Hydrofluoric Acid Market Size, Share, Trends, Industry Analysis Report

By Grade (Anhydrous, Diluted), By Application (Fluorocarbon, Fluorinated Derivatives, Metal Pickling, Glass Etching, Oil Refining, Others), By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6187

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

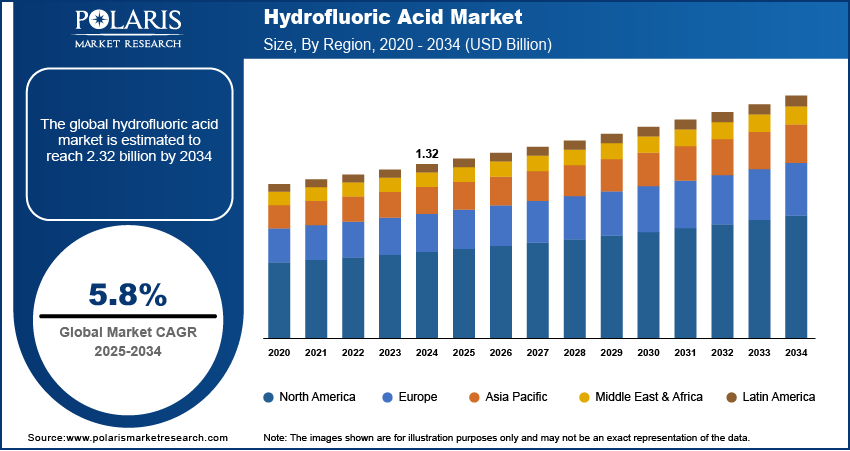

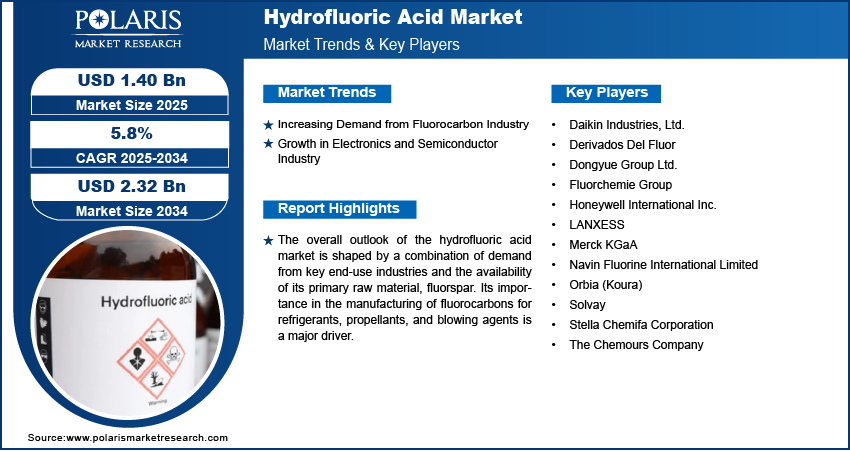

The global hydrofluoric acid market size was valued at USD 1.32 billion in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The demand for hydrofluoric acid is primarily driven by its growing use in the production of fluorocarbons and fluorinated derivatives, which are vital for refrigerants and various industrial applications. Additionally, increasing demand from the electronics and semiconductor sector for etching and cleaning silicon wafers significantly contributes to its growth.

Key Insights

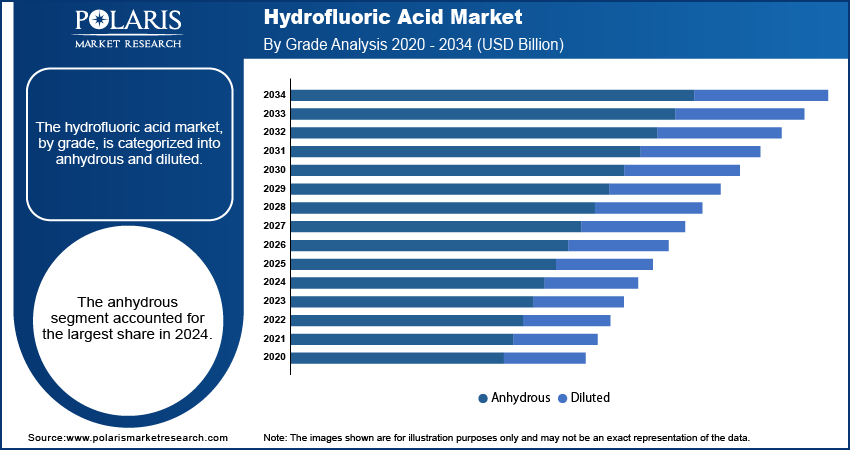

- By grade, the anhydrous segment held the largest share in 2024 due to its critical role in the production of fluorocarbons and its extensive use in the petrochemical sector. Its high purity and absence of water are essential for various chemical processes, making it indispensable for large-scale industrial applications globally.

- Based on application, the fluorocarbon production segment held the largest share in 2024. This is driven by the consistent global demand for fluorocarbons, which are vital for manufacturing refrigerants, air conditioning systems, and various blowing agents, thereby consuming a significant volume of hydrofluoric acid.

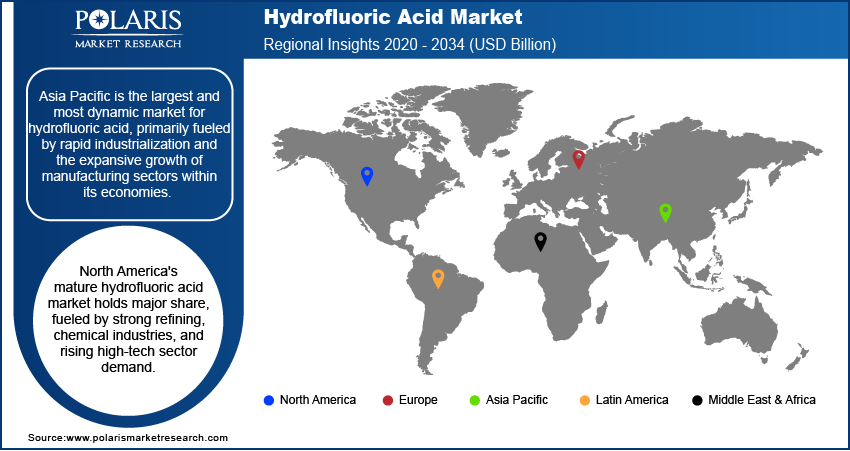

- Asia Pacific is the largest and most dynamic market for hydrofluoric acid, primarily fueled by rapid industrialization and the expansive growth of manufacturing sectors within its economies. The North American hydrofluoric acid market is mature and holds a significant share, driven by established industries such as petroleum refining, chemical manufacturing, and a growing emphasis on high-tech sectors.

Industry Dynamics

- The increasing global demand for fluorocarbons and other fluorinated derivatives significantly boosts consumption. These compounds are essential in the manufacturing of refrigerants, blowing agents, and various specialty chemicals that are widely used across diverse industries. This sustained need for fluorinated products directly influences the production requirements.

- A major driver is the rapid expansion of the electronics and semiconductor sectors. As a critical material for etching and cleaning silicon wafers and other components, the rising production of electronic devices, including smartphones, computers, and advanced circuitry, consistently fuels the need for high-purity forms of this acid.

- Growth in the metal treatment and oil refining industries also contributes substantially to demand. In metal applications, it is used for pickling to remove impurities and scales from various metals, while in oil refining, it plays a vital role in alkylation processes to produce high-octane gasoline.

Market Statistics

- 2024 Market Size: USD 1.32 billion

- 2034 Projected Market Size: USD 2.32 billion

- CAGR (2025–2034): 5.8%

- Asia Pacific: Largest market in 2024

The hydrofluoric acid market involves the production and distribution of hydrofluoric acid (HF), a highly corrosive and versatile compound. The acid is a critical raw material used in numerous industrial processes, forming the backbone for a wide range of fluorine-based products and applications.

The hydrofluoric acid industry is driven by the increasing focus on technological advancements in production processes. Innovations in manufacturing aim to improve efficiency, reduce energy consumption that leads to renewable energy, and minimize environmental impact. New methods for producing hydrofluoric acid from fluorosilicic acid, a byproduct of phosphate fertilizer production, including complex fertilizers, are being explored. This approach could reduce reliance on traditional raw materials like fluorspar and offer a more sustainable production route, thereby affecting the overall supply dynamics.

Another driver is the evolving regulatory landscape and safety standards. Due to its highly corrosive and toxic nature, hydrofluoric acid is subject to strict regulations regarding its handling, storage, transportation, and disposal. These stringent rules, often enforced by government bodies such as the Occupational Safety and Health Administration (OSHA) in the U.S., push manufacturers and users to invest in advanced safety measures and compliance protocols. This leads to higher operational costs and promotes safer practices across the landscape. For example, the U.S. Chemical Safety Board (CSB) has investigated incidents involving hydrofluoric acid, leading to recommendations for enhanced safety procedures in facilities that utilize it.

Drivers and Trends

Increasing Demand from Fluorocarbon Industry: The fluorocarbon sector stands as a primary consumer of hydrofluoric acid, as it is a fundamental building block for a wide range of fluorinated compounds. These compounds are extensively used in various applications, including refrigerants, aerosols, propellants, and blowing agents. The continuous need for refrigeration and air conditioning, especially in developing economies, coupled with the expansion of cold chain logistics for food and pharmaceuticals, consistently drives the demand for fluorocarbons. This robust consumption necessitates a steady supply of hydrofluoric acid for their production.

The U.S. Environmental Protection Agency (EPA) reports on the "Fluorinated Greenhouse Gas Emissions and Supplies Reported to the GHGRP" as of March 2025, indicating that producers of fluorinated gases (F-gases) are required to report their annual emissions and supply data. This data is relevant to the American Innovation and Manufacturing (AIM) Act of 2020, which aims to phase down hydrofluorocarbon (HFC) production and consumption. Despite phase-down efforts for certain types of fluorocarbons, the overall demand for newly developed low global warming potential (GWP) alternatives and other fluorinated derivatives continues to grow, maintaining the need for hydrofluoric acid. This sustained need for fluorinated products, including new generation refrigerants, continues to drive the demand for hydrofluoric acid.

Growth in Electronics and Semiconductor Sector: The electronics and semiconductor sector represents a significant driver, particularly for high-purity grades. Hydrofluoric acid is a crucial chemical in the fabrication of integrated circuits, microchips, and other electronic components. It is widely used in various processes such as etching silicon wafers, cleaning surfaces, and removing unwanted layers during manufacturing. The ongoing trend of miniaturization in electronic devices and the increasing complexity of chip designs necessitate higher purity levels of hydrofluoric acid, driving innovation and demand within this segment.

According to an article titled "The changing landscape of semiconductor manufacturing: why the health sector should care" published in PubMed Central (PMC) in June 2023, modern semiconductor manufacturing relies on highly specialized processes where "fabs sit in prominent positions in supply chains for computers, mobile phones, medical devices, and beyond." This indicates the foundational role of semiconductor devices across numerous industries and consumer products, which directly translates to a sustained and growing demand for high-purity hydrofluoric acid as a key processing chemical. The continuous technological advancements and expanding applications of semiconductors are consistently propelling the demand for hydrofluoric acid.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes anhydrous and diluted. The anhydrous segment held the largest share in 2024. This dominance is primarily attributed to its indispensable role in the production of fluorocarbons and in key processes within the petrochemical sector. Anhydrous hydrofluoric acid (AHF) is valued for its extremely high purity and low water content, which are crucial for chemical reactions that cannot tolerate any moisture. In the manufacturing of refrigerants, propellants, and various specialty chemicals, AHF serves as a critical fluorine source. Its reactivity and efficiency in these large-scale industrial applications contribute significantly to its leading position in terms of volume and value. The extensive use of AHF as an intermediate in synthesizing a wide array of fluorine-based compounds ensures its continued high demand across established industries, solidifying its dominant position.

The diluted segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily attributed to its increasing adoption in the electronics and semiconductor sectors, particularly for applications requiring precise etching and cleaning. Diluted hydrofluoric acid (DHF), especially high-purity variants, is essential for processes such as wet etching of silicon wafers, where controlled removal of thin layers is critical for microchip fabrication. As the demand for advanced electronic devices continues to surge globally, the need for DHF, which offers a balance of etching efficiency and controlled reaction, is escalating. Furthermore, the use of DHF in other areas such as glass etching for display panels and cleaning agents in various industrial settings supports its rapid expansion.

Application Analysis

Based on application, the segmentation includes fluorocarbon, fluorinated derivatives, metal pickling, glass etching, oil refining, and others. The fluorocarbon segment held the largest share in 2024, owing to the widespread use of fluorocarbons in essential industries, including refrigeration, air conditioning, and as blowing agents in foams. Hydrofluoric acid is a critical raw material for synthesizing these compounds. The continuous global demand for cooling solutions, driven by urbanization and economic development, particularly in emerging economies, ensures a steady and significant consumption of hydrofluoric acid for fluorocarbon manufacturing. The established infrastructure for fluorocarbon production and their ongoing utility in numerous everyday products solidify this segment's leading position, making it the most significant consumer of the acid.

The fluorinated derivatives segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is largely driven by the increasing demand for specialized fluorinated compounds in high-growth sectors such as pharmaceuticals, agrochemicals, and lithium-ion batteries. Fluorinated derivatives offer unique properties such as enhanced stability, chemical resistance, and performance, making them indispensable in advanced applications. For example, in the production of electrolytes for electric vehicle (EV) batteries, specific fluorinated salts are crucial for performance and longevity. The rapid EV adoption and the continuous innovation in drug discovery and agricultural science are propelling the demand for these high-value derivatives, thereby fueling the swift expansion of hydrofluoric acid consumption in this segment.

Regional Analysis

The Asia Pacific hydrofluoric acid market accounted for the largest share in 2024, primarily due to rapid industrialization, burgeoning manufacturing sectors, and increasing demand from a diverse range of end-use industries. The region's expansive electronics and semiconductor manufacturing capabilities, particularly in countries with high-volume chip production, are enormous consumers of high-purity hydrofluoric acid for etching and cleaning processes. Beyond electronics, robust growth in the chemical, metallurgical, and automotive industries across the region further fuels the demand for both anhydrous and diluted grades of the acid for various applications, including fluorocarbon production and metal treatment.

China Hydrofluoric Acid Market Insights

China dominated in Asia Pacific hydrofluoric acid industry, acting as both a major producer and consumer. The country's vast industrial output, including significant capacities in fluorochemicals, semiconductors, and aluminum production, drives immense demand for hydrofluoric acid. China's rapid economic development and extensive manufacturing base position it as the leading player, with substantial consumption for diverse applications ranging from basic industrial chemicals to high-end electronic-grade materials. The ongoing expansion of its manufacturing sectors continues to reinforce China's pivotal role in shaping the regional and global demand for hydrofluoric acid.

North America Hydrofluoric Acid Market Trends

North America has a mature yet significant market for hydrofluoric acid, driven by established industries such as petroleum refining, chemical manufacturing, and a growing emphasis on high-tech sectors. A substantial portion of demand in this region comes from the use of hydrofluoric acid in alkylation units within oil refineries, which are crucial for producing high-octane gasoline. Furthermore, the robust chemical sector utilizes the acid as a key building block for various fluorinated compounds and specialty chemicals. The region also sees demand from metal treatment applications and the ongoing push for advanced materials in various manufacturing processes, contributing to a stable but evolving landscape for hydrofluoric acid consumption.

U.S. Hydrofluoric Acid Market Overview

In North America, the U.S. held a prominent position in the hydrofluoric acid industry in 2024, largely propelled by its strong industrial base and significant investments in key sectors. The country's extensive oil refining capacity, with many refineries relying on hydrofluoric acid for alkylation, forms a foundational demand driver. Additionally, substantial government and private sector investments in domestic semiconductor manufacturing, such as initiatives to bolster chip production, are creating a surging demand for high-purity hydrofluoric acid used in etching and cleaning processes for advanced electronic components. This focus on high-tech manufacturing, coupled with a solid chemical sector, ensures consistent consumption and development within the U.S. market.

Europe Hydrofluoric Acid Market Assessment

The European hydrofluoric acid market is characterized by a mix of established industrial applications and a growing focus on high-purity and specialized derivatives. The region has a significant chemical sector that relies on hydrofluoric acid for producing various fluorochemicals and fluoropolymers. There is also a notable demand from the metal sector for pickling and surface treatment processes. European regulations concerning environmental impact and safety standards are generally stringent, which encourages innovation in safer handling and more efficient production methods, influencing the dynamics toward higher-grade products and sustainable practices.

The Germany hydrofluoric acid market is a major economy in Europe, playing a crucial role. Its strong manufacturing base, particularly in the automotive, electronics, and chemical sectors, contributes significantly to demand. The country's emphasis on advanced manufacturing and research and development drives the need for high-purity hydrofluoric acid for specialized applications, including precision etching in the electronics area and the production of complex fluorinated derivatives for pharmaceuticals and advanced materials. This industrial strength and commitment to innovation ensure Germany remains a key consumer and influencer in Europe.

Key Players and Competitive Insights

The hydrofluoric acid market features several key players that drive its competitive landscape, including Honeywell International Inc.; Solvay; Daikin Industries, Ltd.; LANXESS; and Stella Chemifa Corporation. These companies, along with others, compete across various segments, from high-purity electronic-grade acid to industrial-grade products for diverse applications. The competitive environment is shaped by factors such as raw material access, technological capabilities in production and purification, and the ability to meet stringent quality and safety standards for different end-use industries.

A few prominent companies in the industry include Honeywell International Inc.; Solvay; Daikin Industries, Ltd.; LANXESS; Stella Chemifa Corporation; Orbia (Koura); Fluorchemie Group; Dongyue Group Ltd.; Merck KGaA; Navin Fluorine International Limited; The Chemours Company; and Derivados Del Fluor.

Key Players

- Daikin Industries, Ltd.

- Derivados Del Fluor

- Dongyue Group Ltd.

- Fluorchemie Group

- Honeywell International Inc.

- LANXESS

- Merck KGaA

- Navin Fluorine International Limited

- Orbia (Koura)

- Solvay

- Stella Chemifa Corporation

- The Chemours Company

Industry Developments

June 2023: Daikin finalized the first two phases of its large-scale fluorine chemicals production facility in Changshu City, Jiangsu Province, China.

Hydrofluoric Acid Market Segmentation

By Grade Outlook (Volume, Kilotons; Revenue – USD Billion, 2020–2034)

- Anhydrous

- Diluted

By Application Outlook (Volume, Kilotons; Revenue – USD Billion, 2020–2034)

- Fluorocarbon

- Fluorinated Derivatives

- Metal Pickling

- Glass Etching

- Oil Refining

- Others

By Regional Outlook (Volume, Kilotons; Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Hydrofluoric Acid Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.32 billion |

|

Market Size in 2025 |

USD 1.40 billion |

|

Revenue Forecast by 2034 |

USD 2.32 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.32 billion in 2024 and is projected to grow to USD 2.32 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include Honeywell International Inc.; Solvay; Daikin Industries, Ltd.; LANXESS; Stella Chemifa Corporation; Orbia (Koura); Fluorchemie Group; Dongyue Group Ltd.; Merck KGaA; Navin Fluorine International Limited; The Chemours Company; and Derivados Del Fluor.

The anhydrous segment accounted for the largest share in 2024.

The fluorinated derivatives segment is expected to witness the fastest growth during the forecast period.