Healthcare Supply Chain Management Market Size, Share, & Industry Analysis Report

: By Model, Function, Component, Delivery Mode (Cloud and On-Premise), End User, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM5427

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

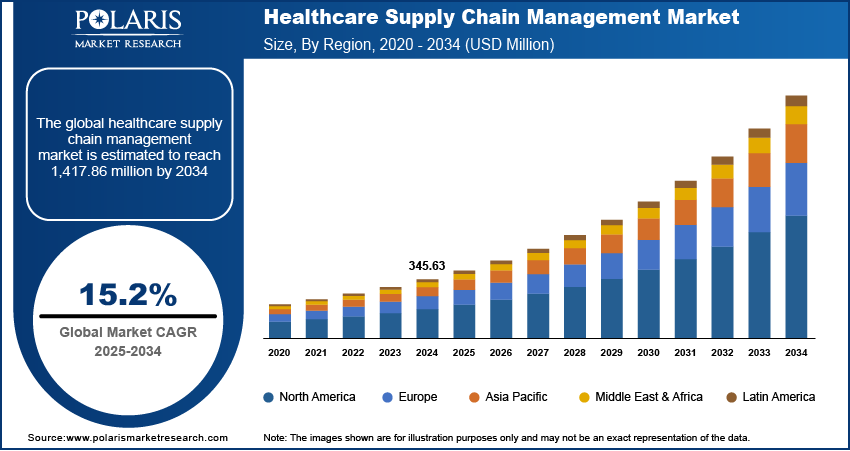

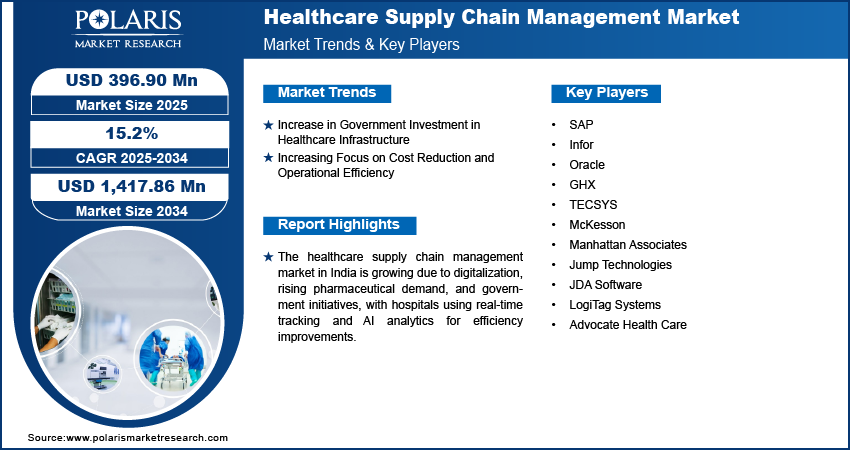

Healthcare supply chain management market size was valued at USD 345.63 million in 2024. The market is projected to grow from USD 396.90 million in 2025 to USD 1,417.86 million by 2034, exhibiting a CAGR of 15.2% during the forecast period. The market is growing due to increasing demand for efficient inventory management, regulatory compliance, and cost reduction.

Key Insights

- The cloud segment is projected to grow at the fastest pace, driven by rising demand for scalable, cost-efficient solutions that offer real-time data access, enhanced collaboration, and improved decision-making in complex healthcare supply chain operations.

- The healthcare manufacturer segment led the market in 2024, fueled by increasing pressure to optimize production workflows, streamline inventory control, and ensure timely distribution of medical supplies amid growing global demand and stringent regulatory compliance.

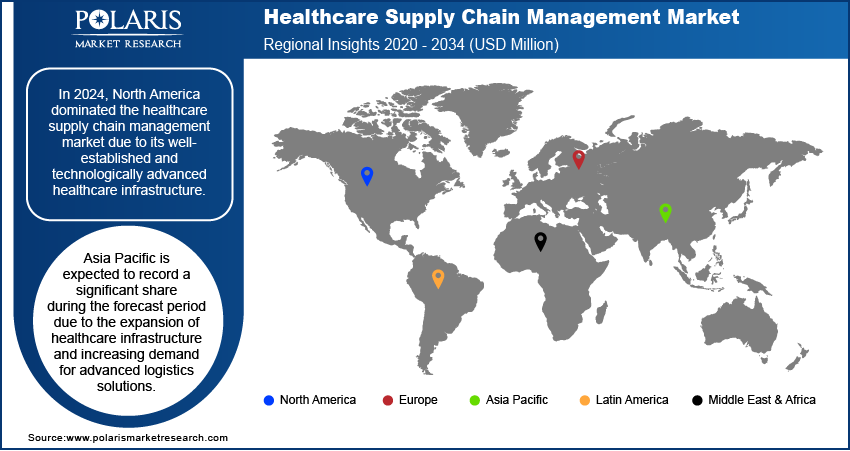

- North America dominated the 2024 market, supported by its robust healthcare infrastructure, early adoption of digital technologies, and significant investments in supply chain modernization to improve efficiency, transparency, and responsiveness in critical healthcare logistics.

- Asia Pacific is poised for substantial market growth, driven by expanding healthcare infrastructure, rising patient populations, government investments in public health systems, and increasing demand for advanced, tech-enabled logistics and supply chain management solutions.

Industry Dynamics

- Increasing demand for efficient and transparent supply chains is driving adoption of healthcare supply chain management solutions, as providers seek to enhance inventory control, reduce waste, and improve patient care through streamlined logistics.

- Expanding application of supply chain management systems in pharmaceutical manufacturing, hospitals, and distribution networks is creating new growth opportunities, fueled by rising healthcare demand, regulatory compliance needs, and the push for digital transformation in healthcare operations.

- High implementation costs, data security concerns, and lack of skilled personnel hinder widespread adoption, particularly in emerging markets with limited digital infrastructure and fragmented healthcare delivery systems.

- Technological advancements in AI, IoT, and cloud computing are improving the accuracy, speed, and visibility of healthcare supply chains, enabling predictive analytics, real-time tracking, and automation aligned with value-based care and operational efficiency goals.

Market Statistics

- 2024 Market Size: USD 345.63 million

- 2034 Projected Market Size: USD 1,417.86 million

- CAGR (2025-2034): 15.2%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Healthcare supply chain management involves coordinating and optimizing the flow of medical supplies, equipment, pharmaceuticals, and other resources from manufacturers to healthcare facilities, ensuring that the right materials are available at the right time and place while minimizing costs and waste. It encompasses everything from procurement and inventory management to storage, distribution, and tracking of medical supplies, with the ultimate goal of maintaining high-quality patient care while managing costs and reducing stockouts of critical items.

The growing adoption of digital technologies is driving the healthcare supply chain management market growth. The healthcare industry is rapidly integrating digital technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain technology to streamline supply chain operations. These technologies improve inventory tracking and real-time visibility and reduce errors in procurement and distribution. Automated systems help hospitals and pharmaceutical companies manage stock levels efficiently, preventing shortages and overstocking. Digital transformation enables predictive analytics, helping organizations forecast demand and optimize supply chain efficiency. Additionally, healthcare providers are aiming for greater accuracy and cost savings, due to which the adoption of advanced technologies is increasing, thereby driving the market growth.

The healthcare supply chain management market is growing due to the increasing need for transparency and regulatory compliance. Governments and regulatory bodies require strict standards for drug safety, cold chain logistics, and anti-counterfeiting. To meet these rules, companies are using advanced tracking technologies like serialization and radio-frequency identification (RFID) tagging, which help ensure compliance while improving transparency. This is leading to greater adoption of healthcare supply chain management solutions. Additionally, patients and healthcare providers want more visibility into the origin and movement of medical products, further increasing the demand for these solutions.

Market Dynamics

Increase in Government Investment in Healthcare Infrastructure

Governments around the world are making large investments in healthcare infrastructure to improve the healthcare sector. These funds are being used to build hospitals and support the manufacturing of pharmaceuticals and medical equipment. For example, in 2023, the Indian government allocated USD 290 million for healthcare infrastructure, highlighting its strong commitment to the sector, according to the India Brand Equity Foundation. As government spending on healthcare grows, the demand for healthcare supply chain management solutions is also increasing. This rising demand is helping drive the growth of the healthcare supply chain management market.

Increasing Focus on Cost Reduction and Operational Efficiency

Healthcare providers and pharmaceutical companies face pressure to reduce costs while ensuring high-quality patient care. Inefficient supply chains create waste, lead to excess inventory, and increase operational expenses. Advanced supply chain management solutions enable organizations to optimize procurement, automate inventory control, and cut unnecessary spending. Techniques such as just-in-time inventory management, predictive analytics, and AI-driven logistics enhance cost efficiency and resource allocation. Tackling supply chain inefficiencies allows healthcare organizations to lower costs and ensure that critical medical supplies are available when needed. Thus, the priority of cost containment is driving the growing demand for smarter and leaner supply chain management solutions, thereby driving the healthcare supply chain management market growth.

Segment Analysis

By Delivery Mode Outlook

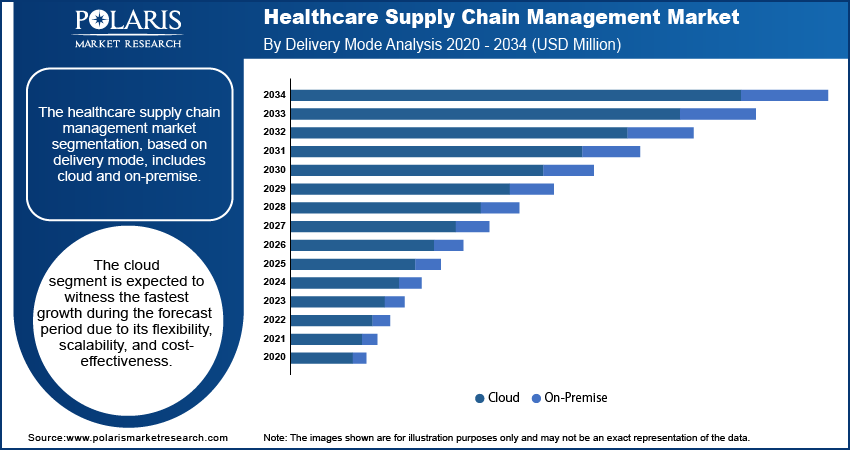

The healthcare supply chain management market segmentation, based on delivery mode, includes cloud and on-premise. The cloud segment is expected to witness the fastest growth during the forecast period due to its flexibility, scalability, and cost-effectiveness. Cloud-based solutions allow healthcare organizations to access real-time data, track inventory, and manage logistics from any location. These systems reduce the need for expensive on-site infrastructure while ensuring seamless data integration across hospitals, suppliers, and distributors. Enhanced security, automatic software updates, and improved collaboration make cloud-based platforms a preferred choice, driving its adoption across the healthcare industry.

By End User Outlook

The healthcare supply chain management market segmentation, based on end user, includes healthcare providers, healthcare manufacturers, distributors, and others. The healthcare manufacturer segment dominated the market in 2024 due to the growing need for efficient production, inventory management, and distribution of medical products. Manufacturers rely on advanced supply chain solutions to track raw materials, optimize production schedules, and ensure timely delivery of pharmaceuticals, medical devices, and equipment. Strict regulatory requirements and increasing global demand for healthcare products further drive the adoption of automated and data-driven supply chain management systems in the healthcare manufacturing sector, driving its segmental growth.

Regional Insights

By region, the study provides the healthcare supply chain management market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market, due to its well-established and technologically advanced healthcare infrastructure. For instance, according to the American Hospital Association, the USA boasts a wide network of hospitals, accounting for 6,120 hospitals in total in 2023. Hospitals, pharmaceutical companies, and medical device manufacturers in the region rely on automated supply chain solutions to manage inventory, reduce costs, and ensure timely delivery of medical products. Additionally, strong regulatory frameworks and high investments in healthcare innovation further drives healthcare supply chain management market demand in North America.

Asia Pacific is expected to record a significant healthcare supply chain management market share during the forecast period due to the expansion of healthcare infrastructure and increasing demand for advanced logistics solutions. Countries such as China, Japan, and Australia are investing in digital healthcare technologies to improve supply chain efficiency. The rise in pharmaceutical manufacturing, medical tourism, and government initiatives to strengthen healthcare logistics further contributes to the supply chain management market growth.

The healthcare supply chain management market in India is experiencing substantial growth due to the growing digitalization of healthcare logistics and the rising demand for efficient medical supply distribution. The country’s pharmaceutical and medical device industries are booming, requiring robust supply chain solutions to manage large-scale production and distribution. Government initiatives such as "Make in India" and increased investment in healthcare technology are driving the adoption of automated and cloud-based supply chain systems. Hospitals and pharmaceutical companies are leveraging real-time tracking and AI-driven analytics to reduce inefficiencies.

Key Players & Competitive Analysis Report

The healthcare supply chain management market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. Continuous progress in product offerings amplifies this competitive environment. Major players in the healthcare supply chain management industry includes SAP, Infor, Oracle, GHX, TECSYS, McKesson, Manhattan Associates, Jump Technologies, JDA Software, LogiTag Systems, and Advocate Health Care.

SAP SE, based in Walldorf, Germany, is a prominent multinational software company that specializes in enterprise resource planning (ERP) and related business applications. Established in 1972, SAP has grown to become the largest vendor of ERP software, serving customers in more than 180 countries globally. The company's primary product, SAP S/4HANA, utilizes in-memory computing to enhance data processing and integrates technologies such as artificial intelligence (AI) and machine learning. SAP's product range includes solutions for various business functions, including finance, human resources, and supply chain management. In the healthcare sector, SAP provides supply chain management solutions aimed at improving operational efficiency. These solutions focus on procurement processes, inventory management, and adherence to regulatory standards. Utilizing real-time data analytics and predictive capabilities, SAP helps healthcare organizations make informed decisions and adapt to changing conditions. SAP operates on a global scale with a significant presence across Europe, the Americas, Asia-Pacific, the Middle East, and Africa.

Oracle Corporation, based in Austin, Texas, is a major technology company known for its database management systems and enterprise software solutions. Established in 1977, Oracle has become one of the largest software firms globally, serving a wide array of industries. Its primary product, the Oracle Database, was the first commercial relational database to use SQL and continues to be a key component of its offerings. Over the years, Oracle has expanded its product range to include cloud computing services and various Software as a Service (SaaS) application that support enterprise resource planning (ERP), customer relationship management (CRM), human capital management (HCM), and supply chain management (SCM). In the healthcare sector, Oracle has made notable advancements, particularly following its acquisition of Cerner, a significant player in health information technology. This acquisition has enabled Oracle to enhance its healthcare supply chain management solutions, focusing on improving operational efficiency and data accessibility for healthcare providers. Oracle operates globally, with a presence in North America, Europe, Asia Pacific, and Latin America.

List of Key Companies

- SAP

- Infor

- Oracle

- GHX

- TECSYS

- McKesson

- Manhattan Associates

- Jump Technologies

- JDA Software

- LogiTag Systems

- Advocate Health Care

Market Developments

November 2024: Blue Ocean Corporation launched a healthcare supply chain corporation in India. The program was aimed at revolutionizing the Indian supply chain management sector.

Market Segmentation

By Model Outlook (Revenue USD Million, 2020–2034)

- Make-To-Stock Model

- Build-To-Order

- Continuous Replenishment Model

- Chain Assembly

- Others

By Function Outlook (Revenue USD Million, 2020–2034)

- Forecasting and Planning

- Inventory Management and Procurement

- Internal Logistics and Operations

- Warehousing and Distribution

- Reverse and Extended logistics

- Others

By Component Outlook (Revenue USD Million, 2020–2034)

- Solutions

- Services

By Delivery Mode Outlook (Revenue USD Million, 2020–2034)

- Cloud

- On-Premise

By End Users Outlook (Revenue USD Million, 2020–2034)

- Healthcare Providers

- Healthcare Manufacturers

- Distributors

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 345.63 million |

|

Market Size Value in 2025 |

USD 396.90 million |

|

Revenue Forecast in 2034 |

USD 1,417.86 million |

|

CAGR |

15.2% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |