these coatings are widely used on walls, roofs, windows, door frames, interior extrusion, and panels.

However, green coatings usually undergo a very complex process to become completely environmentally friendly, that result in increased prices upon reaching the final stage users are not willing to pay an increased amount as there are alternatives available at cheap cost, which may hinder the global market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the green coatings market. The emergence of the deadly virus has stimulated the consumer's desire to know where their food comes from and what additives are being added to the food product. The increased health awareness among consumers has positively influenced the demand for Green Coatings over the preference for synthetic food colorants.

Industry Dynamics

Growth Drivers

There has been a significant increase in awareness regarding the harmful effects of VOC emissions and global warming across the globe, supported by the numerous aforementioned regulations, that has gradually shifted the demand from solvent-borne coatings to environment-friendly products including waterborne, high-solids, and UV-curable coatings, as these kinds of products, contain no or fewer solvents that easily evaporate during the curing phase, thereby driving the global market growth at a rapid pace.

Furthermore, several manufacturers worldwide are highly implementing the reduction of their carbon footprint as per the regulation and different benefits received from government initiatives for the adoption and use of renewable resources, which is also expected to boost the demand for green coatings over the coming years.

For instance, in December 2022, BASF announced the launch of its first and latest biomass balance automotive coatings in China. The first batch of the basecoat has been already delivered to a customer in China and enables about a 20% reduction in the product’s carbon footprint. It further adds a reduced carbon footprint without any need to alter the product’s formulation and performance.

Report Segmentation

The market is primarily segmented based on technology, application, and region.

|

By Technology |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Waterborne segment accounted for the largest market share in 2022

The growing demand for the product in automotive and industrial applications in emerging economies such as Brazil and India and early adoption of the innovated technology in the manufacturing process in North America and Europe region are primary factors driving the segment growth. Additionally, high utilization and prevalence of waterborne coatings across architectural industry, as infrastructure spending with growing economic development across the globe is further anticipated to fuel segment growth.

The high-solids coatings segment is likely to register highest market growth during the projected period on account of its cost-effectiveness, superior water resistance, and excellent viscoelastic properties. A rapid surge in the demand for domestic appliances such as freezer cabinet, microwaves, and washing machine, which results in increased demand for powder coatings and high prevalence of this technology for the manufacturing of consumer goods is anticipated to augment segment growth exponentially in the coming years.

Automotive segment dominated the global market in 2022

The growth of the segment can be mainly attributed to growing use of OEM coatings in automobile manufacturing as it provides high durability and excellent quality and also possesses several mechanical properties for protecting automobiles from scratches, chemical exposure, and the environment. Strict environmental regulations have created significant demand for sustainable development of coating products and reducing the volatile organic compounds to effectively include resource and energy conservations, increasing process efficiency, and renewable waste, and minimizing material waste.

However, the industrial segment is expected to grow at a considerable growth rate over the anticipated period, which is mainly accelerated by increased awareness regarding vehicle paints by healing damages and scratches on product surfaces along with the expansion of consumer base in APAC region owing to high spending capacity on various end-user industries. Industrial coatings are being widely used for a variety of applications to ensure resistance to anti-corrosion, prevent wear & tear, and increased operational efficiency, thereby boosting segment growth over the coming years.

The demand in Asia Pacific is expected to witness significant growth over the forecast period

Asia Pacific region is expected to be the fastest emerging region in the green solvents market throughout the forecast period. Rapid economic development, high consumer disposable income, and a large population base in countries like China and India coupled with a large number of coating manufacturers in China are major factors expected to drive the growth of the market in the region.

In addition, rapid growth in industrialization and urbanization in the region along with the growing support from the government through various incentive programs are likely to provide lucrative growth opportunities for the region.

However, the North American region led the industry and accounted for a substantial market share in 2022 owing to highly recommencing of various industrial operations and robust presence of strict government regulations regarding VOC emissions owing to the rising environmental concerns in countries like the US and Canada. Major players in the region are involved in the expansion of their manufacturing facilities, enhancing sales & operations planning, expanding consumer base, and introducing new products to cater to the growing region across the region.

Competitive Insight

Some of the major players operating in the global market include AkzoNobel N.V., PPG Industries, Axalta Coating Systems, BASF SE, The Sherwin-Williams, Valspar Corporation, Royal DSM, Kansai Paint, Nippon Paint, Koninklijke DSM N.V., Hempel A/S, Chimar Hellas S.A., Eastman Chemical Company, Berger Paints India Limited, Sika AG, Masco Corporation, RPM International Inc., Water Wurdack Inc., and Henkel AG & Co., KGaA.

Recent Developments

- In June 2022, PPG Industries, introduced its latest product PPG ENVIROCRON LUM coating, the industry’s first commercial retroreflective powder coating. The new coating is mainly developed to improve visibility at night and even during low-light conditions, that is available in several colors and has excellent abrasion and chip resistance and also one-cat corrosion protection.

- In May 2022, Allnex announced that the company will participate in Paint India 2022, which is going to be held at JIO World Convention Center, in India. Allnex is planning to bring a broad portfolio of green coating technologies and various innovative developments for customers across numerous industries including automotive, wood, metal, and transportation.

Green Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 131.72 billion |

|

Revenue forecast in 2032 |

USD 186.17 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AkzoNobel N.V., PPG Industries, Axalta Coating Systems, BASF SE, The Sherwin-Williams, Valspar Corporation, Royal DSM, Kansai Paint, Nippon Paint, Koninklijke DSM N.V., Hempel A/S, Chimar Hellas S.A., Eastman Chemical Company, Berger Paints India Limited, Sika AG, Masco Corporation, RPM International Inc., Water Wurdack Inc., and Henkel AG & Co., KGaA. |

FAQ's

The global green coatings market size is expected to reach USD 186.17 billion by 2032.

Key players in the AkzoNobel N.V., PPG Industries, Axalta Coating Systems, BASF SE, The Sherwin-Williams, Valspar Corporation, Royal DSM, Kansai Paint.

Asia Pacific contribute notably towards the global green coatings market.

The global green coatings market expected to grow at a CAGR of 4.4% during the forecast period.

The green coatings market report covering key segments are technology, application, and region.