Mobile Value-Added Services Market Size, Share, Trends, & Industry Analysis Report

By Solutions, By Organization Type, By Application, By Industry Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6052

- Base Year: 2024

- Historical Data: 2020-2023

Overview

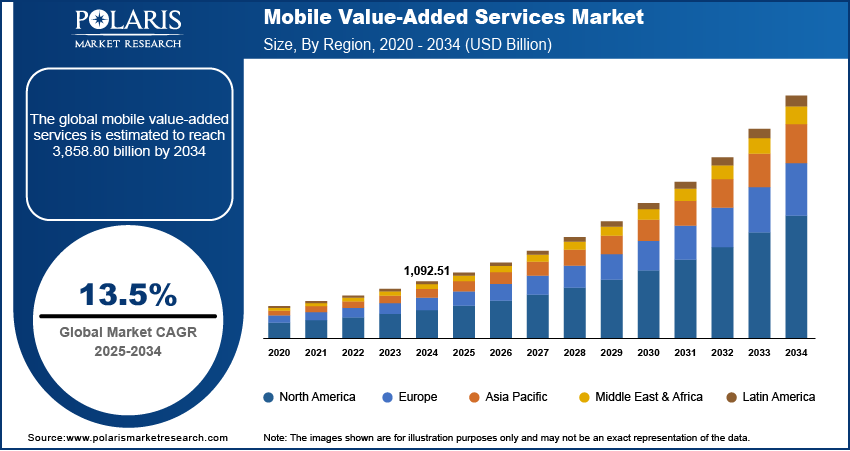

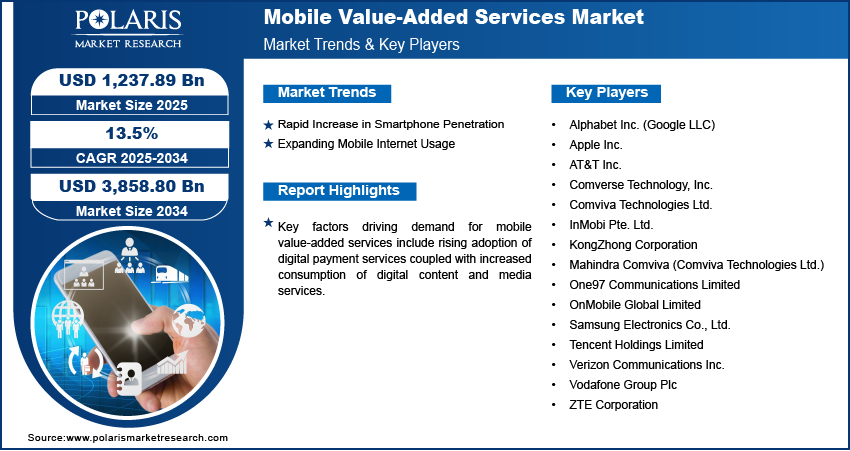

The global mobile value added services (MVAS) market size was valued at USD 1,092.51 billion in 2024, growing at a CAGR of 13.5% from 2025–2034. Rapid increase in smartphone penetration coupled with expanding mobile internet usage is boosting demand for mobile value-added services worldwide.

Key Insights

- The short messaging service (SMS) segment accounted for largest revenue share in 2024, due to its widespread use in communication, authentication, customer engagement, and promotional campaigns across industries.

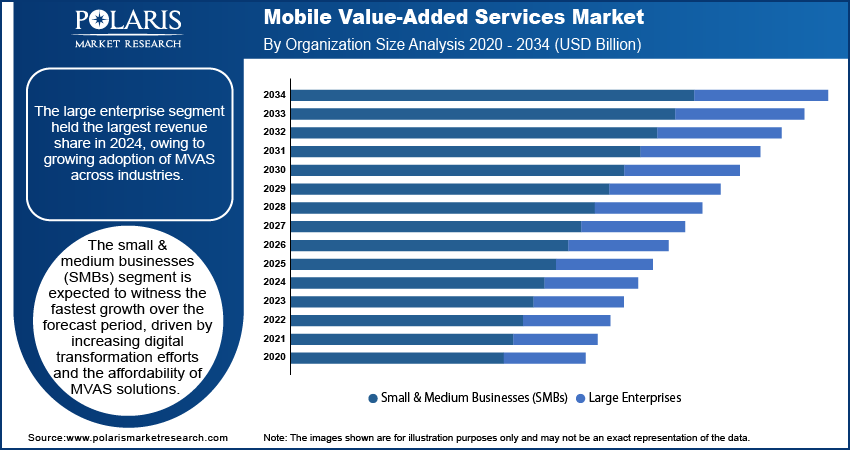

- The large enterprise segment held the largest revenue share in 2024, owing to growing adoption of MVAS across industries.

- The commercial & institutional segment accounted for the largest share of the MVAS market in 2024.

- The BFSI segment held the largest revenue share in 2024, due to high usage of mobile banking, account alerts, payment reminders, and fraud detection services.

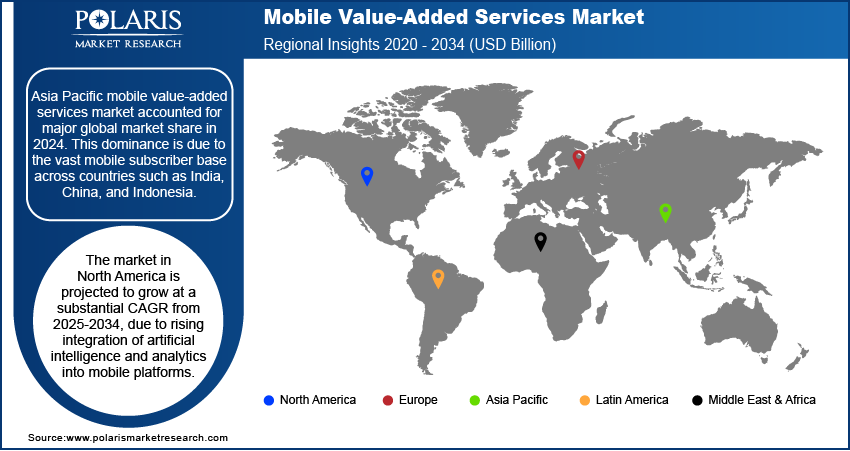

- Asia Pacific mobile value added services market accounted for major global market share in 2024 due to the vast mobile subscriber base across countries such as India, China, and Indonesia.

- The US market is expanding steadily, due to the growing consumption of digital entertainment and on-demand content across the country.

Industry Dynamics

- Rapid increase in smartphone penetration is expanding the addressable base for MVAS, across emerging markets where mobile-first access dominates digital consumption.

- Expanding mobile internet usage is supporting a surge in content streaming, digital payments, mobile learning, and cloud-based services delivered through MVAS platforms.

- Volatility in data privacy regulations across regions is restricting seamless MVAS deployment, as service providers must adapt offerings to local compliance standards and evolving digital policies.

- The integration of artificial intelligence (AI) and machine learning (ML) ecosystems is opening up new opportunities for MVAS expansion in areas such as smart healthcare, industrial automation, and connected mobility.

Market Statistics

- 2024 Market Size: USD 1,092.51 Billion

- 2034 Projected Market Size: USD 3,858.80 Billion

- CAGR (2025-2034): 13.5%

- Asia Pacific: Largest market in 2024

MVAS includes services such as mobile banking, mobile commerce, mobile entertainment, location-based services, mobile health, and mobile learning. These services are integrated into mobile networks and applications to enhance user experiences, offer personalized content, and drive customer retention. The continuous evolution of mobile technologies combined with rising smartphone penetration and growing mobile internet usage is boosting the demand for MVAS across urban and rural markets.

Rising adoption of digital payment services is significantly driving the growth of the MVAS market. Mobile wallets, digital payments, and USSD-based services are providing convenient options for transactions, bill payments, and money transfers. Expansion of mobile-first economies is pushing telecom operators and fintech platforms to collaborate on delivering secure and accessible financial services via mobile devices.

Increased consumption of digital content and media services is further accelerating the demand for MVA services. Music streaming, video-on-demand (VoD), short-form content, and mobile gaming is increasing the demand for telecom and content service providers. The integration of MVAS with AI-driven personalization, subscription models, and in-app engagement features is supporting the monetization of mobile platforms. These offerings are tailored for local languages and preferences, further strengthening market penetration.

Drivers & Opportunities

Rapid Increase in Smartphone Penetration

The growing adoption of smartphones globally is driving the expansion of mobile value-added services across urban and rural areas. According to GSMA Intelligence's baseline forecast, global eSIM smartphone connections are projected to reach around 1 billion by the end of 2025, with the number expected to rise to 6.9 billion by 2030. Consumers are increasingly using smartphones for accessing a wide range of digital services such as mobile banking, video content, location-based assistance, and e-commerce platforms. Emerging markets in Asia, Africa, and Latin America are witnessing significant growth in smartphone ownership due to availability of affordable devices and financing options. Growing dependence on mobile apps for daily tasks is propelling telecom operators and service providers to broaden MVAS portfolios, aiming to offer personalized user experiences and unlock additional revenue opportunities.

Expanding Mobile Internet Usage

Rising internet penetration coupled with broader mobile broadband access and lower data costs is driving the demand for MVAS globally. According to GSMA, by the end of 2022, 54% of the global population (4.3 billion people) owned a smartphone. Among the 4.6 billion mobile internet users, nearly 4 billion accessed it via smartphones, while around 600 million used feature phones. The global rollout of 4G networks and the transition to 5G services are accelerating faster content delivery, seamless streaming, and real-time interaction through MVAS platforms. Mobile internet is increasingly being used for video streaming, learning platforms, gaming, and social media across both developed and emerging markets. This growth is pushing content providers to develop data-rich MVAS content tailored to local needs, languages, and usage habits, thus boosting the market growth.

Segmental Insights

Solutions Analysis

Based on solution, the segmentation includes short messaging service (SMS), multimedia messaging service (MMS), location-based services, mobile email & IM, mobile money, mobile advertising, and mobile infotainment. The short messaging service (SMS) segment accounted for largest revenue share in 2024, due to its widespread use in communication, authentication, customer engagement, and promotional campaigns across industries. SMS remains a reliable and low-cost channel for reaching large user bases, in regions with limited internet access or basic mobile devices.

The mobile money segment is projected to grow at the fastest rate during the forecast period, fueled by increasing adoption of digital payments, peer-to-peer transfers, and financial inclusion initiatives. Telecom operators, fintech companies, and banks are collaborating to expand mobile wallet services, in developing economies where access to formal banking remains limited. The growing emphasis on secure, real-time financial transactions is accelerating the integration of mobile money solutions into MVAS platforms.

Organization Type Analysis

By organization type, the market includes small & medium businesses (SMBs) and large enterprise. The large enterprise segment held the largest revenue share in 2024, owing to growing adoption of MVAS across industries. Businesses are leveraging mobile value-added services to enhance customer engagement, streamline communication, and offer tools such as mobile advertising, push notifications, and real-time support. Enterprises are leveraging MVAS to improve marketing strategies, enable remote workforces, and offer mobile-based loyalty programs that improve retention and personalization.

The small & medium businesses (SMBs) segment is expected to witness the fastest growth over the forecast period, driven by increasing digital transformation efforts and the affordability of MVAS solutions. Small and medium businesses are increasingly using mobile platforms to access broader audiences, conduct transactions, and deliver content without requiring extensive infrastructure. Thus, cloud-enabled MVAS tools are becoming an attractive option for businesses seeking scalable and flexible digital engagement solutions to remain competitive in a rapidly evolving mobile-first industry.

Application Analysis

By application, the market includes residential, commercial & institutional, and industrial. The commercial & institutional segment accounted for the largest share of the MVAS market in 2024. Enterprises, educational institutions, and public sector organizations are leveraging mobile value-added services to enhance digital communication, customer engagement, and operational efficiency. Services such as bulk messaging, mobile banking, location-based advertising, and enterprise mobility solutions are integrated into organizational workflows.

The residential segment is projected to grow at the fastest rate over the forecast period. Rising smartphone penetration and mobile internet usage in households across developing economies is increasing demand for personalized services such as mobile entertainment, cloud gaming, OTT content, and digital learning. Growth in digital literacy, mobile payments, and multilingual content is further accelerating the adoption of MVAS within residential applications.

Industry Vertical Analysis

By industry vertical, the market includes BFSI, media and entertainment, healthcare, education, retail, government, telecom & it, and others. The BFSI segment held the largest revenue share in 2024, due to high usage of mobile banking, account alerts, payment reminders, and fraud detection services. Banks and financial service providers are deploying MVAS to expand digital outreach, improve transaction security, and offer real-time customer service. The integration of mobile channels with banking systems is enhancing customer convenience and helping institutions scale services more efficiently.

The healthcare segment is anticipated to grow at the fastest pace during the forecast period, as hospitals, insurers, and telehealth providers increase the use of MVAS for appointment scheduling, medical alerts, patient education, and remote monitoring. The shift toward digital health platforms is pushing service providers to use SMS, mobile apps, and push notifications to engage patients and improve healthcare access, in remote or underserved regions.

Regional Analysis

Asia Pacific mobile value-added services market accounted for major global market share in 2024. This dominance is due to the vast mobile subscriber base across countries such as India, China, and Indonesia. The scale of mobile connectivity is pushing telecom operators to deliver a wide variety of services tailored to regional languages, lifestyles, and consumption patterns. Government-led initiatives focused on digital inclusion, such as India’s Digital India program and China’s aggressive 5G deployment, are boosting connectivity gaps in rural areas. Expanding mobile internet access is propelling increased demand for mobile payments, e-learning platforms, entertainment services, and region-specific digital content, accelerating the market growth in the region.

India Mobile Value Added Services Market Insight

India held significant market share in the Asia Pacific mobile value-added services landscape in 2024, driven by the growing adoption of digital payments and financial services across urban and rural areas. The widespread use of mobile wallets, QR code-based transactions, and UPI-linked apps is driving demand for value-added services that deliver instant payment confirmations, transaction history, and loyalty integrations. According to the Indian Ministry of Finance, the country recorded an all-time high of 16.73 billion Unified Payments Interface (UPI) transactions in December 2024, highlighting the country’s rapid shift toward a cashless economy. The scale and frequency of mobile-based transactions are pushing telecom operators, fintech companies, and app developers to strengthen MVAS offerings in financial management, reward distribution, and digital banking tools.

North America Mobile Value Added Services Market

The market in North America is projected to grow at a substantial CAGR from 2025-2034, due to rising integration of artificial intelligence and analytics into mobile platforms. This is helping to deliver more personalized services, driving greater user engagement and higher revenue per user. Rising enterprise demand for mobile marketing, customer retention, and remote collaboration tools is further boosting the market growth. Additionally, the rising adoption of mobile financial services, including digital wallets, mobile banking, and budgeting apps, is increasing the demand for mobile value-added services across the region.

US Mobile Value-Added Services Market Overview

The market in the US is expanding due to the growing consumption of digital entertainment and on-demand content. According to a report by the Marketing & Advertising Global Network, over 51 million US households consistently stream content from an OTT platform, with 46% subscribing to two or more services averaging approximately 3.4 subscriptions per household. High mobile data availability and increasing preference for OTT platforms is boosting widespread use of MVAS for video streaming, mobile gaming, podcast listening, and sports viewing. Content providers and telecom operators are forming strategic partnerships to deliver bundled offerings that enhance the overall user experience. Additionally, increasing adoption of location-based services, targeted advertising, and real-time news updates is further accelerating investment in mobile-first service platforms.

Europe Mobile Value Added Services Market

The mobile value-added services landscape in the Europe is projected to hold a substantial share in 2034, driven by strict data protection regulations and a strong focus on user privacy. Compliance with the General Data Protection Regulation (GDPR) is accelerating the development of secure MVAS platforms that handle personal data responsibly. Non-compliance with GDPR may lead to significant penalties, including fines of up to USD 23 million or 4% of a company’s annual global turnover, whichever is greater. Additionally, the growing adoption of mobile ticketing apps, public transit alerts, and digital parking services across European cities is propelling the demand for MVA services. Telecom operators and local governments are increasingly collaborating to create seamless, mobile-integrated urban services focused on real-time engagement and contactless convenience.

Key Players & Competitive Analysis Report

The Mobile Value-Added Services (MVAS) market is moderately consolidated, with competition centered around service innovation, user engagement, and integration across telecom and digital platforms. Leading players are actively enhancing their service portfolios by investing in AI, cloud infrastructure, and data analytics to deliver personalized and high-quality mobile experiences. Companies are focusing on content-rich applications such as mobile entertainment, mobile commerce, messaging, and location-based services to retain users and boost average revenue per user (ARPU). Strategic initiatives include collaborations with telecom operators, content providers, fintech firms, and app developers to diversify service offerings and enhance regional penetration. Additionally, players are adopting monetization models through advertising, subscription-based services, and in-app purchases to improve profitability. The increasing emphasis on mobile-first strategies and digital inclusion across sectors such as banking, healthcare, education, and retail are increasing the demand for MVAS providers.

Prominent companies in the MVAS market include Alphabet Inc. (Google LLC), Apple Inc., AT&T Inc., Comverse Technology, Inc., Comviva Technologies Ltd., InMobi Pte. Ltd., KongZhong Corporation, Mahindra Comviva, One97 Communications Limited, OnMobile Global Limited, Samsung Electronics Co., Ltd., Tencent Holdings Limited, Verizon Communications Inc., Vodafone Group Plc, and ZTE Corporation.

Key Players

- Alphabet Inc. (Google LLC)

- Apple Inc.

- AT&T Inc.

- Comverse Technology, Inc.

- Comviva Technologies Ltd.

- InMobi Pte. Ltd.

- KongZhong Corporation

- Mahindra Comviva (Comviva Technologies Ltd.)

- One97 Communications Limited

- OnMobile Global Limited

- Samsung Electronics Co., Ltd.

- Tencent Holdings Limited

- Verizon Communications Inc.

- Vodafone Group Plc

- ZTE Corporation

Industry Developments

- September 2024: Zoho launched Zoho Payments, marking its entry into the digital payments space. Positioned as a unified payment platform, the service enables businesses to seamlessly collect online payments through various channels, including UPI, cards, NEFT, RTGS, IMPS, and NetBanking.

- September 2024: Mastercard launched its Payment Passkey Service, a new biometric-based authentication solution aimed at enhancing transaction speed and fraud prevention. The service leverages tokenization and biometric credentials to authorize payments without sharing sensitive information with merchants or third parties.

Mobile Value Added Services Market Segmentation

By Solutions Outlook (Revenue, USD Billion, 2020–2034)

- Short Messaging Service (SMS)

- Multimedia Messaging Service (MMS)

- Location Based Services

- Mobile Email & IM

- Mobile Money

- Mobile Advertising

- Mobile Infotainment

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Small & Medium Businesses (SMBs)

- Large Enterprises

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial & Institutional

- Industrial

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Media and Entertainment

- Healthcare

- Education

- Retail

- Government

- Telecom & IT

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mobile Value-Added Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,092.51 Billion |

|

Market Size in 2025 |

USD 1,237.89 Billion |

|

Revenue Forecast by 2034 |

USD 3,858.80 Billion |

|

CAGR |

13.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,092.51 billion in 2024 and is projected to grow to USD 3,858.80 billion by 2034.

The global market is projected to register a CAGR of 13.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Alphabet Inc. (Google LLC), Apple Inc., AT&T Inc., Comverse Technology, Inc., Comviva Technologies Ltd., InMobi Pte. Ltd., KongZhong Corporation, Mahindra Comviva, One97 Communications Limited, OnMobile Global Limited, Samsung Electronics Co., Ltd., Tencent Holdings Limited, Verizon Communications Inc., Vodafone Group Plc, and ZTE Corporation.

The short messaging service (SMS) segment dominated the market in 2024.

The large enterprise segment is expected to witness the fastest growth during the forecast period.