Surgical Dressing Market Size, Share, & Industry Analysis Report

: By Product (Primary Dressing, Secondary Dressing, and Others), Application, End Use, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 115

- Format: PDF

- Report ID: PM1213

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

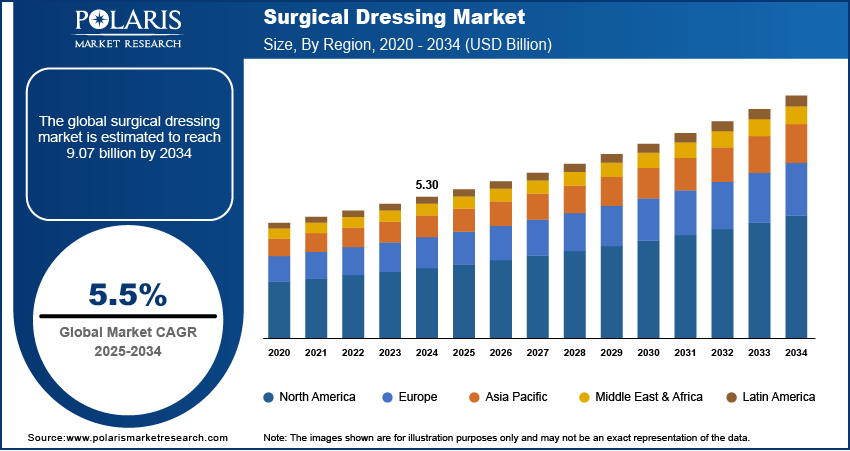

The surgical dressing market size was valued at USD 5.30 billion in 2024. The market is projected to grow from USD 5.58 billion in 2025 to USD 9.07 billion by 2034, exhibiting a CAGR of 5.5% during 2025–2034. The market is driven by rising surgical procedures, increasing chronic wound cases, a growing geriatric population, advancements in wound care technologies, and rising awareness about infection prevention and post-operative care, fueling demand for advanced and sterile dressing solutions.

Key Insights

- The primary dressing segment led in 2024 due to its essential wound protection and healing support.

- Diabetes-related surgeries drives significant market share during the forecast period, reflecting the rising global diabetes prevalence.

- Hospitals dominated revenue share in 2024, fueled by high surgery volumes requiring advanced wound care.

- North America led the market with robust healthcare infrastructure, high spending, and innovation focus.

- Europe’s market growth is supported by advanced healthcare systems and stringent patient care standards.

Industry Dynamics

- Rising demand for surgical dressings is driven by increasing surgical procedures, growing chronic wounds, and heightened awareness of advanced wound care solutions.

- Market expansion is supported by innovations in dressing materials, improved healthcare infrastructure, and rising healthcare expenditure globally.

- Challenges like high costs, risk of infection, and limited access in developing regions may hinder market growth.

- Advances in antimicrobial dressings, hydrocolloid technologies, and smart wound care products are improving healing outcomes, patient comfort, and recovery times.

Market Statistics

- 2024 Market Size: USD 5.30 billion

- 2034 Projected Market Size: USD 9.07 billion

- CAGR (2025-2034): 5.5%

- North America: Largest market in 2024

AI Impact on Surgical Dressing Market

- AI analyzes wound healing data and patient conditions to personalize dressing selection and optimize treatment outcomes.

- Integration of AI enables real-time monitoring of wound progress, allowing timely adjustments to dressing changes and care plans.

- AI-powered tools assist in developing advanced dressing materials by simulating moisture control, antimicrobial efficacy, and biocompatibility.

- AI optimizes supply chain management and inventory forecasting, ensuring timely availability of surgical dressings and reducing operational costs.

The surgical dressing market refers to the sector involved in the production and distribution of materials used to cover and protect wounds during surgical procedures. These dressings play a critical role in promoting healing, preventing infections, and minimizing complications. Key drivers in the market include the increasing number of surgical procedures globally, advancements in wound care technology, and a growing focus on patient safety and infection control. Trends such as the rise in minimally invasive surgeries and the development of advanced wound care materials, including antimicrobial and bioactive dressings, are shaping the market's evolution. Additionally, the aging population and the increasing prevalence of chronic diseases are expected to create lucrative surgical dressings market opportunities during the forecast period.

Market Dynamics

Increase in Surgical Procedures Worldwide

The global rise in the number of surgical procedures is propelling market growth. More patients are undergoing various types of surgeries as medical advancements continue to improve surgical outcomes. In particular, the demand for elective and minimally invasive surgeries has surged, which requires advanced dressing materials for wound care. According to the World Health Organization (WHO), an estimated 235 million major surgeries are performed worldwide each year. The increase in number of surgeries directly translates into higher demand for surgical dressings, as they are essential for managing and protecting surgical wounds, ensuring infection control, and promoting healing.

Advancements in Wound Care Technology

Technological innovations in wound care are significantly driving the surgical dressing market development. The development of advanced wound care products, such as antimicrobial dressings, hydrocolloids, and bioactive dressings, has enhanced the healing process, particularly for complex and chronic wounds. These materials offer superior moisture balance, infection control, and faster healing times. Furthermore, the growing focus on personalized wound care is expected to stimulate market revenue as healthcare providers seek products that cater to specific patient needs and promote optimal recovery.

Aging Population and Prevalence of Chronic Diseases

The aging global population is another key factor contributing to the market demand. As individuals age, they are more likely to require surgical interventions due to age-related health issues, such as cardiovascular diseases, joint replacements, and cancers. Older adults also experience slower wound healing, which increases the need for more effective surgical dressings. According to the United Nations, the global population aged 60 years and above is expected to reach 2.1 billion by 2050, up from 1 billion in 2020. Additionally, the growing prevalence of chronic diseases, such as diabetes, which often requires surgical procedures for wound care, is expected to drive demand for specialized surgical dressings. This demographic shift is expected to create a substantial market opportunity during the forecast period.

Segment Insights

By Product Insights

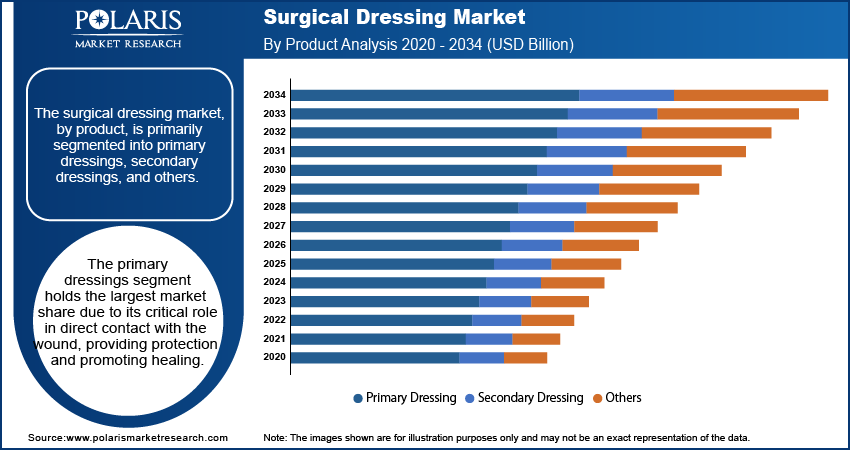

The surgical dressing market, by product, is primarily segmented into primary dressings, secondary dressings, and others. The primary dressing segment dominated the surgical dressing market share in 2024 due to its critical role in direct contact with the wound, providing protection and promoting healing. Primary dressings, such as gauze, films, and foams, are widely used in a variety of surgical procedures for their effectiveness in absorbing exudates and preventing infections. The segment is experiencing steady growth driven by advancements in wound care materials that improve comfort, moisture control, and infection prevention. Additionally, the increasing adoption of minimally invasive surgeries, which require high-quality primary dressings for better wound management, is contributing to its continued dominance in the market.

The secondary dressing segment is registering the fastest growth rate, driven by its complementary role in securing the primary dressing in place and providing additional protection against external contaminants. Secondary dressings, such as adhesive bandages and securing pads, are becoming increasingly sophisticated, with manufacturers incorporating antimicrobial properties and other advanced features to enhance patient recovery. This growth is particularly supported by the rise in chronic disease cases, including diabetes, which necessitates additional layers of protection and management for post-surgical wounds.

By Application Insights

By application, the surgical dressing market is segmented into diabetes based surgeries, cardiovascular diseases, ulcers, burns, transplant sites, and others. The diabetes based surgeries segment accounted for a major market share in 2024, driven by the increasing prevalence of diabetes globally. Diabetic patients often require surgeries due to complications such as diabetic foot ulcers, infections, and amputations, which necessitate advanced wound care solutions. The demand for surgical dressings specifically designed to manage wounds is expected to remain high as the number of diabetic patients continues to rise, particularly in developing regions. This segment benefits from the growing focus on improving post-surgical recovery and preventing infection in diabetic patients, which is propelling surgical dressing market demand.

The ulcers segment is registering the fastest growth, attributed to the rising incidence of chronic ulcers, particularly pressure ulcers and venous ulcers, often seen in aging populations. These ulcers are slow to heal and require constant management, creating a significant demand for advanced surgical dressings that optimize healing conditions, reduce infection risks, and manage exudates effectively. Furthermore, increasing awareness about ulcer management and better treatment protocols are contributing to the growth of the segment. The combination of the aging population and the prevalence of chronic conditions such as vascular diseases and diabetes is likely to further boost the demand for surgical dressings in the ulcer care segment.

By End Use Insights

The surgical dressing market, by end use, is segmented into hospitals, specialty clinics, home healthcare, ambulatory surgery centers, and others. The hospitals segment held the largest share of the surgical dressing market revenue in 2024, driven by the high volume of surgeries performed in hospitals, which necessitate the use of advanced wound care products. Hospitals require a wide range of surgical dressings to manage various types of wounds resulting from surgical procedures, making it a dominant segment. The growing number of hospital admissions and surgical interventions, especially those involving chronic diseases and aging populations, continues to support the demand for surgical dressings in hospitals.

The home healthcare segment is registering the fastest growth rate owing to rising healthcare costs and a shift toward at-home care for post-surgical recovery. The segment benefits from the growing adoption of remote monitoring and telemedicine, which facilitate wound care management at home. The need for high-quality, easy-to-use dressings that can be applied and maintained without professional assistance is becoming more pronounced as home healthcare solutions evolve, contributing to the segment’s rapid expansion.

Regional Outlook

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market share in 2024, primarily driven by advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on innovation in medical products. The region's well-established healthcare systems and rising prevalence of surgical procedures, particularly in hospitals and specialized clinics, contribute significantly to the demand for surgical dressings. Additionally, the increasing adoption of minimally invasive surgeries and growing awareness of advanced wound care technologies further boost the market expansion in North America. The presence of key players and the focus on regulatory approvals for new dressing materials also support the region's dominance in the global market.

Europe is a significant market for surgical dressings, driven by the region’s advanced healthcare infrastructure and high standards of patient care. The demand for surgical dressings in Europe is primarily fueled by an aging population, which increases the incidence of chronic diseases and surgeries requiring wound care. The growing focus on minimally invasive surgeries and advanced wound management technologies further supports market expansion in the region. Additionally, countries such as Germany, the UK, and France are key contributors to the market due to their well-established healthcare systems and regulatory frameworks that ensure the availability of high-quality surgical dressings. Increased awareness and adoption of advanced dressings, such as antimicrobial and bioactive products, are also contributing to the market growth in this region.

The Asia Pacific surgical dressing market is witnessing rapid growth, driven by increasing healthcare investments, a rising population, and improving access to healthcare services. The demand for surgical dressings is particularly strong in countries such as China, India, and Japan, where the growing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, requires more surgical interventions. The expanding middle class in these nations is also contributing to the demand for better healthcare services and advanced wound care products, including surgical dressing. Moreover, the region’s increasing adoption of modern medical practices, combined with the rising awareness of infection control and wound care, is accelerating the market expansion in Asia Pacific.

Key Players and Competitive Analysis Report:

Key players in the market include companies such as 3M Company, Johnson & Johnson, and Medtronic, which offer a wide range of wound care solutions. Other prominent players include Baxter International Inc., Smith & Nephew, and B. Braun Melsungen AG, which are known for their advanced dressings and medical products. Coloplast A/S is also a key participant, focusing on innovative solutions for wound care and management. Further contributors to the market include ConvaTec Group, Molnlycke Health Care, and HARTMANN Group, known for their comprehensive range of dressings and specialized medical supplies. Additional companies such as Derma Sciences, Inc.; Medi-Globe GmbH; and Hollister Incorporated play significant roles in the market with their advanced products tailored for different types of wounds.

The competitive landscape of the market reflects a diverse array of companies working across various segments of wound care, from primary to secondary dressings, and addressing specific patient needs. Companies are focusing on introducing advanced features, such as antimicrobial properties, moisture management, and enhanced comfort, to differentiate their offerings. Additionally, there is significant investment in research and development to create more effective dressings that can help speed up healing and reduce infection risks. These players are also leveraging partnerships, collaborations, and acquisitions to expand their reach and capabilities in the global market. Regulatory approvals and compliance with healthcare standards remain crucial in maintaining a competitive edge, particularly in regions such as North America and Europe.

The strategic direction of these companies often revolves around expanding their product lines to cater to various medical conditions, improving patient care, and driving cost efficiency. Many companies are focusing on emerging markets, such as Asia Pacific and Latin America, where healthcare systems are developing, and demand for advanced medical solutions is rising. Moreover, companies are also focusing on sustainability and eco-friendly packaging, which is becoming an increasingly important factor in the healthcare sector. As the market grows, the key players are likely to increase their investments in both product innovation and global distribution networks to cater to the expanding demand for surgical dressings worldwide.

3M is a multinational conglomerate based in the US, known for its diverse range of products across various sectors, including healthcare, consumer goods, and industrial applications. In the healthcare sector, 3M offers a variety of surgical dressings and wound care solutions designed to promote healing and prevent infection. The company's commitment to innovation is evident in its development of advanced wound care products that address the evolving needs of patients and healthcare providers.

Johnson & Johnson is a global healthcare company headquartered in the US, operating in sectors such as pharmaceuticals, medical devices, and consumer health products. Within the medical devices segment, Johnson & Johnson provides a range of surgical dressings and wound care products aimed at enhancing patient recovery and minimizing complications. The company's focus on research and development has led to the creation of advanced wound care solutions that cater to diverse medical needs.

List of Key Companies

- 3M

- B. Braun Melsungen AG

- Baxter International Inc.

- Coloplast A/S

- ConvaTec Group

- Derma Sciences, Inc.

- HARTMANN Group

- Hollister Incorporated

- Johnson & Johnson

- Medi-Globe GmbH

- Medtronic

- Molnlycke Health Care

- Paul Hartmann AG

- Smith & Nephew

- Zimmer Biomet

Industry Developments

- October 2023: Sylke Inc. launched SYLKE, the first dressing made of pure hypoallergenic silk fibroin. SYLKE is designed to enhance healing across surgical wounds and to reduce complications and infections, which lead to poor scarring outcomes

- October 2021: Healthium Medtech Limited, a global medtech company focused on products used in surgical, post-surgical, and chronic care, announced the launch of TRUSHIELD NXT surgical wound dressing, adding to its portfolio of patented products in the wound care and infection prevention segments.

Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Primary Dressing

- Secondary Dressing

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Diabetes Based Surgeries

- Cardiovascular Disease

- Ulcers

- Burns

- Transplant Sites

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Specialty Clinics

- Home Healthcare

- Ambulatory Surgery Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.30 billion |

|

Market Size Value in 2025 |

USD 5.58 billion |

|

Revenue Forecast by 2034 |

USD 9.07 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The surgical dressing market has been broadly segmented on the basis of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The surgical dressing market growth and marketing strategy focuses on expanding product offerings through innovation and technological advancements. Companies are investing in research and development to create advanced dressings that address specific patient needs, such as antimicrobial properties, better moisture control, and faster healing. Partnerships and collaborations with healthcare providers are increasingly common to enhance distribution networks and reach a broader customer base. Furthermore, companies are targeting emerging markets where healthcare infrastructure is improving, and the demand for surgical dressings is rising. Additionally, the use of digital platforms for marketing and educating healthcare professionals about new products is becoming a key focus.

FAQ's

The surgical dressing market size was valued at USD 5.30 billion in 2024 and is projected to grow to USD 9.07 billion by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market are 3M Company, Johnson & Johnson, and Medtronic, which offer a wide range of wound care solutions. Other prominent players include Baxter International Inc., Smith & Nephew, and B. Braun Melsungen AG, which are known for their advanced dressings and medical products.

The primary dressing segment accounted for the largest share of the market in 2024.

The diabetes based surgeries segment accounted for the largest share of the market in 2024.

Surgical dressing refers to the materials used to cover and protect a wound after a surgical procedure. These dressings are designed to absorb exudates, prevent infection, and promote healing by providing a protective barrier against external contaminants. The dressings are available in various forms, such as gauze, films, foams, and hydrocolloids, and are often chosen based on the type of wound, its location, and the patient's specific needs. Surgical dressings are essential for managing surgical wounds, helping to prevent complications such as infections, and ensuring the proper healing environment for recovery.

A few key trends in the market are described below: Advancements in wound care technology: Development of advanced materials such as antimicrobial, bioactive, and hydrocolloid dressings. Minimally invasive surgeries: Increased adoption leading to a higher demand for specialized surgical dressings. Focus on patient comfort and faster recovery: Dressings are designed for enhanced comfort, quicker healing, and reduced scarring. Customization and personalized wound care: Growing demand for dressings tailored to specific types of wounds and patient needs.

A new company entering the surgical dressing market must focus on innovation by developing advanced wound care solutions, such as antimicrobial and bioactive dressings, which address infection prevention and promote faster healing. Focusing on patient comfort, ease of use, and minimizing scarring would be essential to differentiate in a competitive market. Additionally, targeting emerging markets with growing healthcare infrastructure could offer significant growth opportunities. Investing in sustainable and eco-friendly materials would appeal to the increasing demand for environmentally conscious products. Lastly, building strong partnerships with healthcare providers and leveraging digital platforms for education and remote monitoring could enhance market reach and credibility.

Companies manufacturing, distributing, or purchasing surgical dressing products, and other consulting firms must buy the report.