Green Mining Market Share, Size, Trends, Industry Analysis Report

By Type (Surface Mining and Underground Mining); By Technology; By Region; Segment Forecast, 2023-2032

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2954

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

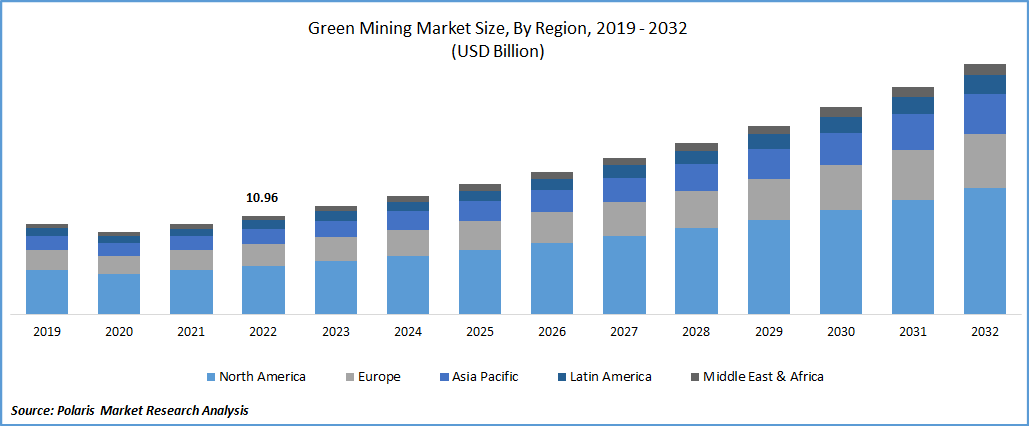

The global green mining market was valued at USD 10.96 billion in 2022 and is expected to grow at a CAGR of 9.8% during the forecast period.

The growing implementation of green mining technologies by various mining corporations as well as governments to reduce or minimize the waste in the mining industry and decreases the several negative environmental repercussions associated with mining activities is a key factor boosting the demand and growth of the market. In addition, a large number of mining businesses are shifting towards surface mining over underground mining owing to several reasons including higher safety and less expensive, which is further expected to fuel the market growth in the next coming years.

Know more about this report: Request for sample pages

In recent years, the green mining market is gaining high traction and expanding rapidly as a result of growing penetration and demand for technologies having a lower environmental impact and fast mining capabilities along with the growing transition to a low-carbon economy and numerous government agencies, enacting restrictions and laws for reducing carbon footprints while extracting minerals and metals is fueling the adoption of green mining all over the world.

For instance, in September 2022, The Biden Administration announced an Inflation Reduction Act, which will be a significant boost to the mining industry across the region. In this Act, the United States, earmarked USD 369 billion in climate and energy provisions to transition the U.S. economy toward green and sustainable energy. The investment has been made with an aim to reduce the country’s greenhouse emissions by 40% low from 2005 levels by 2030.

However, high initial investments are required for the adoption of new and innovative green mining technologies, as it requires the utilization of different equipment and considerable modifications to infrastructure, which is likely to be the key major restraining factor for global market growth. Moreover, growing concerns related to illegal mining and its various environmental implications, impact agricultural practices including terracing, crop rotation, and irrigation of crops.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the green mining market. The demand and production of various green mining products have seen a decline during the pandemic owing to the lockdown and several trade restrictions imposed by governments across the world. The emergence of the deadly coronavirus resulted in the shutdown of product facilities, high disruptions in the global supply chain, and a decline in investments in research & development activities, which had a negative impact on the market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Increasing utilization of renewable energy in the process of green mining which includes wind, solar, hydropower, geothermal, hydrogen, and fuel energy to crush, mine, and minerals, since these are the most environmentally friendly forms of energy production and availability at a lower cost compared to other forms of energy are key factors projected to boost the growth of the market during the forecast period.

Furthermore, the rapidly growing use of electric vehicles that are powered by batteries across the globe and mainly in developed economies such as the United States, Canada, Germany, and France, that require increased mining of metals used in the production of batteries is likely to propel the growth of the market. With all major manufacturers of automobiles bringing electric vehicles into production to catch up with the growing demand for electric vehicles, the demand and prevalence of effective mining processes are influencing rapidly.

For instance, according to International Energy Agency, the number of electric vehicles on the road is projected to grow to over 300 million by 2030, with a significant rise from 16.5 million cars in 2021. And, more than 60% of new car sales across the globe are estimated to be electric vehicles.

Report Segmentation

The market is primarily segmented based on type, technology, and region.

|

By Type |

By Technology |

By Region |

|

|

|

Know more about this report: Request for sample pages

Surface mining segment is projected to witness the fastest growth

The surface mining segment is expected to grow at a significant CAGR throughout the forecast period owing to its various advantages including higher productiveness, lower cost of production, enhanced safety, and cheaper equipment compared to underground mining equipment. In addition, open-pit is known to provide a vast scale of production and consists the ability to provide options for mass production as well. Various surface mines usually operated 24 hours a day and 365 days a year, to put the machinery to work for as much as it can, further reducing the quantity of necessary equipment.

However, the underground mining segment accounted for a considerable market share in 2022, which is mainly accelerated by increasing R&D activities for the development of machines, which are highly resistant to heat temperatures and adapt to humidity changes. Moreover, various companies in the underground mining market are increasing their focus and efforts to fill the gap between actual mining activities and laboratory tests, which are key factors fueling the segment market growth.

Power reduction segment is expected to hold a significant revenue share

The power reduction segment is projected to account for the highest market revenue share during the anticipated period. The increasing prevalence of processes related to reducing solid materials from the average particle size to the smaller particle size by cutting, vibrating, and crushing involving both crushing and grinding are major factors likely to fuel the demand and growth of the segment market.

Furthermore, the emission reduction technology segment is likely to gain significant market growth over the coming years. Due to the growing penetration for the reduction of greenhouse gas emissions across the globe, many countries are enforcing regulations and restrictions along with increased advancements and innovations in technologies by research institutes, the segment market is anticipated to gain high growth in the demand and adoption of innovated emission reduction technologies.

The mining industry contributes nearly 2 to 3 percent of total CO2 emissions worldwide and has a crucial role in emissions reduction. However, the industry is facing continuously growing pressure from investors, regulators, and customers to decarbonize operations, which has led to a rapid surge in substantial initiatives.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific region is expected to grow at the highest CAGR over the projected period on account of rapid economic growth and a high consumer base and demand for elegant and comfortable commodities mainly in developing nations such as India, China, and South Korea. In addition, the rapid expansion of sustainable practices and the rising need to protect the environment with the use of advanced technology in the region is likely to contribute positively to the market growth in the region.

However, the Europe region dominated the global market in 2022. The growth of the regional market can be attributed to ongoing digital mine innovation, increased investment, and growing government support through various initiatives and development programs. Additionally, the incorporation of artificial intelligence in mining equipment, which increased the efficiency and productivity of miners while ensuring their safety of miners is further boosting the market growth.

Competitive Insight

Some of the major players operating in the global market include BHP Billiton, Anglo American, Tata Steel Limited, Jiangxi Copper, Dundee Precious Metals, Liebherr, VALE S.A., Rin Tinto, Saudi Arabian Mining, Doosan Infracore, Shandong Gold Mining, Green Twirl Energy, Deloitte Australia, Wirtgen Group, Glencore, Safe Green Mining, and Freeport-McMoRan.

Recent Developments

In June 2022, Metso Outotec announced a collaboration with “Dynamox” on using its monitoring platform in their mining & aggregating processes. With this partnership, the company is strengthening its flexibility and digital scalability and providing its customers with easy-to-use and digital service solutions.

In September 2021, Powerbridge introduced its “Green Crypto Mining” known as “Powercrypto Holdings, which is powered by renewable energy. It’s likely to achieve a BTC hash rate of 1,000,000 TH/s & ETH Hash rate of 698,224 MH/s.

Green Mining Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 12.01 billion |

|

Revenue forecast in 2032 |

USD 27.76 billion |

|

CAGR |

9.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BHP Billiton, Anglo American PLC, Tata Steel Limited, Jiangxi Copper Corporation, Dundee Precious Metals, Liebherr, VALE S.A., Rin Tinto, Saudi Arabian Mining Corporation, Doosan Infracore, Shandong Gold Mining Co. Ltd., Green Twirl Energy Ltd., Deloitte Australia, Wirtgen Group, Glencore, Safe Green Mining Technology Pvt. Ltd., and Freeport-McMoRan. |

FAQ's

The green mining market report covering key segments are type, technology, and region.

Green Mining Market Size Worth $27.76 Billion By 2032.

The global green mining market expected to grow at a CAGR of 9.8% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in green mining market are rapidly growing use of electric vehicles and increasing utilization of renewable energy in the process of green mining