Paint Protection Films Market Size, Share, & Industry Analysis Report

: By Material (Thermoplastic Polyurethane, Polyvinyl Chloride, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: pdf

- Report ID: PM3036

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

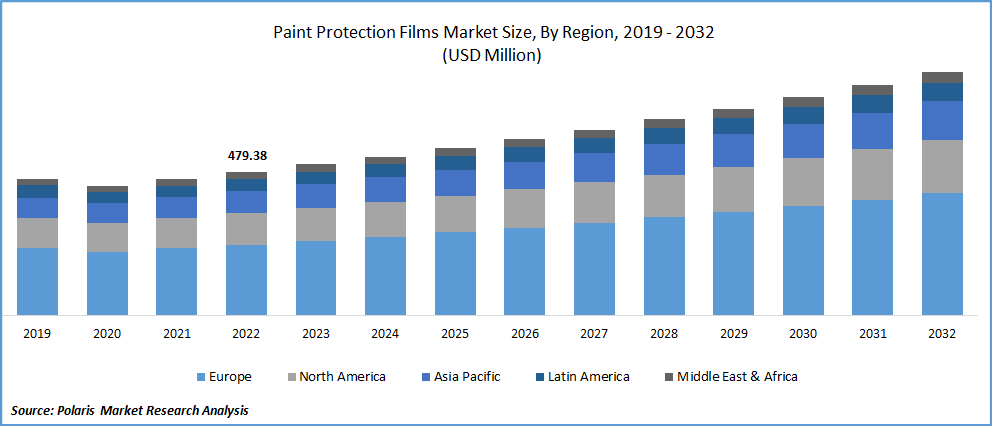

The paint protection films (PPF) market size was valued at USD 502.30 million in 2024. It is projected to grow from USD 533.70 million in 2025 to USD 940.67 million by 2034, exhibiting a CAGR of 6.5% during 2025–2034.

The increasing production and sales of luxury vehicles, especially in developing economies, and the rising awareness about the benefits of PPF in maintaining vehicle appearance and protecting against damage fuel the market expansion.

Paint protection films (PPF), also known as clear bras or clear wraps, are thermoplastic urethane films applied to painted surfaces of vehicles and other items to protect them from scratches, stone chips, bug splatters, and minor abrasions. These automotive wrap films act as a barrier against environmental damage and help maintain the aesthetic appearance and resale value of the protected surfaces. The market is driven by increasing demand for luxury vehicles, growing awareness of vehicle aesthetics and maintenance, and a desire among consumers to preserve the resale value of their vehicles. Technological advancements, such as self-healing properties and improved clarity, are also contributing to the demand for paint protection films.

The automotive industry is the primary consumer of paint protection films, with both original equipment manufacturers (OEMs) and the aftermarket contributing to the PPF demand. The Asia Pacific paint protection films market is experiencing robust growth, driven by expanding automotive and electronics sectors.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Increasing Demand for Luxury Vehicles

The increasing demand for luxury vehicles is significantly propelling the growth of the paint protection film (PPF) market. Affluent consumers are investing in high-end automobiles and seeking advanced solutions to preserve their vehicles' pristine appearance and resale value. PPF offers a durable shield against scratches, stone chips, and environmental contaminants, making it an essential accessory for luxury car owners. The trend of vehicle customization further amplifies this demand, as PPF allows for aesthetic enhancements without compromising protection. Technological advancements, such as self-healing properties and improved optical clarity, have enhanced PPF's appeal. Thus, the PPF market is experiencing robust growth, driven by the intersection of luxury vehicle ownership and the desire for superior protective solutions.

Growing Awareness of Vehicle Aesthetics and Maintenance

There is a growing awareness among vehicle owners regarding the importance of aesthetics and maintenance. The need for PPF is driven by customer preferences for premium vehicles and a growing consciousness of keeping vehicles in top shape. A significant percentage of luxury car buyers are willing to pay more for personalization and maintaining their vehicle's pristine condition, indicating a strong inclination toward protective measures such as PPF. Therefore, increased awareness of vehicle aesthetics and maintenance significantly drives the demand for paint protection films.

Technological Advancements in Paint Protection Films

Technological advancements in paint protection films, such as self-healing properties and improved clarity, are also driving market growth. Ongoing developments in polymer science are leading to PPF with improved clarity, self-healing properties, and increased durability against scratches, chips, and environmental contaminants. Manufacturers are consistently highlighting these advancements in their product literature and demonstrations. Advancements in PPF application techniques, including pre-cut kits and specialized tools, are making the installation process more precise and efficient, reducing the risk of imperfections and improving the overall finish. These technological improvements cater to the increasing consumer demand for high-performance and aesthetically pleasing solutions, such as paint protection films.

Segment Insights

Market Assessment – By Material

The paint protection films (PPF) market, by material, is segmented into thermoplastic polyurethane, polyvinyl chloride, and others. The thermoplastic polyurethane segment holds the largest share, owing to the superior performance characteristics of thermoplastic polyurethane films, including excellent abrasion resistance, high elasticity, and self-healing capabilities. The durability and long-lasting protection offered by thermoplastic polyurethane make it a preferred choice for automotive applications, where safeguarding the vehicle's paints and coatings from various environmental factors is crucial.

The others segment is anticipated to exhibit the highest growth rate in the market. This growth is primarily driven by the increasing adoption of newer, advanced materials and innovative film technologies. These materials often offer specialized properties such as enhanced UV resistance, improved hydrophobic characteristics, and better conformability for complex vehicle surfaces. As technological advancements continue and consumer demand for high-performance and specialized protection solutions rises, the others segment, encompassing these novel materials, is expected to witness substantial expansion in the coming years.

Market Evaluation– By Application

The market, by application, is segmented into automotive & transportation, electrical & electronics, aerospace & defense, and other. The automotive & transportation segment accounts for the largest share, primarily driven by the widespread use of PPF in passenger cars, electric commercial vehicles, and motorcycles to protect their paint from road debris, scratches, and environmental contaminants. The increasing production and sales of vehicles globally, coupled with a growing consumer preference for maintaining vehicle aesthetics and resale value, contribute substantially to the dominance of this application segment.

The electrical & electronics segment is expected to witness the highest growth rate within the market. This rapid growth is fueled by the increasing application of PPF to protect sensitive electronic devices and components from scratches, dust, and moisture. With the proliferation of consumer electronics, such as smartphones, tablets, and wearable devices, there is a rising demand for surface protection solutions that can maintain the aesthetic appeal and functionality of these products. The unique properties of paint protection films, such as their clarity and thinness, make them suitable for various electronic applications, thereby driving significant growth in this segment.

Regional Analysis

The PPF market demonstrates a significant global presence, with distinct regional dynamics shaping its landscape. North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa represent key geographical segments, each influenced by factors such as automotive production rates, consumer spending power, awareness regarding vehicle maintenance, and the presence of key industry players. These regions exhibit varying levels of industry penetration and growth potential, reflecting diverse economic conditions and consumer preferences. Understanding these regional nuances is crucial for assessing the overall market trends and identifying future opportunities.

Asia Pacific currently holds the largest share, and the regional market is expected to record the highest growth rate during the forecast period. This dominance is primarily attributed to the region's burgeoning automotive industry, particularly in countries like China, Japan, and India, which are major vehicle production and consumption hubs. The increasing disposable income of the middle-class population in these countries, coupled with a growing emphasis on vehicle aesthetics and maintenance, fuels the demand for paint protection films. Furthermore, the rising sales of both passenger and commercial vehicles across the region contribute significantly to its leading position in the global market. Moreover, this rapid expansion is driven by a confluence of factors, including the increasing adoption of paint protection films in emerging economies within the region, growing awareness about the benefits of PPF in preserving vehicle appearance and resale value, and the rising demand for luxury and premium vehicles. Additionally, the continuous expansion of the automotive and electronics sectors in Asia Pacific, coupled with technological advancements in film materials and application techniques, is expected to further accelerate the market growth in the region during the forecast period.

Key Players and Competitive Insights

A few major players currently active in the paint protection films market include 3M Company; Eastman Chemical Company (Solutia Inc.); Avery Dennison Corporation; XPEL, Inc.; Madico, Inc.; Saint-Gobain; PremiumShield (Proshield Ltd); STEK Automotive; Orafol Europe GmbH (Orafol); and Argotec LLC. These companies are key manufacturers and suppliers of various types of paint protection films, catering to diverse application industries and end-user demands globally.

The competitive landscape is characterized by a mix of established global players and smaller, specialized manufacturers. Competition is based on product innovation, such as the development of self-healing films and advanced adhesive technologies, product quality and durability, pricing strategies, and the breadth of product offerings. Companies are also focusing on expanding their distribution networks and enhancing customer service to gain a competitive edge. The market witnesses continuous efforts toward product differentiation and strategic collaborations to increase industry penetration and address evolving consumer needs for enhanced vehicle protection and aesthetics.

3M Company, headquartered in Saint Paul, Minnesota, USA, offers a wide range of paint protection films under its Scotchgard brand, catering to the automotive, aerospace, and electronics industries. Their offerings include various film thicknesses and finishes, providing protection against scratches, chips, and stains. 3M's extensive global presence and strong brand reputation contribute to its significant role in the market.

XPEL, Inc., based in San Antonio, Texas, USA, specializes in the manufacturing and distribution of high-performance paint protection films and related software. Their product portfolio includes films with self-healing properties and a variety of finishes. XPEL primarily focuses on the automotive aftermarket, offering solutions for cars, motorcycles, and other vehicles. Their dedication to innovation and a strong focus on the automotive sector have established them as a prominent player in the market.

List of Key Companies in Paint Protection Films Market

- 3M Company

- Argotec LLC

- Avery Dennison Corporation

- Eastman Chemical Company (Solutia Inc.)

- Madico, Inc.

- Orafol Europe GmbH (Orafol)

- PremiumShield (Proshield Ltd)

- Saint-Gobain

- STEK Automotive

- XPEL, Inc.

Paint Protection Films Industry Developments

- February 2025: The Lubrizol Corporation, a specialty chemicals company, announced the launch of a new ESTANE thermoplastic polyurethane (TPU) production line at its manufacturing facility in Shanghai, China.

- January 2025: ALP Group, an Indian manufacturing company, introduced its new range of paint protection films at the Bharat Mobility Global Expo 2025 in New Delhi, India. The new product line includes three variants—Defender, Armor, and Ranger—designed to offer superior protection to vehicle surfaces against environmental damage and wear.

Paint Protection Films Market Segmentation

By Material Outlook (Revenue – USD Million, 2020–2034)

- Thermoplastic Polyurethane

- Polyvinyl Chloride

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defense

- Other

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Paint Protection Films Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 502.30 million |

|

Market Size Value in 2025 |

USD 533.70 million |

|

Revenue Forecast by 2034 |

USD 940.67 million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The paint protection films market has been segmented into detailed segments of material and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy in the market revolves around product innovation, focusing on advancements such as enhanced durability, self-healing capabilities, and improved application techniques to meet evolving consumer demands. Industry penetration can be increased by targeting the growing demand in emerging economies and expanding applications beyond the automotive sector into electronics and aerospace. Strategic collaborations with automotive manufacturers and dealerships can ensure wider adoption at the OEM level.

FAQ's

The paint protection films market size was valued at USD 502.30 million in 2024 and is projected to grow to USD 940.67 million by 2034.

The market is projected to register a CAGR of 6.5% during the forecast period.

North America held the largest share of the market in 2024.

A few major players active in the paint protection films market include 3M Company; Eastman Chemical Company (Solutia Inc.); Avery Dennison Corporation; XPEL, Inc.; Madico, Inc.; Saint-Gobain; PremiumShield (Proshield Ltd); STEK Automotive; Orafol Europe GmbH (Orafol); and Argotec LLC.

The thermoplastic polyurethane segment accounted for the largest share of the market in 2024.

Following are a few of the paint protection films market trends: ? Increasing adoption of self-healing technology: Consumers are increasingly demanding PPF with self-healing properties that can automatically repair minor scratches and swirl marks, enhancing the longevity and appearance of the protected surfaces. ? Growing demand for thicker and more durable films: There's a rising preference for thicker PPF that offers enhanced protection against severe road debris and environmental damage, especially for high-value vehicles.

Paint protection films (PPF), also known as clear bras or clear wraps, are thin, transparent or colored thermoplastic urethane films applied to the painted surfaces of vehicles or other items. These films act as a protective layer, shielding the underlying paint from various forms of damage such as scratches, stone chips, bug splatters, swirl marks, and minor abrasions. The application of PPF helps maintain the aesthetic appearance and preserve the resale value of the protected surface by preventing damage caused by daily wear and tear and environmental elements.