Hydrogen Compressors Market Share, Size, Trends, Industry Analysis Report

By Stage (Single-Stage and Multi-Stage); By Type (Oil-Based and Oil-Free); By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4603

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

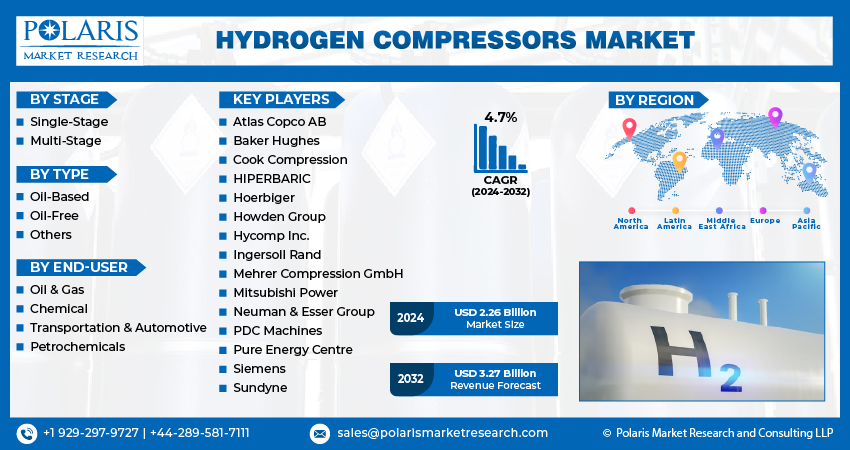

Global hydrogen compressors market size was valued at USD 2.20 billion in 2023. The market is anticipated to grow from USD 2.26 billion in 2024 to USD 3.27 billion by 2032, exhibiting the CAGR of 4.7% during the forecast period

Hydrogen Compressors Market Overview

The push for hydrogen persisted after nine nations representing half of the world's energy sector released fresh plans for reaching their goal of net zero emissions by 2050. Globally, hydrogen technology is advancing quickly as nations seek to switch to renewable energy sources and cut back on carbon emissions. This shift would not be possible without the invention of hydrogen compression units, which allow for the efficient and safe storage and transportation of hydrogen. The advancement of hydrogen technology has accelerated recently on a global basis.

For instance, in October 2023, Atlas Copco collaborated with Hoffman & Hoffman for a distribution agreement for Atlas Copco's full range of industrial process cooling solutions. Hoffman & Hoffman will have exclusive representation for these products in South Carolina, Virginia, North Carolina, and Tennessee.

To Understand More About this Research: Request a Free Sample Report

Moreover, the oil & gas, as well as the chemical sectors, are seeing significant expansion globally. Additionally, there are numerous renewable energy initiatives underway, particularly in Southeast Asia. This growing need for efficient channels in various industries is creating promising prospects for the global hydrogen compressor market development in the future. The present growth in this market is mainly driven by the launch of innovative products by manufacturers of hydrogen compressors.

The COVID-19 pandemic, which began in the early 2020s, had a significant impact on industries worldwide, leading to the enforcement of strict transportation protocols by governments globally. Travel bans, business closures, and widespread lockdowns disrupted industries and economies in various countries. The oil & gas, energy & power, chemical, and other sectors experienced reduced operations due to temporary shutdowns. While all businesses were affected, small and medium enterprises (SMEs) were particularly hard hit by the pandemic. These circumstances also had a detrimental effect on the growth of the hydrogen compressor market.

Hydrogen Compressors Market Dynamics

Market Drivers

Rising Investments by Developing Nations for Substantial Clean Energy is Driving the Market Demand for Hydrogen Compressors

Investments in clean energy often include funding for hydrogen production facilities such as electrolyzers or reforming plants. These facilities typically produce low-pressure hydrogen, which needs to be compressed for storage, transportation, and distribution. The International Energy Agency predicts that global energy investment will reach USD 2.8 trillion in 2023, with a significant portion allocated to clean energy. Over USD 1.7 trillion will go towards renewable electricity, nuclear, grids, storage, low-emission fuels, and efficiency improvements. The remaining funds will support fossil fuel supply and power, with coal receiving about 15% and oil and gas the rest.

As the demand for hydrogen grows, especially in industry, transportation, and power generation, investments in clean energy infrastructure contribute to the hydrogen economy's expansion. Governments worldwide are offering incentives to support renewable energy and hydrogen projects, driving the demand for hydrogen compressors needed for storage and distribution.

Growth in Production Activities by Various Industries is Rising the Demand for Hydrogen Compressor Market

Hydrogen compressors find extensive use across diverse industries for various applications. They are essential for delivering the dry, clean, and oil-free air needed in industries such as food & beverages, pharmaceuticals, consumer electronics, and textiles. The food & beverages sector, in particular, has experienced significant growth, supported by government initiatives. According to a 2022 report from the Food and Agriculture Organization, global government support and funding for the food & agriculture industry amount to approximately US$ 630 billion annually.

Market Restraints

Cost for Maintenance of Hydrogen Compressors Can Restrict the Market Growth

Compressors play a crucial role in safely and cost-effectively transporting hydrogen throughout the value chain. Unlike methane (CH4) or carbon dioxide (CO2), compressing hydrogen presents unique technical challenges. Currently, reciprocating compressors are widely used in hydrogen applications. However, these compressors have limitations in gas flow capacity, especially at low suction pressures, and they tend to have higher maintenance and operation costs compared to rotating turbo compressors. When considering a compressor's lifecycle costs, consider the following factors such as the initial investment, lifetime maintenance costs, and lifetime energy costs. Energy consumption, in particular, makes up a significant portion (around 88%) of a compressor's total cost over a 10-year lifespan. While hydrogen compressors, mainly oil-free options, may have a higher initial cost compared to traditional compressors, this upfront expense can be a deterrent for potential buyers, especially in developing countries or in applications where cost is a significant concern.

Report Segmentation

The market is primarily segmented based on stage, type, end-user, and region.

|

By Stage |

By Type |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Hydrogen Compressors Market Segmental Analysis

By Stage Analysis

The Multi-Stage segment is projected to grow at the fastest CAGR during the projected period. The multi-stage compressor category in the hydrogen compressor market is increasing at the quickest rate due to a number of variables. These compressors are typically utilized for pipe-based hydrogen transfer as well as tank and hydrogen generating facility filling. Because of the multi-stage architecture, compression of hydrogen can be done in numerous steps, reducing temperature rise during the process and labor requirements while increasing overall efficiency. This is particularly important when handling the unique properties of hydrogen gas, namely its high compressibility and low molecular weight. In addition, the growing demand for hydrogen as a renewable alternative fuel and the need for improved and more affordable hydrogen compression technologies are driving the need for multi-stage compressors.

By Type Analysis

The Oil-based segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. In comparison to oil-free compressors, oil-based lubricated compressors are less expensive, have a longer service life, and are best suited for commercial and industrial applications, that is, unless the industry in question has a very high risk of oil contamination and requires the use of oil-free compressors. Oil-based compressors are deemed more effective than oil-free compressors because oil serves as a cooling agent, removing around 80% of the heat generated during compression. This makes them particularly suitable for industrial applications that demand high compression ratios.

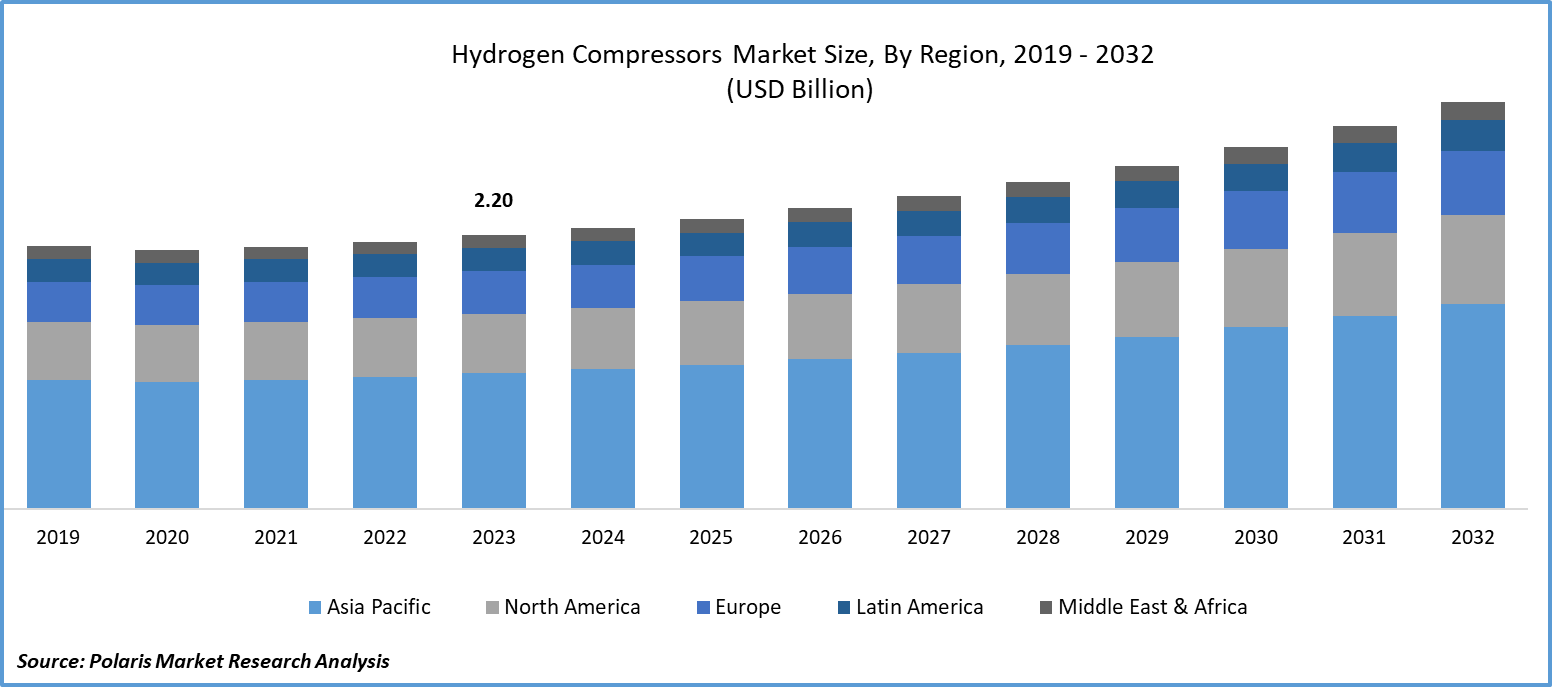

Hydrogen Compressors Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the hydrogen compressor market forecast period. The Asia-Pacific region's leadership in the hydrogen compressor market demand can be attributed to several factors. The region is undergoing rapid industrialization and urbanization, leading to a substantial demand for energy and power. This increased demand aligns with a growing emphasis on renewable energy sources, where hydrogen plays a crucial role. Government policies promoting sustainability and clean energy also contribute to the adoption of hydrogen compressors.

Moreover, the Asia-Pacific region is experiencing significant growth in the reciprocating hydrogen compressor market, driven by the increasing focus on renewable energy. Key manufacturers of hydrogen compressors in Asia-Pacific include well-known companies such as Siemens, Neuman & Esser Group, Mitsubishi Power, and Atlas Copco AB. Moreover, substantial investments from Japan, South Korea, and China in the advancement of hydrogen fuel cell technology and infrastructure are fueling market opportunities in the region.

The Europe region is expected to be the fastest growing region with the highest CAGR rate during the forecast period, owing to government support and initiatives for clean hydrogen production that are driving the Europe hydrogen compressor market. The EU government has allocated approximately US$ 578 billion for climate spending from 2021 to 2027.

Additionally, the European Commission has earmarked US$ 847.2 billion from the climate change innovation fund for the production of renewable hydrogen. Hydrogen compressors are widely used in renewable energy applications, supported by government initiatives. The Europe hydrogen compressor market development is further propelled by increasing investments in the oil & gas industry. The region's oil & gas sector is witnessing significant projects such as the Johan Sverdrup and Johan Castberg oil field developments in Norway, the Lochnagar and Rosebank oil and gas exploration in the UK, and the Aphrodite Gas Field in Cyprus, creating substantial demand for hydrogen compressors.

Competitive Landscape

The Hydrogen Compressors market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Atlas Copco AB

- Baker Hughes

- Cook Compression

- HIPERBARIC

- Hoerbiger

- Howden Group

- Hycomp Inc.

- Ingersoll Rand

- Mehrer Compression GmbH

- Mitsubishi Power

- Neuman & Esser Group

- PDC Machines

- Pure Energy Centre

- Siemens

- Sundyne

Recent Developments

- In August 2023, Sundyne introduced four new standard PPI diaphragm compressor packages aimed at simplifying the process of purchasing, deploying, and maintaining PPI hydrogen compressors. These packages are designed to be more convenient, faster, and cost-effective. They cover a pressure range from 20 bar (290 psi) suction to 550 bar (8,000 psi) discharge, with flow rates ranging from 10 kg/hr (22 lbs/hr) to 60 kg/hr (132 lbs/hr). Each package can be delivered to comply with either North American or European requirements.

Report Coverage

The hydrogen compressors market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, stage, type, end-user and their futuristic growth opportunities.

Hydrogen Compressors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.26 billion |

|

Revenue forecast in 2032 |

USD 3.27 billion |

|

CAGR |

4.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Stage, By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Hydrogen Compressors Market are Siemens, Mitsubishi Power, Neuman & Esser Group, Atlas Copco AB, Howden Group

Hydrogen Compressors Market exhibiting the CAGR of 4.7% during the forecast period

The Hydrogen Compressors Market report covering key segments are stage, type, end-user, and region.

key driving factors in Hydrogen Compressors Market are Rising investments by developing nations for substantial clean energy

The global hydrogen compressors market size is expected to reach USD 3.27 billion by 2032