Gunshot Detection System Market Share, Size, Trends, Industry Analysis Report

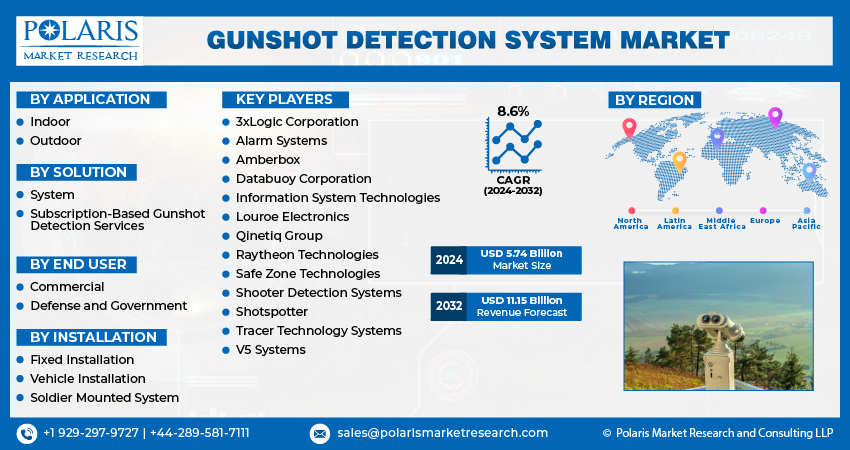

By Application (Indoor, Outdoor); By Solution; By End Use; By Installation; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3211

- Base Year: 2023

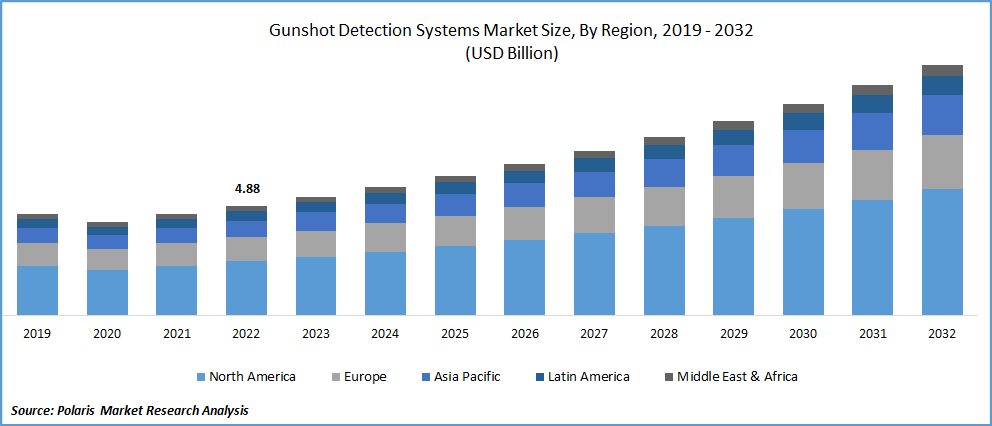

- Historical Data: 2019-2022

Report Outlook

The global gunshot detection system market was valued at USD 5.29 billion in 2023 and is expected to grow at a CAGR of 8.6% during the forecast period. Shooting point of gunshots is detected & transmitted by a conventional gun detection system using some sound sensors. These programs are utilized by the military, law enforcement, and internal security organizations to identify shootings. System uses acoustic detection technology to detect & alert the police. A sensor that detects gunshots, transmits a message to the police control center, & a computer that receives and displays the message make up such system.

Know more about this report: Request for sample pages

There has been a rise in the number of fatalities caused by mass shootings and other gun-related crimes in recent years. According to the CDC, 45,222 persons died from gun-related accidents in the United States in 2020, the most recent period for which complete information is available. This number includes gun crimes and suicides, as well as three other, more common types of gun-related deaths reported by the CDC: unintentional, involving law enforcement, or whose conditions could not be identified.

Many law enforcement agencies around the world have started adopting technologies that speed up their responses to instances involving gun violence and improve their investigations of such crimes to address the pervasive and complicated problem of violence in their communities. A system that uses a network of outside acoustic sensors to automatically detect gunfire and swiftly warn law enforcement officials is known as gunshot detection technology (GDT).

Moreover, executives and command staff in law enforcement have a key role in the selection and application of gunshot detection technologies. They oversee policy formulation and training decisions regarding the usage of such systems in addition to deciding whether to invest in the technology and determining the scope and location of coverage regions. Even though they give law enforcement organizations a competitive edge, gunfire detection systems are expensive to buy and operate.

Gunshot detection is now an appealing service for law enforcement organizations owing to advancements in sensors, dependability, and false triggering immunity. Many organizations throughout the world are now eager to get cutting-edge gunshot detection devices that might help them avoid dangers.

The COVID-19 epidemic harmed the market since there was a decline in new gunshot system manufacturing by many manufacturers, which led to a dip in demand for new gunshot detection systems in numerous nations across the world. Additionally, the pandemic decreased sales for numerous gunshot detection system producers around the world as a result of delayed product deliveries, manufacturing halts, staff reductions at the production facilities, and the limited availability of components required for the production of the final product. In the current situation, manufacturers of gunshot detection have new chances as a result of the pandemic's abating. Production of gunfire detection systems increased significantly as a result of an increase in global procurement plans by numerous nations.

Industry Dynamics

Growth Drivers

With the rise in shootings and gun sales, gunshot detection systems launch as well as government regulations are the major factors bolstering the gunshot detection system market growth. More and more nations throughout the globe are now pushing for the implementation of stronger gun control laws. The purchase of sophisticated gun control detection systems, which may be used to increase public safety and security, is another investment that governments throughout the world plan to make.

In January 2023, Shooter Detection Systems (SDS), a subsidiary of Alarm.com, received its seventh claim from the USPTO for its gunfire detection technology, Patents No. US 11,417,183 subtitled Cable-Free Gunshot Detection. Many manufacturers are producing cutting-edge products by utilizing standardized protocols which can seamlessly integrate with the majority of already installed security cameras & video management to detect gunshots & alert to the concerned authorities.

Additionally, manufacturers have improved how they incorporate more modern technology into their goods by creating a newer generation of gunshot detection systems that can proactively identify, offer assistance, and avert a serious disaster. In December 2022, In Durham, the ShotSpotter gunfire detection system was introduced. The technology is divisive, creating debate in the community about its efficacy and privacy. As a result, the market will experience growth during the forecast period as more mass shootings, a surge in IoT usage, and an increase in the use of gunshot detection systems, along with a rise in the demand for improved gunshot detection systems in various nations.

Report Segmentation

The market is primarily segmented based on application, solution, end use, installation, and region.

|

By Application |

By Solution |

By End User |

By Installation |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Fixed Installation Segment Is Expected to Witness the Fastest Growth

A large growth in the fixed installation category is anticipated. The enhancement in safety systems of the current school, university, and military infrastructures is to blame for the increase in segment compensation. Using acoustic sensor node technology, fixed gunshot detection systems monitor a gunshot incident. To serve military needs, these systems are mounted on walls, poles, or border crossings. The vehicle section that dealt with car installation had the most proportion. The expansion of this market will be fueled by rising defense spending and rising demand for advanced systems from most of the world's nations. The rise in public mass shootings, the rising crime rate, and the resulting security worries in schools are all cited as reasons for the fixed installation growth.

The Commercial Segment Is Expected to Hold the Significant Revenue Share

Segment's growth over the projection period is the rise in public safety demand. Additionally, the increasing number of shootings and gunfire incidents in inside settings including schools, malls, and commercial and government buildings has increased demand for indoor gunshot detection systems, which has boosted industry cases.

The Demand in North America Is Expected to Witness Significant Growth

The market is dominated by North America due to the high frequency of shootings and gunshots near schools, colleges, and institutions as well as other educational facilities in the region. In the upcoming years, the market will rise as a result of the rising rate of gun violence and the increasing demand for sophisticated gunshot detection systems. Gun crime has increased in the US in recent years, leading law enforcement to use gunshot detection equipment.

There has been an increase in gun violence in the United States, which has forced law enforcement agencies to install gunshot detection systems. In the US, guns are frequently used for target shooting, hunting, and self-defense. the rise in gun-related fatalities in the country has forced the government to enact new laws and regulations that, when put into effect, will reduce the number of gun-related fatalities in the country by limiting the number of guns that the general public is allowed to buy.

Competitive Insight

Some of the major players operating in the global gunshot detection system market include 3xLogic Corporation, Alarm Systems, Amberbox, Databuoy Corporation, Information System Technologies, Louroe Electronics, Qinetiq Group, Raytheon Technologies, Safe Zone Technologies, Shooter Detection Systems, Shotspotter, Tracer Technology Systems, and V5 Systems.

Recent Developments

- In September 2022, 3XLOGIC presented a new selection of deployment options for user detection solutions. This gadget is designed for larger spaces like gyms, cafeterias, libraries, or poles erected outside to cover larger areas using the new Single Sensor Gunshot to secure smaller areas in active shooter situations.

- In December 2022, SDS system was formed in partnership with the Department of Homeland Security, Science and Technology Directorate & Shooter Detection Systems.

Gunshot Detection System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.74 billion |

|

Revenue forecast in 2032 |

USD 11.15 billion |

|

CAGR |

8.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Application, By Solution, By End Use, By Installation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3xLOGIC Corporation, ALARM SYSTEMS, INC., AMBERBOX, INC., DATABUOY CORPORATION, INFORMATION SYSTEM TECHNOLOGIES INC, LOUROE ELECTRONICS, QinetiQ GROUP PLC, RAYTHEON TECHNOLOGIES CORPORATION, SAFE ZONE TECHNOLOGIES, INC, SHOOTER DETECTION SYSTEMS, SHOTSPOTTER INC., TRACER TECHNOLOGY SYSTEMS, INC., and V5 SYSTEMS INC. |

FAQ's

The gunshot detection system market report covering key segments are application, solution, end use, installation, and region.

Gunshot Detection System Market Size Worth $11.15 Billion By 2032.

The global gunshot detection system market expected to grow at a CAGR of 8.6% during the forecast period.

North America is leading the global market.

Key driving factors in gunshot detection system market are rise in shootings and gun sales.