Ground-Based Air Defense Systems Market Size, Share, Trends, & Industry Analysis Report

By Type, By Platform, By Component, By Range, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6050

- Base Year: 2024

- Historical Data: 2020-2023

Overview

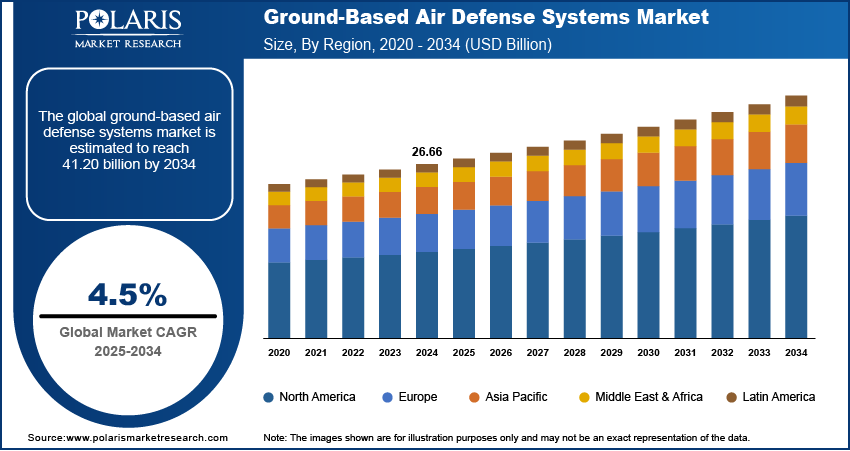

The global ground-based air defense systems market size was valued at USD 26.66 billion in 2024, growing at a CAGR of 4.5% from 2025–2034. Rising defense expenditure coupled with the expanding threat landscape from unmanned aerial vehicles (UAV) and low-altitude projectiles is accelerating the adoption of advanced ground-based air defense systems with enhanced interception capabilities.

Key Insights

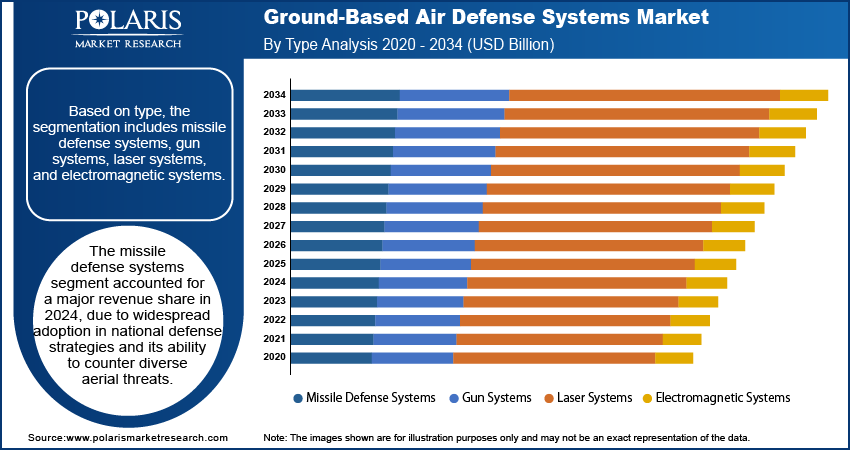

- The missile defense systems segment accounted for largest revenue share in 2024, due to rising investments in intercepting advanced threats such as ballistic and cruise missiles.

- The fixed ground-based platforms material segment accounted for significant revenue share in 2024, due to its extensive deployment in high-value strategic zones, including airbases, command centers, and border areas.

- The radar systems segment held the largest revenue share in 2024, owing to its critical role in early warning, threat detection, and engagement tracking.

- The medium range (10–100 km) segment accounted for largest revenue share in 2024, due to its flexible application in countering a wide spectrum of threats, including aircraft, cruise missiles, and UAVs.

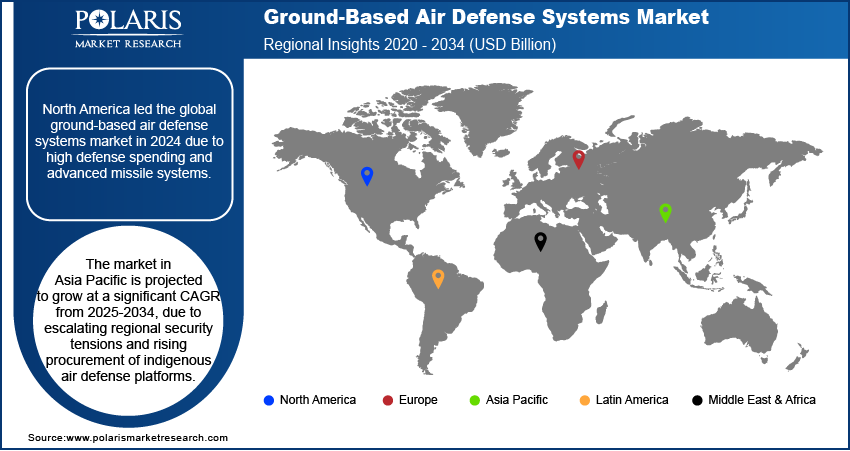

- North America Ground-based air defense systems market accounted for largest global market share in 2024

- The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, due to escalating regional security tensions and rising procurement of indigenous air defense platforms

Market Dynamics

- Expanding military budgets across developed and emerging economies are enabling large-scale procurement of modern and integrated GBADS platforms.

- The increasing use of drones, loitering munitions, and low-altitude aerial systems is driving the demand for agile, short-range air defense systems capable of rapid interception.

- Integration of artificial intelligence (AI), sensor fusion and real-time data processing is creating opportunities for next-generation air defense systems with improved threat detection and decision-making accuracy.

- High development costs, extended procurement cycles and complex system integration requirements are limiting the adoption of GBADS in cost-sensitive and developing defense markets.

Market Statistics

- 2024 Market Size: USD 26.66 Billion

- 2034 Projected Market Size: USD 41.20 Billion

- CAGR (2025-2034): 4.5%

- North America: Largest market in 2024

Ground-based air defense systems (GBADS), also known as surface-to-air missile (SAM) are deployed to detect, track and neutralize aerial threats such as aircraft, drones and missiles across military and strategic infrastructure. Rising geopolitical tensions and increasing defense modernization programs are accelerating the procurement of advanced GBADS globally. Their ability to provide real-time threat interception and integration with network-centric warfare platforms supports their growing deployment across defense forces.

The expansion of unmanned aerial vehicle (UAV) fleets and the emergence of hypersonic missile threats are contributing to the rising demand for multi-layered and mobile air defense capabilities. Government initiatives to enhance border security and critical asset protection coupled with increased investment in indigenous defense manufacturing are strengthening industry development. For instance, Germany led European Sky Shield Initiative (ESSI) to build an integrated ground-based air and missile defense system across Europe. More than 20 countries such as Austria and Switzerland joined the initiative in 2025, which closely meet with NATO to address regional air defense gaps. In addition, rising advancements in radar systems, AI-enabled threat detection and interoperability with command-and-control infrastructure are enhancing the operational efficiency of GBADS platforms.

The rising threat of low-altitude aerial intrusions, including loitering munitions and small drones is increasing the demand for short-range and point-defense ground-based air defense systems. Several nations are prioritizing the deployment of compact and rapidly deployable systems to protect mobile units and urban installations. Growing defense budgets across emerging economies are driving the acquisition of locally manufactured and cost-effective GBADS platforms. Furthermore, the integration of electro-optical tracking, multi-sensor fusion and modular launch systems is enabling enhanced threat response in contested environments.

Drivers & Opportunities

Rapidly Growing Defense Spending Worldwide: Rising global defense budgets are enabling governments to prioritize modernization and capability enhancement programs, including the acquisition of advanced ground-based air defense systems. As per the Stockholm International Peace Research Institute (SIPRI), global military spending reached USD 2,718 billion in 2024, marking a 9.4% rise from the previous year and a 37% increase since 2015. Military expenditure accounted for 2.5% of global GDP and 7.1% of government budgets, with per capita spending at a record high of USD 334. Moreover, rising investments in modern air defense infrastructure are driving the adoption of next-generation ground-based air defense systems (GBADS) in the countries such as India, Poland, and Saudi Arabia among others. These countries are expanding their defense portfolios through domestic programs and international collaborations, supporting the deployment of integrated platforms with advanced radar, missile, and command-control capabilities. Additionally, long-term strategic defense planning in NATO and Indo-Pacific regions is fostering investments in mobile and multi-layered GBADS platforms tailored for high-threat, high-mobility operational environments.

Expansion of UAVs and Low-Altitude Threats: The rapid proliferation of unmanned aerial vehicles (UAVs), loitering munitions and low-altitude cruise missiles is reshaping threat dynamics and driving demand for short and very short-range air defense systems. These aerial systems bypass traditional radar coverage and pose asymmetric risks to military bases, urban zones and critical infrastructure. As a result, defense forces are deploying compact and high-response GBADS equipped with electro-optical sensors, AI-based tracking and modular interceptors. The evolving threat environment is pushing manufacturers to develop adaptable systems capable of operating in complex and low-altitude engagement scenarios.

Segmental Insights

Type Analysis

Based on type, the segmentation includes missile defense systems, gun systems, laser systems, and electromagnetic systems. The missile defense systems segment accounted for largest revenue share in 2024, due to rising investments in intercepting advanced threats such as ballistic and cruise missiles. These systems are widely deployed across strategic zones and military installations, supported by integrated radar, interceptors, and command units. For instance, the deployment of PATRIOT and SAMP/T systems across NATO regions reflects their operational reliability. The growing demand for multi-tiered missile defense and upgrades to legacy platforms continues to drive segment dominance in global military modernization programs.

The laser systems segment is projected to grow at the fastest pace during the forecast period, driven by rising demand for low-cost, high-precision counter-UAV solutions. Laser systems offer silent operation, high scalability, and minimal collateral damage, making them suitable for urban and mobile defense environments. Several nations are investing in the operational deployment of directed-energy systems, including vehicle-mounted platforms and shipborne prototypes. Advancements in high-energy beam stability, target tracking, and power storage are expected to enhance their deployment feasibility across short-range and point-defense missions.

Platform Analysis

Based on material, the segmentation includes fixed ground-based platforms, mobile platforms, and vehicle-mounted platforms. The fixed ground-based platforms material segment accounted for significant revenue share in 2024, due to its extensive deployment in high-value strategic zones, including airbases, command centers, and border areas. These systems offer extended radar range, high firepower, and stable command connectivity, making them integral to national air defense architectures. Fixed platforms such as Iron Dome batteries and THAAD units continue to be deployed in static, high-threat zones where persistent surveillance and long-range coverage are required.

The vehicle-mounted platforms segment is projected to grow at the fastest pace during the forecast period, due to rising demand for flexible, rapidly deployable air defense capabilities. These systems are integrated on wheeled or tracked vehicles and support force mobility in dynamic combat environments. Nations prioritizing expeditionary and urban warfare readiness are adopting vehicle-mounted GBADS with modular launchers and advanced targeting systems. The increasing procurement of platforms including National/Norwegian Advanced Surface-to-Air Missile System (NASAMS) and SPYDER in mobile configurations underscores this trend.

Component Analysis

By type, the market includes radar systems, command & control systems, launchers, and interceptor missiles. The radar systems segment held the largest revenue share in 2024, owing to its critical role in early warning, threat detection, and engagement tracking. Radar technologies such as AESA, 3D phased array, and multi-band radars are integrated into GBADS to detect high-speed and low-observable threats. For instance, in June 2025, Swedish Defence Materiel Administration selected Lockheed Martin’s TPY-4 long-range radar to enhance its national air surveillance and defense capabilities. The procurement supports Sweden’s efforts to modernize its air defense infrastructure amid evolving regional security challenges. Several global defense programs are focused on developing radar sensor systems with higher target discrimination, clutter resistance, and drone swarm tracking. Continued investment in counter-stealth capabilities further strengthens radar system demand across fixed and mobile GBADS units.

The interceptor missiles segment is anticipated to grow at the fastest rate, driven by the need to counter fast-evolving aerial threats, including hypersonic projectiles and UAVs. Advancements in missile propulsion, seeker technology, and maneuverability are improving engagement accuracy against diverse targets. Multiple nations are expanding their inventory of short and medium range interceptors to boost layered defense strategies. Moreover, joint development programs and indigenous manufacturing initiatives are accelerating interceptor integration in next-generation GBADS.

Range Analysis

Based on range, the segmentation includes short range (<10 km), medium range (10–100 km), and long range (>100 km). The medium range (10–100 km) segment accounted for largest revenue share in 2024, due to its flexible application in countering a wide spectrum of threats, including aircraft, cruise missiles, and UAVs. Medium-range systems are favored for base defense and regional threat interception, offering balanced coverage and high engagement capability. Defense agencies are deploying platforms such as Barak-8 and Sky Sabre for regional air defense missions. Their compatibility with mobile platforms and centralized control networks is driving widespread adoption.

The short range (<10 km) segment is projected to grow at the fastest pace during the forecast period, due to rising demand for point-defense systems against drones, loitering munitions, and low-speed projectiles. Short-range GBADS are deployed to protect strategic infrastructure, logistics hubs, and high-value urban assets. Advancements in compact radar, AI-enabled threat recognition, and modular launch systems are expanding their operational utility. Programs across Europe, South Korea, and Israel are focused on scaling short-range air defense networks to counter the rising frequency of low-altitude attacks.

End User Analysis

By end user, the market includes military, homeland security, and critical infrastructure protection. The military segment held the largest revenue share in 2024, due to its widespread deployment of GBADS across border zones, battalion units, and command installations. For instance, in July 2025, Denmark government announced to strengthen its air defense by acquiring three different ground-based air defense systems from German, French, and Norwegian manufacturers. This boosts Denmark’s defense capabilities against potential missile threats and highlights increasing regional cooperation among Nordic countries. Rising investments in defense modernization and cross-domain warfare preparedness are accelerating procurement of missile-based and hybrid air defense platforms. Armed forces globally are prioritizing integration of radar, interceptors, and C2 systems to ensure cohesive, real-time response across diverse operational theaters.

The critical infrastructure protection segment is anticipated to grow at the fastest rate, owing to the increasing risk of aerial attacks on civilian and industrial assets. Utility plants, communication hubs, and transportation nodes are equipped with short-range GBADS to address drone and UAV-based threats. Government initiatives in Europe, Asia-Pacific, and the Middle East are allocating funds to secure vital infrastructure using AI-powered surveillance, early warning systems, and anti-drone launchers. The trend reflects the shift toward hybrid threat preparedness and urban airspace security.

Regional Analysis

North America Ground-based air defense systems market accounted for largest global market share in 2024. This dominance is driven by high defense spending, technological superiority and active deployment of multi-layered missile defense systems. Also, the rapid investments in radar systems, mobile interceptor units and AI-integrated command structures are enhancing the operational readiness of ground-based air defense systems. Additionally, rising focus on critical infrastructure protection, homeland security modernization, and military interoperability with allied nations is boosting system upgrades and new procurement across the region. This in turn fuels the adoption of GBADS to enhance territorial defense.

US Ground-Based Air Defense Systems Market Insight

The US held largest market share in North America ground-based air defense systems landscape in 2024, driven by the extensive modernization of ground-based defense architecture and rapid integration of AI-enabled early warning systems. Moreover, the growing government initiatives such as Department of Defense (DoD) funding for systems including THAAD, NASAMS, and M-SHORAD are driving the deployment of GBADS to counter drones, hypersonic weapons and cruise missiles. As an example, in May 2024, the US Marine Corps announced three new mobile air defense systems by the end of 2025 to strengthen protection against aerial threats, including drones and cruise missiles. These systems are designed to enhance mobility, responsiveness and integration with broader joint force air defense networks. Furthermore, rising strategic collaborations between the Pentagon and defense OEMs are accelerating the testing and deployment of directed-energy weapon prototypes within ground-based air defense systems.

Asia Pacific Ground-Based Air Defense Systems Market

The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, due to escalating regional security tensions and rising procurement of indigenous air defense platforms. Also, rapid force modernization in countries such as India, South Korea, and Japan is supporting adoption of mobile, short-range, and radar-guided GBADS platforms. In addition, governments are expanding GBADS deployment in coastal and border zones to enhance low-altitude threat interception; while rising investment in layered and AI-integrated systems is enabling faster threat identification and real-time engagement capabilities.

China Ground-Based Air Defense Systems Market Overview

The market in China is expanding due to the driven by investment in high-range missile defense systems and strategic deterrence capabilities. The country is expanding its inventory of integrated radar networks, truck-mounted launchers, and centralized fire control systems. According to the China Ministry of National Defense, China’s 2025 defense budget exceeded USD 249 billion, marking a 7.2% increase from the previous year. Moreover, the deployment of GBADS in maritime borders and disputed territories coupled with increasing R&D in electromagnetic and AI-based interception technologies is boosting the market growth.

Europe Ground-Based Air Defense Systems Market

The ground-based air defense systems landscape in Europe is projected to hold a substantial share in 2034, driven by multinational initiatives and strong regional defense cooperation and joint programs such as the European Sky Shield Initiative are facilitating coordinated procurement and deployment of interoperable air defense systems across Central and Eastern Europe. Additionally, rising defense funding in countries such as the UK, Germany, Poland and France is driving large-scale acquisitions of systems such as SAMP/T, IRIS-T SLM, and NASAMS. Growing focus on mobile GBADS units for urban defense and critical infrastructure protection is further accelerating adoption amid increasing drone incursions and hybrid warfare threats. For instance, in May 2025, the UK army announced to launch its Land GBAD project under Project Land GBAD, aimed at replacing the ageing Sky Sabre system with a modern, layered air defense capability. The initiative focuses on enhancing coverage against drones, cruise missiles, and fixed-wing threats by integrating advanced sensors, effectors, and command-and-control systems, with full operational capability expected by the early 2030.

Key Players & Competitive Analysis Report

The ground-based air defense systems market is moderately consolidated, with major defense contractors competing on system range, mobility and integration capabilities. Key strategies include developing multi-layered platforms, advancing radar and interceptor technologies and integrating AI-based threat detection. Companies are focusing on modular designs to support rapid deployment and interoperability across allied forces. Moreover, rising strategic government contracts, joint development programs and indigenous manufacturing partnerships are driving market presence. Additionally, investment in directed-energy weapons and counter-UAV systems is emerging as a key area of competitive differentiation.

Major companies operating in the ground-based air defense systems industry include Almaz-Antey Corporation, ASELSAN A.Ş., BAE Systems plc, Hanwha Aerospace, Hensoldt AG, Israel Aerospace Industries (IAI), Kongsberg Defence & Aerospace, Lockheed Martin Corporation, MBDA, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, and Thales Group.

Key Players

- Almaz-Antey Corporation

- ASELSAN A.Ş.

- BAE Systems plc

- Hanwha Aerospace

- Hensoldt AG

- Israel Aerospace Industries (IAI)

- Kongsberg Defence & Aerospace

- Lockheed Martin Corporation

- MBDA

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Thales Group

Industry Developments

- June 2025: Northrop Grumman partnered with the UK’s Marshall Futureworx to develop a new command and control system for counter-uncrewed aerial systems (C-UAS). This collaboration aims to enhance layered air defense capabilities by integrating advanced threat detection and response technologies.

- June 2025: Hanwha partnered with Northrop Grumman to develop a new short-range air defense system tailored for the US military, integrating Hanwha’s launcher with Northrop’s C2 and missile technologies. This collaboration aims to enhance layered defense capabilities against drones, cruise missiles, and rotary-wing threats.

- March 2024: Northrop Grumman partnered with Diehl Defence to enhance integrated air and missile defense capabilities. This partnership aims to meet Diehl's ground-based missile systems with Northrop Grumman’s Integrated Battle Command System (IBCS) to support multi-domain operations.

Ground-Based Air Defense Systems Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Missile Defense Systems

- Gun Systems

- Laser Systems

- Electromagnetic Systems

By Platform Outlook (Revenue, USD Billion, 2020–2034)

- Fixed Ground-Based Platforms

- Mobile Platforms

- Vehicle-Mounted Platforms

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Radar Systems

- Command & Control Systems

- Launchers

- Interceptor Missiles

By Range Outlook (Revenue, USD Billion, 2020–2034)

- Short Range (<10 km)

- Medium Range (10-100 km)

- Long Range (>100 km)

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Military

- Army

- Air Force

- Navy

- Homeland Security

- Critical Infrastructure Protection

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ground-Based Air Defense Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.66 Billion |

|

Market Size in 2025 |

USD 27.81 Billion |

|

Revenue Forecast by 2034 |

USD 41.20 Billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.66 billion in 2024 and is projected to grow to USD 41.20 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Almaz-Antey Corporation, ASELSAN A.?., BAE Systems plc, Hanwha Aerospace, Hensoldt AG, Israel Aerospace Industries (IAI), Kongsberg Defence & Aerospace, Lockheed Martin Corporation, MBDA, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, and Thales Group.

The missile defense systems segment dominated the market in 2024 share. This dominance is attributed to its extensive deployment across high-threat zones and offering long-range interception capabilities.

The critical infrastructure protection segment is expected to witness the fastest growth during the forecast period, owing to rising threats from drones and low-altitude aerial systems targeting non-military assets such as utilities, transport hubs, and communication facilities.