Higher Education Technology Market Share, Size, Trends & Industry Analysis Report

By Component (Hardware, Software, Services); By Deployment; By Learning Mode; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM4297

- Base Year: 2024

- Historical Data: 2020-2023

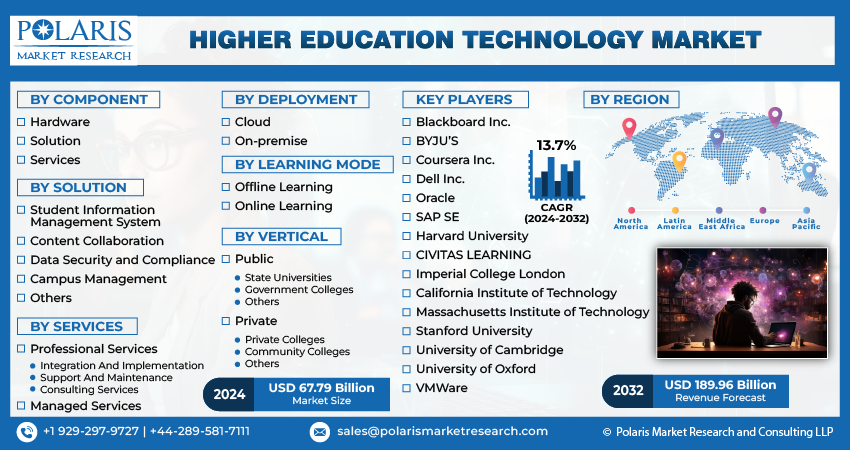

The global Higher Education Technology Market was valued at USD 45.82 billion in 2024 and is forecasted to grow at a CAGR of 19.20% from 2025 to 2034. Digital transformation in universities, e-learning adoption, and hybrid learning models are key growth catalysts.

The market is experiencing growth due to the widespread adoption of competency-based education, enabling students to progress based on their mastery of specific skills instead of traditional credit-hour methods. Additionally, the trend toward personalized and adaptive learning is gaining momentum. Educational institutions are leveraging technology to tailor educational content according to individual student needs, preferences, and learning styles, enhancing the overall learning experience and creating significant opportunities for market expansion. Governments are allocating funds to support higher education institutions in covering operational expenses, infrastructure development, and research. Sufficient funding is crucial for maintaining the quality of education and fostering innovation.

To Understand More About this Research: Request a Free Sample Report

Integrated campus management systems have become increasingly important, offering comprehensive solutions to streamline various administrative processes. These systems often incorporate modules for student information, finance, human resources, and facilities management, creating a unified platform for efficient campus operations. The primary factor fueling the market growth is the increasing embrace of cloud-based campus management solutions. This advancement allows institutions to securely access and handle data from any location, enhancing flexibility and scalability. Cloud solutions also promote collaboration among different departments within an institution. Institutions are realizing the importance of implementing cloud solutions to meet evolving student needs and enhance overall campus experiences.

Online learning platforms are incorporating advanced collaborative tools and social learning features. These tools allow students to collaborate on projects, engage in discussions, and create a virtual community, replicating aspects of the traditional classroom environment. Online learning platforms prioritize accessibility, ensuring that content is tailored to diverse learners, including those with disabilities. This focus on inclusivity aims to make education accessible to a wider range of students. As the market progresses, online learning is anticipated to play a more prominent role in meeting the diverse educational needs of students worldwide, contributing significantly to market expansion.

Scientists are utilizing machine learning models to forecast the characteristics of novel materials by analyzing existing datasets. This approach has the potential to greatly accelerate the identification of materials with specific properties like enhanced conductivity or strength, opening various future avenues for higher education technology market expansion.

- For instance, in April 2023, Imperial College London revealed a collaboration with Cornell University to explore the application of artificial intelligence in advancing scientific breakthroughs and future technologies.

Growth Drivers

Integration of artificial intelligence in education

The market dynamics are shifting due to the increased incorporation of advanced technologies like Artificial Intelligence (AI), virtual reality, and augmented reality, driving the market's expansion. Educational institutions are swiftly embracing online learning platforms, leveraging data analytics for student insights, and exploring innovative methods to enhance the digital learning experience. As an illustration, in May 2023, Ellucian, a leading enterprise software provider in higher education, introduced a new partner network aimed at integrating its capabilities with other educational technology applications on college campuses worldwide. This collaboration within the Ellucian Partner Network, consisting of 150 member organizations, will focus on technology development, sales, and marketing initiatives.

Report Segmentation

The market is primarily segmented based on component, solution, service, deployment, learning mode, vertical, and region.

|

By Component |

By Solution |

By Services |

By Deployment |

By Learning Mode |

By Vertical |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Vertical Analysis

Private segment garnered the largest share of the market in 2024

The private segment dominated the market. Private universities are progressively aligning their educational programs with industry demands. This involves collaborating closely with employers, conducting regular assessments of skill gaps, and updating curricula to ensure graduates possess skills that are pertinent to the evolving job market. Private educational institutions are harnessing technology to offer tailored learning paths. Adaptive learning systems, data analytics, and artificial intelligence are being employed to customize educational experiences for individual students, leading to increased engagement and higher success rates.

The public segment will grow at a significant pace. This growth is driven by the rising utilization of data analytics in public colleges. Data analytics are increasingly becoming instrumental in decision-making processes for public educational institutions. This involves scrutinizing student performance data, enrollment patterns, and various metrics to inform strategic decisions related to resource allocation, student assistance programs, and academic offerings.

By Solution Analysis

Student information management system segment accounted for the largest market share in 2024

The student information system segment accounted for the largest market share. This growth can be attributed to the increasing adoption of decentralized identity systems, which have gained significant traction. These solutions, often built on blockchain or other distributed ledger technology, empower students with greater control over their personal information, ensuring secure and privacy-focused identity management. Additionally, institutions are favoring student information management system solutions that employ API-driven approaches for interoperability.

The campus management system segment will exhibit a robust growth rate. This is due to the adoption of the smart campuses concept, harnessing the power of Internet of Things (IoT) technology. Smart campuses utilize sensors and interconnected devices to enhance security measures, optimize resource utilization, and offer data-driven insights for informed decision-making. Furthermore, the development and utilization of mobile applications for campus administration have surged. These applications grant students, instructors, and staff convenient access to information, services, and communication tools via their smartphones, fostering a more connected and efficient campus environment.

By Learning Mode Analysis

Offline segment accounted for the largest market share in 2024

Offline segment accounted for the largest market share. Offline learning plays a pivotal role in fostering cultural and social engagement among students. Educational institutions are increasingly recognizing the value of the campus environment in cultivating a sense of community, encouraging cultural diversity, and promoting social participation. Offline learning methods facilitate the establishment of practical skill development centers, allowing institutions to create dedicated facilities equipped with industry-grade tools and equipment.

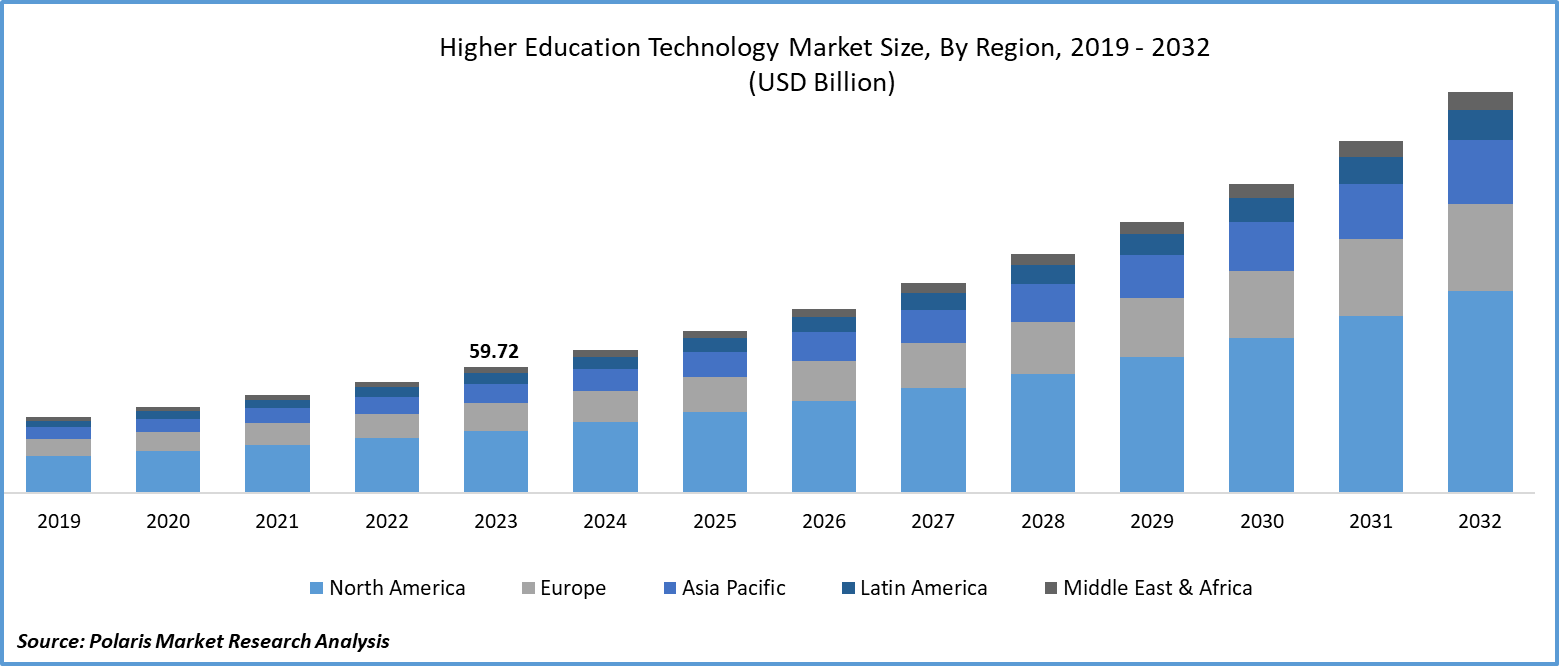

Regional Insights

North America accounted for the largest share of global market in 2024

North America garnered the largest share. The region's prominent position in the global higher education sector can be credited to the widespread adoption of adaptive learning systems within educational institutions. These advanced technologies tailor the learning experience to individual student requirements, enhancing engagement and outcomes through the utilization of data analytics and artificial intelligence. Furthermore, educational institutions in the region are actively investing in innovative online learning delivery methods.

Asia Pacific will grow at a substantial pace. This growth is driven by the rise in transnational education programs in the region. Educational institutions are collaborating with international partners to offer joint degree programs, establish branch campuses, and facilitate various forms of cross-border education. For instance, in May 2023, Ritsumeikan University (RU) entered a partnership with the Australian National University (ANU) to launch a dual degree program, combining Bachelor of Global Liberal Arts and Bachelor of Asia Pacific Affairs, thereby providing a fully internationalized learning experience.

Key Market Players & Competitive Insights

Companies are actively pursuing mergers, acquisitions, and partnerships to enhance their products and gain a competitive edge in the market. They are focusing on developing new products and improving existing ones to attract new customers and expand their market presence.

Some of the major players operating in the global market include:

- Blackboard Inc.

- BYJU’S

- California Institute of Technology

- CIVITAS LEARNING

- Coursera Inc.

- Dell Inc.

- Harvard University

- Imperial College London

- Massachusetts Institute of Technology

- Oracle

- SAP SE

- Stanford University

- University of Cambridge

- University of Oxford

- VMWare

Recent Developments

- In March 2025, zSpace Technologies acquired both Blockscad , a 3D platform for design & coding, and Second Avenue Learning, interactive digital content developer . These strategic moves enhanced zSpace’s portfolio in AR/VR-enabled STEM education offerings—strengthening its position in immersive K–12 learning tech

- In July 2023, The United Negro College Fund (UNCF), a minority education organization, has joined forces with Axim Collaborative and Harvard University to enhance the development of HBCUv (HBCU Virtual). This initiative showcases UNCF's commitment, along with nine collaborating Historically Black Colleges and Universities (HBCUs), to transform higher education using innovative educational technology.

Higher Education Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 54.63 billion |

|

Revenue forecast in 2034 |

USD 262.02 billion |

|

CAGR |

19.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Solution, By Services, By Deployment Mode, By Learning Mode, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The higher education technology market report covering key segments are component, solution, service, deployment, learning mode, vertical, and region.

Higher Education Technology Market Size Worth $262.02 Billion By 2034

The global higher education technology market is expected to grow at a CAGR of 19.20% during the forecast period.

North America is leading the global market

key driving factors in higher education technology market are integration of artificial intelligence in education.