Pediatric Diabetes Management Market Size, Share, Trends, & Industry Analysis Report

By Technology (Connected Devices, Non-connected Devices), By Product, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6053

- Base Year: 2024

- Historical Data: 2020-2023

Overview

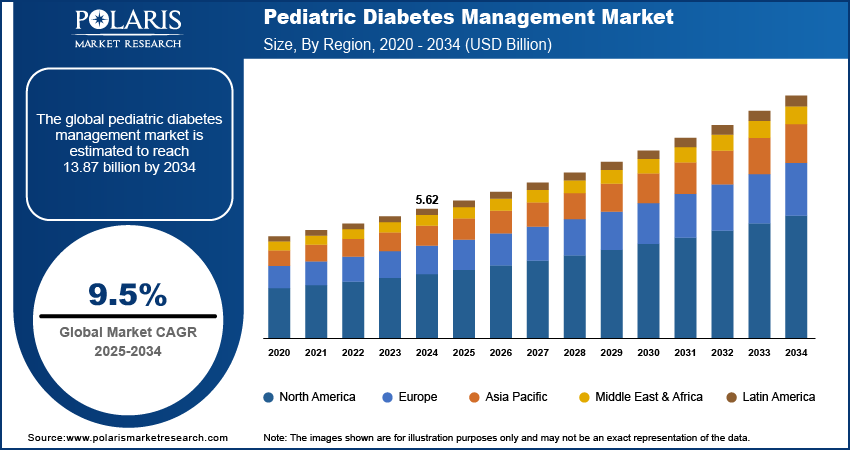

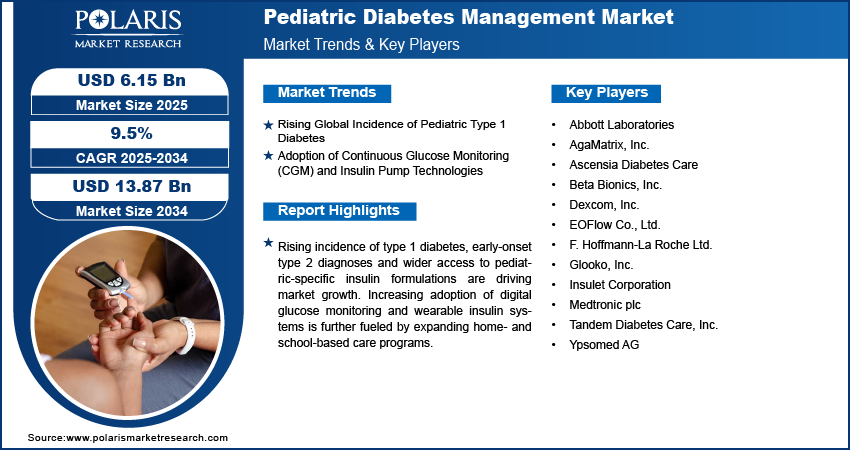

The global pediatric diabetes management market size was valued at USD 5.62 billion in 2024, growing at a CAGR of 9.5% from 2025–2034. Rising incidence of pediatric type 1 diabetes coupled with the growing adoption of continuous blood glucose monitoring devices and insulin pump technologies, is accelerating the demand for precise and responsive diabetes management solutions.

Key Insights

- The continuous glucose monitors (CGM) segment accounted for largest revenue share in 2024, driven by its ability to provide real-time glucose data, trend analysis, and alerts for hypoglycemic events.

- The non-connected devices segment accounted for largest revenue share in 2024, owing to its utilization in cost-sensitive regions with limited access to digital infrastructure.

- The hospitals segment held the largest revenue share in 2024, due to their access to specialized pediatric endocrinology units and advanced diabetes care infrastructure.

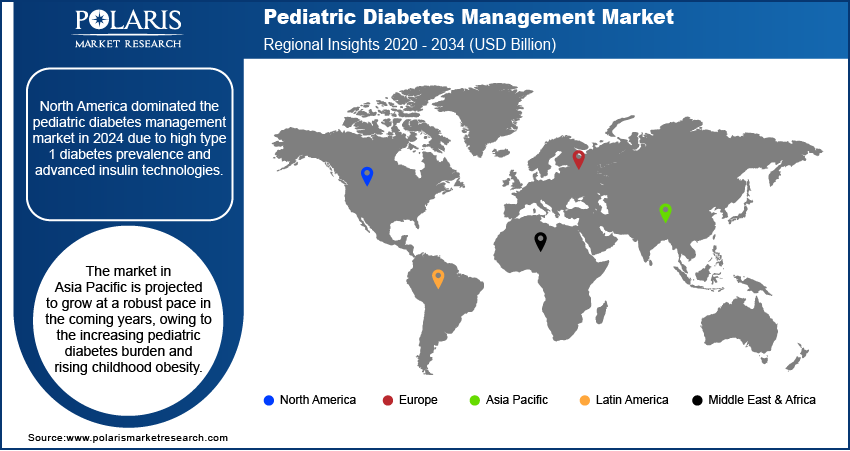

- North America pediatric diabetes management market accounted for major global market share in 2024. This dominance is attributed to the high prevalence of pediatric type 1 diabetes and extensive adoption of insulin pumps and continuous glucose monitoring systems across the US and Canada.

- The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, driven by increasing prevalence of type 1 and type 2 diabetes among children.

- The China market is expanding steadily, fueled by a large pediatric population base, improving healthcare access and public initiatives promoting digital health tools for chronic disease care.

Market Dynamics

- Increasing diagnosis rates of type 1 diabetes among children are contributing to the rising demand for pediatric-specific insulin delivery and glucose monitoring solutions.

- Adoption of continuous glucose monitoring and sensor-integrated insulin pump systems is improving treatment adherence, real-time glycemic tracking, and overall therapeutic outcomes in children.

- Integration of AI-based decision support in pediatric endocrinology is creating opportunity for the market to improve accuracy and treatment personalization.

- High device and treatment costs associated with CGMs, insulin pumps, and digital support systems limit adoption in cost-sensitive and underfunded healthcare markets.

Market Statistics

- 2024 Market Size: USD 5.62 Billion

- 2034 Projected Market Size: USD 13.87 Billion

- CAGR (2025-2034): 9.5%

- North America: Largest market in 2024

Pediatric diabetes management focuses on delivering age-appropriate insulin therapies, digital monitoring solutions and user-friendly delivery devices for children and adolescents. These interventions aim to maintain optimal glycemic levels, minimize the risk of hypoglycemia and improve clinical outcomes. Increasing specialized care units, including pediatric hospitals and endocrinology clinics are integrated to automate insulin delivery systems and real-time glucose tracking to ensure consistent monitoring and adherence.

The market is expanding due to the increasing incidence of type 1 diabetes among children and broader access to advanced technologies such as continuous glucose monitoring and sensor-integrated insulin pumps. In July 2025, Mattel launched a Barbie doll with type 1 diabetes, featuring a glucose monitor and insulin pump, to promote awareness and inclusivity in childhood diabetes. Regulatory bodies are focusing pediatric-focused safety frameworks and evidence-based innovation. Moreover, the adoption of AI-enabled decision-support tools for dose optimization and remote monitoring is advancing personalized disease management across pediatric settings.

Increasing policy focus on pediatric metabolic health is driving investments in early screening programs and digital education initiatives for families managing childhood diabetes. Health authorities across key markets are expanding registries and clinical data networks to support evidence-based decision-making in pediatric endocrinology. Additionally, rising funding support for decentralized care delivery and school-based diabetes management is contributing to improved accessibility and timely intervention.

Drivers & Opportunities

Increasing Global Incidence of Pediatric Type 1 Diabetes: The increasing incidence of type 1 diabetes among children and adolescents is a key factor driving the demand for pediatric diabetes management solutions. According to the International Diabetes Federation, over 1.8 million children and adolescents under the age of 20 are living with type 1 diabetes globally. Rising environmental triggers, autoimmune susceptibility, and genetic predisposition are contributing to earlier disease onset. This growing patient pool is increasing the need for early diagnosis, continuous monitoring, and effective insulin delivery systems. Healthcare providers are expanding screening programs and initiating disease management at earlier stages, which is propelling the demand for pediatric-focused glucose monitoring devices and insulin delivery products.

Rising Adoption of Continuous Glucose Monitoring (CGM) and Insulin Pump Technologies: Growing technological advancements in diabetes care such as CGM systems and insulin pump therapies among pediatric populations is fueling the market. These digital tools offer real-time glucose tracking, reduced need for finger-prick testing, and personalized insulin delivery, improving glycemic control and reducing the risk of hypoglycemia in children. Integration of CGM with closed-loop systems and mobile health platforms is enhancing user compliance and caregiver oversight. This shift towards minimally invasive, automated, and user-friendly solutions is accelerating device adoption across developed and emerging markets among pediatric endocrinologists and diabetes clinics.

Segmental Insights

Product Analysis

Based on product, the segmentation includes blood glucose monitors (BGM), continuous glucose monitors (CGM), insulin pumps, insulin pens, and insulin syringes. The continuous glucose monitors (CGM) segment accounted for largest revenue share in 2024, driven by its ability to provide real-time glucose data, trend analysis, and alerts for hypoglycemic events. These systems are adopted in pediatric settings for their accuracy and ability to reduce the need for frequent finger-prick testing. For instance, in April 2025, Ambrosia launched India's first 24x7 real-time glucose and stress monitoring service using advanced continuous glucose monitoring (CGM) technology. This health-tech innovation enables round-the-clock tracking of glucose levels and stress indicators, aiming to improve chronic disease management and preventive care. Healthcare providers are favoring CGM integration in pediatric care plans due to its role in improving glycemic control and long-term outcomes. Regulatory approvals for pediatric-specific CGM models and favorable reimbursement policies in developed markets are driving segment dominance across clinical and homecare environments.

The insulin pump segment is projected to grow at the fastest pace during the forecast period, due to increasing demand for automated and personalized insulin delivery in children. These systems enable precise basal-bolus dosing and are widely adopted for their compatibility with smart glucose sensors and algorithm-based decision tools. Pediatric endocrinologists are recommending pump therapy to reduce glycemic fluctuations and treatment burden in young patients. Manufacturers are introducing compact, wearable, and age-specific pump models, further accelerating adoption. Technological improvements in hybrid closed-loop systems are also contributing to segment growth in high-income and emerging economies.

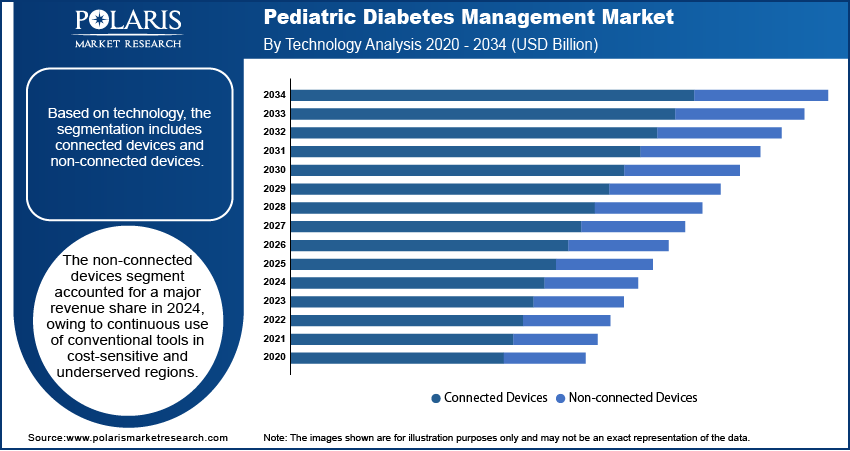

Technology Analysis

Based on technology, the segmentation includes connected devices and non-connected devices. The non-connected devices segment accounted for largest revenue share in 2024, owing to its utilization in cost-sensitive regions with limited access to digital infrastructure. These include conventional insulin pens, syringes, and standalone blood glucose monitors, which remain widely used in low- and middle-income countries. Their affordability and ease of use make them suitable for resource-constrained settings and early-stage disease management. Despite the transition toward connected technologies in urban healthcare systems, the broad patient base in rural and underserved areas continues to rely on non-connected tools, sustaining their market relevance during the forecast period.

The connected devices segment is projected to grow at the fastest pace during the forecast period, driven by increasing integration of real-time data analytics, cloud connectivity, and remote monitoring capabilities in pediatric diabetes care. These include smart CGMs, insulin pumps, and mobile-linked applications that enable continuous oversight and precision dosing. Parents and caregivers benefit from automated alerts and trend analysis features, improving compliance and glycemic control. Pediatric clinics and hospitals are adopting connected ecosystems to facilitate proactive disease management and reduce acute complications. Rising demand for integrated digital platforms and favorable reimbursement for connected devices are driving rapid segment expansion globally.

End User Analysis

By end user, the market includes hospitals, homecare, and pediatric clinics. The hospitals segment held the largest revenue share in 2024, due to their access to specialized pediatric endocrinology units and advanced diabetes care infrastructure. Newly diagnosed pediatric patients are initiated on treatment in hospital settings under professional supervision. Multidisciplinary care teams, including diabetologists, dietitians, and educators, contribute to comprehensive disease management during hospital stays. Government-funded programs and tertiary care facilities in developed and emerging economies are supporting hospital-based interventions. High utilization of advanced devices such as CGMs and insulin pumps during inpatient care is boosting the segment’s dominant position in the market.

The homecare segment is anticipated to grow at the fastest rate, due to the rising availability of portable diabetes management devices and caregiver training programs. Children with diabetes rely on home-based monitoring and therapy solutions to maintain glycemic control outside clinical settings. Technological advances in compact CGMs and wireless insulin pumps, along with digital platforms for real-time monitoring, are enabling flexible and independent care. Reimbursement support and digital literacy campaigns are further facilitating transition to home-based models. The shift toward decentralized care is making homecare a preferred approach for long-term disease management in pediatric populations.

Regional Analysis

North America pediatric diabetes management market accounted for major global market share in 2024. This dominance is attributed to the high prevalence of pediatric type 1 diabetes and extensive adoption of insulin pumps and continuous glucose monitoring systems across the US and Canada. The region is driven by advanced clinical infrastructure, well-developed pediatric endocrinology networks and favorable reimbursement policies. Furthermore, rising innovation in child-specific insulin delivery technologies and rising awareness of early-stage diabetes management are driving the market growth in this region.

US Pediatric Diabetes Management Market Insight

The US held largest market share in North America pediatric diabetes management landscape in 2024, owing to the robust investments in chronic disease care and the expansion of nationwide screening initiatives. According to the November 2024 report by the U.S. National Center for Health Statistics (NCHS), between August 2021 and August 2023, 15.8% of U.S. adults were living with diabetes, including 11.3% with a diagnosed condition and an estimated 4.5% undiagnosed. Additionally, around 1.2 million new cases of diabetes are identified annually in the country. In addition, favorable insurance policies covering insulin therapies and glucose monitoring solutions are facilitating greater treatment access. Several healthcare institutions across the country are integrating AI-powered dosing platforms and digital management tools to improve glycemic outcomes in pediatric patients.

Asia Pacific Pediatric Diabetes Management Market

The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, driven by increasing prevalence of type 1 and type 2 diabetes among children. Rapidly growing urbanization and changing lifestyle patterns is escalating the regional disease burden. Also, the rising cases in childhood obesity and earlier emergence of metabolic conditions in countries such as China, India, and Japan is boosting the adoption of pediatric diabetes management systems. Moreover, government initiatives aimed at enhancing early diagnosis through expanded screening efforts and strengthening pediatric endocrinology infrastructure are driving market expansion across the region.

China Pediatric Diabetes Management Market Overview

The market in China is experiencing steady growth, primarily driven by the rising prevalence of type 1 diabetes and government-led enhancements in chronic disease management. Public hospitals are prioritizing pediatric diabetes care by implementing standardized insulin therapy protocols and expanding access to digital glucose monitoring solutions. Additionally, rising healthcare expenditure, continued urbanization and broader health insurance coverage are collectively boosting the demand for pediatric diabetes management. According to a 2024 report by the Shanghai University of Engineering Science, China’s total healthcare expenditure reached approximately USD 1,268.60 billion in 2022, representing 7.05% of the national GDP.

Europe Pediatric Diabetes Management Market

The pediatric diabetes management market in Europe is projected to hold a significant share by 2034, driven by standardized treatment guidelines, universal healthcare access, and high diagnosis rates in countries such as Germany, France, Italy, and the UK. According to the National Library of Medicine, the incidence of type 1 diabetes among children aged 0 to 14 years in Europe increased from 10.85 to 20.96 per 100,000 person-years between 1994 to 2003 and 2013 to 2022. Moreover, the hospital-based care and school-based diabetes management programs are helping improve treatment adherence among children. In addition, the growing availability of advanced insulin delivery devices and supportive regional policies for early screening and digital health monitoring are contributing to steady market growth.

Key Players & Competitive Analysis Report

The pediatric diabetes management market is moderately consolidated, with key players focusing on device miniaturization, integration of digital health features and pediatric-specific usability enhancements. Major manufacturers are advancing CGMs, insulin pumps, and mobile-linked platforms to improve treatment precision and patient adherence. Rising adoption of key strategic initiatives including collaborations with pediatric care providers, expansion into school-based healthcare programs and regulatory approvals for child-friendly devices in emerging markets. In addition, prominent companies are investing in AI-driven insulin dosing systems and remote monitoring technologies to meet growing demand for personalized and home-based diabetes management solutions.

Major companies operating in the pediatric diabetes management industry include Medtronic plc, Dexcom, Inc., Abbott Laboratories, Insulet Corporation, F. Hoffmann-La Roche Ltd., Tandem Diabetes Care, Inc., Ypsomed AG, Ascensia Diabetes Care, Glooko, Inc., AgaMatrix, Inc., EOFlow Co., Ltd., and Beta Bionics, Inc.

Key Players

- Abbott Laboratories

- AgaMatrix, Inc.

- Ascensia Diabetes Care

- Beta Bionics, Inc.

- Dexcom, Inc.

- EOFlow Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Glooko, Inc.

- Insulet Corporation

- Medtronic plc

- Tandem Diabetes Care, Inc.

- Ypsomed AG

Industry Developments

- April 2025: Insulet Corporation launched the Omnipod 5 Automated Insulin Delivery System in Canada for individuals aged two years and older with type 1 diabetes. This marks the first tubeless, wearable system in the country that integrates continuous glucose monitoring with automated insulin delivery.

- March 2025: Tandem Diabetes Care announced the launch of its new Control-IQ technology, an advanced automated insulin delivery system designed to improve glucose control for people with diabetes. This system integrates with the t:slim X2 insulin pump and delivers insulin adjustments based on continuous glucose monitoring data.

Pediatric Diabetes Management Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Blood Glucose Monitors (BGM)

- Continuous Glucose Monitors (CGM)

- Insulin Pumps

- Insulin Pens

- Insulin Syringes

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Connected Devices

- Non-connected Devices

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- General Hospitals

- Children Hospitals

- Homecare

- Pediatric Clinics

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pediatric Diabetes Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.62 Billion |

|

Market Size in 2025 |

USD 6.15 Billion |

|

Revenue Forecast by 2034 |

USD 13.87 Billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.62 billion in 2024 and is projected to grow to USD 13.87 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Medtronic plc, Dexcom, Inc., Abbott Laboratories, Insulet Corporation, F. Hoffmann-La Roche Ltd., Tandem Diabetes Care, Inc., Ypsomed AG, Ascensia Diabetes Care, Glooko, Inc., AgaMatrix, Inc., EOFlow Co., Ltd., and Beta Bionics, Inc.

The continuous glucose monitors (CGM) segment dominated the market in 2024. This is attributed to its widespread use of real-time glucose tracking devices in pediatric care.

The connected devices segment is expected to witness the fastest growth during the forecast period, owing to increasing use of app-integrated CGMs, sensor-enabled insulin pumps, and remote monitoring platforms.