Hemodialysis Catheters Market Size, Share, Trends, & Industry Analysis Report

By Lumen, By Material, By Product, By Tip Configuration, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6051

- Base Year: 2024

- Historical Data: 2020-2023

Overview

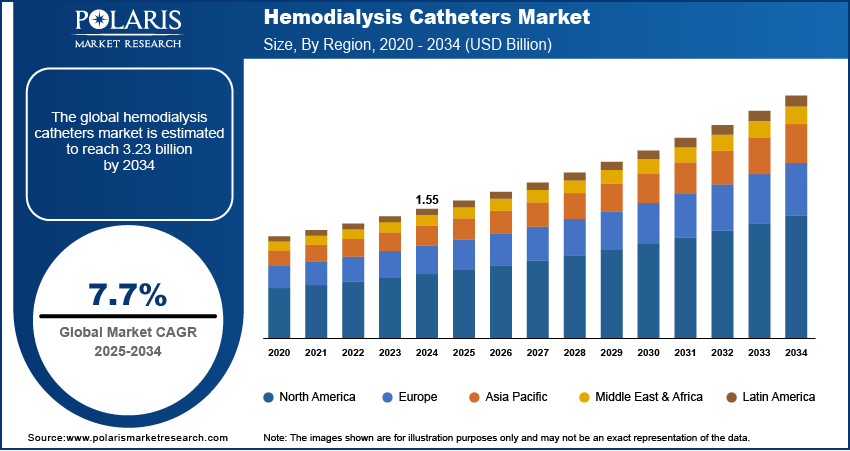

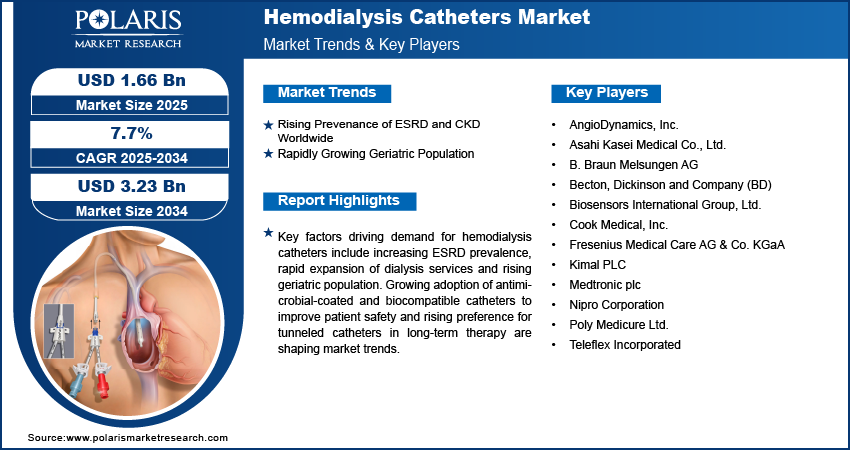

The global hemodialysis catheters market size was valued at USD 1.55 billion in 2024, growing at a CAGR of 7.7% from 2025–2034. Rising prevalence of end-stage renal disease (ESRD) and chronic kidney disease (CKD) along with growing geriatric population is driving the growth of the hemodialysis catheters.

Key Insights

- The double lumen segment accounted for largest revenue share in 2024, due to their dual-channel design, enabling simultaneous blood withdrawal and return during dialysis

- The polyurethane segment accounted for largest revenue share in 2024, driven by their balance between strength and flexibility

- The tunneled segment held the largest revenue share in 2024, due to their extended usability and lower infection risks in chronic dialysis patients

- The split-tip segment accounted for significant revenue share in 2024, owing to their ability to reduce recirculation rates and enhance dialysis efficiency

- North America hemodialysis catheters market accounted for major global market share in 2024. This dominance is due to high prevalence of end-stage renal disease (ESRD) and widespread access to dialysis services across the U.S. and Canada

- The market in Asia Pacific is projected to grow at a substantial CAGR from 2025-2034, due to rising incidence of chronic kidney disease, large population base, and expanding renal care infrastructure in China, India, and Japan.

Market Dynamics

- Increasing prevalence of ESRD and CKD is boosting the demand for hemodialysis catheters in hospitals and dialysis centers across emerging economies.

- Rising geriatric population coupled with increasing prevalence of diabetes and hypertension is contributing to the growing patient pool requiring hemodialysis.

- Growing investments in renal care infrastructure and expansion of government-sponsored dialysis programs creates opportunity for the market.

- High cost associated with the hemodialysis is restraining the market growth in cost-sensitive markets.

Market Statistics

- 2024 Market Size: USD 1.55 Billion

- 2034 Projected Market Size: USD 3.23 Billion

- CAGR (2025-2034): 7.7%

- North America: Largest market in 2024

Hemodialysis catheters are used for vascular access in patients undergoing dialysis due to chronic kidney disease or acute renal failure. The increasing prevalence of end-stage renal disease (ESRD) and growing dependence on dialysis procedures are accelerating the demand for these catheters. Their widespread use in hospitals, dialysis centers, and home care settings is attributed to their rapid blood flow rates and ease of placement.

Rising incidence of diabetes and hypertension across developing economies is contributing to the growing dialysis population. Government investments in renal care infrastructure and expanding reimbursement for dialysis services are further driving catheter adoption. Technological advancements focused on reducing infection risks and improving biocompatibility are shaping product innovation in this segment.

Regulatory frameworks by healthcare authorities such as the U.S. FDA, European Medicines Agency (EMA) and Central Drugs Standard Control Organization (CDSCO) are driving quality compliance for vascular access devices, including hemodialysis catheters. These mandates focus on biocompatibility, sterility assurance, and catheter-related bloodstream infection (CRBSI) reduction. Manufacturers are incorporating antimicrobial coatings and using advanced biomaterials to meet evolving safety standards and reduce complications associated with long-term catheterization. The market is further driven by national renal health programs and insurance coverage for dialysis procedures, growing awareness regarding early diagnosis and treatment of chronic kidney disease. In addition, increasing strategic collaborations between catheter manufacturers, dialysis service providers, and hospital networks are facilitating the development of advanced catheter designs and improving distribution efficiency across healthcare settings. For instance, in August 2023, Teleflex introduced the Arrow ErgoPack system, which integrates hemodialysis and large bore catheters in a streamlined, ready-to-use configuration to improve procedural efficiency. The system is designed to enhance clinician workflow by combining essential components for catheter placement in a single ergonomic package.

Drivers & Opportunities

Rising Prevenance of ESRD and CKD Worldwide: The global burden of end-stage renal disease (ESRD) and chronic kidney disease (CKD) is increasing due to rising incidence of diabetes, hypertension, and lifestyle-related disorders. According to the International Society of Nephrology, over 850 million individuals are affected by kidney diseases globally. Chronic kidney disease (CKD) affects 10.4% of men and 11.8% of women, while acute kidney injury (AKI) impacts 13.3 million annually, with 5.3 to 10.5 million requiring dialysis or transplantation. This trend is significantly raising demand for hemodialysis procedures and vascular access devices. Hemodialysis catheters serve as a primary access route for initiating dialysis in emergency and short-term scenarios. This improves diagnosis and treatment rates across developed and developing regions, thus driving the adoption of these catheters.

Rapidly Growing Geriatric Population: The rising elderly population is driving demand for hemodialysis catheters, as older people are more susceptible to renal impairment and require long-term dialysis support. According to the United Nations, global population is projected to peak at approximately 10.3 billion by the mid-2080s, up from 8.2 billion in 2024. This demographic shift is contributing to a higher prevalence of chronic kidney disease and comorbid conditions such as diabetes and cardiovascular disorders. As the aging population expands, the need for reliable vascular access solutions, including tunneled and non-tunneled catheters, is growing significantly.

Segmental Insights

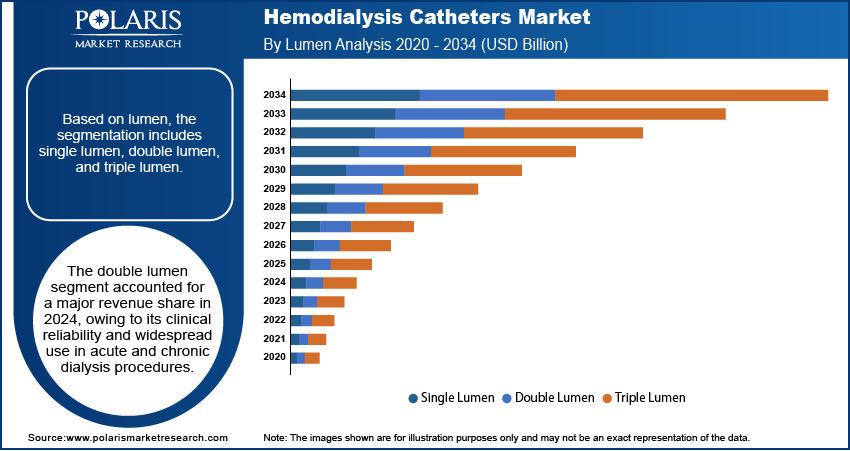

Lumen Analysis

Based on lumen, the segmentation includes single, double, and triple lumen catheters. The double lumen segment accounted for largest revenue share in 2024, due to their dual-channel design, enabling simultaneous blood withdrawal and return during dialysis. These catheters are widely adopted in acute and chronic hemodialysis procedures for their efficiency and reliability. Their versatility across tunneled and non-tunneled configurations makes it suitable option in hospitals and dialysis centers. Rising procedural volumes and high physician familiarity are sustaining the dominance of double lumen catheters in vascular access applications. The rapid design advancements by manufacturers to reduce thrombogenic risks and enhance flow efficiency are further driving segment growth.

The triple lumen segment is projected to grow at the fastest pace during the forecast period, due to their ability to support simultaneous drug administration, blood sampling and dialysis therapy. These catheters offer enhanced clinical functionality in critically ill and intensive care patients. Growing demand for multifunctional devices in complex dialysis cases and increasing adoption in inpatient settings are driving segment growth. The expanding use of triple lumen designs in ICUs and transplant units is driven by their clinical advantages in patient management.

Material Analysis

Based on material, the segmentation includes polyurethane and silicone. The polyurethane segment accounted for largest revenue share in 2024, driven by their balance between strength and flexibility. These catheters are widely used in short- and medium-term dialysis access due to their superior flow performance and ease of insertion. Polyurethane’s compatibility with antimicrobial coatings and reduced thrombogenicity contributes to its preference in clinical settings. The growing availability of cost-effective polyurethane-based devices across developed and emerging healthcare markets is fueling segment dominance. Manufacturers are advancing material formulations to enhance patient comfort and prolong catheter dwell time while maintaining safety standards.

The silicone segment is projected to grow at the fastest pace during the forecast period, owing to their biocompatibility and suitability for long-term dialysis access. These catheters cause minimal tissue irritation and preferred for tunneled placements in chronic dialysis patients. The growing adoption of silicone-based catheters among elderly and comorbid populations is boosting market growth. Additionally, increasing preference for home-based and long-term dialysis along with continuous product enhancements to improve flexibility and reduce infection risk is further driving the growth of this segment.

Product Analysis

By product, the market includes tunneled and non-tunneled. The tunneled segment held the largest revenue share in 2024, due to their extended usability and lower infection risks in chronic dialysis patients. These catheters are surgically placed and designed for long-term use, making it suitable for patients awaiting permanent vascular access such as arteriovenous fistulas. Their widespread adoption in hospital and outpatient settings is driven by advancements in catheter materials and infection-prevention technologies. Rising global dialysis prevalence and increasing adoption in home healthcare environments are further driving the segment growth.

The non-tunneled segment is anticipated to grow at the fastest rate, due to rising demand for immediate vascular access in acute and emergency dialysis cases. These catheters are commonly used in hospital ICUs and emergency departments for short-term dialysis needs. The segment is growing due to the rapid insertion technique and cost-effectiveness of non-tunneled catheters, making it suitable for critically ill patients requiring urgent vascular access. Additionally, rising hospital admissions from acute kidney injury and sepsis along with advancements focused on minimizing catheter-related bloodstream infections are contributing to market growth.

Tip Configuration Analysis

Based on tip configuration, the segmentation includes step-tip, split-tip, symmetric, and other types. The split-tip segment accounted for significant revenue share in 2024, owing to their ability to reduce recirculation rates and enhance dialysis efficiency. These catheters feature separate lumens extending from the tip, allowing smooth and simultaneous inflow and outflow of blood. Split-tip designs are widely used in tunneled catheters for long-term dialysis in chronic kidney disease patients. Their structural design reduces the risk of thrombus formation and improves hemodynamic performance. Growing emphasis on catheter performance and patient outcomes is driving the adoption of split-tip configurations across high-volume dialysis centers.

The symmetric tip segment is projected to grow at the fastest pace during the forecast period, due to their balanced design that facilitates efficient blood flow with reduced resistance. These catheters enable consistent dialysis performance and growing adoption in acute and chronic care settings. The rising preference for symmetric tip catheters is driven by their design advantages, which minimize recirculation and enable consistent therapy delivery. Moreover, supportive clinical evidence indicating improved performance and fewer complications is further accelerating their adoption in advanced dialysis care.

End User Analysis

By end user, the market includes hospitals, dialysis centers, ambulatory surgical centers (ASCs), and home healthcare. The hospital segment held the largest revenue share in 2024, due to high procedural volumes and the availability of skilled healthcare professionals. According to the US Centers for Medicare & Medicaid Services, healthcare spending in the US increased by 7.5% in 2023, reaching USD 4.9 trillion, or approximately USD 14,570 per person. Health expenditures represented 17.6% of the country’s Gross Domestic Product (GDP). The increasing number of hospital admissions for acute kidney injury and the availability of advanced dialysis units are driving the demand for hemodialysis catheters in hospital settings. Additionally, centralized procurement processes, standardized care protocols and favorable reimbursement frameworks further support the dominance of hospitals in this segment.

The home healthcare segment is anticipated to grow at the fastest rate, owing to the increasing adoption of home-based dialysis therapies. The growing shift toward patient-centric care and cost-effective treatment is driving the adoption of vascular access devices suitable for home hemodialysis. Government initiatives promoting home-based therapies along with supportive insurance coverage and advancements in user-friendly, low-maintenance catheter designs are further accelerating home healthcare segment.

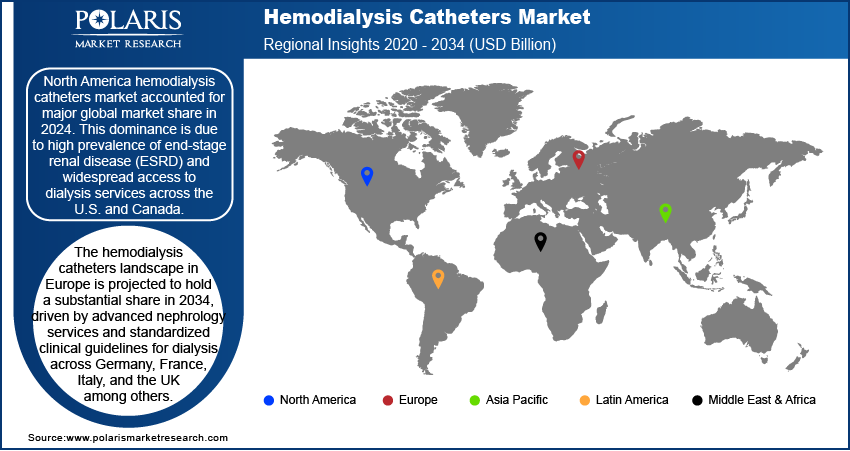

Regional Analysis

North America hemodialysis catheters market accounted for major global market share in 2024. This dominance is due to high prevalence of end-stage renal disease (ESRD) and widespread access to dialysis services across the U.S. and Canada. The region benefits from well-established nephrology infrastructure, favorable reimbursement frameworks and growing adoption of tunneled catheters for long-term vascular access. Moreover, ongoing innovation in catheter design and strong presence of leading manufacturers are fueling hemodialysis catheters market growth.

U.S. Hemodialysis Catheters Market Insight

The U.S. held significant market share in North America hemodialysis catheters landscape in 2024, driven by the expanding dialysis population and healthcare investments. As per the Center for Medicare and Medicaid Services, healthcare spending in the U.S. increased by 7.5%, reaching USD 4.9 trillion or approximately USD 14,570 per person in 2023. Additionally, high disease burden linked to diabetes and hypertension is pushing the need for vascular access solutions. Thus, hospitals and outpatient dialysis centers across the U.S. are prioritizing the use of biocompatible and antimicrobial-coated catheters to reduce catheter-related bloodstream infections (CRBSIs).

Asia Pacific Hemodialysis Catheters Market

The market in Asia Pacific is projected to grow at a substantial CAGR from 2025-2034, due to rising incidence of chronic kidney disease, large population base, and expanding renal care infrastructure in China, India, and Japan. According to the International Society of Nephrology, chronic kidney disease (CKD) affected an estimated 20.18% of Japan’s population in 2023, followed by 16.67% in Thailand and 16.27% in Taiwan. Additionally, the growing government programs to improve CKD screening and subsidize dialysis treatments are increasing access across public hospitals is driving the demand for hemodialysis catheters across the region.

China Hemodialysis Catheters Market Overview

The market in China is expanding due to the driven by high CKD prevalence and government-led expansion of dialysis capacity. According to the China National Center for Bioinformation (CNCRB), total number of dialysis patients rose from 750,000 in 2021 to around 1,025,000 in 2025. The dialysis patient population in China is growing at rate of approximately 10% annually. Moreover, rising urbanization and aging population are increasing demand for long-term vascular access solutions across the country.

Europe Hemodialysis Catheters Market

The hemodialysis catheters landscape in Europe is projected to hold a substantial share in 2034, driven by advanced nephrology services and standardized clinical guidelines for dialysis across Germany, France, Italy, and the UK among others. According to National Library of Medicine 2025, In Germany, approximately 80,000 individuals rely on long-term renal replacement therapy (RRT). Dialysis patients face a nearly 67% lower life expectancy than the general population, due to cardiovascular and infection-related complications. Moreover, the presence of universal healthcare access and high procedural volumes in hospital-based dialysis settings are contributing to the demand for hemodialysis catheters in this region.

Key Players & Competitive Analysis Report

The hemodialysis catheters market is moderately consolidated, with key players competing on technological innovation, infection control features and distribution networks. Leading manufacturers are focusing on antimicrobial coatings, biocompatible materials and advanced tip designs to enhance patient safety and catheter longevity. Moreover, rising strategic initiatives include regional manufacturing expansion, partnerships with dialysis service providers and product approvals in emerging markets. Key players are focusing on regulatory standards and investing in R&D to address rising demand for long-term vascular access in hospital and home-based dialysis settings.

Major companies operating in the hemodialysis catheters industry include Medtronic plc, Becton, Dickinson and Company (BD), Fresenius Medical Care AG & Co. KGaA, B. Braun Melsungen AG, Nipro Corporation, AngioDynamics, Inc., Cook Medical, Inc., Teleflex Incorporated, Poly Medicure Ltd., Biosensors International Group, Ltd., Asahi Kasei Medical Co., Ltd., and Kimal PLC.

Key Players

- AngioDynamics, Inc.

- Asahi Kasei Medical Co., Ltd.

- B. Braun Melsungen AG

- Becton, Dickinson and Company (BD)

- Biosensors International Group, Ltd.

- Cook Medical, Inc.

- Fresenius Medical Care AG & Co. KGaA

- Kimal PLC

- Medtronic plc

- Nipro Corporation

- Poly Medicure Ltd.

- Teleflex Incorporated

Industry Developments

- June 2025: Fresenius Medical Care partnered with Mexico's National Institutes of Health and a specialty hospital to expand access to advanced dialysis therapies across the country. This initiative is expected to improve the adoption of innovative hemodialysis technologies, thereby driving demand for reliable and efficient hemodialysis catheters in clinical settings.

- November 2023: the U.S. FDA approved CorMedix Inc.'s DefenCath (taurolidine and heparin catheter lock solution) to reduce catheter-related bloodstream infections (CRBSIs) in adult hemodialysis patients with central venous catheters. This approval is expected to support safer catheter-based hemodialysis procedures and positively impact the demand for antimicrobial hemodialysis catheters.

- October 2023: B. Braun launched the Introcan Safety 2 IV Catheter with Multi-Access Blood Control in 2023, featuring an enhanced blood control system designed to reduce blood exposure and needlestick injuries during vascular access. These technological advancements in catheter safety and design are expected to influence innovation in hemodialysis catheters.

Hemodialysis Catheters Market Segmentation

By Lumen Outlook (Revenue, USD Billion, 2020–2034)

- Single Lumen

- Double Lumen

- Triple Lumen

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Polyurethane

- Silicone

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Tunneled Catheters

- Cuffed tunneled catheters

- Non-cuffed tunneled catheters

- Non-tunneled Catheters

By Tip Configuration Outlook (Revenue, USD Billion, 2020–2034)

- Step-tip Catheters

- Split-tip Catheters

- Symmetric Catheters

- Other Tip Configuration Types

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Dialysis Centers

- Ambulatory Surgical Centers (ASCs)

- Home Healthcare

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hemodialysis Catheters Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.55 Billion |

|

Market Size in 2025 |

USD 1.66 Billion |

|

Revenue Forecast by 2034 |

USD 3.23 Billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.55 billion in 2024 and is projected to grow to USD 3.23 billion by 2034.

The global market is projected to register a CAGR of 7.7% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Medtronic plc, Becton, Dickinson and Company (BD), Fresenius Medical Care AG & Co. KGaA, B. Braun Melsungen AG, Nipro Corporation, AngioDynamics, Inc., Cook Medical, Inc., Teleflex Incorporated, Poly Medicure Ltd., Biosensors International Group, Ltd., Asahi Kasei Medical Co., Ltd., and Kimal PLC.

The tunneled segment dominated the market in 2024. This is due to long-term usability, lower infection risk and growing use in chronic dialysis patients.

The home healthcare segment is expected to witness the fastest growth during the forecast period, owing to increasing adoption of home-based dialysis therapies and demand for patient-centric vascular access solutions.