Industrial Coatings Market Size, Share, & Industry Analysis Report

: By Technology (Solventborne, Waterborne, Powder Based, and Others), By Resin, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM2508

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

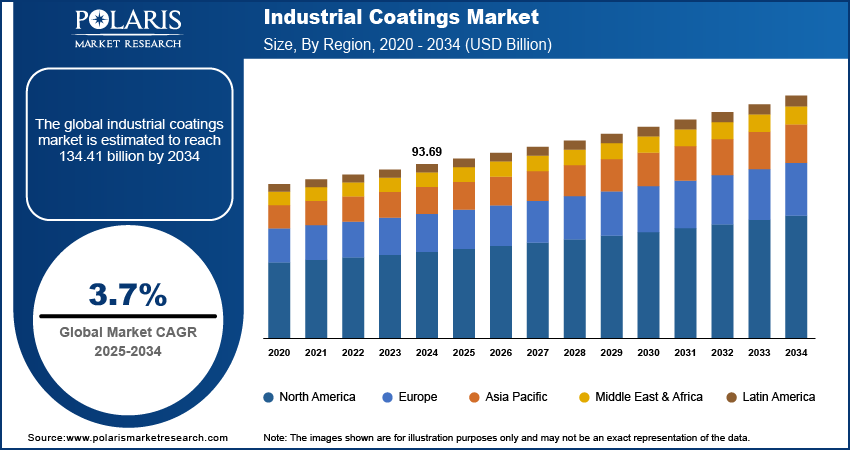

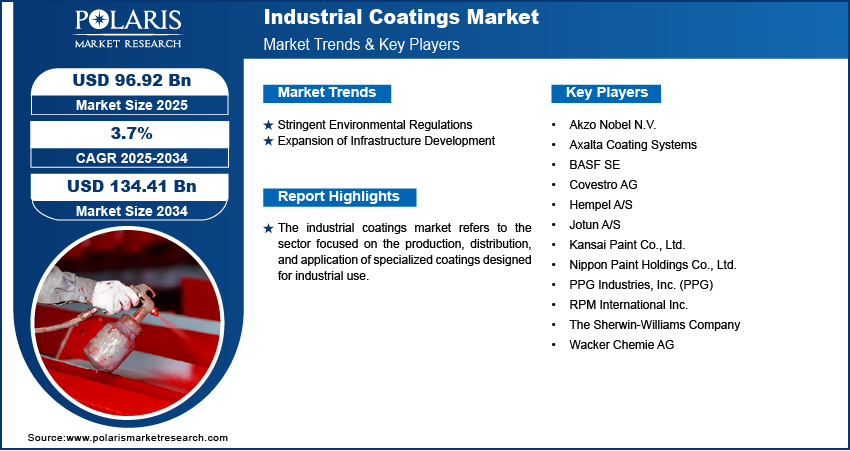

The industrial coatings market size was valued at USD 92.74 billion in 2024. It is projected to grow from USD 95.75 billion in 2025 to USD 130.50 billion by 2034, exhibiting a CAGR of 3.5% during 2025–2034.

The industrial coatings market encompasses protective or functional layers applied to various surfaces in industrial sectors to enhance their performance and longevity. These coatings are specifically engineered to offer resistance against factors such as corrosion, chemicals, abrasion, and extreme temperatures, thereby extending the lifespan of industrial assets and reducing maintenance costs. The demand for industrial coatings is significantly influenced by the level of industrial activity and infrastructure development across different regions. A key driver is the increasing awareness and implementation of stringent environmental regulations, pushing manufacturers to develop and adopt eco-friendly coating solutions such as water-based and low-volatile organic compound (VOC) coatings.

Key Insights

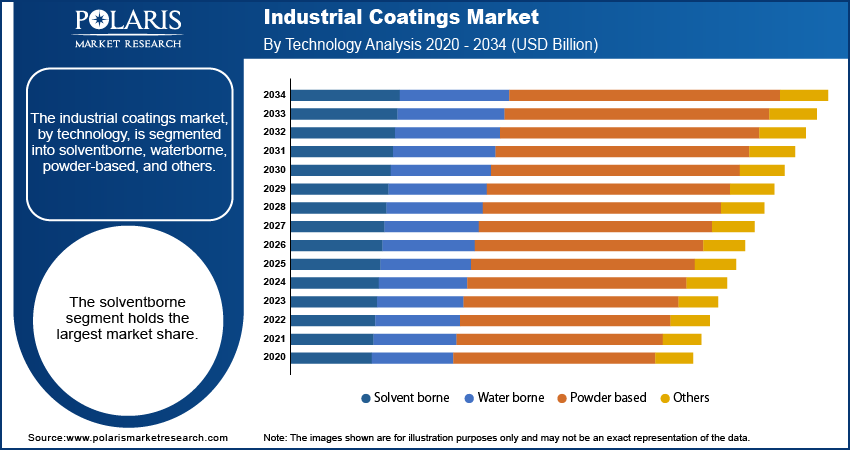

- By technology, solventborne held the largest share in 2024 because of the performance, longevity, and environmental durability of moisture and chemicals.

- By resin, the subsegment epoxy resins held the largest share in 2024 due to the resins having unique attributes, such as high adhesion, high chemical and corrosion resistance.

- By end use, industry segment held the largest share in 2024, because there is increasing requirements for coatings in coil, packaging, building, and farming construction.

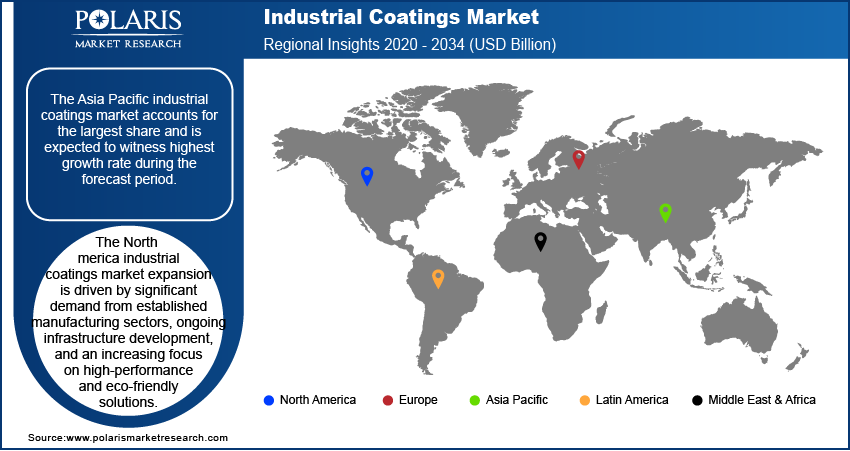

- By region, the Asia Pacific held the largest share in 2024. The region's ongoing industrialization and progress in construction, automotive, and manufacturing sectors are driving industrial coatings demand.

Industry Dynamics

- The rising number of infrastructure projects, especially in emerging countries, is a key driver.

- There is a shift globally in the approach to governing the emission of Volatile Organic Compounds (VOC).

- The general, automotive, and aerospace industries are rapidly growing, which in turn provides demand for coatings.

Market Statistics

- 2024 Market Size: USD 92.74 billion

- 2034 Projected Market Size: USD 130.50 billion

- CAGR (2025-2034): 3.5%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Another significant factor driving the demand for industrial coatings or hard coatings is the robust growth in key end-use industries such as automotive, aerospace, construction, marine, and oil & gas. In the automotive sector, these coatings provide aesthetic appeal and crucial protection against environmental elements, including a product such as paint protective films, contributing to the vehicle's durability. Similarly, in the construction industry, industrial coatings safeguard steel and concrete structures from corrosion and wear, ensuring the longevity and safety of infrastructure projects. The rising demand for high-performance coatings that offer specialized properties, coupled with technological advancements in coating formulations, continues to fuel the expansion.

Market Dynamics

Stringent Environmental Regulations

The increasing implementation of stringent environmental regulations worldwide is a significant driver. Governments and regulatory bodies are focusing on reducing volatile organic compound (VOC) emissions from coatings to mitigate air pollution and protect public health. For instance, the European Union has implemented directives such as the VOC Emissions Directive, which sets limits on the VOC content of paints and varnishes used in buildings and vehicle refinishing. According to a research paper published on PubMed in 2021, the implementation of such regulations has spurred the development and adoption of water-based coatings and powder coatings, which have significantly lower VOC content compared to traditional solvent-based coatings. The rising shift toward eco-friendly coatings, driven by environmental compliance, is a key factor propelling the growth as industries seek sustainable coating solutions.

Expansion of Infrastructure Development

Governments across the world are investing heavily in the construction and maintenance of transportation networks, buildings, and utilities. These infrastructure projects, often involving large steel and concrete structures, require high-performance industrial coatings to provide long-term protection against corrosion, weathering, and other environmental factors. The Global Infrastructure Hub estimates that the world needs to invest $94 trillion in infrastructure by 2040, a significant portion of which will involve projects requiring industrial coatings for protection and durability. For example, as highlighted by the National Center for Biotechnology Information (NCBI) in a 2023 publication discussing material degradation in infrastructure, durable coatings are essential for extending the service life of these assets and reducing maintenance costs. The increasing number of infrastructure development projects, particularly in developing economies, directly translates to a higher demand for industrial coatings.

Growing Automotive Production and Demand

Coatings play a crucial role in the automotive industry, providing both aesthetic appeal and essential protection to vehicle surfaces. These coatings offer resistance against scratches, corrosion, UV radiation, and other environmental damage, contributing to the longevity and overall quality of vehicles. According to data from the Bureau of Transportation Statistics in 2022, the production of passenger cars and light trucks saw a significant rebound globally. The global automotive production reached ∼90 million units in 2023, indicating a significant demand for automotive coatings used for both original equipment manufacturing (OEM) and refinishing. Furthermore, the rising trend of vehicle customization and the increasing focus on exterior finishes are also boosting the demand for a variety of specialized industrial coatings in the automotive sector. Therefore, growing automotive production and increasing demand for vehicles globally act as a significant driver.

Segmental Insights

Market Assessment By Technology

The industrial coatings market, by technology, is segmented into solventborne, waterborne, powder-based, and others. The solventborne coatings segment holds the largest share. These coatings are favored due to their superior performance characteristics, including enhanced resistance to environmental conditions such as temperature and humidity during the curing phase, making them ideal for applications requiring high durability. They are widely used in various industrial sectors, including general industry, oil & gas, marine, and automotive.

The waterborne coatings segment is experiencing the highest growth rate during the forecast period. This growth is primarily driven by increasing environmental awareness and the implementation of stringent regulations regarding VOC emissions across major markets. Waterborne coatings are gaining traction due to their eco-friendly nature; lower VOC content; and other properties such as low odor, enhanced durability, and superior block resistance. The automotive refinishing sector significantly contributes to the demand for waterborne coatings, as manufacturers increasingly adopt these solutions to comply with environmental standards while maintaining high-quality finishing requirements.

Market Evaluation By Resin

The segmentation, by resin, includes epoxy, acrylic, alkyd, polyester, polyurethane, fluoropolymer, and others. The epoxy resin segment accounts for the largest share. Epoxy coatings are highly valued for their exceptional adhesion, chemical resistance, and mechanical strength. These properties make them well-suited for a wide array of demanding industrial applications, including protective coatings for metal substrates, flooring, and industrial maintenance. The extensive use of epoxy coatings in sectors such as construction, marine, and oil & gas contributes significantly to their dominant position.

The polyurethane resin segment is observed to be exhibiting the highest growth rate, fueled by the increasing demand for coatings with excellent flexibility, abrasion resistance, and durability. Polyurethane coatings find extensive applications in industries such as automotive, aerospace, and wood coatings, where these performance characteristics are highly valued. Furthermore, ongoing advancements in polyurethane technology are expanding their application scope and driving their rapid penetration across various industrial sectors.

Market Evaluation By End Use

The segmentation, by end use, includes general industry, automotive, aerospace, power generation, oil and gas, mining, and others. The general industry segment holds the largest share. This segment encompasses a broad range of applications across various manufacturing sectors, including machinery, metal fabrication, and infrastructure. The extensive utilization of industrial coatings for the protection and enhancement of diverse industrial equipment and structures within this segment contributes significantly to its leading position. The sheer volume and variety of coating applications within the general industry underpin its substantial presence.

The automotive segment is experiencing the highest growth rate. This growth is propelled by the increasing global production of vehicles and the rising demand for advanced coatings that offer both aesthetic appeal and functional benefits, such as enhanced durability and resistance to environmental factors. The continuous technological advancements in automotive coatings, coupled with the increasing focus on vehicle lifespan and appearance, are key factors driving the rapid expansion of this end-use segment.

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market demonstrates varied dynamics across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region exhibits unique characteristics influenced by factors such as industrial growth, regulatory landscape, and end-user industry trends. Asia Pacific and North America are significant regions in terms of size and consumption, while other regions present considerable growth opportunities driven by increasing industrialization and infrastructure development.

The Asia Pacific industrial coatings market accounts for the largest share and is also witnessing the highest growth. This dominance is primarily attributed to the rapid industrialization and robust growth in key end-use industries, including automotive, construction, and manufacturing, in countries such as China and India. The increasing investments in infrastructure projects of China and the expanding manufacturing base in this region continue to drive the high demand for industrial coatings, solidifying Asia Pacific's leading position in the global market. The confluence of factors such as increasing disposable incomes, growing manufacturing output, and supportive government initiatives promoting industrial development is fueling this rapid expansion. The rising adoption of advanced coating technologies in India and the increasing awareness regarding the benefits of high-performance industrial coatings across various sectors within Asia Pacific are contributing significantly to its accelerated development and promising outlook.

Which Country Dominated the Asia Pacific Industrial Coatings Market in 2024?

China held the largest revenue share in Asia Pacific market in 2024. Industrialization and infrastructure development in sectors such as transportation, energy, and manufacturing fuel the market demand. Stringent environmental standards encourage the adoption of low-VOC and eco-friendly coatings. Favorable economic conditions and technological advancements fuel the industry growth. The increasing demand for sustainable solutions also drives expansion. The following table provides a summary of the competitive strategies of key companies:

|

Company |

Strategic Focus |

Key Initiatives |

|

Akzo Nobel N.V. |

Shift toward B2B performance coatings |

|

|

PPG Industries, Inc. |

Expansion through manufacturing and distribution network optimization |

|

|

RPM International Inc. |

Focus on protective coatings for industrial applications |

|

|

Jotun |

Focus on marine and protective coatings |

|

|

Sherwin-Williams |

Expansion of product portfolio and regional presence |

|

Companies are focusing on innovation, sustainability, and strategic partnerships. They are expanding their presence in emerging markets. They help maintain competitiveness in the industrial coatings sector.

The North America industrial coatings market expansion is driven by significant demand from established manufacturing sectors, ongoing infrastructure development, and an increasing focus on high-performance and eco-friendly solutions. The construction sector's substantial growth, fueled by rapid urbanization and infrastructure projects, also significantly boosts demand for industrial coatings to protect and enhance building surfaces. The robust growth of the US is underpinned by the country's extensive manufacturing base, particularly in the automotive and aerospace sectors, which are major consumers of industrial coatings for corrosion protection, aesthetic appeal, and increased durability. Stringent environmental regulations, such as those related to volatile organic compound (VOC) emissions, are accelerating the shift toward waterborne, powder, and UV-curable coatings, driving innovation in low-VOC formulations. Additionally, significant reconstruction activities and continuous infrastructure development are creating substantial opportunities for high-performance protective coatings.

Key Players and Competitive Insights

A few of the major players in the industrial coatings market include PPG Industries, Inc. (PPG); The Sherwin-Williams Company; Akzo Nobel N.V.; RPM International Inc.; Axalta Coating Systems; BASF SE; Kansai Paint Co., Ltd.; Nippon Paint Holdings Co., Ltd.; Hempel A/S; Jotun A/S; Wacker Chemie AG; and Covestro AG. These companies offer a wide range of industrial coating solutions catering to diverse end-use industries and applications.

The competitive landscape is characterized by the presence of numerous global and regional players. Competition is primarily based on product innovation, technological advancements, product quality, pricing strategies, and the ability to cater to specific customer requirements. Key insights reveal a focus on developing sustainable and high-performance coatings, along with strategic collaborations, acquisitions, and expansions to enhance penetration and address the evolving demand trends across different geographies and end-user segments.

PPG Industries, Inc. (PPG), headquartered in Pittsburgh, Pennsylvania, USA, offers a comprehensive portfolio of industrial coatings, including liquid, powder, and electrocoat products, serving a wide array of sectors such as automotive, aerospace, industrial equipment, and packaging. Their focus on innovation and sustainable solutions makes them a relevant player in addressing the evolving needs.

Akzo Nobel N.V., based in Amsterdam, Netherlands, provides a broad spectrum of industrial coatings, including protective coatings, marine coatings, and coil coatings, catering to industries such as oil & gas, infrastructure, and transportation. Their commitment to developing advanced and environmentally responsible coating technologies positions them as a key participant.

List of Key Companies in Industrial Coatings Market

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE

- Covestro AG

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc. (PPG)

- RPM International Inc.

- The Sherwin-Williams Company

- Wacker Chemie AG

Industrial Coatings Industry Developments

- February 2025: AkzoNobel's Sikkens Wood Coatings business introduced RUBBOL WF 3350, a new waterborne wood coating containing 20% bio-based content. This product aims to increase the use of renewable raw materials without compromising performance for both interior and exterior applications.

- December 2024: PPG finalized the sale of its architectural coatings business in the US and Canada to American Industrial Partners. This strategic move allows PPG to further optimize its portfolio by focusing on its performance coatings and industrial coatings segments, indicating a strategic realignment.

Industrial Coatings Market Segmentation

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Solventborne

- Waterborne

- Powder Based

- Others

By Resin Outlook (Revenue – USD Billion, 2020–2034)

- Epoxy

- Acrylic

- Alkyd

- Polyester

- Polyurethane

- Fluoropolymer

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- General Industry

- Automotive

- Aerospace

- Power Generation

- Oil and Gas

- Mining

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Industrial Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 92.74 billion |

|

Market Size Value in 2025 |

USD 95.75 billion |

|

Revenue Forecast by 2034 |

USD 130.50 billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The industrial coatings market has been segmented into detailed segments of technology, resin, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A key growth strategy revolves around continuous product innovation, focusing on developing high-performance, sustainable, and specialized coatings tailored to specific end user needs. Market penetration can be enhanced through strategic collaborations with end-use industries and expanding geographical presence, particularly in high-growth regions. Effective marketing strategies emphasize the performance benefits, cost-effectiveness, and environmental advantages of their coating solutions. Furthermore, providing customized solutions and strong technical support to clients can foster long-term relationships and drive demand trends. Exploring digital marketing channels and participating in industry events also aids in increasing brand visibility and reach for industrial coatings.

FAQ's

The global market size was valued at USD 92.74 billion in 2024 and is projected to grow to USD 130.50 billion by 2034.

The market is projected to register a CAGR of 3.5% during the forecast period.

Asia Pacific held the largest share of the market in 2024.

A few of the major players include PPG Industries, Inc. (PPG); The Sherwin-Williams Company; Akzo Nobel N.V.; RPM International Inc.; Axalta Coating Systems; BASF SE; Kansai Paint Co., Ltd.; Nippon Paint Holdings Co., Ltd.; Hempel A/S; Jotun A/S; Wacker Chemie AG; and Covestro AG.

The solventborne segment accounted for the larger share of the market in 2024.

Following are a few of the trends: ? Increasing Demand for Sustainable Coatings: Driven by stricter environmental regulations and growing consumer awareness, there's a significant shift toward eco-friendly coatings with low or zero VOC content, such as waterborne, powder-based, and UV-cured coatings. ? Advancements in Coating Technologies: Continuous innovation in materials science is leading to the development of high-performance coatings with enhanced properties such as self-healing capabilities, anticorrosion, antimicrobial, and improved durability. Nanotechnology is also playing a crucial role in enhancing coating performance. ? Focus on Energy Efficiency: Coatings that contribute to energy savings, such as heat-reflective coatings for buildings and coatings that improve the efficiency of solar panels and electric vehicle batteries, are gaining traction.

Industrial coatings are specialized protective or functional layers applied to surfaces in various industrial sectors. Unlike decorative paints and coatings, their primary purpose is to enhance the performance, durability, and longevity of the underlying materials. These coatings are engineered to withstand harsh conditions such as corrosion, abrasion, chemical exposure, extreme temperatures, and UV radiation, thereby safeguarding industrial assets and reducing maintenance costs. They are applied to a wide range of substrates, including metals, concrete, wood, and plastics, across diverse end-use industries such as automotive, aerospace, construction, oil & gas, and general manufacturing.