Hospitality Mattress Market Size, Share, Trends, Industry Analysis Report

By Type (Innerspring, Foam, Hybrid, and Others), By Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6223

- Base Year: 2024

- Historical Data: 2020-2023

Overview

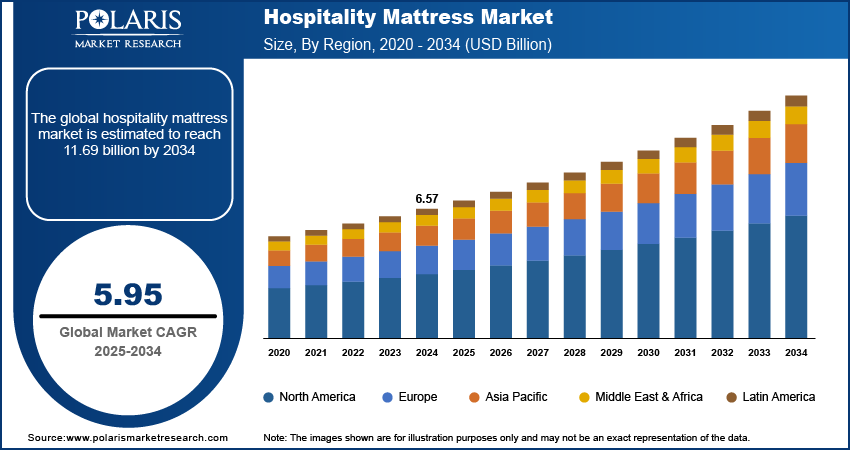

The global hospitality mattress market size was valued at USD 6.57 billion in 2024, growing at a CAGR of 5.95% from 2025 to 2034. Key factors driving demand for hospitality mattresses include urbanization and infrastructure development, coupled with government incentives and tourism infrastructure investments accelerating market expansion.

Key Insights

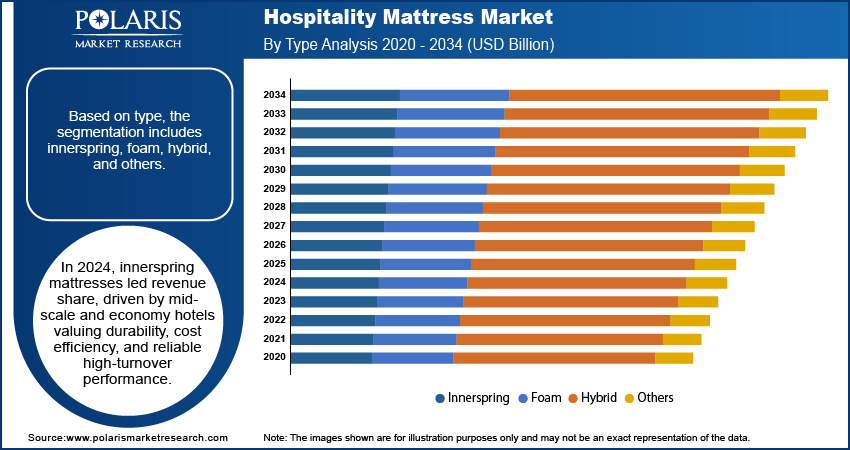

- The innerspring mattresses segment held a dominating market share in 2024, fueled by widespread adoption in mid-scale and economy hotels due to durability, cost efficiency, and consistent performance under high guest turnover.

- The queen-size mattresses segment accounted for the largest share in 2024, driven by a balance of comfort, versatility, and cost-effectiveness for a wide range of room categories in mid-scale and upscale properties.

- The Asia Pacific hospitality mattress market accounted highest global revenue share in 2024. This dominance is attributed to the government initiatives to promote domestic and international tourism, particularly in Southeast Asia.

- India held the largest revenue share in the Asia Pacific hospitality mattress landscape in 2024, driven by rapid hotel construction to accommodate a surge in domestic and international tourism.

- The industry in North America is projected to grow at the fastest pace in the coming years, due to the high renovation frequency in established hotel chains aimed at maintaining brand standards and enhancing guest satisfaction.

- The market in the U.S. is driven by robust tourism and business travel sectors, which sustain high hotel occupancy rates year-round.

Industry Dynamics

- Rapid urbanization and large-scale infrastructure development are creating new hospitality hubs worldwide, driving demand for high-quality mattresses in hotels.

- Government incentives and substantial investments in tourism infrastructure are accelerating market expansion, particularly in emerging and high-growth travel destinations.

- Increasing adoption of smart mattresses with integrated sleep tracking technology presents lucrative opportunities for market players to cater to tech-savvy and health-conscious travelers.

- The high initial cost of advanced hospitality mattresses is projected to hinder market growth, especially in price-sensitive and budget hotel segments.

Market Statistics

- 2024 Market Size: USD 6.57 Billion

- 2034 Projected Market Size: USD 11.69 Billion

- CAGR (2025–2034): 5.95%

- Asia Pacific: Largest Market Share

The hospitality mattress market is a key component of the global hospitality infrastructure, providing specialized bedding solutions tailored to the comfort, durability, and hygiene requirements of hotels, resorts, serviced apartments, and other accommodation facilities. These products are designed to enhance guest experience while meeting the operational demands of high-occupancy environments. Manufacturers in this space provide end-to-end solutions, ranging from premium mattress design and material sourcing to customized manufacturing, quality certification, and logistics support. The growing emphasis on enhancing guest experience, optimizing sleep quality, and extending product lifespan is driving demand for advanced hospitality mattresses tailored to diverse property categories and brand standards.

The demand for high-performance hospitality mattresses is increasing due to rising global travel activity, expansion of luxury and mid-scale hotel chains, and heightened guest expectations for comfort and wellness. Hospitality operators are collaborating with mattress manufacturers to integrate ergonomic designs, hypoallergenic materials, and temperature-regulating technologies that cater to a broad range of sleeper preferences. Also, vendors are enhancing production capabilities by investing in automated manufacturing lines, sustainable raw materials, and modular design systems to address evolving sustainability mandates and operational cost considerations.

The expansion of the global travel and tourism sector is boosting demand for high-quality hospitality mattresses, thus fueling the market growth. Increasing hotel occupancy rates, coupled with the surge in construction of new properties across luxury, mid-scale, and budget segments, are driving large-scale procurement of durable and comfortable bedding solutions. According to a long-term forecast by the United Nations World Tourism Organization (UNWTO), international tourist arrivals are projected to reach 1.8 billion by 2030, reflecting a sustained recovery and growth in global travel activity. This rising demand for accommodation is pushing hotel operators to invest in premium mattress solutions that enhance guest comfort, meet brand standards, and support positive reviews, therefore improving occupancy and revenue performance.

Urbanization and Infrastructure Development Creating New Hospitality Hubs Worldwide: Rapid urbanization in emerging economies, coupled with infrastructure investments in metropolitan and secondary cities, is boosting the development of new hospitality hubs. According to the latest report by the United Nations, 55% of the global population currently resides in urban areas, and this share is projected to rise to 68% by 2050. Major global cities, along with fast-growing urban centers in Asia, the Middle East, and Africa, are witnessing an influx of domestic and international travelers, spurring the establishment of new hotels, resorts, and serviced apartments. This trend is fueling the demand for customizable hospitality mattresses that address diverse design preferences, climate conditions, and guest profiles.

Government Incentives and Tourism Infrastructure Investments Accelerating Market Expansion: Governments across countries are actively promoting tourism to boost economic growth by offering tax incentives, subsidies, and investment programs for the hospitality sector. For instance, in the Union Budget 2025–26, the Indian government allocated approximately USD 30.62 million to enhance infrastructure, skill development, and travel facilitation. Strategic initiatives such as large-scale event hosting, heritage site development, and eco-tourism projects are increasing the need for new and upgraded hospitality infrastructure, including bedding solutions. This growth in investment, coupled with rising private sector participation, is expected to further strengthen market growth by supporting large-volume orders and long-term supply agreements.

Segmental Insights

Type Analysis

Based on type, the hospitality mattress market is segmented into innerspring, foam, hybrid, and others. Innerspring mattresses accounted for the largest revenue share in 2024, fueled by widespread adoption in mid-scale and economy hotels due to durability, cost efficiency, and consistent performance under high guest turnover. The segment’s dominance is strengthened by ease of maintenance and the ability to withstand frequent use without significant wear, making it a preferred choice for large hotel chains and budget accommodations.

Hybrid mattresses are projected to register the highest growth rate during the forecast period, driven by the combination of robust innerspring support with the comfort layers of foam or latex. This balanced firmness, effective motion isolation, and elevated guest comfort are making the category increasingly appealing for upscale and boutique properties aiming to differentiate through an enhanced sleep experience.

Size Analysis

Based on size, the market is categorized into single, double, queen, and king. Queen-size mattresses held the largest share in 2024, driven by a balance of comfort, versatility, and cost-effectiveness for a wide range of room categories in mid-scale and upscale properties. It offers ample sleeping space for couples while fitting comfortably in standard room layouts, contributing to their popularity among global hospitality operators.

King-size mattresses are anticipated to register the fastest growth over the forecast period, fueled by the expansion of luxury and premium hotel segments that prioritize spaciousness and high-end guest experiences. The segment’s momentum is further supported by rising consumer expectations for premium bedding standards in resort and executive suite accommodations.

End Use Analysis

Based on end use, the hospitality mattress market is divided into hotels & resorts, vacation rentals, hostels, and others. Hotels & resorts represented the largest revenue-generating segment in 2024, fueled by continuous refurbishment cycles, brand-specific bedding standards, and investment in guest comfort as a competitive differentiator. Global tourism growth, coupled with increasing occupancy rates in business and leisure travel markets, is further sustaining demand.

Vacation rentals are expected to record the highest CAGR during the forecast period, driven by the rapid growth of platforms such as Airbnb and Vrbo, along with property owners’ rising focus on offering hotel-like comfort to enhance guest satisfaction and reviews. This segment’s growth is also supported by increased penetration of professionally managed short-term rental operators who prioritize high-quality, durable mattresses.

Regional Analysis

The Asia Pacific hospitality mattress market accounted for the highest market share in 2024. This dominance is attributed to the government initiatives to promote domestic and international tourism, particularly in Southeast Asia. Also, a rapidly expanding middle-class population with higher disposable incomes is fueling demand for mid-tier and premium hotels, creating substantial opportunities for mattress suppliers. Additionally, rising brand penetration of global hospitality chains in developing markets is accelerating demand for standardized, high-quality bedding solutions.

India Hospitality Mattress Market Insights

India held the largest revenue share in the Asia Pacific hospitality mattress landscape in 2024, driven by rapid hotel construction to accommodate a surge in domestic and international tourism. For instance, in August 2025, the Oberoi Group announced the launch of four new hotel projects in India. These properties include The Oberoi, Gir, The Oberoi, Hyderabad, Trident, Nandi Hills, and Trident, Fort Aguada. The government’s sustained focus on tourism promotion, coupled with major private-sector investments in hospitality infrastructure, is accelerating the demand for premium mattresses. Emerging hotel brands and international chains are prioritizing sleep comfort and durability as core purchasing criteria, driving supplier innovation in design, material quality, and sustainability.

North America Hospitality Mattress Market Trends

The market in North America is projected to hold a substantial revenue share in 2034 due to the high renovation frequency in established hotel chains aimed at maintaining brand standards and enhancing guest satisfaction. The region benefits from a mature hospitality infrastructure and a growing preference for luxury and wellness-focused accommodations, which is driving the adoption of premium mattresses.

The U.S. Hospitality Mattress Market Overview

The U.S. is a key market for hospitality mattresses, attributed to its robust tourism and business travel sectors, which sustain high hotel occupancy rates year-round. According to the World Travel & Tourism Council (WTTC) 2024 Economic Impact Trends Report, the United States emerged as the world’s most powerful travel and tourism market in 2023, contributing a record-breaking USD 2.36 trillion to the national economy. Major hotel brands are investing in upgraded bedding solutions to support brand loyalty and guest retention. Continuous expansion of urban convention centers, leisure tourism hotspots, and corporate travel hubs is further boosting replacement and procurement cycles for hospitality mattresses.

Europe Hospitality Mattress Market Assessments

The industry in Europe is projected to grow at the fastest pace in the coming years, owing to the strong heritage and cultural tourism industry that sustains consistent accommodation demand. Frequent refurbishments in historic and boutique hotels are aimed at preserving architectural authenticity while upgrading bedding to meet modern comfort standards. Luxury and design-led hotels across the region are increasingly opting for bespoke and hybrid mattress solutions to align with brand identity and guest expectations, further boosting the market growth.

Key Players & Competitive Analysis

The global hospitality mattress market is highly competitive, with key players such as Serta Simmons Bedding, Tempur Sealy International, Sleep Number Corporation, and King Koil dominating due to strong brand recognition, extensive product portfolios, and expansive distribution networks across the global hospitality sector. Tempur Sealy International leads with a wide range of premium and mid-tier mattress solutions, supported by advanced material innovations and partnerships with major hotel chains. Serta Simmons Bedding leverages its diverse brand portfolio and large-scale manufacturing capabilities to serve luxury and budget hospitality segments. Sleep Number Corporation stands out for its smart bed technology and customizable comfort features, increasingly favored by wellness-focused hotels. King Koil differentiates itself through design-led mattresses tailored for high-end resorts and boutique hotels, combining aesthetic appeal with ergonomic support.

The market is witnessing a growing focus on sustainable manufacturing and eco-friendly mattress production, driven by hospitality brands’ emphasis on ESG goals and guest preferences for environmentally responsible accommodations. Manufacturers are investing in advanced materials such as organic fabrics, natural latex, flexible foam and recyclable foams, alongside innovations in modular and hybrid mattress designs to improve comfort, durability, and ease of maintenance. Strategic partnerships with hotel chains, co-branding initiatives, and region-specific product customization remain core growth strategies, while competition is intensifying in emerging hospitality hubs across Asia Pacific and the Middle East.

Prominent companies in the market include Kingsdown, Inc., Corsicana Mattress Company, Pikolin, Breckle, Hilding Anders, Restonic Mattress Corporation, AH Beard, Sealy (India), Comfort Sleep Bedding, Sleepeezee, and Casper Sleep Inc.

Key Players

- Serta Simmons Bedding

- Tempur Sealy International

- Sleep Number Corporation

- King Koil

- Kingsdown, Inc.

- Corsicana Mattress Company

- Pikolin

- Breckle

- Hilding Anders

- Restonic Mattress Corporation

- AH Beard

- Sealy (India)

- Comfort Sleep Bedding

- Sleepeezee

- Casper Sleep Inc.

Hospitality Mattress Industry Developments

In October 2024, Piana Sleep partnered with Reveille Hospitality to debut the Rinnovo mattress in upscale and luxury hotels. The product blends eco-friendly innovation featuring take-back recycling programs, reduced CO₂ emissions, and molecular-printing technology with exceptional comfort and customizable firmness options, enhancing guest experiences across global hospitality destinations.

In June 2024, Pottery Barn, a flagship brand of Williams-Sonoma, collaborated with Westin Hotels & Resorts to introduce the “Westin for Pottery Barn” collection, merging luxury hospitality design with home living. The collection includes premium bedroom furniture, bedding, and bath accessories inspired by Westin’s wellness-focused philosophy.

Hospitality Mattress Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Innerspring

- Foam

- Hybrid

- Others

By Size Outlook (Revenue, USD Billion, 2020–2034)

- Single

- Double

- Queen

- King

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hotels & Resorts

- Vacation Rentals

- Hostels

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hospitality Mattress Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.57 Billion |

|

Market Size in 2025 |

USD 6.95 Billion |

|

Revenue Forecast by 2034 |

USD 11.69 Billion |

|

CAGR |

5.95% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.57 billion in 2024 and is projected to grow to USD 11.69 billion by 2034.

The global market is projected to register a CAGR of 5.95% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Kingsdown, Inc., Corsicana Mattress Company, Pikolin, Breckle, Hilding Anders, Restonic Mattress Corporation, AH Beard, Sealy (India), Comfort Sleep Bedding, Sleepeezee, and Casper Sleep Inc.

The innerspring mattresses segment dominated the market revenue share in 2024.

The king-size mattresses segment is projected to witness the fastest growth during the forecast period.