Healthcare Third-party Logistics Market Size, Share, Trends, & Industry Analysis Report

By Type (Pharmaceutical, Biopharmaceutical), By Service, By Supply Chain, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM4059

- Base Year: 2024

- Historical Data: 2020-2023

What is the Healthcare Third-Party Logistics Market Size?

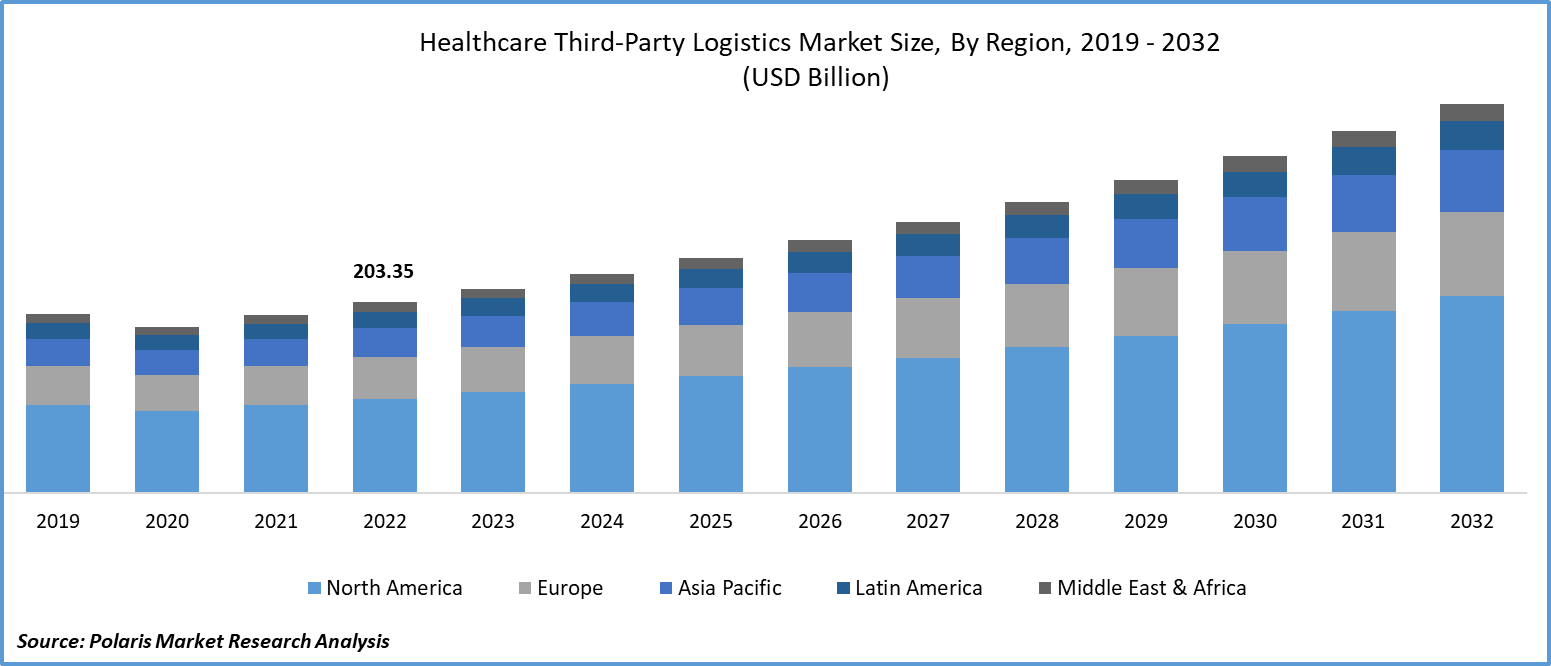

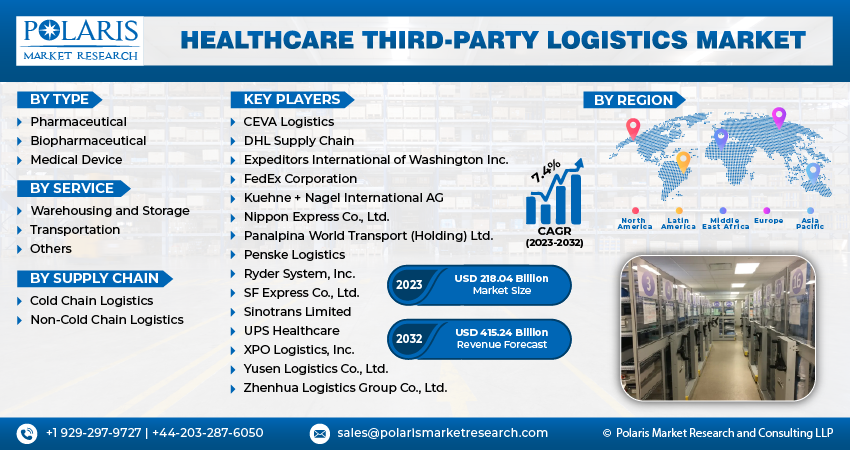

The global healthcare third-party logistics market was valued at USD 267.59 billion in 2024 and is expected to grow at a CAGR of 7.8% during the forecast period. The growth is driven by technological advancements, specialized service demands, and the need for compliance with stringent regulations.

Key Insights

- The pharmaceutical segment is expected to witness significant growth during the forecast period driven by the global demand for pharmaceutical products.

- The warehousing and storage dominated with largest share in 2024 due to increasing need for specialized storage solutions.

- North America dominated with largest share in 2024 due to well-established healthcare infrastructure and a robust pharmaceutical industry.

- Asia Pacific is projected to accounted for a significant share in the global market driven by burgeoning pharmaceutical sector and the government's push for universal healthcare.

Industry Dynamics

- The increasing demand for specialized services is fueling the market growth.

- The stringent government regulations is driving the growth.

- The integration of advance technology is boosting the industry growth.

- Strict regulatory compliance requirements that increase operational complexity and limit flexibility restrains the growth.

Market Statistics

- 2024 Market Size: USD 267.59 Billion

- 2034 Projected Market Size: USD 567.60 Billion

- CAGR (2025-2034): 7.8%

- Largest Market: North America

Impact of AI on Industry

- Enables real-time demand forecasting and inventory optimization, reducing stockouts and overstock situations for critical medical supplies.

- Improved route planning and delivery efficiency by using predictive analytics and traffic data.

- Improve cold chain monitoring by predicting temperature fluctuations in real time

To Understand More About this Research: Request a Free Sample Report

The incorporation of 3PL services in healthcare has notably improved operational efficiency. Delegating logistics tasks allows healthcare providers to concentrate on their primary strengths, leading to smoother operations and financial savings. Consequently, this leads to improved patient care and decreased healthcare expenses. Timely delivery of medical supplies and pharmaceuticals is paramount in ensuring uninterrupted patient care. 3PL providers bring expertise in supply chain management, ensuring that critical supplies reach healthcare facilities precisely when needed. This leads to improved patient satisfaction and outcomes. The globalization of the healthcare industry has created a need for efficient and reliable logistics solutions. 3PL providers with a global footprint are equipped to navigate complex international regulations and facilitate the smooth movement of healthcare products across borders.

Growth Drivers

What are the Factors Driving the Healthcare Third-Party Logistics Market?

The healthcare industry requires specialized handling of products, especially temperature-sensitive pharmaceuticals and medical devices. 3PL providers with expertise in cold chain logistics and other specialized services are in high demand to ensure the integrity of these products from production to delivery. The integration of advanced technologies, such as blockchain, IoT, and AI, in logistics operations has revolutionized the healthcare 3PL market. These technologies provide real-time tracking, temperature monitoring, and data analytics capabilities, ensuring the integrity and quality of medical products throughout the supply chain. Moreover, stringent regulations governing the transportation and storage of healthcare products necessitate the expertise of 3PL providers well-versed in compliance requirements. These providers ensure that all logistics activities adhere to industry-specific standards, safeguarding the quality and safety of healthcare products, thereby driving the growth.

Report Segmentation

The market is primarily segmented based on type, service, supply chain, and region.

|

By Type |

By Service |

By Supply Chain |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Which Segment by Type is Expected to Witness Significant Growth?

The pharmaceutical segment is projected to grow at a significant CAGR during the projected period, mainly driven by the global demand for pharmaceutical products, including life-saving drugs and temperature-sensitive biologics, continues to rise exponentially. As a result, pharmaceutical companies are increasingly turning to specialized 3PL providers to ensure the safe and timely delivery of these critical supplies. Moreover, the stringent regulatory landscape governing the storage and transportation of pharmaceuticals necessitates expertise in compliance and quality assurance. 3PL providers equipped with the necessary knowledge and infrastructure to meet these strict requirements are experiencing a surge in demand from pharmaceutical manufacturers, thereby driving the segment growth.

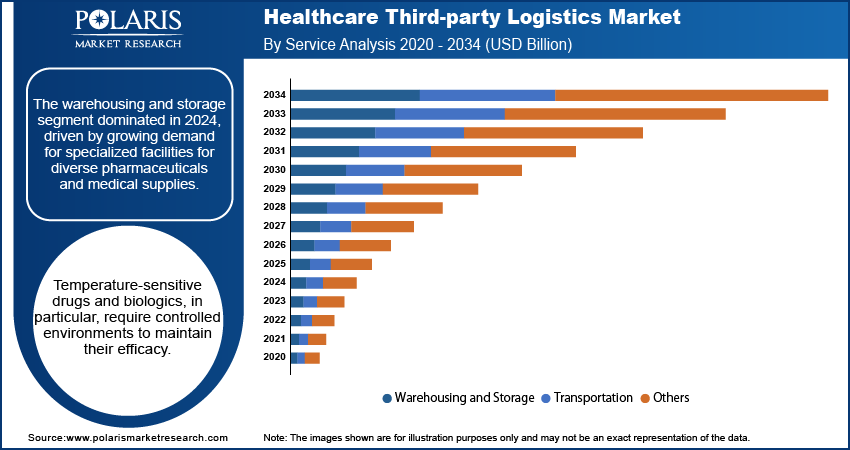

Why Warehousing and Storage Segment Dominated with Largest Share?

The warehousing and storage segment accounted for the largest market share in 2024 propelled by the increasing need for specialized storage solutions to accommodate the diverse range of pharmaceuticals and medical supplies. Temperature-sensitive drugs and biologics, in particular, require controlled environments to maintain their efficacy. 3PL providers equipped with state-of-the-art warehouses and advanced inventory management systems are in high demand. Moreover, compliance with stringent regulatory standards for pharmaceutical storage is non-negotiable, necessitating the expertise of 3PL providers in this domain. The COVID-19 pandemic has further amplified the importance of efficient warehousing and distribution capabilities for critical medical supplies. Outsourcing warehousing functions to specialized 3PL providers has become an increasingly attractive solution as healthcare organizations prioritize leaner operations. This trend is set to continue driving growth in the warehousing and storage segment of the healthcare third-party logistics market.

Regional Insights

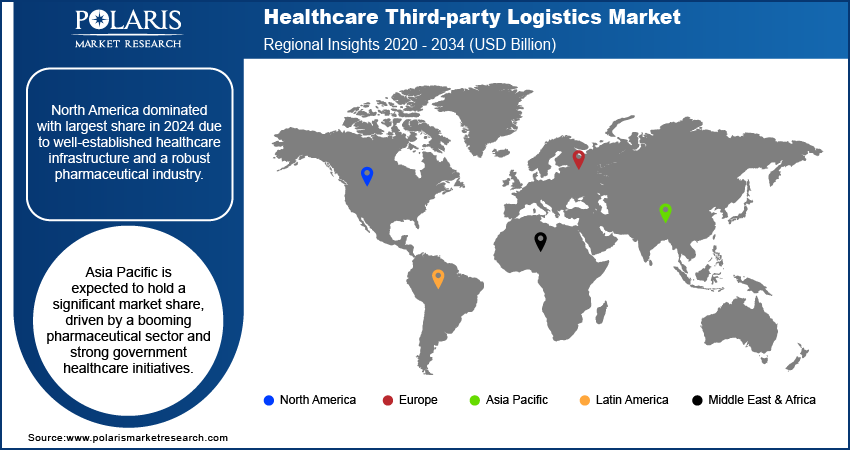

How North America Captured Largest Market Share in 2024

The North America region dominated the global market with the largest market share in 2024 due to well-established healthcare infrastructure and a robust pharmaceutical industry, driving the demand for specialized logistics services. Stringent regulatory requirements for pharmaceutical storage and transportation necessitate the expertise of 3PL providers with in-depth knowledge of compliance standards. The COVID-19 pandemic further accentuated the importance of agile and efficient supply chains in healthcare, leading to increased reliance on 3PL solutions. Moreover, the expansion of e-commerce in healthcare, including direct-to-patient deliveries of medications, presents a burgeoning opportunity for 3PL providers in the North American market.

What are the Reasons for Asia Pacific's Significant Growth?

The Asia-Pacific healthcare third party logistics market is experiencing significant growth propelled by a burgeoning pharmaceutical sector and the government's push for universal healthcare. The adoption of advanced technologies and a surge in e-commerce are reshaping logistics practices. With a vast and diverse population, the need for streamlined distribution of pharmaceuticals and medical supplies is paramount. This, coupled with the country's robust IT infrastructure, positions India as a key player in the healthcare third party logistics market in the region.

Key Market Players & Competitive Insights

The healthcare third party logistics market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- CEVA Logistics

- DHL Supply Chain

- Expeditors International of Washington Inc.

- FedEx Corporation

- Kuehne + Nagel International AG

- Nippon Express Co., Ltd.

- Panalpina World Transport (Holding) Ltd.

- Penske Logistics

- Ryder System, Inc.

- SF Express Co., Ltd.

- Sinotrans Limited

- UPS Healthcare

- XPO Logistics, Inc.

- Yusen Logistics Co., Ltd.

- Zhenhua Logistics Group Co., Ltd.

Recent Developments

-

March 2025, DHL Group acquired 100% of CRYOPDP from Cryoport to strengthen its specialized pharma logistics capabilities, expanding its global health logistics footprint and aligning with its 2030 strategy to lead in life sciences and healthcare supply chain solutions

-

April 2025, EVERSANA expanded its 3PL operations by launching a new 358,000-square-foot distribution center in Memphis, enhanced with AI-powered robotics, upgraded warehouse systems, and increased cold chain capacity to meet growing pharmaceutical logistics and patient care demands.

-

June 2023, IntegriChain, a data and business process platform serving the pharmaceutical industry entered into an agreement with Knipper Health, a healthcare solutions company, in a non-exclusive partnership aimed at assisting emerging manufacturers. Under this collaboration, the two entities are set to offer support for products requiring comprehensive third-party logistics (3PL) services, order-to-cash processes, government pricing compliance, and claims adjudication support.

Healthcare Third-party Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 267.59 billion |

| Market size value in 2025 | USD 288.04 billion |

|

Revenue forecast in 2034 |

USD 567.60 billion |

|

CAGR |

7.8% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Service, By Supply Chain, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

• The market size was valued at USD 267.59 Billion in 2024 and is projected to grow to USD 567.60 Billion by 2034.

• The market is projected to register a CAGR of 7.8% during the forecast period.

• A few of the key players in the market are CEVA Logistics, DHL Supply Chain, Expeditors International of Washington Inc., FedEx Corporation, Kuehne + Nagel International AG, Nippon Express Co., Ltd., Panalpina World Transport (Holding) Ltd., Penske Logistics, Ryder System, Inc., SF Express Co., Ltd., Sinotrans Limited, UPS Healthcare, XPO Logistics, Inc., Yusen Logistics Co., Ltd., Zhenhua Logistics Group Co., Ltd.

• The warehousing and storage segment accounted for the largest market share in 2024.

• The pharmaceutical is expected to record significant growth.