Home Bedding Market Size, Share, Trends, Industry Analysis Report

: By Product Type, Material Type, Application (Residential and Commercial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM3078

- Base Year: 2024

- Historical Data: 2020-2023

Home Bedding Market Overview

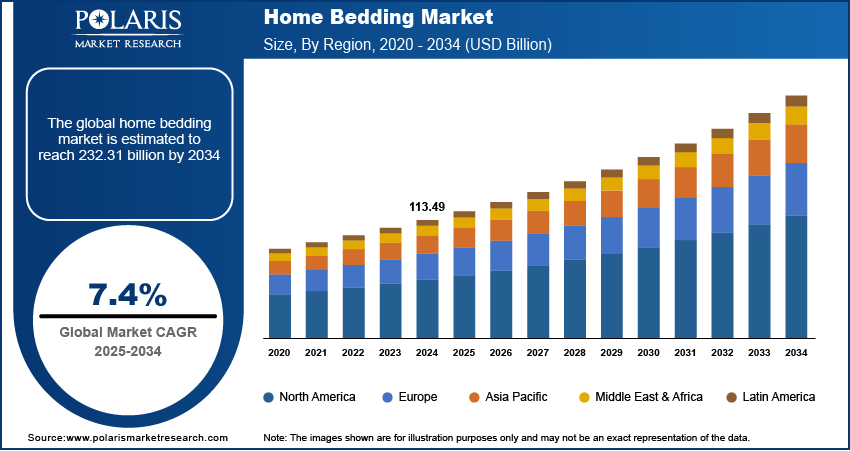

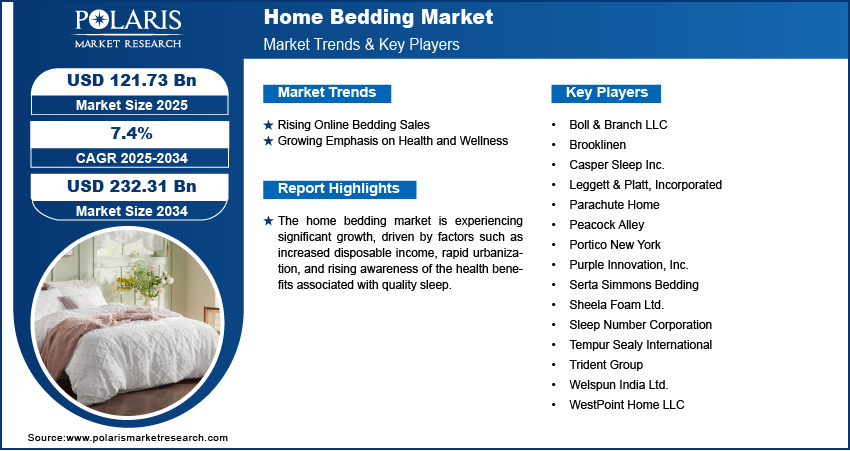

The global home bedding market size was valued at USD 113.49 billion in 2024. The market is projected to grow from USD 121.73 billion in 2025 to USD 232.31 billion by 2034, exhibiting a CAGR of 7.4% from 2025 to 2034.

The global home bedding market encompasses products such as mattresses, bed linens, pillows, and duvets, all designed to enhance sleep quality and overall comfort. The dynamic market is characterized by evolving consumer preferences for premium, sustainable, and multifunctional bedding solutions. The market has experienced significant growth due to factors such as increased disposable income, rapid urbanization, and rising awareness of the health benefits associated with quality sleep.

The home bedding market is growing due to rising demand for eco-friendly and organic bedding products. Consumers are increasingly drawn to bedding materials free from harmful chemicals, such as organic cotton and bamboo fibers, driven by heightened environmental awareness and health concerns. This shift is supported by manufacturers who are innovating with sustainable practices and materials. The growing trend of home remodeling and décor updates, particularly in developed economies, is expected to further contribute to the rising demand for home bedding products.

To Understand More About this Research: Request a Free Sample Report

The home bedding market expansion is driven by rising disposable income in global markets. Improved economic conditions enable consumers to invest in higher-quality bedding products that enhance comfort and reflect personal lifestyle preferences. Greater financial capacity empowers individuals to prioritize premium mattresses, luxurious sheets, and sophisticated bedding accessories. Urbanization and evolving consumer expectations further accelerate this shift, motivating people to seek products that offer functional sleep solutions while also contributing to aesthetic home décor and personal well-being.

Home Bedding Market Dynamics

Rising Online Bedding Sales

With the expansion of online retail platforms, consumers now have access to a broad range of bedding products. These platforms offer the advantage of easy comparisons, reviews, and competitive pricing, which encourages consumer engagement. In addition, the convenience of doorstep delivery and easy returns have accelerated online purchases, especially among younger demographics. Key players in the market are focusing on direct-to-consumer models to ensure a seamless shopping experience. The integration of augmented reality and virtual visualization tools is transforming online shopping experiences, further driving the home bedding market development.

Growing Emphasis on Health and Wellness

The increasing awareness of the importance of sleep quality for mental and physical health has fueled the demand for orthopedic and memory foam mattresses, anti-allergenic pillows, and temperature-regulating bedroom linens. Technological advancements have led to the development of smart bedding solutions, such as mattresses with sleep-tracking sensors and bedding with temperature-control features. The demand for these innovative products has significantly contributed to the home bedding market value, encouraging manufacturers to focus on R&D and cater to the health-conscious consumer base.

Home Bedding Market Segment Insights

Home Bedding Market Assessment by Product Type Outlook

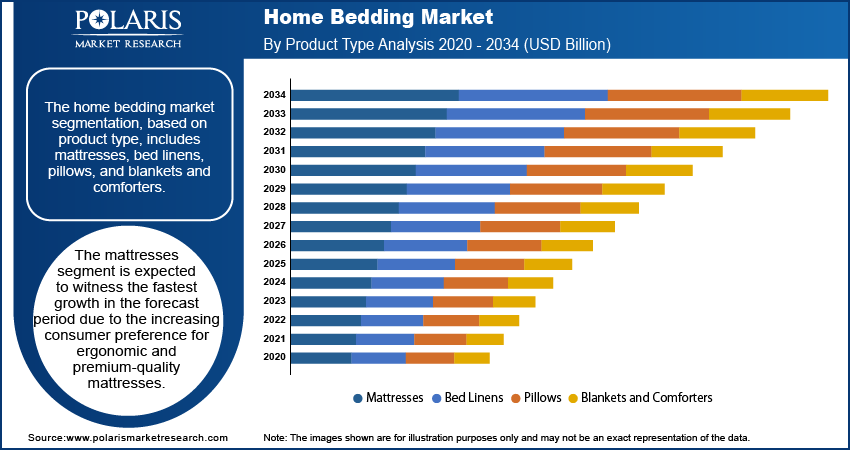

The home bedding market segmentation, based on product type, includes mattresses, bed linens, pillows, and blankets and comforters. The mattresses segment is expected to witness the fastest growth from 2025 to 2034, driven by the increasing consumer preference for ergonomic and premium-quality mattresses. Memory foam and hybrid mattresses, known for their superior comfort and orthopedic benefits, are leading this expansion. A key factor behind this growth is the rising awareness of sleep’s role in overall health, especially with the rise of lifestyle-related ailments such as back pain and insomnia. Additionally, the introduction of innovative products with advanced technologies, like smart mattresses equipped with sleep monitoring, is fueling the segment's growth.

Home Bedding Market Evaluation by Material Type Outlook

The home bedding market segmentation, based on material type, includes cotton, linen, polyester, and silk. The cotton segment dominated the home bedding market in 2024. Cotton bedding is preferred for its versatility and ability to cater to varied consumer needs, from luxurious designs to cost-effective options. The rising demand for organic cotton bedding aligns with market trends that emphasize sustainability. In addition, the focus on eco-friendly manufacturing practices by leading brands enhances this segment's appeal, supporting continued market growth.

Home Bedding Market Regional Analysis

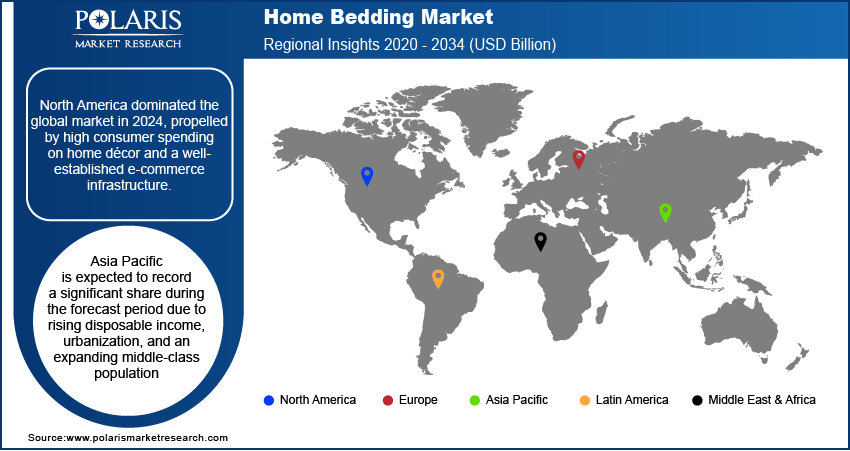

By region, the study provides the home bedding market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, driven by high consumer spending on home décor and a well-established C2C (consumer-to-consumer) e-commerce infrastructure. The US, a key contributor to the market, exhibits strong demand for premium bedding products. Factors such as increased awareness of sleep health, a preference for sustainable materials, and frequent home renovations contribute to market dominance. The home bedding market analysis reveals significant innovation among key players in this region, particularly in smart bedding solutions.

The Asia Pacific home bedding market is expected to record a significant share during the forecast period due to rising disposable income, growing urbanization, and an expanding middle-class population. Key countries like China and India are pivotal drivers of growth in this region, with China's expansion fueled by a booming e-commerce sector and a growing preference for luxury bedding among the urban population. Additionally, government initiatives promoting sustainable manufacturing practices are encouraging the adoption of eco-friendly materials.

China stands out as a leading country within the Asia Pacific market. Its dominance is attributed to a robust manufacturing sector and cost-effective production capabilities. The home bedding market in China benefits from technological advancements in production processes and a strong emphasis on exports. The increasing popularity of online retail and local players entering the premium segment further boosts the market growth in this country.

Home Bedding Market – Key Players and Competitive Insights

The home bedding market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the home bedding market include Tempur Sealy International; Serta Simmons Bedding; Sleep Number Corporation; Purple Innovation, Inc.; Casper Sleep Inc.; Sheela Foam Ltd.; Boll & Branch LLC; WestPoint Home LLC; Welspun India Ltd.; Leggett & Platt, Incorporated; Portico New York; Brooklinen; Trident Group; Parachute Home; and Peacock Alley

Serta Simmons Bedding, LLC (SSB) is an American manufacturer of mattresses and bedding products based in Doraville, Georgia. The company was formed through the merger of Serta and Simmons, both of which have long histories in the mattress industry—Serta was established in 1931, while Simmons dates back to 1870. Together, they hold a significant share of the North American mattress market. Serta Simmons Bedding offers a diverse product range, including traditional innerspring mattresses, gel-infused memory foam mattresses, hybrid models that combine various technologies, and Talalay latex mattresses. These products cater to different segments, including residential consumers and the hospitality industry, with clients such as Hilton and Wyndham. The company operates several brands under its umbrella, including Serta, Beautyrest, Simmons, and Tuft & Needle, each targeting distinct consumer preferences and price ranges. Serta Simmons Bedding primarily operates in North America, with 18 manufacturing facilities located in the US and Puerto Rico. Recently, the company opened a new facility in Janesville, Wisconsin, aimed at improving production capabilities.

WestPoint Home, LLC is a manufacturer and supplier of home textiles with a history spanning over 200 years. The company was formed from the merger of three historic textile firms: J.P. Stevens & Co., Pepperell Manufacturing Company, and West Point Manufacturing Company. Headquartered in New York City, WestPoint Home operates under the ownership of Icahn Enterprises. The company produces a wide range of home textile products, including bedding items such as sheets, comforters, and blankets, as well as bath products like towels and mattress pads. Its brand portfolio includes names like Martex, Vellux, Lady Pepperell, and licensed brands such as Ralph Lauren and Izod. WestPoint Home's operations are divided into several key segments. The home fashion textiles segment focuses on decorative bedding and related products for retail markets. The bath products segment includes towels and shower curtains designed for both residential and commercial use. Additionally, the WestPoint Hospitality division supplies bedding and bath solutions to hotels, resorts, and cruise lines, and healthcare facilities. This structure enables the company to cater to a wide range of customers with specific needs. WestPoint Home, LLC operates globally with manufacturing facilities located in the US (Florida) and Bahrain. Its distribution network extends across regions including North America, Europe, the Middle East, and Asia, covering countries such as China, Pakistan, and India.

List of Key Companies in Home Bedding Market

- Boll & Branch LLC

- Brooklinen

- Casper Sleep Inc.

- Leggett & Platt, Incorporated

- Parachute Home

- Peacock Alley

- Portico New York

- Purple Innovation, Inc.

- Serta Simmons Bedding

- Sheela Foam Ltd.

- Sleep Number Corporation

- Tempur Sealy International

- Trident Group

- Welspun India Ltd.

- WestPoint Home LLC

Home Bedding Industry Developments

January 2025: Alok Industries launched innovative bed and bath linen products at Heimtextil 2025. The new product range features the Leap Bedding Collection and the Sumptuous Living Towel Collection, emphasizing luxury and performance.

Home Bedding Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Mattresses

- Bed Linens

- Pillows

- Blankets and Comforters

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Cotton

- Linen

- Polyester

- Silk

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Home Bedding Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 113.49 billion |

|

Market Size Value in 2025 |

USD 121.73 billion |

|

Revenue Forecast by 2034 |

USD 232.31 billion |

|

CAGR |

7.4% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The home bedding market size was valued at USD 113.49 billion in 2024 and is projected to grow to USD 232.31 billion by 2034.

The global market is projected to register a CAGR of 7.4% from 2025 to 2034.

North America had the largest share of the global market in 2024.

The key players in the market are Tempur Sealy International; Serta Simmons Bedding; Sleep Number Corporation; Purple Innovation, Inc.; Casper Sleep Inc.; Sheela Foam Ltd.; Boll & Branch LLC; WestPoint Home LLC; Welspun India Ltd.; Leggett & Platt, Incorporated; Portico New York; Brooklinen; Trident Group; Parachute Home; and Peacock Alley.

The cotton segment dominated the home bedding market in 2024 due to the rising demand for organic cotton bedding.

The mattresses segment is expected to witness the fastest growth during the forecast period due to increasing consumer preference for ergonomic and premium-quality mattresses.