Himalayan Salt Market Share, Size, Trends, Industry Analysis Report

By Type (Iodized and Non-Iodized); By Application; By Distribution Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 116

- Format: PDF

- Report ID: PM3456

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

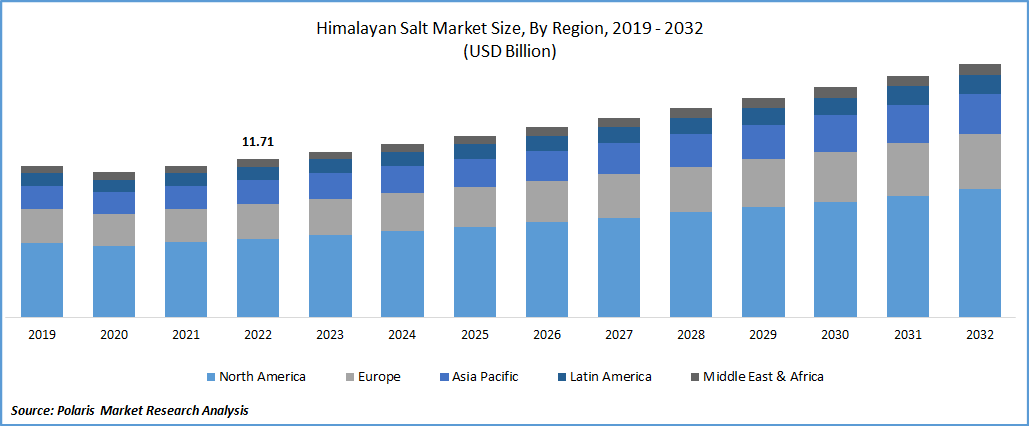

The global himalayan salt market was valued at USD 11.71 billion in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period. The market's growth is attributed to the increasing awareness among consumers about the health benefits of Himalayan salt compared to regular table salt. Himalayan salt is believed to contain trace minerals beneficial for health, such as magnesium and potassium. As a result, there is growing demand for Himalayan salt as a healthier alternative to traditional salt. Himalayan salt, also known as pink salt, is a type of rock salt mined from the foothills of the Himalayan Mountains in Pakistan. It is known for its distinctive pink color, which comes from minerals like iron, magnesium, and potassium. Himalayan salt is widely used in cooking and spa treatments and is often marketed as a healthier alternative to regular table salt.

To Understand More About this Research: Request a Free Sample Report

One of the main benefits of Himalayan salt is that it contains trace amounts of minerals important for maintaining good health. These minerals include magnesium, which is important for muscle and nerve function, and potassium, which helps to regulate blood pressure. Himalayan salt is also said to contain up to 84 trace minerals, making it a rich source of essential nutrients. Himalayan salt is mostly used as a natural remedy for several health issues. For example, it is also known to alleviate respiratory problems by clearing the airways and reducing inflammation. At the same time, people with high blood pressure or other health issues related to sodium intake should speak with their doctor before using Himalayan salt as a dietary supplement.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growing popularity of natural and organic products is driving the market. Consumers increasingly seek products free from artificial additives and preservatives, and Himalayan salt fits this trend. For instance, companies such as Evolution Salt Co. and The Spice Lab offer Himalayan salt products that are organic, non-GMO, and gluten-free, appealing to consumers looking for natural and healthy options.

The use of Himalayan salt in spa treatments is also driving growth in the himalayan salt market. Himalayan salt is believed to have detoxifying and healing properties and is used in various spa treatments, including salt scrubs, bath salts, and salt lamps. For example, Saltability, a company that provides Himalayan salt products for spas, has reported increased demand for their products due to the growing popularity of salt therapy. The increasing use of Himalayan salt in the food industry contributes to the market's growth. Himalayan salt is used as a seasoning and flavor enhancer in various food products, such as snacks, sauces, and condiments. For instance, Himalayan Chef, a company specializing in Himalayan salt products, offers a range of salt blends and seasonings used in cooking and baking.

Report Segmentation

The Himalayan Salt market is segmented based on type, application, distribution channel, and region.

|

By Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The iodized segment is expected to witness fastest growth in the forecast period

Iodized and un-iodized Himalayan salt are two types that are becoming increasingly popular in the health and wellness industry. The growing demand for natural and holistic health products is a major driver of the iodized segment. Consumers are increasingly turning to natural remedies and products to improve their health and well-being, and iodized Himalayan salt is considered a safe and effective option. Like iodized Himalayan salt, the growing demand for natural and holistic health products is a key driver of the un-iodized Himalayan salt market. Consumers are increasingly looking for natural and unprocessed foods and ingredients, and un-iodized Himalayan salt fits this trend.

The food & beverage segment is augmenting the market during forecast period

Himalayan salt is a versatile ingredient with many applications across several industries, including food and beverage, healthcare, personal care, and home decor. Himalayan salt is widely used in the food and beverage industry as a natural seasoning and flavor enhancer. It is used in various products, including snack foods, seasoning blends, and gourmet salts. The increasing demand for natural and organic food products is a key driver of the Himalayan salt market in the food and beverage industry. Consumers are increasingly looking for natural and unprocessed foods, and Himalayan salt is a healthier alternative to traditional table salt.

Himalayan salt is also used in the healthcare industry for various purposes, including respiratory therapy, detoxification, and pain relief. Himalayan salt is also used in the personal care industry for different purposes, including exfoliation, relaxation, and skin conditioning. The growing demand for natural and organic personal care products is a key driver of the Himalayan salt market in the personal care industry. Consumers increasingly seek natural and non-toxic products for their skin and hair care needs.

Online channel is expected to register considerable CAGR in projected period

There has been a significant shift towards online sales due to the increasing popularity of e-commerce platforms and their convenience. However, offline channels such as supermarkets, specialty stores, and health food stores still play a crucial role in distributing Himalayan salt products. The increasing use of social media marketing services in India and social media marketing agencies in the USA also contributes to the growth of the online sales channel. Many Himalayan salt brands leverage social media platforms such as Instagram and Facebook to reach a wider audience and promote their products. This has led to an increase in online sales and helped brands to establish a strong online presence.

However, offline channels such as supermarkets and health food stores still account for large quantity himalayan salt sales. Consumers who prefer to buy products in-store can touch and feel the product before making a purchase, which can be an important factor in their decision-making process.

North America garnered the largest revenue share in 2022

North America is the largest market for Himalayan salt, with the United States being a major contributor to the market's growth. The growth in the region is attributed to increased government investment in food and drinks. Moreover, the rise in chronic obstructive pulmonary diseases (COPD) also aids in boosting the market in the region. The Asia Pacific region is expected to experience the highest growth in the coming years due to the increasing popularity of Himalayan salt in countries such as India and China. The trend of using Himalayan salt in aroma therapy to treat asthma, respiratory problems, lung disease, and others has increased.

Europe is also a significant market, with countries such as Germany and the United Kingdom being major consumers of Himalayan salt owing to its use in traditional recipes across the globe and increasing use of salt in hotels, luxury restaurants, and hotels. The market witnessed significant growth in the middle east owing to consumers' growing awareness regarding multiple health & skin benefits and the rising incidence of hypertension & mineral deficiency-related diseases.

Competitive Insight

Some of the major players operating in the global market include Salt work Technologies; Spice Lab; Keya Foods; Morton Salt; San Francisco Salt; & Nature Healthplus.

Recent Developments

- In June 2021, The Spice Lab introduced a new line of gourmet salt blends made with Himalayan salt. The new combinations include unique flavors such as truffle salt, garlic salt, and jalapeno salt, catering to consumers looking for more diverse seasoning options.

- In 2020, Evolution Salt partnered with Spa Equip, offering a range of Himalayan salt spa products. This collaboration allowed Evolution Salt to expand its reach in the spa industry and offer its products to a wider audience.

Himalayan Salt Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 12.25 billion |

|

Revenue forecast in 2032 |

USD 18.75 billion |

|

CAGR |

4.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Latin America, Europe, Middle East & Africa, Asia Pacific |

|

Key companies |

Salt work Technologies Inc.; The Spice Lab; Keya Foods; Morton Salt; San Francisco Salt Co; nature healthplus. |

FAQ's

The himalayan salt market report covering key segments are type, application, distribution channel, and region.

Himalayan Salt Market Size Worth $18.75 Billion By 2032.

The global himalayan salt market is expected to grow at a CAGR of 4.8% during the forecast period.

North America is leading the global market.

key driving factors in himalayan salt market are growing popularity of natural and organic products.