Health & Hygiene Packaging Market Share, Size, Trends, Industry Analysis Report

By Product Type; By Form (Rigid Packaging and Flexible Packaging); By Structure; By Distribution Channel; By End-Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4464

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

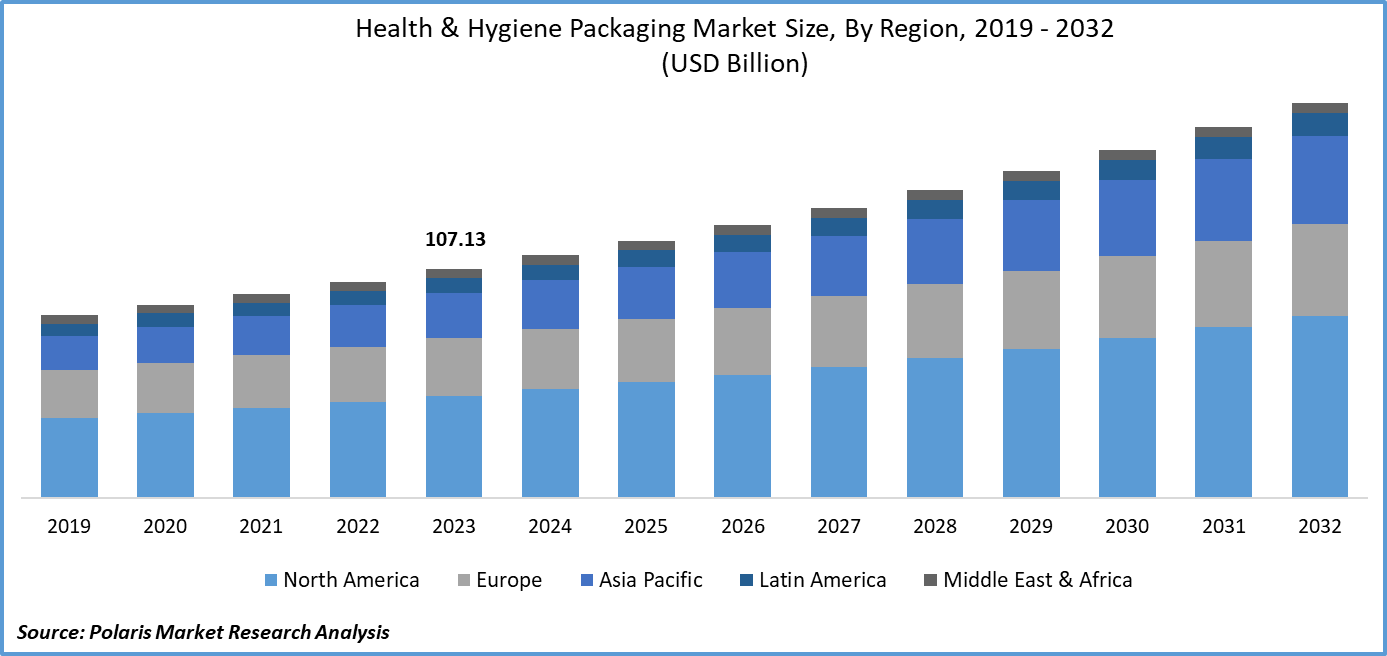

Health & Hygiene Packaging Market size was valued at USD 107.13 billion in 2023. The market is anticipated to grow from USD 113.54 billion in 2024 to USD 185.03 billion by 2032, exhibiting a CAGR of 6.3% during the forecast period

Industry Trends

Health and hygiene packaging refers to the use of packaging materials and designs that promote cleanliness, prevent contamination, and protect the health and well-being of consumers. This type of packaging is used across various industries, including health beverages, pharmaceuticals, cosmetics, and personal care packaging. Health and hygiene packaging includes features such as tamper-evident closures, sterilizable materials, and anti-microbial coatings that help prevent the spread of bacteria and other microorganisms.

The global health and hygiene packaging market is expected to experience significant growth over the forecast period, driven by increasing consumer awareness about health and hygiene, rising demand for convenient and portable products, and growing concerns about contamination and food safety. The outbreak of COVID-19 has further accelerated the demand for health and hygiene packaging, as consumers have become more conscious about personal protective equipment (PPE) and sanitization products.

Advancements in packaging technologies, such as biodegradable materials, nanotechnology, and smart packaging solutions, also drive the market. These innovations enable companies to create products that are not only safe but also sustainable and environmentally friendly.

For instance, in November 2023, Amcor Plc, a company that develops and produces responsible packaging solutions, announced the launch of the next generation medical laminates solutions.

To Understand More About this Research: Request a Free Sample Report

Further, the rise of e-commerce and online shopping has created new opportunities for health and hygiene packaging manufacturers, as consumers are looking for easy-to-use and tamper-evident packaging solutions that ensure product safety during transportation and storage. However, the market is hindered by stringent regulations and standards, high raw material costs, and concerns about waste management and environmental impact. Manufacturers need to comply with various regulations and guidelines set by government agencies, such as the U.S. Food and Drug Administration (FDA), which is time-consuming and costly.

Key Takeaways

- North America dominated the market and contributed over 34% of the share in 2023

- By product type category, the films and sheets segment is expected to register a significant CAGR over the health & hygiene packaging industry forecast period

- By form category, the flexible packaging segment is witnessing a substantial CAGR in the assessment period

- By distribution channel category, the direct sales segment is expected to grow with a lucrative CAGR over the health & hygiene packaging industry forecast period

- By end-use industry category, the home care & toiletries segment was the dominating sector in terms of health & hygiene packaging market share in 2023

What are the Market Drivers Driving the Demand for the Health & Hygiene Packaging Market?

The Growing Awareness about Health and Hygiene Drives Market Growth

As consumers become more informed and proactive about their health and well-being, they are increasingly demanding packaging solutions that prioritize safety and cleanliness. This includes packaging that prevents contamination, protects against germs and bacteria, and promotes overall product quality and freshness. In parallel, consumers are seeking out packaging that is easy to use and dispose of without compromising on convenience or functionality. This shift in consumer preferences is driving companies to develop innovative packaging solutions that address these concerns, thereby fueling the growth of the market. Also, increased awareness about the impact of packaging on the environment has further accelerated the demand for eco-friendly and sustainable packaging alternatives, contributing to the expansion of the market.

Which Factor is Restraining the Demand for Health & Hygiene Packaging?

The High Cost of Implementation Hinders Health & Hygiene Packaging Market Growth

Inadequate recycling facilities and regulations pose a significant challenge to the growth of the market. Despite the increasing demand for sustainable packaging solutions, many countries need more infrastructure and regulations to support the recycling and proper disposal of health and hygiene packaging waste. This not only creates environmental concerns but also makes it difficult for companies to justify investments in sustainable packaging solutions, as the need for recycling facilities and regulations limits the potential for closed-loop systems. Furthermore, the absence of harmonized regulations across different regions and countries creates complexity and additional costs for companies looking to introduce sustainable packaging solutions, making it harder for them to scale up their operations. This restricts the health & hygiene packaging market growth potential.

Report Segmentation

The market is primarily segmented based on product type, form, structure, distribution channel, end-use industry, and region.

|

By Product Type |

By Form |

By Structure |

By Distribution Channel |

By End-Use Industry |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Type Insights

Based on product type analysis, the market is segmented on the basis of films and sheets, bags & pouches, laminates, labels, jars & bottles, sachets, boxes and cartons, and others. The films and sheets segment in the market is anticipated to experience substantial growth with a notable CAGR during the forecast period. This growth can be attributed to the increasing demand for flexible packaging solutions that offer better protection, convenience, and shelf life to healthcare and hygiene products. Films and sheets are widely used in the packaging of medical devices, pharmaceuticals, and personal care items, owing to their excellent barrier properties against moisture, oxygen, and other contaminants.

Also, advancements in film and sheet technologies have led to the development of specialized materials that can enhance product safety, such as anti-counterfeiting features, UV protection, and tamper-evident designs. The rising popularity of convenient, single-use packaging formats, like sachets, is also boosting the demand for films and sheets in the market.

By Form Insights

Based on form analysis, the market has been segmented on the basis of rigid packaging and flexible packaging. The flexible packaging segment, which is further divided into single-layer and multi-layer, is expected to witness a significant CAGR over the forecast period. Flexible packaging offers several advantages, such as lightweight, flexibility, and cost-effectiveness, which make it an ideal choice for packaging healthcare and hygiene products. Additionally, advancements in flexible packaging materials and technologies have enabled the creation of innovative, convenient, and user-friendly packaging solutions that cater to the needs of both consumers and healthcare professionals. For instance, stand-up pouches and resealable packages have gained popularity in the market due to their ease of use and ability to preserve product freshness.

By End-Use Industry Insights

Based on end-use industry analysis, the market has been segmented on the basis of nutraceuticals and food supplements, personal care & cosmetics, functional/health beverages, pharmaceutical and OTC formulations, home care & toiletries, and others. The Home Care & Toiletries segment emerged as the largest category in terms of health & hygiene packaging market size in 2023 because of the widespread consumption of home care and toiletry products, such as soaps, shampoos, conditioners, body lotions, and cleaning agents. These require reliable and effective packaging solutions to maintain their quality. Further, the COVID-19 pandemic has amplified the need for hygiene and cleanliness, resulting in a higher demand for packaging solutions that ensure the safety and purity of these products. The Home Care & Toiletries segment is expected to continue its dominance in the coming years, driven by the increasing preference for convenient, eco-friendly, and cost-effective packaging solutions that cater to the evolving needs of consumers.

Regional Insights

North America

The North American region emerged as the largest health & hygiene packaging market share in 2023, and this dominance is due to the increasing healthcare expenditure and growing awareness about personal hygiene and cleanliness. The United States, in particular, is a major contributor to the regional health & hygiene packaging market growth, owing to its well-established healthcare system, high per capita income, and strong demand for healthcare and personal care products. The presence of prominent players in the region, such as Amcor, Becton, Dickinson and Company, and Cardinal Health, also supports the growth of the market in North America.

Asia Pacific

The Asia Pacific region is expected to witness substantial growth in the market over the forecast period, driven by innovative packaging solutions and government regulations. Countries such as China, India, and Indonesia are expected to be major contributors to the regional health & hygiene packaging market growth, owing to their large populations, increasing demand, and expanding healthcare sectors. Additionally, the increasing trend of e-commerce and online shopping in the region is expected to drive the demand for convenient, affordable, and hygienic packaging solutions, further fueling the market growth.

Competitive Landscape

The health & hygiene packaging market is highly competitive, with market top manufacturers seeking to dominate market share. Some of the prominent players in the market include Amcor, Mondi, Huhtamaki, Becton, Dickinson, and Company. These companies have been focusing on product innovation, geographical expansion, and strategic partnerships to strengthen their positions in the market. These market top manufacturers’ efforts to differentiate themselves through innovation, sustainability, and customer service are expected to drive the growth of the health & hygiene packaging market in the coming years.

Some of the major players operating in the global market include:

- Alpla Group

- Amcor Plc

- Amerplast Ltd.

- Berry Global

- Comar

- Diversey

- Essity

- Glenroy

- JohnsByrne

- Kimberly Clark

- Mondi Group

- Napco National

- Sidel

- Sonoco Products Company

- UMF Corp

- WestRock

Recent Developments

- In January 2024, Sidel, a packaging solutions provider, introduced EvoFILL PET, a new filler for water and still beverages, to the packaging market, which aims to provide optimal hygiene and efficiency for beverage packaging manufacturing lines.

- In October 2023, UMF Corp. announced the launch of new, fully compostable packaging for all of its PerfectCLEAN product line.

- In September 2022, Diversey, a player in hygiene, infection prevention, and cleaning solutions, launched SafePack pouches, which are fully recyclable and are also UN-approved for classified liquids.

- In June 2023, Berry Global, launched sustainable wipes materials for hard surface disinfecting.

Report Coverage

The Health & Hygiene Packaging market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, form, structure, distribution channel, end-use industry, and their futuristic growth opportunities.

Health & Hygiene Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 113.54 billion |

|

Revenue Forecast in 2032 |

USD 185.03 billion |

|

CAGR |

6.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Form, By Structure, By Distribution Channel, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global health & hygiene packaging market size is expected to reach USD 185.03 Billion by 2032

Key players in the market are Alpla Group, Amcor Plc, Amerplast Ltd., Berry Global, Comar, Diversey

North American contribute notably towards the global Health & Hygiene Packaging Market

Health & Hygiene Packaging Market exhibiting the CAGR of 6.3% during the forecast period

The Health & Hygiene Packaging Market report covering key segments are product type, form, structure, distribution channel, end-use industry, and region.