Industrial Boiler Market Size, Share, Trends, Industry Analysis Report

: By Fuel Type (Oil & Gas, Fossil, Non-Fossil, Biomass, and Others), By Boiler Type, By Function, By End-Use Industry, By Region – Market Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5672

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

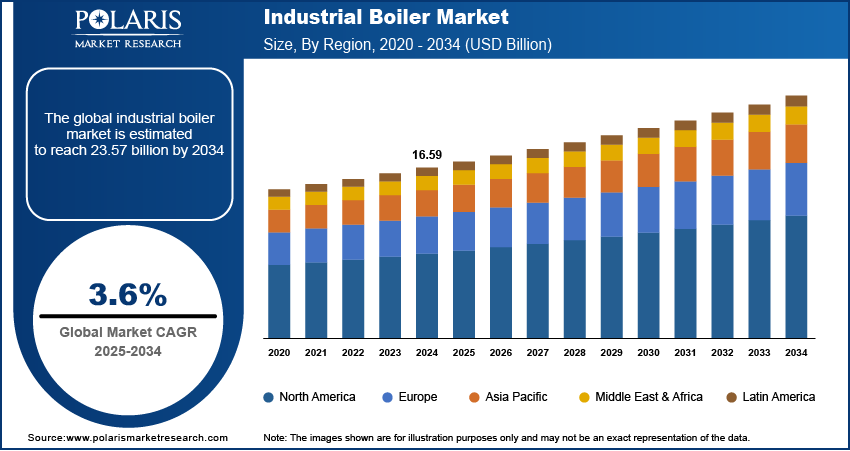

Industrial boiler market size was valued at USD 16.59 billion in 2024, exhibiting a CAGR of 3.6% during the forecast period. The industrial boiler industry is propelled by growing energy efficiency needs, swift industrialization, tougher environmental standards, and rising use of smart technologies and infrastructure investment.

Key Insights

- In 2024, the fossil fuel segment accounted for the largest share of the market, primarily due to its long history of application in high-heat-demand industries, such as power generation and manufacturing.

- The paper & pulp sector is expected to grow the fastest because more people worldwide need paper and paperboard packaging.

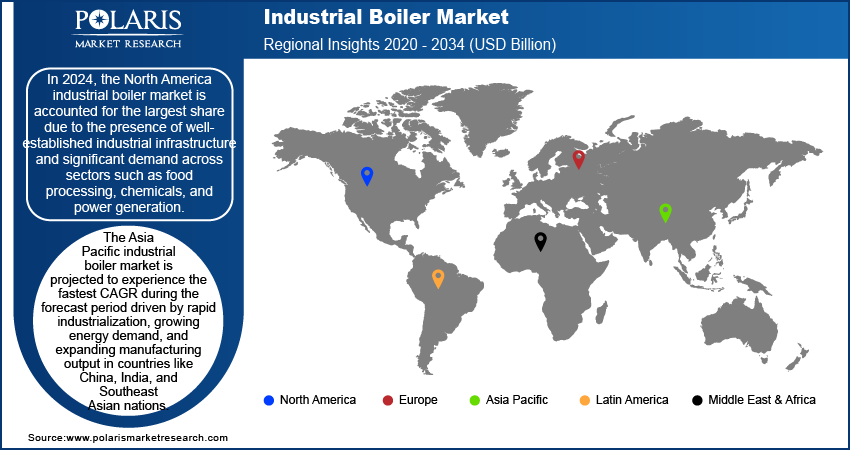

- North America dominated the industrial boiler market in 2024, driven by its well-developed industrial base and substantial demand from major industries, including food processing, chemicals, and power generation.

- The market in Asia Pacific is predicted to register the highest CAGR over the forecast period, driven by rapid industrialization, increasing energy demands, and expanding manufacturing operations in countries such as China, India, and those in Southeast Asia.

Industry Dynamics

- The increasing need for efficient steam and heat production, along with the advancement of automation and intelligent technologies, is driving long-term market growth.

- Growing investment in industrial and power infrastructure in developing markets is a significant driver of market expansion.

- Stronger environmental rules are helping to make boilers cleaner and more efficient, allowing industries to use greener heating solutions.

- High upfront costs and installation expenses make it challenging for small and medium-sized businesses to purchase industrial boilers.

Market Statistics

2024 Market Size: USD 16.59 billion

2034 Projected Market Size: USD 23.57 billion

CAGR (2025-2034): 3.6%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

The industrial boiler market refers to the global industry focused on the manufacturing, distribution, and deployment of large-scale boilers used in industrial processes to generate steam or hot water. These boilers are essential components in industries such as food and beverage, chemicals, oil and gas, pulp and paper, power generation, and manufacturing. Designed for high efficiency and scalability, industrial boilers support heating, energy production, and mechanical operations within complex industrial environments. The market includes various types such as fire-tube, water-tube, and electric boilers, and operates under stringent regulatory standards related to emissions, fuel efficiency, and operational safety. Rising demand for energy-efficient heating solutions is driving market expansion. Industries are under increasing pressure to reduce operational costs and environmental impact. Energy-efficient industrial boilers that offer lower fuel consumption and reduced emissions are in high demand. This trend is contributing to industrial boiler market growth, particularly as companies upgrade or replace older systems with modern, high-efficiency units.

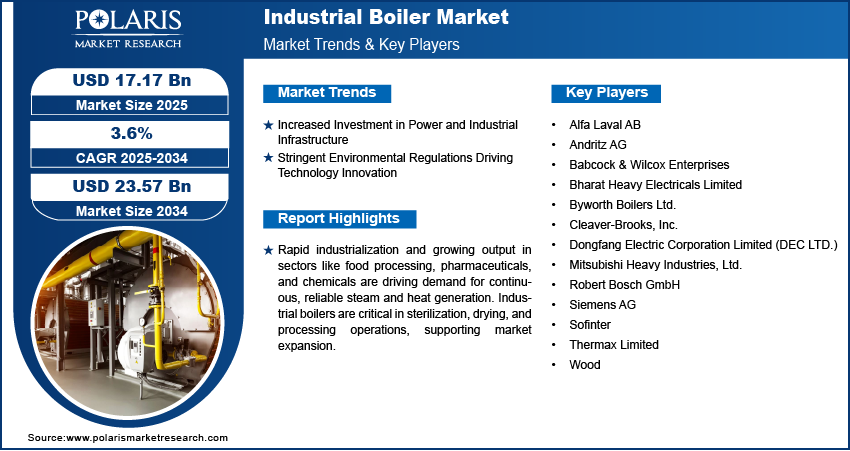

Rapid industrialization and growing output in sectors like food processing, pharmaceuticals, and chemicals are driving demand for continuous, reliable steam and heat generation. Industrial boilers are critical in sterilization, drying, and processing operations, supporting market expansion. For instance, in 2023, according to the US Energy Information Administration, industrial energy consumption in the US. increased by 3% compared to the previous year, driven by growth in food processing, pharmaceuticals, and chemical manufacturing. Additionally, the emergence of Industry 4.0 is driving the integration of automation, IoT, and advanced control systems in boiler operations. Smart boilers equipped with real-time monitoring, predictive maintenance, and automated controls are enhancing operational efficiency and safety. These technological advancements are supporting industrial boiler market expansion by offering improved performance, reduced downtime, and optimized energy use.

Market Dynamics

Increased Investment in Power and Industrial Infrastructure

Rising investments in industrial and power infrastructure across emerging markets are significantly contributing to industrial boiler market growth. Rapid urbanization, expanding manufacturing output, and rising energy demand in regions such as Asia Pacific, the Middle East, and Latin America are driving the need for high-capacity and reliable steam generation systems. Governments and private sector players are pouring capital into large-scale projects in sectors like oil & gas, chemicals, and power generation, creating steady demand for robust and efficient industrial boilers. For instance, according to the US Department of Energy, the Bipartisan Infrastructure Law allocates USD 62 billion to the Department of Energy, establishing 60 new initiatives and enhancing funding for 12 pre-existing programs. This investment aims to accelerate innovation and infrastructure development across various energy sectors, enhancing resilience and promoting sustainable practices. These infrastructure upgrades require advanced thermal systems that ensure high operational uptime and energy efficiency. The sustained pace of these developments is reinforcing long-term industrial boiler market expansion across both greenfield and brownfield installations.

Stringent Environmental Regulations Driving Technology Innovation

Stringent global environmental regulations aimed at curbing industrial emissions and improving energy efficiency are pushing boiler manufacturers toward innovative, cleaner technologies. Regulatory frameworks such as the Industrial Emissions Directive (IED) in Europe and Clean Air Acts in various countries are compelling the adoption of low NOx and SOx emission boilers. Manufacturers are investing in R&D to develop systems that accommodate alternative fuels, advanced combustion controls, and waste heat recovery features. This regulatory environment is driving innovation and also contributing to the market growth of next-generation industrial boilers. The demand for systems that meet compliance without compromising performance is accelerating the transition to environmentally sustainable industrial heating solutions.

Segment Insights

Market Assessment by Fuel Type Outlook

The global industrial boiler market segmentation is based on product and fuel type includes, oil & gas, fossil, non-fossil, biomass, and others. In 2024, the fossil fuel segment held the largest market share due to its long-established presence in industries requiring high heat output, such as power generation and manufacturing. Fossil fuels, particularly coal, liquefied natural gas, and oil, continue to be the most reliable and cost-effective energy sources for high-capacity steam generation. Industries with high thermal energy demands, including cement, steel, and power plants, still predominantly rely on fossil fuels to ensure consistent energy supply. Despite the growth of renewable energy sources, the fossil fuel segment remains a key player, supporting the global industrial boiler market.

The oil & gas segment is expected to witness significant growth over the forecast period, driven by increasing demand for energy and advancements in extraction processes. The industry’s requirement for continuous, high-efficiency steam generation for refining, processing, and power transformer applications directly boosts the demand for specialized oil & gas boilers. Additionally, the adoption of natural gas as a cleaner alternative to coal in power plants and industrial processes is further contributing to the oil & gas boiler segment's expansion.

Market Evaluation by End-Use Industry Outlook

The global industrial boiler market segmentation is based on end-use industry includes, chemicals & petrochemicals, paper & pulp, food & beverages, metals & mining, and others. The chemicals & petrochemicals segment accounted for the largest market share in 2024 due to the sector's high energy requirements for manufacturing processes such as refining, polymer production, and chemical synthesis. Industrial boilers are integral in maintaining the consistent temperature and steam pressure needed for critical processes, including distillation, drying, and heat exchangers. As global demand for chemicals, especially in emerging markets, continues to rise, manufacturers in this sector are increasingly investing in advanced boiler technologies to enhance energy efficiency, reduce emissions, and meet regulatory standards. These factors are significantly driving market growth in this segment.

The paper & pulp segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing global demand for paper and paperboard packaging materials. Industrial boilers play a crucial role in providing the high-pressure steam necessary for pulping, drying, and energy generation in paper mills. The growing emphasis on sustainable practices within the paper industry, including the adoption of biomass and waste materials as fuel sources, is also contributing to the demand for efficient and eco-friendly boiler solutions. Additionally, the industry's need for cost-effective, reliable energy sources to optimize production processes is set to drive further growth in the paper & pulp segment.

Market Share by Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America industrial boiler market is accounted for the largest share due to the presence of well-established industrial infrastructure and significant demand across sectors such as food processing, chemicals, and power generation. Strong regulatory frameworks encouraging the adoption of energy-efficient and low-emission boilers have led to early adoption of advanced technologies in the region. Continuous modernization of aging industrial equipment, combined with increasing investment in cleaner fuel technologies, has reinforced regional market dominance. Moreover, stringent emission norms set by agencies such as the Environmental Protection Agency (EPA) are pushing industries to upgrade or replace legacy boiler systems, further contributing to industrial boiler market growth across North America.

The Asia Pacific industrial boiler market is projected to experience the fastest CAGR during the forecast period driven by rapid industrialization, growing energy demand, and expanding manufacturing output in countries like China, India, and Southeast Asian nations. For instance, in 2023, the National Bureau of Statistics (NBS) of China reported a 10% year-on-year growth in the food processing and pharmaceutical sectors, driven by increased investments in industrial infrastructure. The chemical industry also reported a 7% output increase, primarily due to rising demand for steam and heat generation systems for processing needs. Government-led infrastructure projects and rising investment in sectors such as cement, steel, chemicals, and food processing are creating robust demand for high-capacity, fuel-efficient boilers. In addition, increasing adoption of biomass and alternative fuels, particularly in rural and semi-urban industrial zones, is supporting market expansion. Industrial policy reforms, supportive incentives, and growing environmental awareness are further accelerating the shift toward technologically advanced, emission-compliant boiler systems across the region.

Key Players & Competitive Analysis Report

The competitive landscape of the industrial boiler market is characterized by intense industry analysis and a strong focus on market expansion strategies aimed at catering to evolving industrial energy demands. Key players are prioritizing technology advancements to develop high-efficiency, low-emission boilers that comply with tightening global environmental regulations. Strategic alliances and joint ventures are being actively pursued to expand manufacturing capabilities, enhance distribution networks, and penetrate emerging markets. Mergers and acquisitions are reshaping the competitive hierarchy, allowing companies to diversify product portfolios and consolidate regional footholds. Post-merger integration efforts are increasingly centered around harmonizing R&D, optimizing supply chains, and accelerating product innovation. Market participants are also launching advanced boiler systems equipped with smart control technologies and automation to meet the rising demand for operational efficiency and remote monitoring capabilities.

Customization and fuel-flexibility are becoming critical differentiators as end users demand solutions that align with both environmental and operational mandates. Furthermore, long-term service agreements and retrofitting solutions are being leveraged to retain existing customers and tap into the aftermarket revenue stream. As industrial sectors evolve, the market is witnessing a shift from traditional boiler models to modular, compact, and digitally integrated systems, reinforcing a dynamic, innovation-driven competitive environment.

Bharat Heavy Electricals Limited (BHEL) is engaged in the manufacturing of electrical equipment and services for power generation and transmission, specializing in heavy electrical machinery. The company was founded in 1964 and is headquartered in New Delhi, India. BHEL's product portfolio includes boilers, turbines, generators, and transformers tailored for thermal and hydroelectric power plants. The services provided by BHEL encompass project engineering, procurement, construction management, and after-sales support for various power projects. The company operates numerous manufacturing facilities across India and has a significant footprint in over 80 countries. Furthermore, in the power plant boiler market, BHEL designs and manufacture high-efficiency boilers that provide diverse energy needs. Bharat Heavy Electricals Limited is engaged in the manufacturing and supply of industrial boilers and boiler components, serving power plants and various industrial sectors in India and overseas. The company provides a comprehensive range of boiler solutions, including fuel-flexible boilers for large-scale projects, and regularly dispatches boiler components for both domestic and international installations

Siemens AG is engaged in the engineering and manufacturing of technology solutions, specializing in electrification, automation, and digitalization across various industries. The company was founded in 1847 and is headquartered in Munich, Germany. Siemens' product portfolio includes systems for power generation and transmission, industrial automation equipment, medical devices, and smart infrastructure solutions. The services provided by Siemens encompass engineering solutions, consulting, and customized systems integration tailored to specific customer needs. Siemens operates in approximately 190 countries. The company's diverse operations allow it to serve a broad range of sectors, including energy, healthcare, transportation, and manufacturing. Moreover, Siemens AG is engaged in the industrial boiler sector by delivering automation, control systems, and digital solutions that enhance the efficiency, safety, and operational reliability of industrial boilers. The company integrates advanced technologies for process optimization within boiler systems, supporting a range of industries worldwide with its engineering expertise and digitalization capabilities.

List Of Key Companies

- Alfa Laval AB

- Andritz AG

- Babcock & Wilcox Enterprises

- Bharat Heavy Electricals Limited

- Byworth Boilers Ltd.

- Cleaver-Brooks, Inc.

- Dongfang Electric Corporation Limited (DEC LTD.)

- Mitsubishi Heavy Industries, Ltd.

- Robert Bosch GmbH

- Siemens AG

- Sofinter

- Thermax Limited

- Wood

Industrial Boiler Industry Developments

In September 2024, Babcock Wanson launched the LV-Pack, an innovative low-voltage electric boiler designed for industrial applications. This advanced boiler combines efficiency and reliability, providing a seamless solution for a variety of steam and hot water requirements. The LV-Pack operates at lower voltage levels, enhancing safety while minimizing energy consumption.

In June 2023, Alfa Laval introduced the world’s first steam boiler systems specifically designed to operate on methanol fuel. This innovative solution enhances fuel flexibility, allowing for the efficient use of methanol in steam generation applications.

In January 2025, Sussman Electric Boilers launched the EWx series electric hot water boiler. This innovative system sets a new benchmark for sustainable heating in commercial and industrial HVAC applications, featuring zero emissions and significantly lowering carbon footprints while ensuring high energy efficiency.

Industrial Boiler Market Segmentation

By Fuel Type Outlook (Revenue USD Billion 2020 - 2034)

- Oil & Gas

- Fossil

- Non-fossil

- Biomass

- Others

By Boiler Type Outlook (Revenue USD Billion 2020 - 2034)

- Fire Tube

- Water Tube

- Others

By Function Outlook (Revenue USD Billion 2020 - 2034)

- Hot Water

- Steam

By End-Use Industry Outlook (Revenue USD Billion 2020 - 2034)

- Chemicals & Petrochemicals

- Paper & Pulp

- Food & Beverages

- Metals & Minings

- Others

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Boiler Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.59 billion |

|

Market Size Value in 2025 |

USD 17.17 billion |

|

Revenue Forecast in 2034 |

USD 23.57 billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue, USD Billion; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global industrial boiler market size was valued at USD 16.59 billion in 2024 and is projected to grow to USD 23.57 billion by 2034.

The global market is projected to grow at a CAGR of 3.6% during the forecast period.

In 2024, the North America industrial boiler market is accounted for the largest share due to the presence of well-established industrial infrastructure and significant demand across sectors such as food processing, chemicals, and power generation.

Some of the key players in the market are Alfa Laval AB; Andritz AG; Babcock & Wilcox Enterprises; Bharat Heavy Electricals Limited; Byworth Boilers Ltd.; Cleaver-Brooks, Inc.; Dongfang Electric Corporation Limited (DEC LTD.); Mitsubishi Heavy Industries, Ltd.; Robert Bosch GmbH; Siemens AG; Sofinter; Thermax Limited; Wood.

In 2024, the fossil fuel segment held the largest market share due to its long-established presence in industries requiring high heat output, such as power generation and manufacturing.

The chemicals & petrochemicals segment accounted for the largest market share in 2024 due to the sector's high energy requirements for manufacturing processes such as refining, polymer production, and chemical synthesis.