Heat Treating Market Size, Share, Trends, Industry Analysis Report

By Material (Steel, Cast iron, and Others), By Process, By Equipment, By End-User Industry, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6222

- Base Year: 2024

- Historical Data: 2020-2023

Overview

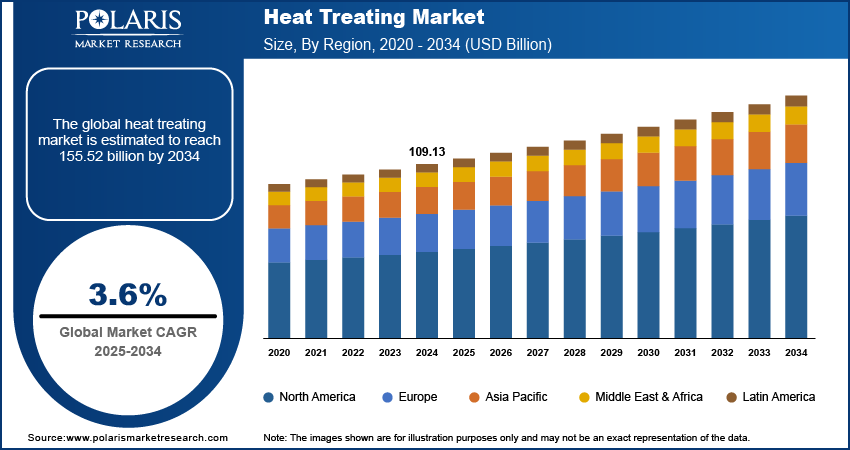

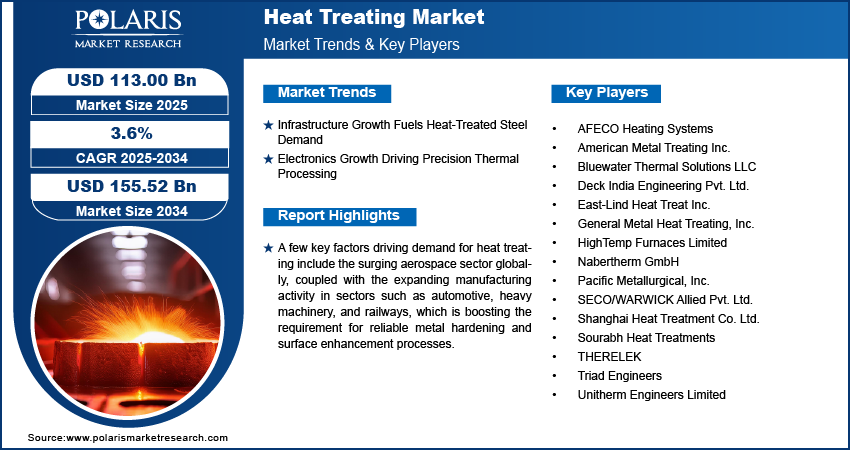

The global heat-treating market size was valued at USD 109.13 billion in 2024, growing at a CAGR of 3.6% from 2025 to 2034. Key factors driving demand for heat treating include rising infrastructure development coupled with the expanding electronics and semiconductor industry.

Key Insights

- The steel segment held the largest market share in 2024, driven by its extensive use across diverse industries such as automotive, construction, and heavy machinery.

- The hardening & tempering segment accounted for the highest share in 2024, owing to its ability to significantly improve strength and toughness in metal parts used in critical applications.

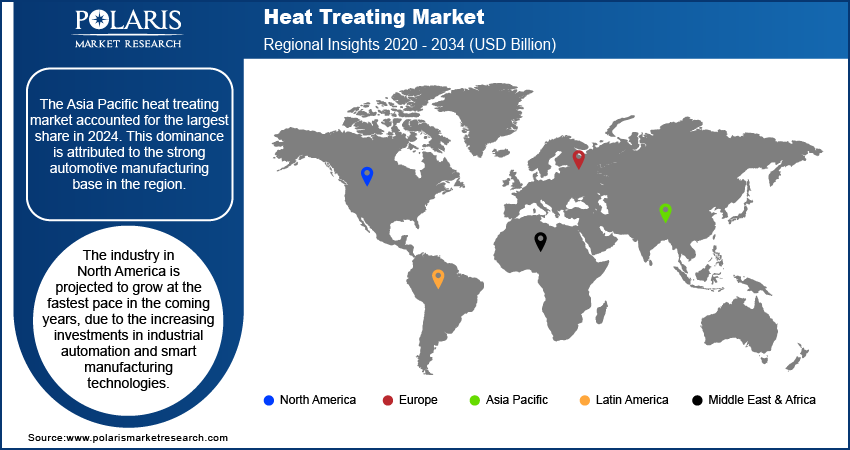

- The Asia Pacific heat treating market dominated the market in 2024. This dominance is attributed to the strong automotive manufacturing base in the region.

- India held the largest revenue share in the Asia Pacific heat treating market in 2024, driven by government initiatives promoting advanced manufacturing and the “Make in India” programs aimed at strengthening domestic production.

- The market in North America is projected to grow at the fastest pace in the coming years, due to the increasing investments in industrial automation and smart manufacturing technologies.

- The U.S. market is growing significantly, driven by the highly advanced aerospace industry requiring high-precision heat treatment for critical engine, landing gear, and structural components.

Industry Dynamics

- Infrastructure development is driving demand for heat-treated steel used in construction and structural applications, boosting the market growth.

- The expanding electronics and semiconductor industries are increasing the need for precision thermal processing to meet stringent quality standards.

- Vacuum heat treatment presents a significant opportunity by offering cleaner, more efficient processing with superior material properties.

- High capital investment required for advanced heat treating equipment is restraining the market expansion among smaller manufacturers.

Market Statistics

- 2024 Market Size: USD 109.13 Billion

- 2034 Projected Market Size: USD 155.52 Billion

- CAGR (2025–2034): 3.6%

- Asia Pacific: Largest Market Share

AI Impact on Heat Treating Market

- AI optimizes heat treatment cycles by adjusting temperatures in real-time, reducing energy waste while ensuring precise material properties.

- Machine learning predicts equipment failures before they happen, minimizing unplanned downtime and maintenance costs for manufacturers.

- Computer vision inspects treated components automatically, catching defects early to improve quality control and reduce scrap rates.

- AI-driven process simulations accelerate new recipe development, cutting trial-and-error time for advanced alloys and specialized heat treatments.

The heat treating market is an integral part of the global manufacturing and materials engineering landscape, delivering essential thermal processing services to enhance the mechanical properties, durability, and performance of metals and alloys. Heat treating providers offer a broad portfolio of solutions, including annealing, carburizing, nitriding, quenching, and tempering, to meet the performance specifications of industries such as automotive, aerospace, construction, energy, and heavy machinery. The market is witnessing steady growth as manufacturers seek to improve component strength, wear resistance, and fatigue life while maintaining production efficiency and cost-effectiveness.

The heat treating market is growing significantly owing to the surging aerospace sector globally. Heat-treated components are essential for ensuring structural integrity, fatigue resistance, and high-temperature performance in aircraft engines, aircraft landing gear, and airframe assemblies. The Aerospace Technology Institute (ATI) estimates that the global market for new aircraft deliveries to reach about USD 5.8 trillion from 2022 to 2050. The expansion of global air travel, coupled with next-generation aircraft programs, is driving the need for advanced heat treatment processes capable of meeting exacting tolerances and material specifications.

Expanding manufacturing activity in sectors such as automotive, heavy machinery, and railways is boosting the requirement for reliable metal hardening and surface enhancement processes. This trend is strong in Asia Pacific and Latin America, where rapid industrialization and capacity expansions are propelling manufacturers to partner with specialized heat treating providers to improve production efficiency and extend component lifespan.

Drivers & Opportunities

Infrastructure Development Driving Demand for Heat-Treated Steel in Construction and Structural Applications: Large-scale infrastructure programs, including transportation networks, urban redevelopment, and renewable energy projects, are propelling the heat treating market. According to the World Bank, private participation in investment totaled USD 86.0 billion in 2023, accounting for 0.2 percent of the GDP across all low- and middle-income countries. However, this amount reflects a slight decline from USD 91.3 billion in 2022, the total commitments in 2023 surpassed the five-year average of USD 85.5 billion recorded between 2018 and 2022. These materials are essential for achieving the load-bearing capacity, fatigue resistance, and long-term stability required in demanding construction environments.

Expanding Electronics and Semiconductor Industries Requiring Precision Thermal Processing: The growth of electronics and semiconductor production is increasing the need for precision-controlled heat treating processes, including annealing and stress relieving, boosting the market growth. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached USD 627.6 billion in 2024, marking a 19.1% increase compared to USD 526.8 billion in 2023. Advanced thermal technologies offering precise control over tolerances and uniform heat distribution are emerging as key differentiators for service providers in high-value sectors such as consumer electronics, computing, and industrial automation. These capabilities enhance component reliability and performance, meeting stringent industry requirements and driving increased adoption of specialized heat treatment solutions.

Segmental Insights

Material Analysis

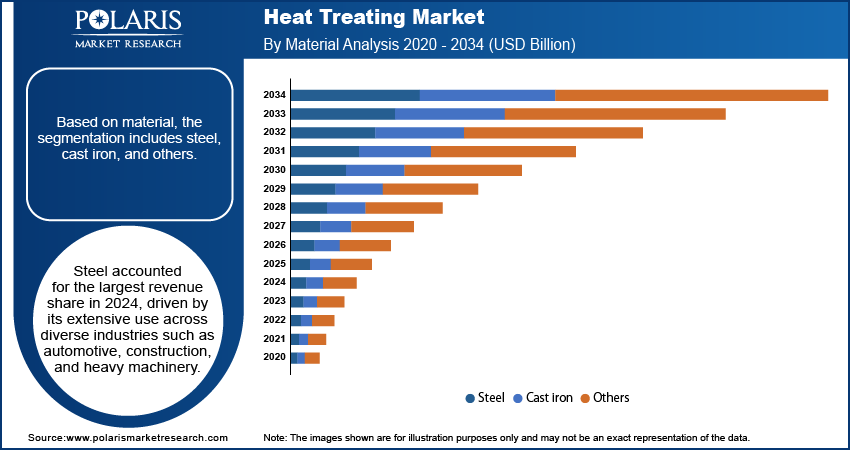

Based on material, the segmentation includes steel, cast iron, and others. Steel accounted for the largest revenue share in 2024, driven by its extensive use across diverse industries such as automotive, construction, and heavy machinery. The high demand for heat-treated steel components with enhanced hardness, strength, and wear resistance supports the segment’s dominance. Advanced steel grades requiring specialized thermal processes for improved mechanical properties continue to propel the segment’s growth globally.

Cast iron is projected to register the fastest CAGR during the forecast period, fueled by its growing application in engine blocks, pipes, and heavy-duty components that benefit from improved surface hardness and fatigue resistance through heat treatment. The segment’s growth is supported by technological advancements in heat treating techniques tailored to cast iron’s unique metallurgical characteristics, enabling better performance and longevity in demanding environments.

Process Analysis

The process segmentation includes case hardening, hardening & tempering, annealing, normalizing, and others. Hardening & tempering dominated the market in 2024, owing to their ability to significantly improve strength and toughness in metal parts used in critical applications. This process is widely adopted in sectors requiring components that withstand mechanical stress and impact, such as automotive and aerospace manufacturing. The combination of hardening and tempering enhances fatigue resistance and durability, reinforcing the segment’s leading position.

Case hardening is expected to grow at the fastest rate over the forecast period due to rising demand for surface hardening techniques that improve wear resistance without compromising the core toughness of components. Industries such as gears, bearings, and fasteners are increasingly relying on case hardening to extend service life and maintain dimensional stability, driving the adoption of this process globally.

Equipment Analysis

Based on equipment, the segmentation covers electrically heated furnaces, fuel-fired furnaces, and others. Electrically heated furnaces held the largest market share in 2024, supported by superior temperature control, energy efficiency, and suitability for precision heat treating applications. These furnaces are preferred in industries with stringent quality requirements, including aerospace and electronics, where process consistency is critical. The growing emphasis on automation and integration with digital monitoring systems further strengthens the segment’s dominance.

Fuel-fired furnaces are projected to witness the fastest growth during the forecast period, driven by widespread use in heavy industrial sectors and regions where fuel availability and cost advantages favor their operation. These furnaces are commonly applied in large-scale heat treating operations for heavy and bulky components, such as those used in construction and metalworking industries, sustaining demand for fuel-fired solutions.

End-User Industry Analysis

The end-user industry segmentation includes automotive, aerospace, construction, energy, and others. Automotive accounted for the largest revenue share in 2024, owing to the sector’s extensive use of heat-treated components in engine parts, transmissions, and chassis systems. The demand for lightweight yet durable materials and the ongoing shift towards electric vehicles are propelling the adoption of advanced heat treatment processes to meet evolving performance standards.

Aerospace is anticipated to register the fastest CAGR during the forecast period, propelled by the expansion of aircraft manufacturing and the stringent quality requirements for heat-treated parts in engines, landing gear, and structural components. The need for precise thermal processing to ensure safety, fatigue resistance, and compliance with industry standards is intensifying demand for specialized heat treating services in this sector.

Regional Analysis

The Asia Pacific heat treating market held the dominating market share in 2024. This dominance is attributed to the strong automotive manufacturing base demanding lightweight, heat-treated components to improve fuel efficiency and meet emissions standards. Rapid industrialization and urbanization across the region are further fueling demand for heat-treated metals in construction, infrastructure development, and heavy machinery applications. Countries such as China, Japan, South Korea, and Australia are investing heavily in modernizing manufacturing capabilities, which is accelerating the adoption of advanced heat treatment technologies.

India Heat Treating Market Insights

India held the largest revenue share in the Asia Pacific heat treating landscape in 2024, driven by government initiatives promoting advanced manufacturing and the “Make in India” programs aimed at strengthening domestic production. Investments in industrial infrastructure and a focus on improving metallurgical capabilities are boosting demand for specialized heat treatment services. For instance, in 2025, the Indian government allocated USD 157.7 million to enhance domestic production of rare earth magnets, which are essential for electric vehicles, electronics, and renewable energy. Supportive policies and expanding manufacturing sectors, including automotive and construction, are increasing the demand for heat treating service providers in the country.

North America Heat Treating Market Trends

The market in North America is projected to hold a substantial revenue share in 2034, due to the increasing investments in industrial automation and smart manufacturing technologies. Companies are adopting energy-efficient heat treatment processes in response to strict environmental regulations targeting reduced emissions and optimized resource use. The region benefits from well-established manufacturing ecosystems that focus on innovation and process optimization, further driving demand for precision thermal processing solutions.

The U.S. Heat Treating Market Overview

The U.S. is a key market for heat treating, driven by the highly advanced aerospace industry requiring high-precision heat treatment for critical engine, landing gear, and structural components. According to the Aerospace Industry Association, in 2023, the U.S. aerospace and defense industry achieved a significant milestone by generating more than USD 955 billion in sales, representing a 7.1 percent growth compared to the previous year. The growing focus on aircraft safety, durability, and regulatory compliance is pushing the adoption of state-of-the-art heat treating technologies. Additionally, defense and automotive sectors contribute significantly to the demand for heat-treated metals with superior mechanical properties.

Europe Heat Treating Market Assessments

The industry in Europe is projected to grow at the fastest pace in the coming years, propelled by a strong focus on sustainability and investment in eco-friendly, energy-efficient heat treatment technologies. Regulatory frameworks emphasize reducing carbon footprints and minimizing waste generated from industrial thermal processes. As per European Commission data, the EU established a 2030 climate target to reduce net greenhouse gas (GHG) emissions by at least 55% compared to 1990 levels. These regulations are pushing manufacturers to upgrade facilities and adopt cleaner, more efficient heat treatment methods across key industries such as automotive, aerospace, and heavy machinery manufacturing.

Key Players & Competitive Analysis

The global heat treating market is highly competitive, with key players such as AFECO Heating Systems, American Metal Treating Inc., Bluewater Thermal Solutions LLC, and Deck India Engineering Pvt. Ltd. leading due to advanced thermal processing technologies, extensive service portfolios, and strong regional presence. AFECO Heating Systems distinguishes itself with innovative furnace designs tailored for high-precision applications across the aerospace and automotive sectors. American Metal Treating Inc. leverages a broad network of facilities and technical expertise to provide comprehensive heat treatment services for diverse industrial clients. Bluewater Thermal Solutions LLC focuses on energy-efficient equipment and process optimization, catering to evolving regulatory requirements. Deck India Engineering Pvt. Ltd. offers customized thermal solutions supporting heavy machinery and construction industries.

The market is witnessing increased adoption of environmentally sustainable and energy-efficient heat treatment technologies, driven by stringent emissions regulations and rising operational cost concerns. Service providers are investing in digital process controls and automation to enhance precision, repeatability, and throughput. Strategic partnerships, acquisitions, and expansion into emerging economies remain key strategies to strengthen market foothold and address growing demand from sectors such as aerospace, automotive, and electronics manufacturing. The competitive landscape is also shaped by specialized firms focusing on niche processes and tailored client requirements, intensifying competition across regions.

Prominent companies in the market include Deck India Engineering Pvt. Ltd., East-Lind Heat Treat Inc., General Metal Heat Treating, Inc., HighTemp Furnaces Limited, Nabertherm GmbH, Pacific Metallurgical, Inc., SECO/WARWICK Allied Pvt. Ltd., Shanghai Heat Treatment Co. Ltd., Sourabh Heat Treatments, THERELEK, Triad Engineers, and Unitherm Engineers Limited.

Key Players

- AFECO Heating Systems

- American Metal Treating Inc.

- Bluewater Thermal Solutions LLC

- Deck India Engineering Pvt. Ltd.

- East-Lind Heat Treat Inc.

- General Metal Heat Treating, Inc.

- HighTemp Furnaces Limited

- Nabertherm GmbH

- Pacific Metallurgical, Inc.

- SECO/WARWICK Allied Pvt. Ltd.

- Shanghai Heat Treatment Co. Ltd.

- Sourabh Heat Treatments

- THERELEK

- Triad Engineers

- Unitherm Engineers Limited

Heat Treating Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Steel

- Cast iron

- Others

By Process Outlook (Revenue, USD Billion, 2020–2034)

- Case hardening

- Hardening & tempering

- Annealing

- Normalizing

- Others

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Electrically heated furnace

- Fuel-fired furnace

- Others

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace

- Construction

- Energy

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Heat Treating Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 109.13 Billion |

|

Market Size in 2025 |

USD 113.00 Billion |

|

Revenue Forecast by 2034 |

USD 155.52 Billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 109.13 billion in 2024 and is projected to grow to USD 155.52 billion by 2034.

The global market is projected to register a CAGR of 3.6% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Deck India Engineering Pvt. Ltd., East-Lind Heat Treat Inc., General Metal Heat Treating, Inc., HighTemp Furnaces Limited, Nabertherm GmbH, Pacific Metallurgical, Inc., SECO/WARWICK Allied Pvt. Ltd., Shanghai Heat Treatment Co. Ltd., Sourabh Heat Treatments, THERELEK, Triad Engineers, and Unitherm Engineers Limited.

The steel segment dominated the market revenue share in 2024.

The case hardening segment is projected to witness the fastest growth during the forecast period.