High-Speed Camera Market Size, Share, Trends, & Industry Analysis Report

By Spectrum (Infrared, X-Ray, and Visible RGB), By Component, By Application, By Frame Rate, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5817

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

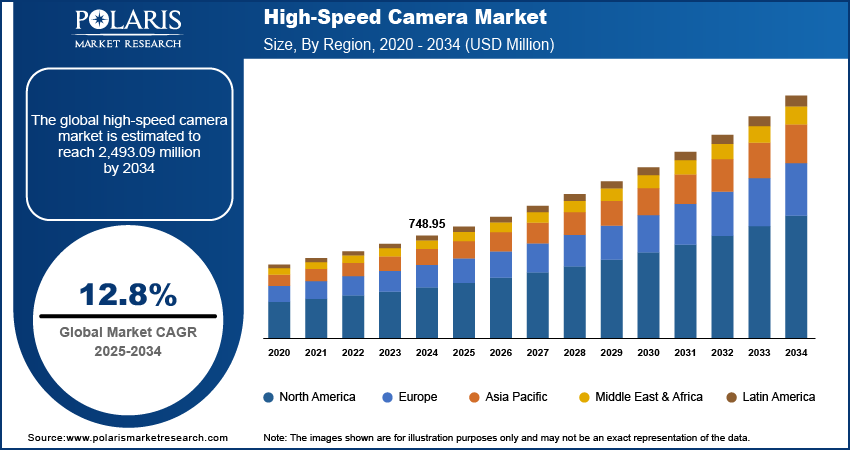

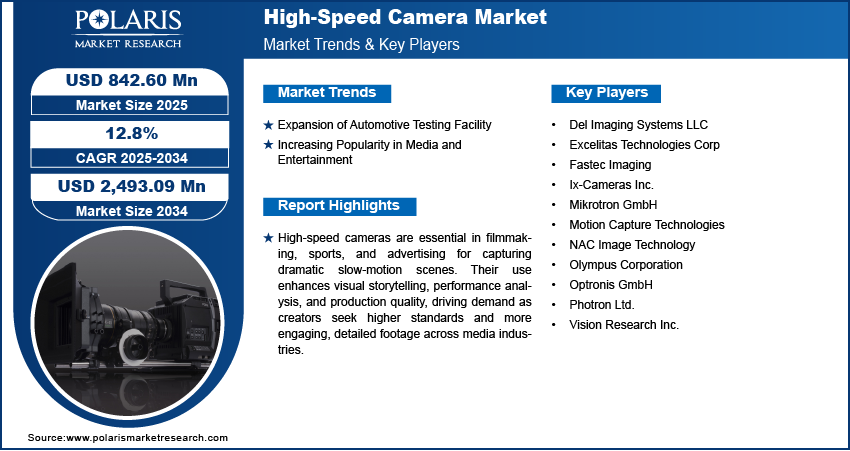

The global high-speed camera market size was valued at USD 748.95 million in 2024, growing at a CAGR of 12.8% during 2025–2034. The growth is driven by the expansion of the automotive testing facility and the increasing popularity in media and entertainment.

A high-speed camera is a specialized imaging device capable of capturing moving objects at extremely high frame rates, often thousands to millions of frames per second. This allows detailed analysis of fast phenomena that are invisible to the human eye in real time.

High-speed cameras are increasingly used in research labs across industries such as aerospace, automotive, and materials science. Researchers employ these cameras to study fast events such as explosions, impacts, or stress tests in great detail. These cameras help capture such events frame-by-frame for deep analysis. The demand for accurate visual data grows as industries focus more on innovation and safety. Additionally, universities, defense organizations, and private labs rely on high-speed imaging to improve designs, ensure reliability, and understand complex physical processes. This expanding need for precision in R&D continues to drive the demand for high-speed cameras.

Technological advancements in camera sensors, storage, and image processing have made high-speed cameras more powerful and compact. Cameras can capture millions of frames per second with higher resolution, better light sensitivity, and faster data transfer. These improvements make them easier to use in different environments, such as labs and outdoor fieldwork. Innovations such as back-side illuminated sensors and global shutters also reduce image distortion and improve clarity. More industries are adopting high-speed imaging solutions as these technologies become more affordable and accessible, thereby driving the growth.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Expansion of Automotive Testing Facility

The automotive industry relies heavily on high-speed cameras for crash testing, component stress analysis, and safety system validation. Engineers use these cameras to capture precise details of how vehicles and their parts perform under sudden forces. Testing has become important due to rising safety standards and the growing demand for electric and autonomous cars. According to the International Energy Agency, electric vehicle sales rose by 25%, with an outstanding number of 17 million vehicles sold worldwide in 2024. High-speed cameras provide visual proof of performance and failure points, helping manufacturers design safer, more reliable cars. The demand for advanced, high-frame-rate imaging systems to support these engineering needs grows as global vehicle testing expands, thereby driving the growth.

Increasing Popularity in Media and Entertainment

High-speed cameras are widely used in filmmaking, sports broadcasting, and advertising to create dramatic slow-motion effects. These cameras capture moments that are hard to capture with normal cameras, such as action movies, product commercials, and nature documentaries. According to the Red Bull Media House, for every commercial shooting of slow-motion sports, high-speed frame rates are advised, which can be captured with the help of high-speed cameras. Additionally, Filmmakers use them to highlight detail and emotion, while sports analysts break down athlete movements frame-by-frame. The demand for high-speed cameras in the creative world is rising as content creators and production studios continue to push for higher visual standards and more engaging footage, thereby driving the growth.

Segmental Insights

By Component Analysis

The segmentation, based on component, includes image sensors, processors, lenses, memory, fans and cooling, and others. In 2024, the image sensors segment dominated with the largest share, as they are the core component that captures light and converts it into a digital image. Advanced sensors, especially CMOS and BSI types, provide high sensitivity, low noise, and fast readout speeds, which are essential for recording ultra-fast events. Manufacturers are focusing on developing better sensors with improved resolution and frame rates as demand increases for high-quality slow-motion and real-time analysis across industries. The increasing use of image sensors in automotive testing, research, and manufacturing inspections drives the segment growth.

By Application Analysis

The segmentation, based on application, includes automotive & transportation, consumer electronics, aerospace & defense, healthcare, media & entertainment, and others. The automotive & transportation segment is expected to experience significant growth due to its rising use in safety testing, crash simulations, and component analysis. High-speed cameras allow engineers to visualize what happens during a crash or high-stress condition, frame by frame. Testing and validation have become more rigorous with the push toward autonomous and electric vehicles. Automakers depend on high-speed imaging to meet global safety standards and optimize vehicle performance. The demand for accurate and fast imaging tools is rising as the industry continues innovating, especially with smart systems and AI-based driving technologies, thereby driving the segment growth.

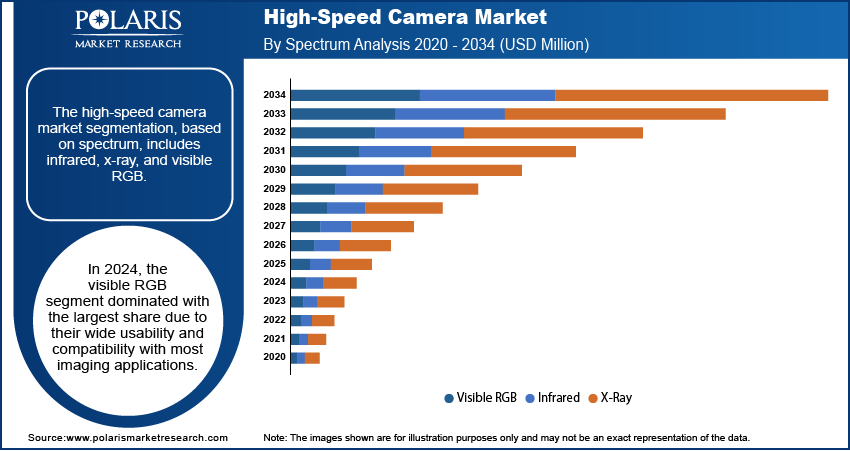

By Spectrum Analysis

The segmentation, based on spectrum, includes image infrared, x-ray, and visible RGB. In 2024, the visible RGB segment dominated with the largest share due to its wide usability and compatibility with most imaging applications. These cameras capture color images similar to what the human eye sees, which makes them ideal for research, industrial inspection, filmmaking, and product testing. Since most real-world objects are analyzed in visible light, RGB cameras provide cost-effective and user-friendly solutions. Growing adoption in sectors such as automotive, manufacturing, and entertainment is further driving the demand, thereby driving the segment growth.

By Frame Rate Analysis

The segmentation, based on frame rate, includes 250–1000 FPS, 1000–10000 FPS, 10000–30000 FPS, 30000–50000 FPS, and above 50000 FPS. The 30000–50000 FPS segment is expected to experience the fastest growth during the forecast period, driven by demand for high-speed visualization in both industrial and scientific applications. This frame rate range offers a strong balance between capturing extremely fast events and maintaining good resolution, making it ideal for analyzing high-speed processes such as material stress testing, fluid dynamics, and ballistic impact. Industries such as aerospace, automotive, and electronics benefit from this range to study failure points and optimize designs. More organizations are investing in this FPS category to meet their high-speed imaging needs effectively with increasing affordability and better sensor technology, thereby driving the segment growth.

Regional Analysis

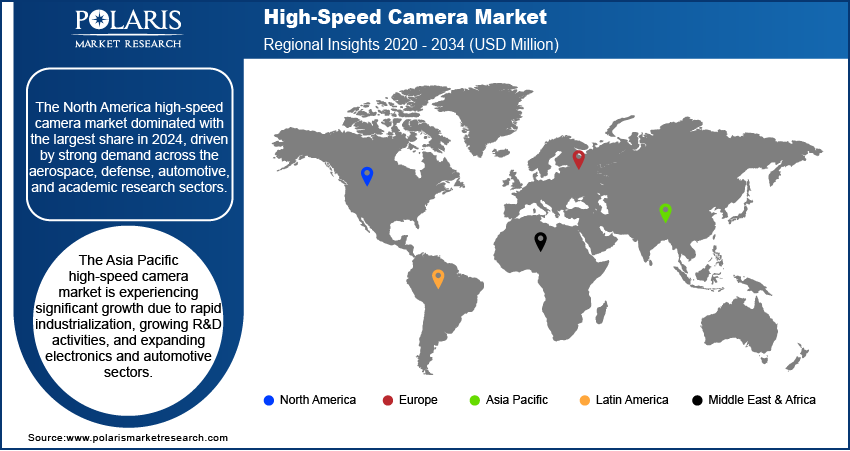

High-Speed Camera Market in North America

The North America high-speed camera market dominated with the largest share in 2024, driven by strong demand across the aerospace, defense, automotive, and academic research sectors. The region's focus on technological innovation and advanced testing in the US and Canada supported the widespread adoption of high-speed imaging. North America further benefits from the presence of major aerospace, automotive manufacturers, and well-established R&D infrastructure. Additionally, investments in motion analysis, crash testing, and high-speed diagnostics drive the industry growth in North America.

High-Speed Camera Market in US

The US high-speed camera market is expected to witness significant growth due to its advanced manufacturing. US companies and institutions widely use high-speed cameras for aerospace testing, defense applications, medical research, and industrial inspection. Government support for defense and scientific research, along with a strong presence of major players such as Vision Research, boosted adoption. Additionally, the growing use of high-speed cameras in sports, entertainment, and automotive crash analysis has expanded their relevance. Moreover, expanding research budgets and focus on automation are driving the adoption of high-speed cameras in the country.

High-Speed Camera Market in Asia Pacific

The Asia Pacific high-speed camera market is projected to witness substantial growth during the forecast period, driven by rapid industrialization, growing R&D activities, and expanding electronics and automotive sectors. Countries such as China, Japan, South Korea, and India are investing in technology, automation, and product testing. The region’s rising demand for precision engineering mechanics, quality control, and scientific visualization has increased the use of high-speed imaging solutions. Additionally, academic institutions and defense sectors are adopting advanced imaging tools to improve research and security. Moreover, manufacturing and innovation are accelerating across the region, which is fueling the Asia Pacific market growth.

High-Speed Camera Market in China

The China high-speed camera market is expected to experience significant growth during the forecast period as its industries and research sectors rapidly adopt advanced imaging technologies. High-speed cameras are now commonly used in Chinese automotive crash tests, electronics manufacturing, and materials science research. The need for high-performance imaging tools is rising with government support for smart manufacturing and increased investments in defense, aerospace, and academic R&D. Additionally, Chinese universities and tech firms are also contributing to homegrown innovations in sensor and optics technology. Moreover, the country is pushing for global competitiveness in high-tech fields, which boosts the industry growth in China.

High-Speed Camera Market in Europe

The Europe high-speed camera market is expected to experience substantial growth driven by strong industrial, automotive, and research ecosystems. Countries such as Germany, France, and the UK are major users of high-speed imaging for applications such as quality control, product development, and scientific research. The region’s focus on sustainability, precision engineering, and automation is driving demand for advanced imaging solutions. Additionally, Europe’s advance aerospace and defense industries require detailed motion analysis for safety and performance testing, thereby driving the Europe high-speed camera industry.

High-Speed Camera Market in Germany

The Germany high-speed camera market hold significant market share in the coming years, driven by its strong automotive, industrial, and engineering sectors. German companies rely on high-speed cameras for crash testing, machine diagnostics, and precision manufacturing. Universities and technical institutes further use these cameras for advanced studies in physics, materials, and biomechanics with a deep focus on research. Additionally, Germany is home to major manufacturers such as Mikrotron GmbH, and produces high-performance imaging systems, thereby driving the growth of the country.

Key Players & Competitive Analysis Report

The high-speed camera market is highly competitive, driven by innovation and specialized applications across research, manufacturing, defense, and media. Vision Research Inc., Photron Ltd., and NAC Image Technology lead with ultra-high frame rate capabilities for scientific and industrial use. Fastec Imaging, Ix-Cameras Inc., and Mikrotron GmbH focus on compact, portable solutions for lab and field environments. Olympus Corporation and Excelitas Technologies Corp provide integrated imaging systems, while Optronis GmbH and Del Imaging Systems LLC cater to niche, high-precision sectors. Motion Capture Technologies specializes in motion analysis applications. Differentiation lies in frame rates, resolution, sensor technology, portability, and software integration.

Key Players

- Del Imaging Systems LLC

- Excelitas Technologies Corp

- Fastec Imaging

- Ix-Cameras Inc.

- Mikrotron GmbH

- Motion Capture Technologies

- NAC Image Technology

- Olympus Corporation

- Optronis GmbH

- Photron Ltd.

- Vision Research Inc.

Industry Developments

In February 2025, Shimadzu launched the HyperVision HPV-X3 high-speed video camera, doubling the speed of its predecessor to 20 million fps and tripling resolution. Featuring FTCMOS3 sensor and frame synchronization, it enabled unprecedented imaging of ultra-fast, microscopic physical and industrial phenomena.

In February 2025, Vision Research launched the Phantom T2110 high-speed camera, capturing up to 483,300 fps. Featuring a 12-bit BSI sensor and advanced synchronization, it delivered exceptional low-light performance and ultra-fast imaging for scientific, industrial, and cinematic applications.

In September 2024, RDI Technologies launched three high-speed cameras, the FASTEC HS5i, HS7i, and upgraded Iris MX integrating PC controllers for efficient data capture, portability, and high-speed performance, enhancing Motion Amplification capabilities for field and industrial vibration analysis applications.

High-Speed Camera Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Image Sensors

- Processors

- Lens

- Memory

- Fans and Cooling

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Automotive & Transportation

- Consumer Electronics

- Aerospace & Defense

- Healthcare

- Media & Entertainment

- Others

By Spectrum Outlook (Revenue, USD Million, 2020–2034)

- Infrared

- X-Ray

- Visible RGB

By Frame Rate Outlook (Revenue, USD Million, 2020–2034)

- 250–1000 FPS

- 1000–10000 FPS

- 10000–30000 FPS

- 30000–50000 FPS

- Above 50000 FPS

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High-Speed Camera Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 748.95 Million |

|

Market Size in 2025 |

USD 842.60 Million |

|

Revenue Forecast by 2034 |

USD 2,493.09 Million |

|

CAGR |

12.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 748.95 million in 2024 and is projected to grow to USD 2,493.09 million by 2034.

The global market is projected to register a CAGR of 12.8% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Del Imaging Systems LLC, Excelitas Technologies Corp, Fastec Imaging, Ix-Cameras Inc., Mikrotron GmbH, Motion Capture Technologies, NAC Image Technology, Olympus Corporation, Optronis GmbH, Photron Ltd., and Vision Research Inc.

The image sensor segment dominated the market share in 2024.

The automotive & transportation segment is expected to witness the significant growth during the forecast period.