Containerboard Market Size, Share, Trends, & Industry Analysis Report

By Material, By Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6049

- Base Year: 2024

- Historical Data: 2020-2023

Overview

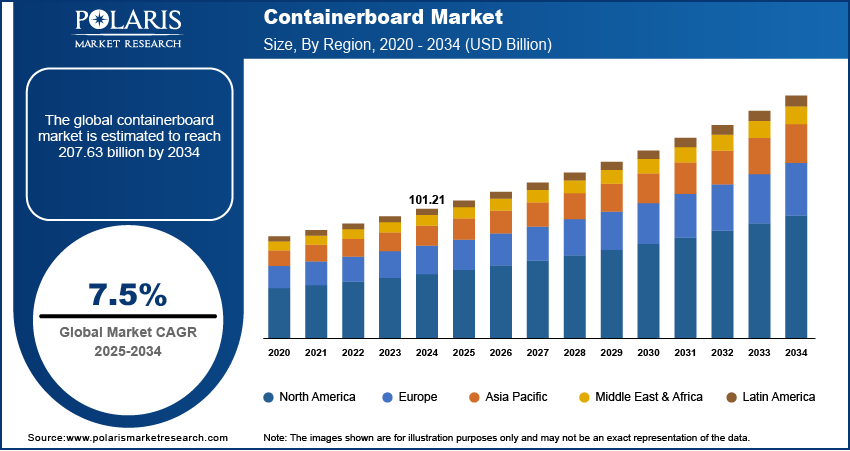

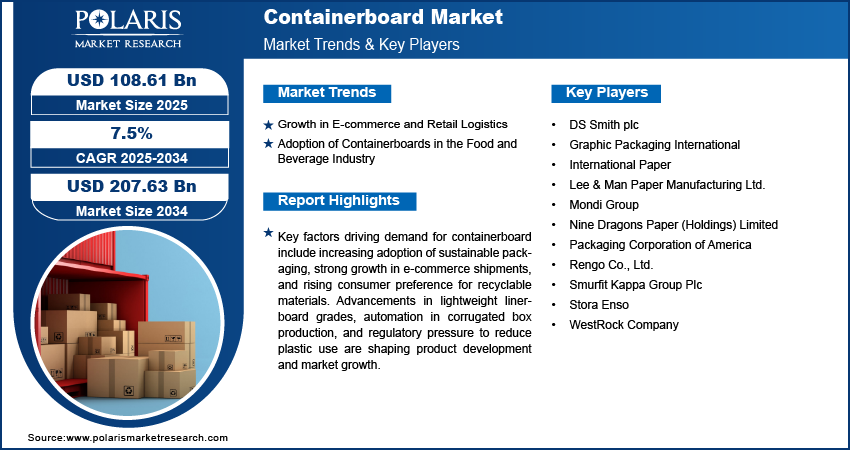

The global containerboard market size was valued at USD 101.21 billion in 2024, growing at a CAGR of 7.5% from 2025–2034. Expansion of e-commerce and retail logistics, coupled with growing adoption of containerboards in the food and beverage industry is fueling demand for durable and sustainable corrugated packaging solutions across global supply chains.

Key Insights

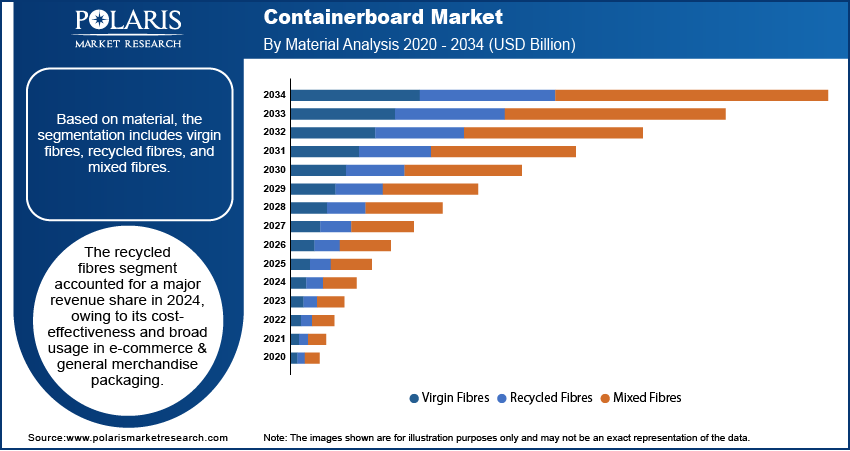

- The recycled fibres material segment accounted for largest revenue share in 2024, due to its extensive use in corrugated packaging across e-commerce, retail logistics and consumer goods sectors.

- The linerboard segment held the largest revenue share in 2024, due to its essential role in providing rigidity and print surface in corrugated box manufacturing.

- The food and beverage segment held the largest revenue share in 2024, due to increasing demand for retail-ready and hygienic packaging formats.

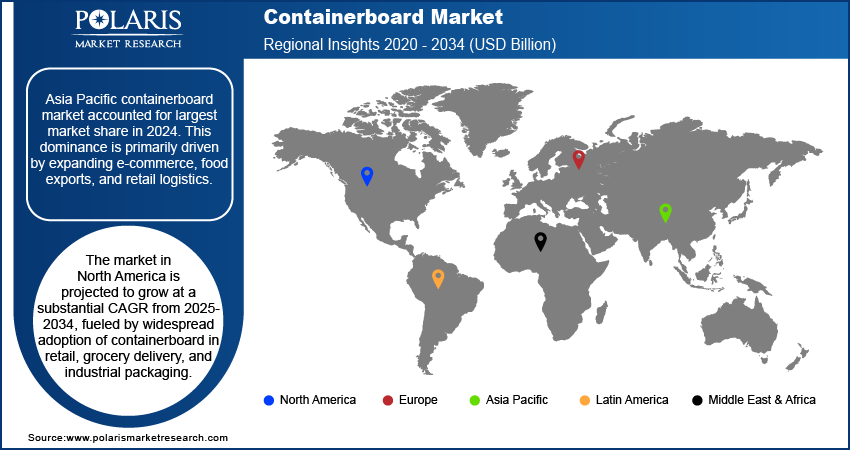

- Asia Pacific containerboard market accounted for largest market share in 2024 driven by expanding e-commerce, food exports, and retail logistics.

- China held significant market share in Asia Pacific containerboard landscape in 2024, with high domestic production capacity, growth in online retail logistics and government initiatives promoting recyclable packaging.

- The market in North America is projected to grow at a substantial CAGR from 2025-2034, driven by growing demand from e-commerce, food delivery services and automation in corrugated packaging plants.

- The US market is expanding steadily, fueled by rising demand for lightweight, recyclable materials in consumer packaging and continued investment in advanced paper recovery and processing systems.

Market Dynamics

- Rapid growth in e-commerce and retail logistics is driving the demand for durable and lightweight containerboard packaging, suitable for high-frequency shipping and automated fulfillment systems.

- Increasing consumption of packaged food and beverages is driving the use of food-grade containerboard materials that comply with hygiene and safety standards.

- Integration of nanotechnology and biodegradable packaging in containerboard is creating growth opportunities by enhancing performance, sustainability and supply chain efficiency.

Market Statistics

- 2024 Market Size: USD 101.21 Billion

- 2034 Projected Market Size: USD 108.61 Billion

- CAGR (2025-2034): 7.5%

- Asia Pacific: Largest market in 2024

Volatility in raw material prices and energy costs is restraining the demand for containerboards while hampering manufacturers in maintaining stable profit margins.

Containerboards are extensively used in the manufacturing of corrugated boxes for packaging applications across industrial, commercial and consumer sectors. The rising demand for sustainable and recyclable packaging solutions is accelerating the adoption of containerboard in the global packaging industry. Their high strength-to-weight ratio and cost-effectiveness support widespread use across logistics, e-commerce and food packaging sectors.

Growing online retail and increasing focus on reducing plastic usage are contributing to the expanding containerboard consumption across developing economies. Government regulations promoting green packaging materials, along with growing investment in automated corrugated packaging plants are driving industry development. As an example, in February 2025, International Paper and DS Smith announced a merger to form a global player in sustainable packaging solutions. The combined entity aims to enhance innovation, expand geographic reach, and accelerate progress toward circular packaging systems. Rapid innovations in lightweight containerboard grades and digital printing compatibility are enhancing product functionality and supply chain efficiency.

The expansion of fast-moving consumer goods (FMCG) and fresh produce distribution is increasing the deployment of containerboard-based packaging for short-cycle logistics. According to the Food and Agriculture Organization (FAO), global food packaging demand is rising due to urbanization and changing consumption patterns. Containerboards are preferred for their structural integrity and compliance with food safety standards.

Rising investments in circular economy initiatives are pushing manufacturers to integrate recycled fiber into production processes. This shift is driven by stricter environmental norms and extended producer responsibility (EPR) frameworks. In addition, the proliferation of smart packaging technologies is creating opportunities for containerboard products embedded with QR codes, sensors and track-and-trace features to enhance supply chain visibility.

Drivers & Opportunities

Growth in E-commerce and Retail Logistics: The rapid expansion of e-commerce and omnichannel retail is driving the demand for corrugated packaging solutions made from containerboard. According to the International Trade Administration (ITA), the global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, growing at a compound annual rate of 14.4%. These packaging materials offer strength, stack ability and cost efficiency, making them suitable for diverse shipping and storage needs. Rising parcel volumes and increasing frequency of last-mile deliveries are accelerating the deployment of high-performance containerboard packaging in online retail. Additionally, third-party logistics providers are standardizing the use of lightweight and recyclable materials to reduce operational costs and meet sustainability targets.

Adoption of Containerboards in Food and Beverage: The food and beverage industry is rapidly adopting containerboard-based packaging due to its compatibility with hygiene standards and ease of customization. The shift toward packaged fresh produce, ready meals and direct-to-consumer grocery delivery is boosting the demand for corrugated boxes with moisture resistance and ventilation features. Regulatory focus on safe and recyclable materials for food contact applications is further boosting the use of virgin and recycled fiber-based containerboards in secondary and tertiary packaging.

Segmental Insights

Material Analysis

Based on material, the segmentation includes virgin fibres, recycled fibres, and mixed fibres. The recycled fibres material segment accounted for largest revenue share in 2024, due to its extensive use in corrugated packaging across e-commerce, retail logistics and consumer goods sectors. For instance, in May 2025, Cascades started operations of its new lightweight recycled containerboard production line at the Bear Island mill in Virginia. This facility enhances the company’s capacity to produce sustainable, high-performance packaging materials using 100% recycled fiber. Recycled containerboards offer cost efficiency, reduced carbon footprint and compliance with global circular economy regulations. The rising advancements in fiber processing technologies are improving performance attributes such as stiffness, printability, and durability, driving the dominance in high-volume and non-food packaging applications.

The virgin fibres segment is projected to grow at the fastest pace during the forecast period, due to increasing demand for high-strength and food-safe packaging. These fibres are preferred in regulated sectors such as food, beverages and pharmaceuticals, where hygiene and structural integrity are critical. Virgin containerboards deliver superior performance in moisture resistance and compression strength, making it suitable for heavy-duty and export packaging. In addition, the rising investment in virgin kraft liner and white-top linerboard production in Asia Pacific and Latin America is expected to drive segment expansion.

Type Analysis

By type, the market includes linerboard and fluting. The linerboard segment held the largest revenue share in 2024, due to its essential role in providing rigidity and print surface in corrugated box manufacturing. Linerboards are widely used in retail-ready, shelf-ready, and branded packaging solutions due to their strength and visual appeal. Innovations in surface coating and lightweighting technologies are enhancing their functional value and reducing total material usage. Strong demand from sectors such as food delivery, personal care, and general merchandise fuels the consumption of linerboard globally.

The fluting segment is anticipated to grow at the fastest rate, due to rising demand for cushioning materials in consumer electronics, industrial components and heavy machinery packaging. Fluting offers impact resistance and crush protection, making it ideal for fragile and high-value items. Moreover, increasing production of double and triple wall corrugated structures for export and long-distance shipping is further driving segment growth. Manufacturers are focusing on developing fluting grades with improved recyclability and reduced weight to meet global sustainability goals.

End User Analysis

By end user, the market includes food and beverage, consumer electronics, personal care & cosmetics, and other end users. The food and beverage segment held the largest revenue share in 2024, due to increasing demand for retail-ready and hygienic packaging formats. Containerboard-based boxes are widely adopted for fresh produce, beverages, dairy and frozen food applications. Compliance with food safety standards and ease of customization make containerboard ideal for shelf and transport packaging. Additionally, cold chain logistics and expansion of online grocery platforms are boosting segment dominance.

The consumer electronics segment is anticipated to grow at the fastest rate, owing to the rising shipments of smartphones, home appliances and computing devices. Protective containerboard packaging is essential for safeguarding electronic components from physical damage during transit. Custom-fit corrugated inserts and anti-static linerboard are rapidly adopted to support high-value exports. This is due to growing focus on eco-friendly and branded packaging formats for recyclable and high-strength containerboard solutions.

Regional Analysis

Asia Pacific containerboard market accounted for largest market share in 2024. This dominance is primarily driven by expanding e-commerce, food exports, and retail logistics. Also, the increasing investments in corrugated packaging infrastructure to support rising demand for recyclable and cost-efficient containerboard products. Moreover, rising government initiatives promoting environmentally sustainable packaging alternatives are accelerating the adoption of recycled containerboard across industrial supply chains.

China Containerboard Market Insight

China held significant market share in Asia Pacific containerboard landscape in 2024, due to its high-volume e-commerce sector, food processing capacity, and investments in domestic packaging innovation. According to the China Ministry of Commerce, the China online retail sales reached approximately USD 620.52 billion in 2024, marking an 11.5% year-on-year increase. Also, growing participation from local manufacturers in scaling up virgin and recycled linerboard production to meet green packaging and circular economy targets is driving increased domestic containerboard utilization.

North America Containerboard Market

The market in North America is projected to grow at a substantial CAGR from 2025-2034, fueled by widespread adoption of containerboard in retail, grocery delivery, and industrial packaging. The US and Canada continue to expand automated corrugation facilities, driven by demand for lightweight and branded packaging. In addition, retailer-led sustainability mandates and extended producer responsibility (EPR) programs are accelerating the shift from plastic to fiber-based packaging across consumer and commercial supply chains.

US Containerboard Market Overview

The market in US is expanding due to surging e-commerce parcel volumes, customized packaging demand, and focus on recyclable materials. For instance, in May 2025, Kadant Black Clawson collaborated with Cascades to launch a new lightweight recycled containerboard production line. This highlights a significant step in advancing sustainable packaging solutions using high-efficiency fiber processing technology. Moreover, rising investments in domestic paper recycling infrastructure and modernization of box plants are enhancing containerboard production capacity across the country.

Europe Containerboard Market

The containerboard landscape in Europe is projected to hold a substantial share in 2034, driven by strict regulatory policies to adopt recyclable and biodegradable packaging formats. The Packaging and Packaging Waste Directive (PPWD) is driving the replacement of plastic with paper-based materials across FMCG, food, and personal care sectors. According to the European Union, the regulation mandates member states to reduce plastic packaging waste, with overall packaging reduction targets set at 5% by 2030, 10% by 2035, and 15% by 2040. It also prohibits specific single-use plastic packaging by 2030, including those used for fresh produce, food and beverages served in hospitality establishments, and small cosmetic and toiletry items. In addition, growing focus on strong recycling infrastructure and climate-neutrality targets are fueling the use of containerboard in export and transit packaging applications.

Key Players & Competitive Analysis Report

The containerboard market is moderately consolidated, with leading players competing on fiber quality, print performance and environmental compliance. Key strategies include expanding recycled fiber processing capacity, launching lightweight grades and investing in automated corrugation lines. Companies are focusing on sustainability by enhancing recyclability and reducing water and energy use in production. Strategic partnerships with e-commerce, food and FMCG brands are driving customized packaging solutions while backward integration and supply chain optimization support competitive differentiation.

Major companies operating in the containerboard industry include International Paper, WestRock Company, Smurfit Kappa Group Plc, Nine Dragons Paper (Holdings) Limited, DS Smith plc, Packaging Corporation of America, Graphic Packaging International, Rengo Co., Ltd., Stora Enso, Mondi Group, and Lee & Man Paper Manufacturing Ltd.

Key Players

- DS Smith plc

- Graphic Packaging International

- International Paper

- Lee & Man Paper Manufacturing Ltd.

- Mondi Group

- Nine Dragons Paper (Holdings) Limited

- Packaging Corporation of America

- Rengo Co., Ltd.

- Smurfit Kappa Group Plc

- Stora Enso

- WestRock Company

Industry Developments

- July 2025: Packaging Corporation of America announced to acquire Greif’s containerboard business for USD 1.8 billion, adding two mills and eight corrugated facilities to its portfolio. The deal is expected to enhance operational efficiency and generate approximately USD 60 million in synergies within two years.

- May 2025: Norske Skog began containerboard production at its Golbey mill in France, marking a strategic shift from newsprint to packaging materials. The transition supports growing demand for recycled containerboard in Europe and strengthens the company’s position in the sustainable packaging market.

- April 2024: Rengo Co., Ltd., completed construction of a new corrugated packaging plant in Malaysia under its subsidiary, Hexa Evergreen. The facility is expected to strengthen Rengo’s production capabilities in Southeast Asia and meet growing regional demand for high-quality, sustainable packaging.

Containerboard Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Virgin Fibres

- Recycled Fibres

- Mixed Fibres

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Linerboard

- Kraftliner

- Testliner

- Flutting

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Food and Beverage

- Consumer Electronics

- Personal Care & Cosmetics

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Containerboard Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 101.21 Billion |

|

Market Size in 2025 |

USD 108.61 Billion |

|

Revenue Forecast by 2034 |

USD 207.63 Billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 101.21 billion in 2024 and is projected to grow to USD 207.63 billion by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are International Paper, WestRock Company, Smurfit Kappa Group Plc, Nine Dragons Paper (Holdings) Limited, DS Smith plc, Packaging Corporation of America, Graphic Packaging International, Rengo Co., Ltd., Stora Enso, Greif, Inc., Mondi Group, and Lee & Man Paper Manufacturing Ltd.

The linerboard segment dominated the market in 2024. This dominance is attributed to its critical role in the outer layers of corrugated packaging, offering strength, durability and printability required for retail, industrial and logistics applications.

The consumer electronics segment is expected to witness the fastest growth during the forecast period, owing to rising demand for durable, recyclable, and protective packaging for electronic devices.