Hydrocolloids Market Size, Share, Trends, Industry Analysis Report

By Type (Gelatin, Pectin, Xanthan Gum, Carrageenan, Guar Gum, Alginates); By Source; By Application (Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Industrial); Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM3081

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

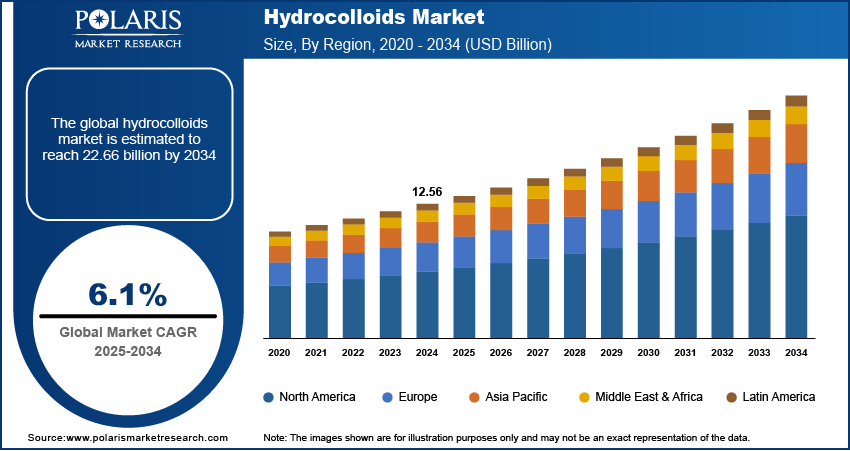

The hydrocolloids market size was worth USD 12.56 billion in 2024. It is projected to grow at a CAGR of 6.1% from 2025 to 2034. Hydrocolloids are substances that form gels and thicken or stabilize solutions in various industrial applications. They are widely used in industries such as food & beverages, pharmaceuticals, and cosmetics to improve texture, extend shelf life, and enhance sensory properties of products.

Market Insights

- Based on type, the gelatin segment is expected to record the fastest CAGR from 2025 to 2034, driven by its extensive use in confectionery, dairy products, and desserts, among others.

- Among major applications, the food & beverage segment dominated the market in 2024 due to the critical role of hydrocolloids in improving food quality and shelf life.

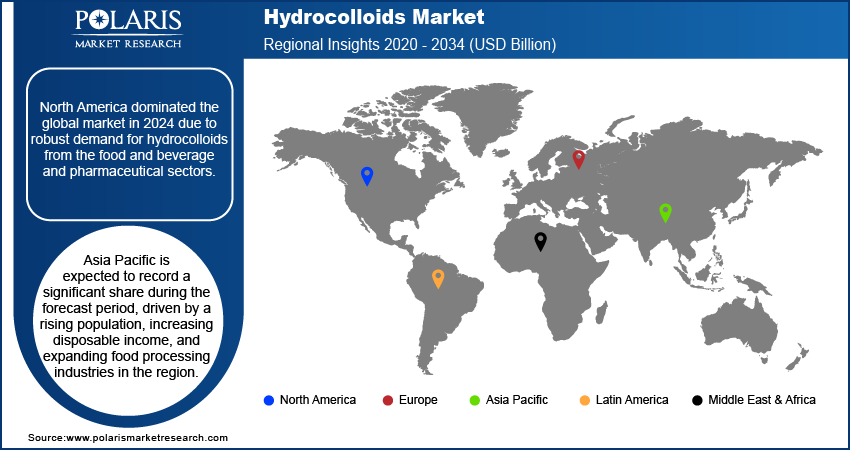

- North America dominated the global hydrocolloids industry in 2024. The food & beverage and pharmaceutical sectors are the major enablers of growth in this region.

- Asia Pacific is expected to occupy a significant share in the global market during the forecast period, mainly driven by the rising population, increasing disposable income, and rapidly growing food processing industries.

Market Dynamics

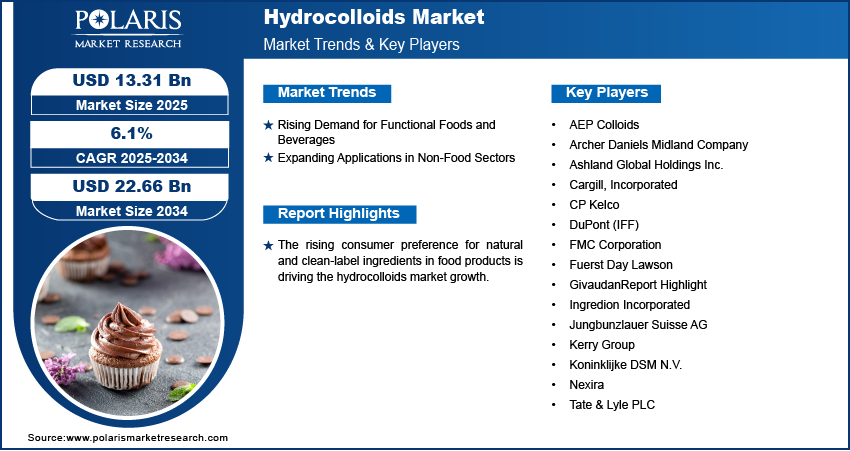

- The rising consumer preference for natural and clean-label ingredients to replace synthetic additives in food products is driving the hydrocolloids market growth.

- The increasing popularity of functional food products and beverages benefits the hydrocolloids market, as they are valued for their role in improving digestion and immunity, and reducing cholesterol levels.

- The market benefits from the burgeoning demand for low-fat and gluten-free food products, as hydrocolloids help maintain structural integrity in these formulations.

- The expanding use of hydrocolloids in non-food applications such as pharmaceuticals, personal care, and industrial manufacturing is expected to present significant growth opportunities in the market over the coming years.

- The volatility of raw material prices, regulatory pressures, and substitution with synthetic alternatives are the main factors limiting the growth of hydrocolloid businesses.

Market Statistics

Market Size in 2024: USD 6.24 billion

Projected Market Size in 2034: USD 22.66 billion

CAGR, 2025–2034: 6.1%

Largest Regional Market, 2024: North America

AI Impact on Hydrocolloid Market

- AI platforms are utilized to optimize extraction and processing by enhancing the yield, texture quality, and consistency of hydrocolloids derived from seaweed, plants, and microbial sources.

- Machine learning accelerates R&D by studying functional properties (gelling, thickening, stabilizing) to create novel hydrocolloid blends.

- AI can bring improvements in imaging and spectroscopy outcomes to ensure uniformity, purity, and compliance with international safety standards.

- Predictive analytics monitors trends in consumer preferences for clean-label and plant-based ingredients, guiding production planning and inventory management.

- AI ensures the traceability of raw materials (algae, fungi, seaweed), thereby reducing the likelihood of logistics disruptions.

To Understand More About this Research: Request a Free Sample Report

The hydrocolloids market focuses on substances that form gels, thicken, or stabilize solutions in various industrial applications. Derived from natural sources such as plants, algae, and microbes, hydrocolloids are widely used in industries like food & beverage, pharmaceuticals, cosmetics, and more. They play a crucial role in improving texture, extending shelf life, and enhancing the sensory properties of products.

The rising consumer preference for natural and clean-label ingredients in food products is driving the hydrocolloids market growth. The demand for natural hydrocolloids, such as pectin, guar gum, and xanthan gum, is increasing as alternatives to synthetic additives. Additionally, the market is benefiting from the growing demand for low-fat and gluten-free food products, where hydrocolloids play a critical role in maintaining product quality.

Medical advancements have significantly expanded the applications of hydrocolloids in wound healing, surgical dressings, and pharmaceutical formulations. Growing global healthcare investments, the increasing prevalence of chronic diseases, and rising patient care standards are driving demand for advanced medical-grade hydrocolloid products. These versatile materials offer superior wound management capabilities, promoting faster healing processes and reducing infection risks. Medical professionals are increasingly recognizing hydrocolloids' effectiveness in managing complex wounds, thereby accelerating hydrocolloids market expansion and technological innovations in healthcare treatment solutions.

Market Dynamics

Rising Demand for Functional Foods and Beverages

Consumers are increasingly seeking products that offer health benefits, such as improved digestion, enhanced immunity, and reduced cholesterol. Hydrocolloids, including carrageenan and alginates, serve as essential ingredients in these products, providing texture and stability while retaining their nutritional integrity. The rising demand for prebiotic ingredient and probiotic products is further driving the hydrocolloids market development, as hydrocolloids enhance the delivery and stability of active components in functional foods.

Expanding Applications in Non-Food Sectors

The dynamics of hydrocolloids are increasingly influenced by their growing adoption in non-food applications, such as pharmaceuticals, personal care, and industrial manufacturing. In pharmaceuticals, hydrocolloids like agar and gelatin are widely used in capsule formulations, wound dressings, and drug delivery systems. In personal care products, hydrocolloids enhance product consistency and stability, particularly in lotions and gels. Technological advancements are further expanding their industrial applications, including water-based paints and adhesives, driving hydrocolloids market revenue.

Segment Insights

Market Assessment by Type Insights

The hydrocolloids market segmentation, based on type, includes gelatin, pectin, xanthan gum, carrageenan, guar gum, and alginates. The gelatin segment is expected to witness the fastest growth from 2025 to 2034, driven by its extensive use in food products such as confectionery, dairy, and desserts highlights this dominance. Gelatin’s ability to enhance texture and stability, along with health benefits such as improved joint health, makes it a preferred choice among manufacturers. Gelatin is extensively used in pharmaceuticals for capsule production and in the personal care industry for products like face masks, further driving its demand.

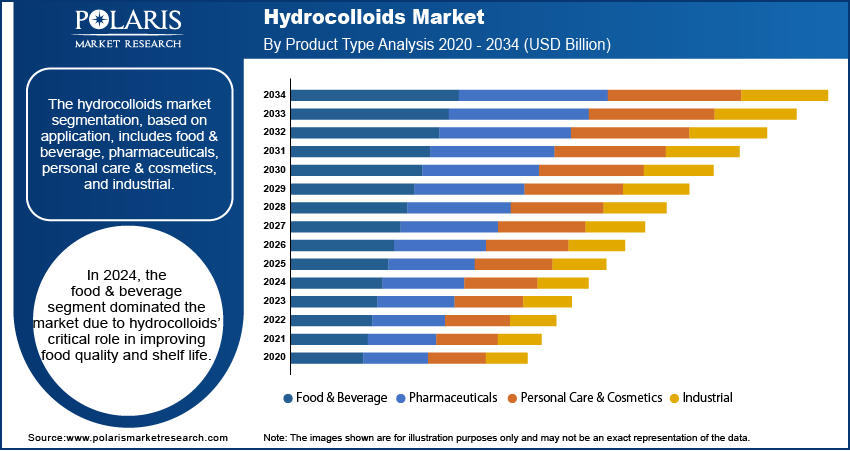

Market Evaluation by Application Insights

The hydrocolloids market segmentation, based on application, includes food & beverage, pharmaceuticals, personal care & cosmetics, and industrial. The food & beverage segment dominated the market in 2024 due to hydrocolloids’ critical role in improving food quality and shelf life. Hydrocolloids are increasingly used in dairy, bakery, and gluten-free products, driven by rising consumer preference for clean-label and healthier options. For instance, carrageenan and xanthan gum are popular in low-fat formulations, where they replicate the texture of fats while maintaining taste. This growth is driven by research on the hydrocolloids market, showing their role in replacing synthetic additives and meeting demand for natural options.

Regional Analysis

By region, the study provides the hydrocolloids market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the hydrocolloids market in 2024 due to robust demand from the food & beverage and pharmaceutical sectors. The region benefits from well-established industries and strong consumer preference for premium and functional food products. The hydrocolloids market analysis reveals that innovations in plant-based and vegan food alternatives are driving market expansion in the region, with the US leading as a key contributor. US-based companies are increasingly focusing on clean-label product formulations, further contributing to the regional market dominance.

Asia Pacific is expected to record a significant share during the forecast period. This growth is driven by a rising population, increasing disposable income, and the expansion of food processing industries. The demand for convenience foods, along with growing awareness of health and wellness, fuels the adoption of hydrocolloids in this region. Countries like China and India are leading this growth due to their expanding food and pharmaceutical industries.

China stands as a key player in the Asia Pacific hydrocolloids market due to its vast production capacity and rising consumer demand for processed and functional foods. The country’s focus on adopting advanced technologies in food processing has enhanced the applications of hydrocolloids. Furthermore, China's thriving e-commerce platforms have expanded access to hydrocolloid-based products, propelling market growth.

Key Players and Competitive Insights

The hydrocolloids market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the hydrocolloids market include Cargill, Incorporated; DuPont (IFF); CP Kelco; Ingredion Incorporated; Koninklijke DSM N.V.; Kerry Group; Ashland Global Holdings Inc.; Archer Daniels Midland Company; Tate & Lyle PLC; Jungbunzlauer Suisse AG; Fuerst Day Lawson; Nexira; FMC Corporation; AEP Colloids; and Givaudan.

Archer Daniels Midland Company (ADM) is engaged in the manufacture and distribution of food & beverage products, animal feed, and industrial chemicals. The company was founded in 1902 and headquartered in Chicago, Illinois, US. The company’s operations are classified into three business segments: Ag Services & Oilseeds, Carbohydrate Solutions, and Nutrition. The company offers various types of floors and starches through its human nutrition segment. Apart from human nutrition, it also operates animal nutrition and industrial biosolutions. ADM has diversified its operations to include oilseeds processing, corn processing, specialty food ingredients, animal nutrition, and bioactives. Its products are used in a variety of applications, including food and beverages, animal feed, industrial uses, and renewable fuels. The company's customer base includes food and beverage manufacturers, animal nutrition companies, industrial manufacturers, and energy producers, among others. ADM operates in over 190 countries and has consolidated subsidiaries in more than 70 countries. It owns more than 160 warehouses and terminals, which are used as bulk storage, and has 62 innovation centers. Archer Daniels Midland Company (ADM) offers hydrocolloids like xanthan gum, guar gum, and pectin for texture, stability, and thickening in food applications.

Cargill, Incorporated is a global provider of food, ingredients, agricultural solutions, and industrial products, serving multiple sectors with a focus on safety, responsibility, and sustainability. The company's diverse product and service offerings span agriculture, animal nutrition, beauty, bio-industrial solutions, data asset solutions, food and beverage, food service, industrial applications, meat and poultry, pharmaceuticals, risk management, supplements, and transportation. In the agricultural sector, Cargill supplies grains, oilseeds, cotton, and palm oil, contributing to global food systems and commodity markets. The company's animal nutrition division offers specialized products, including NutreBeef Cattle Feeds, Right Now Minerals, Fescue EMT Mineral Defense, Cattle Grazers Mineral, Ranger Limiter, and Safe-Guard 32SG Mineral to support livestock health and performance. Cargill’s beauty segment provides a broad range of ingredients, such as rheology modifiers, emulsifiers, emollients, sensory enhancers, bio-actives, base ingredients, skin lipid mimetics, and botanical beads to meet the evolving demands of personal care and cosmetics industries. The company, through its bio-industrial solutions and risk management services, supports businesses with sustainable industrial products and financial tools. Cargill, Incorporated offers hydrocolloids like pectin, xanthan gum, carrageenan, and alginate for texture, stability, and thickening in food applications..

List of Key Companies in Hydrocolloids Market

- AEP Colloids

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- Cargill, Incorporated

- CP Kelco

- DuPont (IFF)

- FMC Corporation

- Fuerst Day Lawson

- Givaudan

- Ingredion Incorporated

- Jungbunzlauer Suisse AG

- Kerry Group

- Koninklijke DSM N.V.

- Nexira

- Tate & Lyle PLC

Hydrocolloids Industry Developments

In September 2024, Marine Hydrocolloids was showcased at FI India 2024, presenting a diverse range of hydrocolloids, stabilizers, gums, and gelling agents to industry professionals and culinary experts in attendance.

In July 2024, Meron Hydrocolloids launched new flavored jelly crystal mixes and custard powders, expanding its product range and enhancing culinary experiences for home cooks and chefs alike with innovative dessert options.

Hydrocolloids Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Gelatin

- Pectin

- Xanthan Gum

- Carrageenan

- Guar Gum

- Alginates

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Plant-Based

- Microbial-Based

- Animal-Based

- Seaweed-Based

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.56 billion |

|

Market Size Value in 2025 |

USD 13.31 billion |

|

Revenue Forecast by 2034 |

USD 22.66 billion |

|

CAGR |

6.1% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The hydrocolloids market size was valued at USD 12.56 billion in 2024 and is projected to grow to USD 22.66 billion by 2034.

The global market is projected to register a CAGR of 6.1% from 2025 to 2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Cargill, Incorporated; DuPont (IFF); CP Kelco; Ingredion Incorporated; Koninklijke DSM N.V.; Kerry Group; Ashland Global Holdings Inc.; Archer Daniels Midland Company; Tate & Lyle PLC; Jungbunzlauer Suisse AG; Fuerst Day Lawson; Nexira; FMC Corporation; AEP Colloids; and Givaudan.

The food & beverage segment dominated the market in 2024, driven by rising consumer preference for clean-label and healthier options.

The gelatin segment is expected to witness the fastest growth during the forecast period, driven by gelatin’s extensive use in food products such as confectionery, dairy, and desserts.