Educational Robot Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Service Robot and Industrial Robot), By Application, By Component, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM2867

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

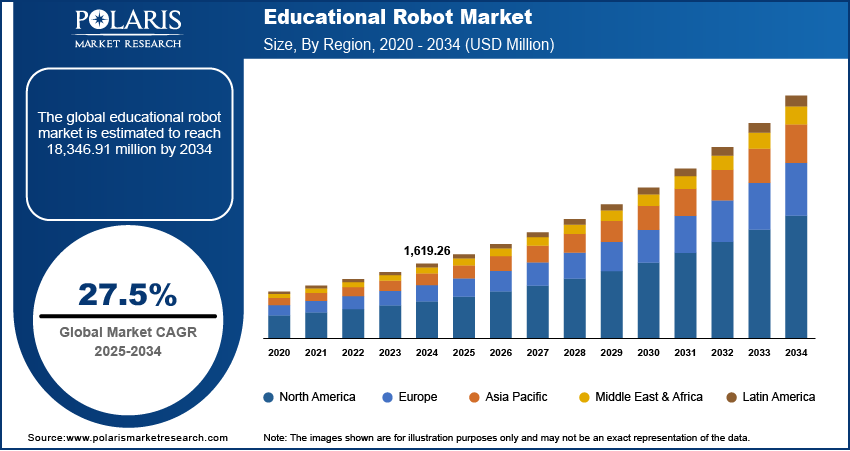

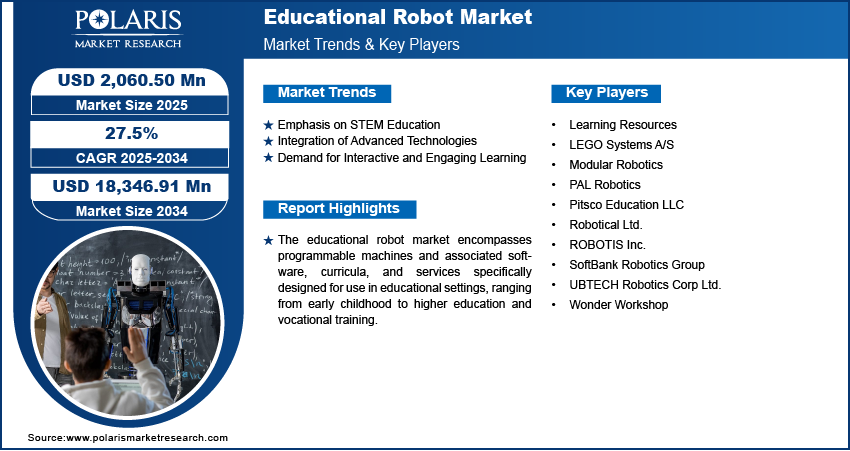

The educational robot market size was valued at USD 1,619.26 million in 2024, growing at a CAGR of 27.5% during 2025–2034. The growing global emphasis on STEM education and rising demand for interactive and engaging learning methodologies primarily drive the market growth.

Key Insights

- The service robot segment leads the market, primarily driven by the versatility and broad applicability of service robots in educational settings.

- The special education segment is anticipated to register the highest growth rate. The rising awareness about the potential of robots to cater to the unique learning needs of students with disabilities drives the growth of the segment.

- North America dominates the market. The presence of a well-established educational infrastructure and significant investments in educational technology contributes to the region’s leading market share.

- Asia Pacific is anticipated to register the highest growth rate during the projection period, owing to growing government focus on improving educational quality and promoting STEM education.

Industry Dynamics

- The rising global emphasis on STEM education has prompted governments to implement policies and initiatives to strengthen their STEM learning from primary to higher education levels, driving market demand.

- The growing demand for interactive and engaging learning methodologies is another factor fueling market expansion.

- Increasing integration of advanced technologies into educational robots is projected to provide several opportunities in the coming years.

- High costs and limited access in underfunded schools may present market challenges.

Market Statistics

2024 Market Size: USD 1,619.26 million

2034 Projected Market Size: USD 18,346.91 million

CAGR (2025-2034): 27.5%

North America: Largest Market in 2024

AI Impact on the Educational Robot Market

- AI allows educational robots to assess student performance in real time and adjust challenges to maintain engagement.

- Intelligent speech recognition and natural language processing enable more conversational interactions with learners.

- AI-driven analytics track progress across subjects, enabling educators to identify strengths and areas needing support.

- Adaptive learning algorithms allow robots to deliver culturally relevant examples, multilingual content, and customized pacing for diverse learning environments.

To Understand More About this Research: Request a Free Sample Report

The educational robot market encompasses programmable machines designed and utilized within educational settings to facilitate and enhance learning across various age groups and subjects. These robots serve as interactive tools that can make complex concepts more tangible and engaging for students. The increasing global emphasis on Science, Technology, Engineering, and Mathematics (STEM) education drives the demand for educational robots. Recognizing the critical role of these disciplines in future innovation and economic growth, educational institutions are actively seeking tools that can foster deeper understanding and practical skills in these areas. Furthermore, the integration of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) is expanding the capabilities of educational robots, enabling personalized learning experiences and adapting to individual student needs, thereby increasing the demand for these robots.

The educational robot market growth is driven by the rising demand for interactive and engaging learning methodologies. Traditional teaching methods are evolving, with educators increasingly adopting hands-on and experiential learning approaches to improve student outcomes. Educational robots provide a unique platform for such learning, allowing students to actively participate in the learning process through programming, problem-solving, and creative design. Moreover, government initiatives and increasing investments in EdTech across various regions are creating a favorable environment for educational robot market development. These investments often aim to modernize educational infrastructure and integrate innovative tools such as educational robots to prepare students for a technologically driven future, signaling strong potential for the industry.

Market Dynamics

Emphasis on STEM Education

A significant factor fueling the educational robot market demand is the escalating global emphasis on STEM education. Governments worldwide are recognizing the importance of these fields for future of robotics and economic competitiveness and are implementing policies and initiatives to strengthen STEM learning from primary to higher education levels. Educational robots serve as invaluable tools in achieving these objectives by providing an engaging and interactive medium for students to explore concepts in science, technology, engineering, and mathematics. For instance, the National Science Foundation (NSF) in the US has funded numerous projects focused on integrating robotics into STEM curricula, as highlighted in their report on "Advancing STEM Education through Robotics" published in 2023 on the NSF website. Studies have indicated that students engaged in robotics programs show a 15–20% improvement in STEM-related test scores. Organizations such as FIRST (For Inspiration and Recognition of Science and Technology) run robotics competitions that involve hundreds of thousands of students worldwide, showcasing the growing integration of robotics in education.

Integration of Advanced Technologies

The increasing integration of advanced technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT), into educational robots is expected to create new educational robot market opportunities during the forecast period. These technologies are enhancing the functionality and pedagogical value of robots, making them more adaptable and effective learning companions. AI capabilities enable robots to provide personalized feedback, adapt to individual learning paces, and offer intelligent tutoring, thereby catering to diverse learning needs within a classroom. The IoT integration allows robots to connect with other devices and platforms, creating interconnected learning environments and expanding the scope of educational activities. Modern educational robots are equipped with a wide array of sophisticated sensors (e.g., light, sound, touch, and distance) that enable them to interact with their environment in more complex ways, providing richer learning opportunities in areas such as physics, environmental science, and robotics itself.

Demand for Interactive and Engaging Learning

The rising demand for interactive and engaging learning methodologies is a crucial factor propelling the educational robot market expansion. Traditional passive learning approaches are increasingly being recognized as less effective in fostering deep understanding and long-term retention, particularly in a generation accustomed to interactive digital education experiences. Educational robots offer a hands-on, problem-based learning environment that actively involves students in the learning process. By programming robots, conducting experiments with them, and using them to solve challenges, students develop critical thinking, creativity, and collaboration skills in an engaging manner. A study published on a United Kingdom government website for educational research in 2021, titled "Enhancing Student Engagement through Robotics-Based Projects," highlighted the positive impact of robotics on student motivation and participation in science and higher educational technology subjects.

Segment Insights

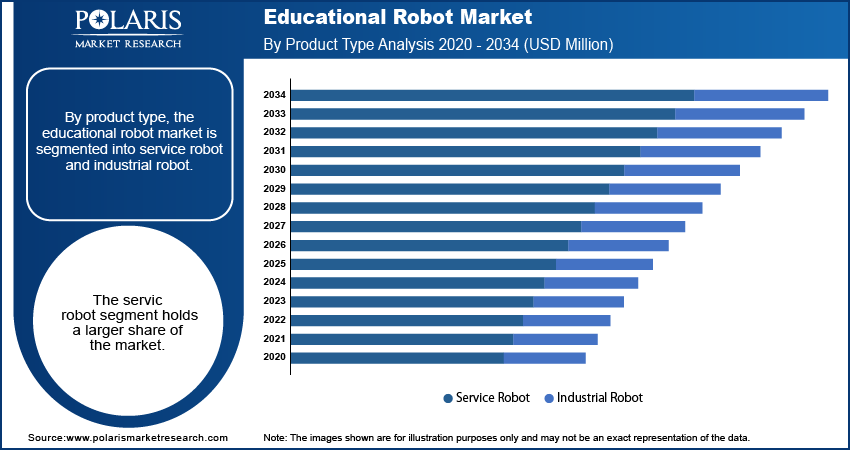

Market Assessment – By Product Type

The market, by product type, is segmented into service robot and industrial robot. The service robot segment dominates the educational robot market share. This dominance can be attributed to the broad applicability and versatility of service robots in educational settings. These robots are designed to directly interact with students and educators, facilitating a wide range of learning activities. Their functionalities often include interactive tutoring, assistance in demonstrating complex concepts, and providing personalized learning experiences. The increasing adoption of these robots across various educational levels, from early childhood education to higher education, underscores their significant presence and established role in supporting pedagogical objectives, thereby contributing to their dominance.

The industrial robot segment is anticipated to exhibit a higher growth rate in during the forecast period. This growth is driven by the increasing emphasis on vocational training and the need to prepare students for careers in advanced manufacturing and automation. Industrial robots used in education provide students with hands-on experience in programming, operating, and maintaining the types of robots they are likely to encounter in modern industrial environments. The rising demand for skilled professionals in these sectors, coupled with government initiatives promoting vocational education and industry-academia collaborations, is fueling the adoption of industrial robots in educational institutions. This focus on practical skills development and industry relevance positions the industrial robot segment for substantial expansion.

Market Evaluation – By Application

The market, by application, is segmented into primary education, secondary education, higher education, special education, and others. The primary education segment accounts for the largest share, driven by the increasing recognition of the benefits of introducing robotics and computational thinking at an early age. Educational robots designed for primary education often focus on making learning interactive and fun, fostering foundational skills in problem-solving, logical reasoning, and basic programming concepts. The widespread adoption of these tools in elementary schools globally, aimed at preparing students for a technologically advanced future, contributes substantially to the dominant position of the primary education segment.

The special education segment is poised to experience the highest growth rate. This anticipated growth is fueled by the increasing awareness of the potential of robots to cater to the unique learning needs of students with disabilities. Educational robots can be customized and programmed to provide personalized support, facilitate communication, and enhance motor skills development for students in special education settings. The growing emphasis on inclusive education and the development of tailored learning solutions are driving the demand for these specialized robotic tools. As technological advancements continue to offer more sophisticated and adaptable robots for special needs education, this segment is expected to witness significant expansion in the coming years.

Market Evaluation – By Component

The market, by component, is segmented into hardware and software. The hardware segment constitutes a larger revenue share, due to the fundamental requirement of physical robotic platform and units for educational purposes. The hardware component encompasses the tangible elements of educational robots, including the robot body, sensors, actuators, controllers, and other electronic and mechanical parts. The initial investments in acquiring these physical robots across educational institutions globally contribute significantly to the substantial revenue share held by the hardware segment. The ongoing need for diverse types of robots tailored for various educational applications further reinforces the importance and market size of the hardware component.

The software segment is anticipated to demonstrate the highest growth rate during the forecast period. This rapid growth is driven by the increasing sophistication of educational robots and the growing demand for advanced functionalities and personalized learning experiences. The software component includes programming platforms, educational content, learning management system integration, AI algorithms for adaptive learning, and user interfaces. As educational robots become more technologically advanced and focused on delivering tailored educational content and data-driven insights, the demand for robust and innovative software solutions is expected to surge, leading to the highest growth rate in this segment.

Regional Analysis

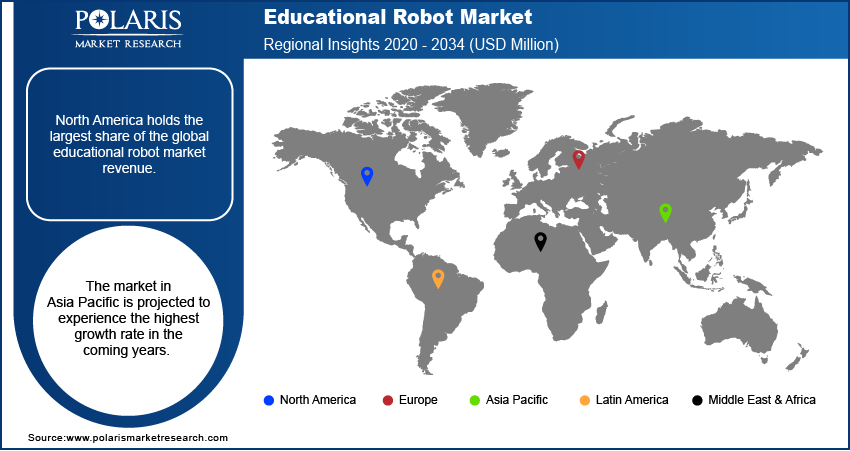

The market exhibits diverse regional dynamics influenced by varying levels of technological adoption, government initiatives in education, and economic development. North America and Europe have historically been early adopters of educational technologies, demonstrating a mature industry with significant integration of robots in educational curricula. Asia Pacific is emerging as a high-growth area, driven by increasing investments in STEM education and a burgeoning demand for innovative learning tools. Latin America and the Middle East & Africa are also witnessing growing interest and adoption of educational robots, albeit from a relatively smaller base, indicating substantial market potential in the long term as educational infrastructure and technology integration advance in these regions.

North America holds the largest share of the educational robot market revenue. This significant share can be attributed to the region's well-established educational infrastructure, high levels of technological literacy, and substantial investments in educational technology. Furthermore, the presence of leading educational robot manufacturers and a strong emphasis on STEM education initiatives across the US and Canada have fostered widespread adoption of these technologies in schools and universities. The integration of robotics into various subjects and the availability of sophisticated educational robots contribute to North America's leading position in terms of market size.

The Asia Pacific market is projected to experience the highest growth rate in the coming years. This rapid expansion is fueled by several factors, including increasing government focus on improving educational quality and promoting STEM fields, a large and growing student population, and rising disposable incomes enabling greater investments in educational resources. Countries such as China, Japan, South Korea, and India are actively integrating robotics into their education systems to enhance student engagement, develop future-ready skills, and drive innovation. The region's dynamic economic growth and increasing technological adoption are creating a significant product demand and potential for educational robots, positioning Asia Pacific as the fastest-growing industry for these technologies globally.

Key Players and Competitive Insights

A few major players actively involved in the market, who have not been acquired, include LEGO Systems A/S (LEGO Group), ROBOTIS Inc., SoftBank Robotics Group (SoftBank Group Corp.), Wonder Workshop, UBTECH Robotics Corp Ltd., Robotical Ltd., Modular Robotics, PAL Robotics, Pitsco Education LLC, and Learning Resources. These companies offer a diverse range of educational robots and related solutions tailored for various age groups and learning objectives, demonstrating their continued presence and relevance in this evolving Industry.

The competitive analysis reveals an industry landscape characterized by both established players and emerging innovators. Competition is centered around product innovation, the development of user-friendly programming interfaces, and the integration of advanced technologies such as AI and IoT to enhance learning experiences. Partnerships with educational institutions and curriculum developers are becoming increasingly important for product penetration and the creation of effective educational content. Furthermore, the ability to offer robots at different price points to cater to varying budget constraints across educational settings is a key factor in gaining market share. The market also sees competition based on the specific educational applications targeted, such as primary, secondary, higher, and special education.

LEGO Systems A/S, headquartered in Billund, Denmark (part of the LEGO Group) offers popular LEGO Education SPIKE Prime and LEGO Mindstorms Robot Inventor, which provide versatile platforms for students to learn about coding, engineering, and design through hands-on building and programming activities. These products are widely used in classrooms and extracurricular programs globally, catering primarily to primary and secondary education levels, making them highly relevant to fostering foundational STEM skills.

ROBOTIS Inc., located in Seoul, South Korea, provides a comprehensive range of educational robots, including the ROBOTIS MINI and the BIOLOID Premium Kit, which are utilized across various educational levels from introductory robotics to more advanced engineering projects. Their robots are known for their modular design and programmability, allowing for extensive customization and experimentation. ROBOTIS also offers software and curriculum resources, making their products a relevant solution for educators seeking tools to teach robotics, coding, and mechatronics.

List of Key Companies

- Learning Resources

- LEGO Systems A/S

- Modular Robotics

- PAL Robotics

- Pitsco Education LLC

- Robotical Ltd.

- ROBOTIS Inc.

- SoftBank Robotics Group

- UBTECH Robotics Corp Ltd.

- Wonder Workshop

Educational Robot Industry Developments

- March 2025: Sphero launched an enhanced Bolt+ coding robot and Blueprint Engineering kits, now utilized by 40,000 educators across 20,000 schools.

- August 2024: Kawasaki Robotics (USA) Inc. unveiled Astorino, an innovative educational robotics platform, at the 2024 IMTS Smartforce Student Summit in Chicago. Developed for industrial and technical education providers, Astorino mirrors the functionality of a modern industrial robot, making it easier for educators to teach real-world robotics skills. The platform features a 6-axis robot with a 1kg payload, built-in safety functions, an integrated control system, and support for 3D-printed replacement parts for hands-on student learning.

- September 2023: ABB Robotics introduced the IRB 1090, a new educational robot certified by STEM.org, designed to equip students with skills aligned to future workforce demands. Powered by ABB’s OmniCore E10 controller, the robot delivers advanced motion control, robotics capabilities, and energy-efficient power grid feedback. Additionally, it includes 100 free RobotStudio premium licenses, allowing students to practice programming in a virtual environment before operating physical robots.

Educational Robot Market Segmentation

By Product Type Outlook (Revenue-USD Million, 2020–2034)

- Service Robot

- Industrial Robot

By Application Outlook (Revenue-USD Million, 2020–2034)

- Primary Education

- Secondary Education

- Higher Education

- Special Education

- Others

By Component Outlook (Revenue-USD Million, 2020–2034)

- Hardware

- Software

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Educational Robot Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,619.26 million |

|

Market Size Value in 2025 |

USD 2,060.50 million |

|

Revenue Forecast by 2034 |

USD 18,346.91 million |

|

CAGR |

27.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The educational robot market has been segmented on the basis of product type, application, and component. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Entry Strategies: A successful growth and marketing strategy for the market necessitates a multi-faceted approach. Emphasizing the pedagogical benefits and demonstrable improvements in student engagement and learning outcomes is crucial for market penetration. Targeted marketing campaigns should highlight the alignment of robot functionalities with educational curricula and standards, addressing the specific needs of primary, secondary, higher, and special education segments. Strategic collaborations with educational institutions, curriculum developers, and technology integrators can facilitate wider adoption and build trust. Furthermore, offering comprehensive training and support for educators, alongside the development of user-friendly interfaces and accessible pricing models, will be key to expand market share.

FAQ's

The market size was valued at USD 1,619.26 million in 2024 and is projected to grow to USD 18,346.91 million by 2034.

The market is projected to register a CAGR of 27.5% during the forecast period.

North America held the largest share in 2024.

A few key players include LEGO Systems A/S (LEGO Group), ROBOTIS Inc., SoftBank Robotics Group (SoftBank Group Corp.), Wonder Workshop, UBTECH Robotics Corp Ltd., Robotical Ltd., Modular Robotics, PAL Robotics, Pitsco Education LLC, and Learning Resources.

The service robot segment accounted for a larger share of the market in 2024.

Following are a few of the market trends: ? Increasing Integration of AI and Machine Learning: AI is making educational robots more interactive, adaptive, and capable of providing personalized learning experiences tailored to individual student needs and learning paces. ? Growing Emphasis on STEM Education: The rising global focus on Science, Technology, Engineering, and Mathematics (STEM) is driving the demand for educational robots as engaging tools to teach these subjects and foster crucial skills such as coding and problem-solving. ? Rise of Collaborative Robots: There is a growing trend toward robots designed for group-based projects, promoting teamwork, communication, and collaborative problem-solving among students.

An educational robot is a programmable machine specifically designed and utilized within learning environments to facilitate and enhance the educational process. These robots serve as interactive tools that can make abstract concepts more concrete and engaging for students across various age groups and subjects, particularly in STEM fields. They often involve hands-on interaction, allowing students to learn through building, programming, and problem-solving activities.