Healthcare Mobile Robots Market Share, Size, Trends, Industry Analysis Report

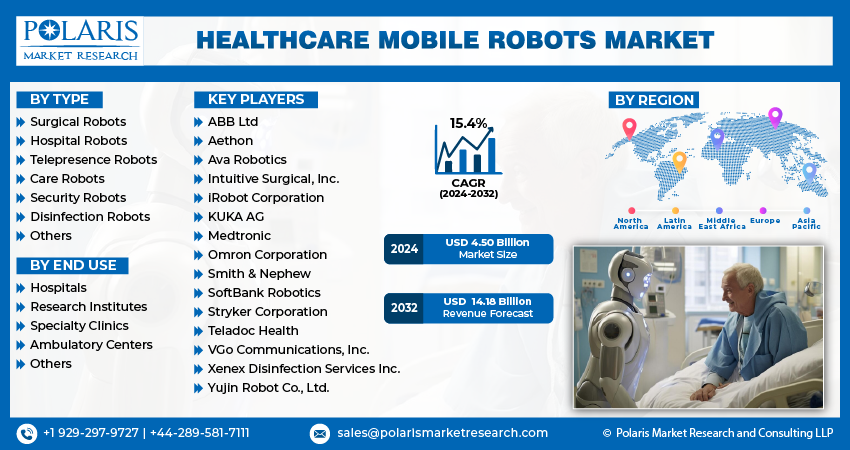

By Type (Surgical Robots, Hospital Robots, Telepresence Robots, Care Robots, Security Robots, Disinfection Robots, Others); By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4620

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

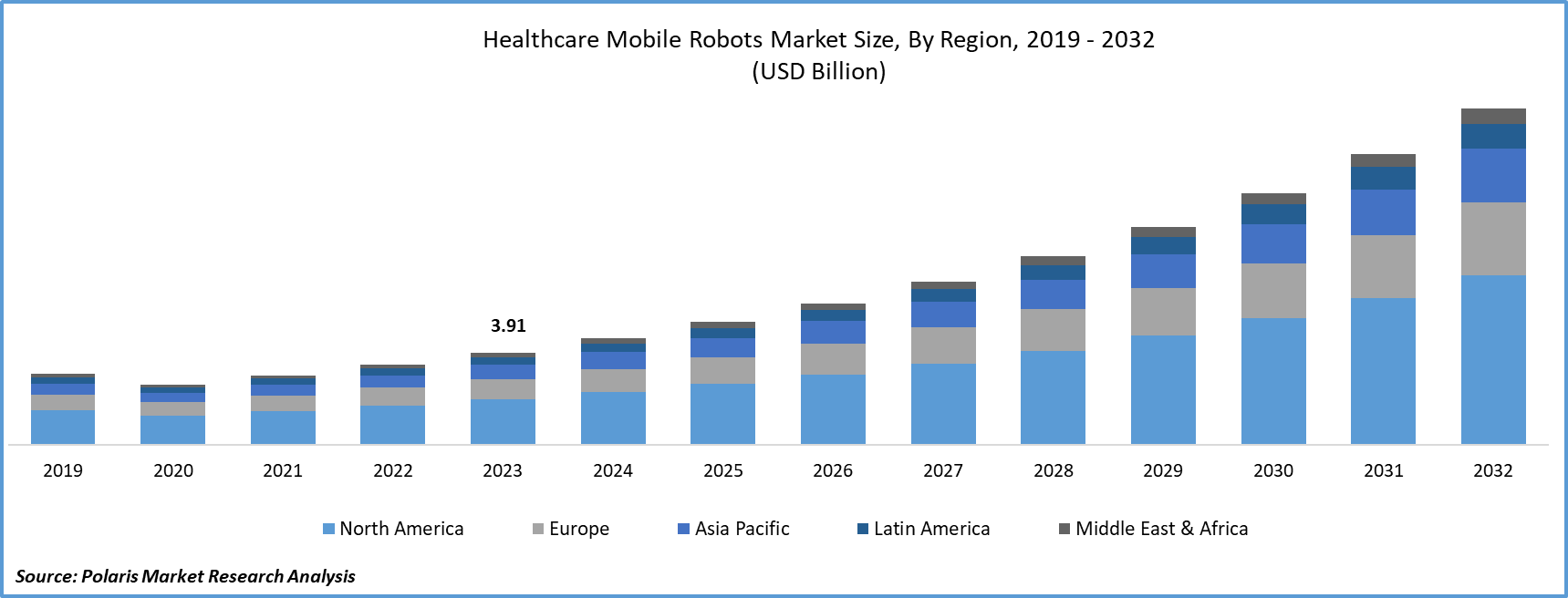

- Healthcare Mobile Robots Market size was valued at USD 3.91 billion in 2023.

- The market is anticipated to grow from USD 4.50 billion in 2024 to USD 14.18 billion by 2032, exhibiting the CAGR of 15.4% during the forecast period.

Market Introduction

The healthcare mobile robots market share is experiencing substantial growth due to the heightened demand for automation in healthcare. As providers prioritize operational efficiency and error reduction, mobile robots play a pivotal role in tasks like medication delivery and patient transportation. The emphasis on infection control, particularly in the post-COVID era, has further accelerated the integration of robotic solutions to minimize human exposure. Mobile robots offer a seamless blend of technology into healthcare workflows, ensuring precision and consistency while optimizing resource utilization. This surge in automation recognition underscores a transformative shift in healthcare delivery, highlighting the increasing importance of healthcare mobile robots in enhancing efficiency and patient care.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

- For instance, in May 2023, THIRA Robotics Co. revealed its intentions to showcase advanced autonomous mobile robots tailored for healthcare and supply chain applications at Automate 2023. The company highlighted that its AMRs have been specifically crafted to address the limitations observed in the earlier generation of AMRs when navigating intricate facilities.

To Understand More About this Research: Request a Free Sample Report

The healthcare mobile robots market report has witnessed a significant upswing driven by the COVID-19 pandemic. These robots have played a crucial role in pandemic response by autonomously disinfecting surfaces in healthcare facilities, reducing viral transmission risks. With the imperative to minimize human contact, robots have been widely adopted for tasks like medication and supply delivery, safeguarding frontline healthcare workers. Telepresence robots have enabled remote consultations and patient monitoring, ensuring uninterrupted healthcare services while minimizing exposure.

Industry Growth Drivers

Growth in aging population is projected to spur the product demand

The expanding aging population globally is a key driver of growth in the healthcare mobile robots market trends. With an increasing demand for healthcare services due to age-related challenges, mobile robots emerge as crucial tools to support caregiving. These robots address tasks like medication delivery, patient monitoring, and mobility assistance, offering valuable aid to healthcare professionals. As nations confront the implications of an aging demographic, the integration of mobile robots becomes essential for optimizing patient care and alleviating the strain on healthcare systems. This demographic shift not only amplifies the need for healthcare services but positions mobile robots as pivotal assets in delivering efficient and comprehensive care to the growing elderly population.

Greater focus on telehealth and remote monitoring is expected to drive healthcare mobile robots market growth

Telehealth and remote monitoring are catalysts propelling the market. The integration of telehealth technologies has created a demand for mobile robots, which play a crucial role in tasks like medication delivery, patient interaction, and vital signs monitoring in remote settings. With the escalating adoption of telehealth, especially accelerated by the COVID-19 pandemic, there is an increased need for robots with telepresence features to facilitate virtual patient-doctor interactions. Additionally, in remote monitoring scenarios, robots equipped with advanced sensors autonomously navigate healthcare facilities, collecting and transmitting real-time patient data.

Industry Challenges

High initial costs are likely to impede the market growth

High initial costs present a barrier to the widespread adoption of healthcare mobile robots. The substantial investment in research, engineering, and regulatory compliance, coupled with the need for specialized personnel training, strains the budgets of healthcare facilities. Operating within tight financial constraints, hospitals find it challenging to justify these upfront expenses. Uncertainties about the long-term cost-effectiveness and return on investment further contribute to hesitation. Despite the potential benefits such as increased efficiency and improved patient care, overcoming the initial financial barrier remains a pivotal challenge. Innovative cost-effective solutions and collaborative efforts are essential to propel the broader integration of mobile robots, transforming patient care in the healthcare sector.

Report Segmentation

The healthcare mobile robots market analysis is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Care robots segment is expected to experience significant growth during the forecast period

The care robots segment is expected to experience significant growth during the forecast period. Care robots revolutionize hospitals by continuously monitoring vital signs through advanced sensors, ensuring personalized patient care. Beyond aiding in daily activities, they excel in precise medication dispensing, minimizing errors, and promoting adherence. Social robots provide companionship, addressing emotional well-being during hospitalization. Active participation in rehabilitation exercises and streamlined logistics optimize patient experiences. Robots equipped with disinfection features play a vital role in infection control, crucial in pandemic scenarios. Telepresence-enabled robots bridge geographical gaps for remote consultations, especially beneficial for specialists. Surgical assistance robots enhance precision in minimally invasive procedures, accelerating patient recovery. Educative robots empower patients by providing informative content on conditions and treatment plans.

By End Use Analysis

Hospitals segment held significant market revenue share in 2023

The hospitals segment held significant revenue share in 2023. Healthcare mobile robots are indispensable in hospitals, autonomously delivering medications, meals, and supplies, relieving staff and ensuring precise distribution. Advanced telepresence features enable remote medical consultations, allowing specialists to monitor patients remotely. Dedicated disinfection robots navigate hospital spaces, reducing infection risks. Streamlining logistics, robots transport medical items, optimizing operational efficiency. Robotic surgical assistance enhances precision in minimally invasive procedures, leading to faster recoveries. Social robots provide companionship, easing patient stress. Data-collecting robots aid healthcare professionals in real-time monitoring and analytics for personalized patient care. Automated tasks improve resource management, and emergency-response robots offer situational awareness. Some robots serve as training tools, simulating medical scenarios to enhance healthcare professionals' skills.

Regional Insights

North America region dominated the global market in 2023

In 2023, North America region dominated the global market. Autonomous logistics and delivery robots have streamlined operations in hospitals, efficiently transporting supplies. Patient care robots offer advanced features like vital signs monitoring and medication reminders, enhancing healthcare services. Disinfection robots, particularly relevant during the COVID-19 pandemic, utilize UV light for effective surface sanitization. Integration with AI and IoT technologies have improved navigation and decision-making. Regulatory considerations focused on patient privacy and compliance, drive the healthcare mobile robots market growth in the region. Collaboration with startups support innovation, with healthcare institutions seeking cutting-edge solutions for evolving challenges.

Asia-Pacific is expected to experience significant growth during the forecast period. Asia, particularly Japan and South Korea, faces challenges due to an aging population, increasing the demand for innovative healthcare solutions. Governments, research institutions, and private companies in Asia-Pacific have been investing in the development of healthcare robotics. Collaborations between academia and industry aim to create innovative solutions to address healthcare challenges.

Key Market Players & Competitive Insights

The healthcare mobile robots market encompasses a wide range of participants, and the anticipated influx of new entrants is set to heighten competition. Established market leaders consistently improve their technologies to sustain a competitive edge, focusing significantly on efficiency, dependability, and safety. These entities prioritize strategic initiatives, such as forming partnerships, enhancing product offerings, and engaging in collaborative projects, aimed at surpassing competitors in the industry. Their primary objective is to secure a substantial healthcare mobile robots market share.

Some of the major players operating in the global market include:

- ABB Ltd

- Aethon

- Ava Robotics

- Intuitive Surgical, Inc.

- iRobot Corporation

- KUKA AG

- Medtronic

- Omron Corporation

- Smith & Nephew

- SoftBank Robotics

- Stryker Corporation

- Teladoc Health

- VGo Communications, Inc.

- Xenex Disinfection Services Inc.

- Yujin Robot Co., Ltd.

Recent Developments

- In September 2023, Diligent Robotics disclosed a new round of financing amounting to $25 million. The company intends to utilize these funds to support comprehensive expansions of its innovative Moxi robot deployment in hospitals, bolster product development efforts, and significantly increase its market presence.

- In August 2023, Chang Industrial and Mobile Industrial Robots (MiR) declared the establishment of a strategic alliance, paving the way for autonomous systems to play an enhanced role in transforming the patient experience, nursing staff responsibilities, and the management of supplies within the healthcare sector.

- In August 2020, Invento Robotics unveiled a robot designed for delivering food and medicine. This autonomous robot is capable of navigating through the layout of a hospital once it has been programmed.

Report Coverage

The healthcare mobile robots market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, end uses, and their futuristic growth opportunities.

Healthcare Mobile Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.50 billion |

|

Revenue forecast in 2032 |

USD 14.18 billion |

|

CAGR |

15.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Healthcare Mobile Robots market size is expected to reach USD 14.18 billion by 2032

Key players in the market are ABB Ltd, Aethon, Intuitive Surgical, Inc., iRobot Corporation, KUKA AG, Omron Corporation

North America contribute notably towards the global Healthcare Mobile Robots Market

Healthcare Mobile Robots Market exhibiting the CAGR of 15.4% during the forecast period.

The Healthcare Mobile Robots Market report covering key segments are type, end use, and region.