Japan Electrophysiology Mapping and Ablation Devices Market Size, Share, Trends, Industry Analysis Report

By Product (Mapping & Lab Systems, Diagnostic Catheters, Ablation Catheters), By Procedure – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6218

- Base Year: 2024

- Historical Data: 2020-2023

Overview

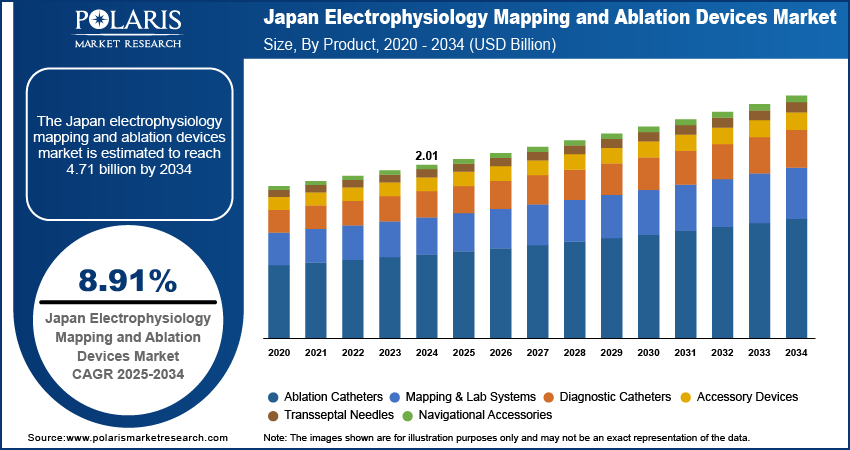

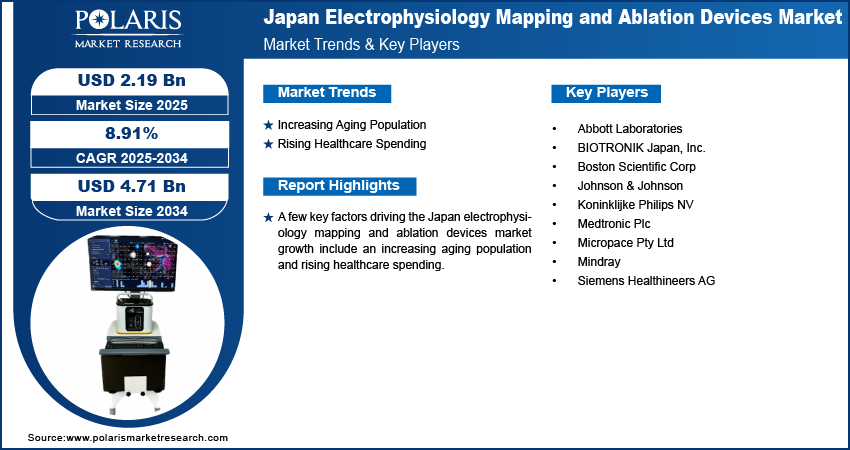

The Japan electrophysiology mapping and ablation devices market size was valued at USD 2.01 billion in 2024, growing at a CAGR of 8.91% from 2025 to 2034. Key factors driving demand for the electrophysiology mapping and ablation devices in Japan include an increasing aging population and rising healthcare spending.

Key Insights

- The ablation catheters segment accounted for a major Japan electrophysiology mapping and ablation devices market share in 2024, due to the rising prevalence of atrial fibrillation.

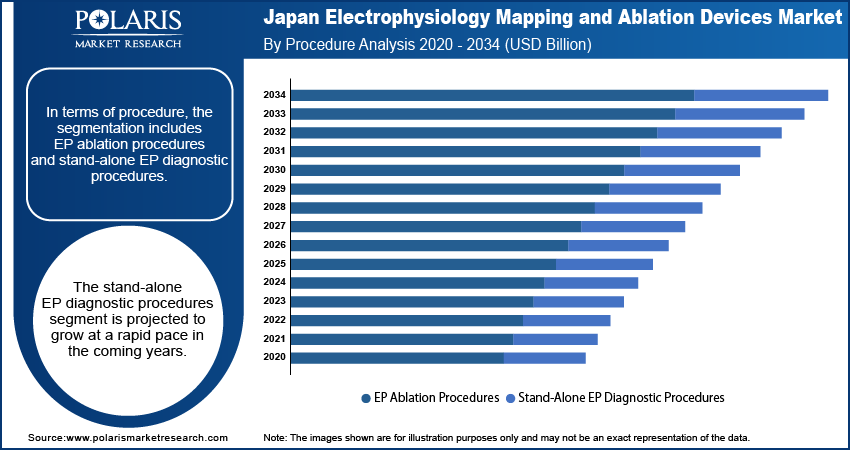

- The stand-alone EP diagnostic procedures segment is projected to grow at a rapid pace in the coming years, owing to rising emphasis on accurate diagnosis of arrhythmias.

Industry Dynamics

- The increasing aging population in Japan is driving the demand for electrophysiology mapping and ablation devices, as the prevalence of cardiac arrhythmias, such as atrial fibrillation, is rapidly rising among the aging population.

- The rising healthcare spending is driving the Japan electrophysiology mapping and ablation devices market growth by allowing hospitals to invest in EP technologies to improve access to minimally invasive arrhythmia treatments.

- The increasing awareness of minimally invasive cardiac procedures is expected to create a lucrative market opportunity during the forecast period.

- The high cost of ablation devices is projected to hinder the Japan electrophysiology mapping and ablation devices market growth during 2025–2034.

Market Statistics

- 2024 Market Size: USD 2.01 Billion

- 2034 Projected Market Size: USD 4.71 Billion

- CAGR (2025–2034): 8.91%

AI Impact on Japan Electrophysiology Mapping and Ablation Devices Market

- The government’s push for value-based care encourages hospitals to adopt AI-enabled EP platforms as AI tools offer real-time decision support and reduce recurrence rates.

- In Japan, the health ministry and hospitals increasingly approve AI-enabled EP devices for limited clinical use and clinical trials, which is expected to create lucrative opportunities for the market players in the coming years.

- Medtech companies in the country invest in AI integration in EP systems to align with national goals for smart medical device innovation and compete in the global market.

The Japan electrophysiology mapping and ablation devices market involves advanced medical technologies used to diagnose and treat cardiac arrhythmias. EP mapping devices create real-time 3D images of the heart’s electrical activity, allowing clinicians to identify abnormal pathways. Ablation devices deliver energy, usually radiofrequency or cryoablation, to destroy faulty heart tissue, causing arrhythmias. These tools are primarily used in the treatment of atrial fibrillation, atrial flutter, and ventricular tachycardia. The key benefits of these devices include improved accuracy in diagnosis, minimally invasive treatment, shorter recovery time, and reduced recurrence rates. Japan’s aging population and increasing prevalence of heart rhythm disorders drive demand for these devices. Ongoing technological advancements, such as artificial intelligence and rising awareness of minimally invasive cardiac procedures, are creating opportunities in the market. However, the high cost of devices, a limited number of specialized electrophysiologists, and lengthy procedural times restrain the market growth. Additionally, strict regulatory requirements and the complexity of reimbursement pathways hinder market growth.

Drivers and Opportunities

Increasing Aging Population: The prevalence of cardiac arrhythmias, such as atrial fibrillation, is rapidly rising among the growing aging population, creating a need for electrophysiology mapping and ablation devices, which enable precise detection and treat irregular heart rhythms caused by atrial fibrillation. World Economic Forum, in its 2023 article, stated that more than 1 in 10 people in Japan are aged 80 and above. Moreover, EP mapping and ablation devices offer minimally invasive procedures that older patients often prefer over open surgery. Therefore, as the geriatric population in Japan expands, hospitals and clinics require more EP mapping and ablation devices, boosting Japan electrophysiology mapping and ablation devices market demand.

Rising Healthcare Spending: Increasing healthcare spending is allowing hospitals to invest in EP technologies to improve access to minimally invasive arrhythmia treatments. Higher healthcare budgets are also supporting training for specialists, expanding the pool of physicians capable of performing these procedures, leading to market growth. According to a World Economic Forum article, Japan's healthcare costs totaled around USD 280 million in 2000, and this figure exceeded USD 316 million in 2022. Additionally, increasing spending is leading to better reimbursement policies, making EP therapies more affordable for patients, thereby fueling Japan electrophysiology mapping and ablation devices market growth.

Segmental Insights

Product Analysis

Based on product, the segmentation includes mapping & lab systems, diagnostic catheters, ablation catheters, accessory devices, transseptal needles, and navigational accessories. The ablation catheters segment accounted for a major Japan electrophysiology mapping and ablation devices market share in 2024. Cardiologists increasingly adopted ablation catheters due to the rising prevalence of atrial fibrillation and other cardiac arrhythmias among the aging population. The segment registered growth with hospitals prioritizing minimally invasive treatment approaches that offer faster recovery, shorter hospital stays, and lower complication rates compared to traditional surgical interventions. Additionally, favorable reimbursement policies and technological advancements, including contact force sensing and irrigated tip catheters, improved procedural precision and outcomes, further contributing to the segment’s dominance.

Procedure Analysis

In terms of procedure, the segmentation includes EP ablation procedures and stand-alone EP diagnostic procedures. The stand-alone EP diagnostic procedures segment is projected to grow at a rapid pace in the coming years. Growing emphasis on early detection and accurate diagnosis of arrhythmias is driving demand for diagnostic electrophysiology procedures, especially among patients with unexplained syncope or palpitations. Additionally, healthcare providers in Japan are expanding outpatient diagnostic services to reduce hospitalization costs and streamline patient management, contributing to the segment growth. The increasing investments in diagnostic infrastructure in Japan are expected to drive the demand for stand-alone EP diagnostic procedures further.

Key Players & Competitive Analysis

The electrophysiology (EP) mapping and ablation devices market in Japan is highly competitive, with the presence of key global and regional players vying for dominance. Johnson & Johnson leads the market with advanced technologies such as the CARTO 3D mapping system and THERMOCOOL ablation catheters, known for precision and safety. Abbott Laboratories follows closely with its EnSite X mapping system and TactiCath ablation catheter, leveraging strong R&D and strategic partnerships. Medtronic competes aggressively with its Arctic Front cryoablation systems and Advisor HD Grid mapping technology, particularly in atrial fibrillation treatment. Boston Scientific holds a significant share with its RHYTHMIA HDx mapping system and INTRACEPT ablation catheters, focusing on innovation and physician training. Philips and Siemens Healthineers provide integrated imaging and navigation systems, supporting EP procedures. The market is driven by technological advancements, increasing arrhythmia prevalence, and government support for minimally invasive treatments, intensifying competition among established and emerging players.

A few major companies operating in the Japan electrophysiology mapping and ablation devices industry include Abbott Laboratories; BIOTRONIK Japan, Inc.; Boston Scientific Corp; Johnson & Johnson; Koninklijke Philips NV; Medtronic Plc; Micropace Pty Ltd; Mindray; and Siemens Healthineers AG.

Key Companies

- Abbott Laboratories

- BIOTRONIK Japan, Inc.

- Boston Scientific Corp

- Johnson & Johnson

- Koninklijke Philips NV

- Medtronic Plc

- Micropace Pty Ltd

- Mindray

- Siemens Healthineers AG

Industry Developments

May 2025: Abbott launched the TactiFlex Sensor Ablation Catheter, the world’s first ablation catheter with a flexible tip and contact force technology.

September 2024: Boston Scientific Corporation announced it received Pharmaceuticals and Medical Device Agency (PMDA) approval in Japan for the FARAPULSE Pulsed Field Ablation (PFA) System.

May 2024: Medtronic announced regulatory approval of its PulseSelect pulsed field ablation (PFA) system in Japan for the treatment of paroxysmal and persistent atrial fibrillation (AFib) patients.

Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Mapping & Lab Systems

- Diagnostic Catheters

- Ablation Catheters

- Accessory Devices

- Transseptal Needles

- Navigational Accessories

By Procedure Outlook (Revenue, USD Billion, 2020–2034)

- EP Ablation Procedures

- Stand-Alone EP Diagnostic Procedures

Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.01 Billion |

|

Market Size in 2025 |

USD 2.19 Billion |

|

Revenue Forecast by 2034 |

USD 4.71 Billion |

|

CAGR |

8.91% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.01 billion in 2024 and is projected to grow to USD 4.71 billion by 2034.

The market is projected to register a CAGR of 8.91% during the forecast period.

A few of the key players in the market are Abbott Laboratories; BIOTRONIK Japan, Inc.; Boston Scientific Corp; Johnson & Johnson; Koninklijke Philips NV; Medtronic Plc; Micropace Pty Ltd; Mindray; and Siemens Healthineers AG.

The ablation catheters segment dominated the market share in 2024.

The stand-alone EP diagnostic procedures segment is expected to witness the fastest growth during the forecast period.