Japan Immunoassay Market Size, Share, Trends, Industry Analysis Report

By Product (Reagents & Kits, Analyzers/Instruments), By Technology, By Specimen, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6160

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

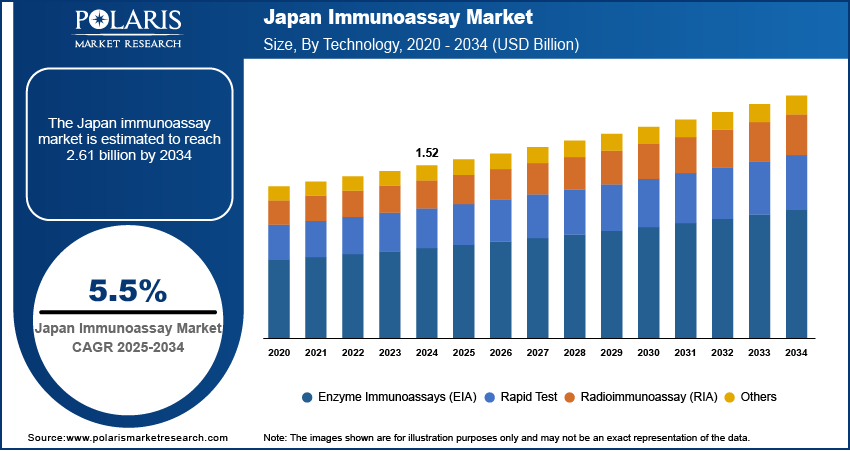

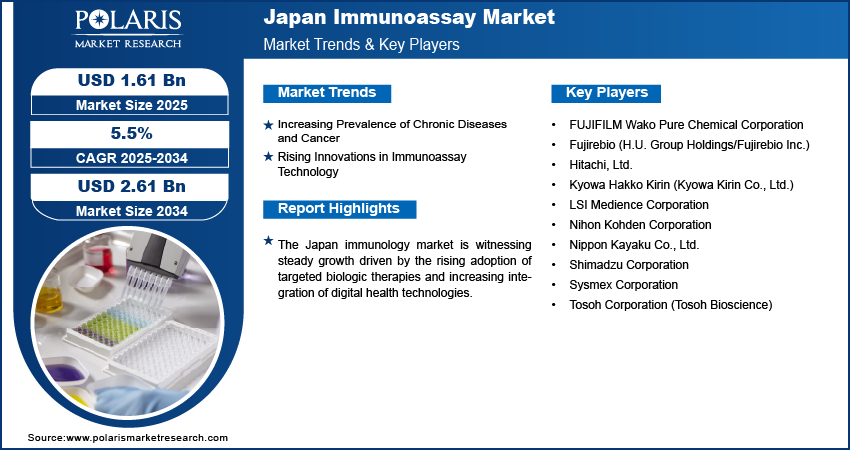

The Japan immunoassay market size was valued at USD 1.52 billion in 2024, growing at a CAGR of 5.5% from 2025 to 2034. Key factors driving demand for the market include the country’s expanding focus on disease management, early diagnostics, and an aging population with increasing healthcare needs, also, the increasing prevalence of chronic diseases and cancer with rising innovations in immunoassay technology further contributes to the growth opportunities.

Key Insights

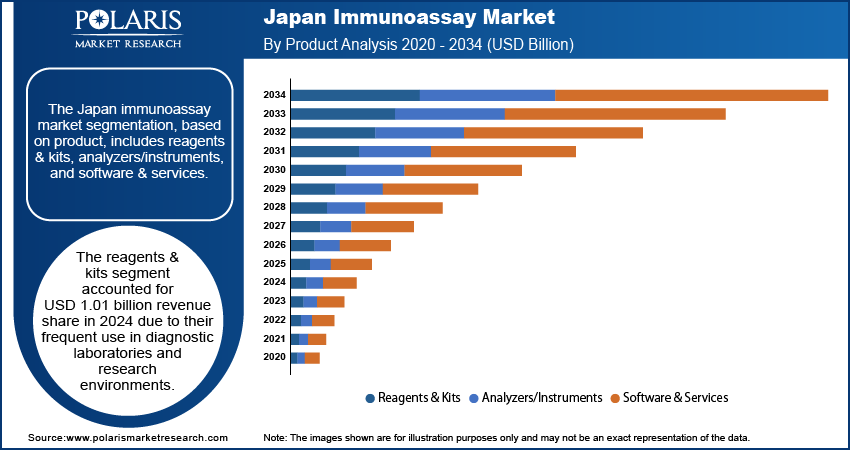

- The reagents & kits segment accounted for USD 1.01 billion revenue share in 2024 due to their frequent use in diagnostic laboratories and research environments.

- The rapid test segment is projected to register a CAGR of 5.0% during the forecast period, fueled by Japan’s increasing focus on decentralized and preventive healthcare solutions.

Industry Dynamics

- Rising cancer/chronic disease rates in Japan boost demand for high-performance diagnostic tools, supporting expansion opportunities.

- Advances in immunoassay systems enhance speed, accuracy, and flexibility, unlocking new growth potential.

- Japan's aging population and rising chronic diseases create strong demand for advanced immunoassays, particularly in cancer and diabetes monitoring. Automated systems and AI integration offer growth potential for high-throughput testing solutions.

- Strict regulatory approvals and reimbursement policies delay market entry, while cost pressures limit adoption in smaller clinics and rural healthcare facilities.

Market Statistics

- 2024 Market Size: USD 1.52 Billion

- 2034 Projected Market Size: USD 2.61 Billion

- CAGR (2025–2034): 5.5%

To Understand More About this Research: Request a Free Sample Report

Immunoassay refers to a biochemical testing method used to detect or quantify specific proteins, hormones, or biomarkers using antigen-antibody reactions. In the context of Japan’s healthcare landscape, immunoassays serve as a critical diagnostic tool across clinical, pharmaceutical, and research applications. The Japan immunoassay market is witnessing steady growth, driven by the country’s expanding focus on disease management, early diagnostics, and an aging population with increasing healthcare needs. According to a 2024 World Bank report, ~30% of Japan's total population consists of individuals aged 65 and above. The growing application of immunoassays in detecting infectious diseases, chronic conditions, and cancer biomarkers continues to enhance their relevance in both hospital and point-of-care settings. Therefore, as diagnostic accuracy becomes increasingly essential, immunoassays remain integral to improving clinical outcomes and supporting evidence-based treatment decisions.

Drivers & Opportunities

Increasing Prevalence of Chronic Diseases and Cancer: The increasing prevalence of chronic diseases and cancer in Japan is driving the growth, as it directly boosts the demand for reliable diagnostic and monitoring tools. According to a September 2023 NLM report, Japan's cancer prevalence is projected to reach ~3.67 million cases by 2050, reflecting a 13.1% increase. Immunoassays are widely used for the early detection, prognosis, and therapeutic monitoring of various chronic conditions, such as cardiovascular diseases, diabetes, and autoimmune disorders. In Japan’s aging community, where the incidence of these conditions is steadily rising, regular and precise diagnostic testing has become essential for effective disease management. Immunoassays offer the sensitivity and specificity required to detect disease biomarkers at early stages, enabling timely clinical intervention and enhancing patient outcomes.

Rising Innovations in Immunoassay Technology: Rising innovations in immunoassay technology are driving the growth opportunities, as they continuously enhance the precision, efficiency, and adaptability of diagnostic testing. Technological advancements have enabled the development of highly sensitive assays, multiplex testing formats, and fully automated platforms, all of which are aligned with Japan’s demand for accurate and rapid diagnostics. In July 2024, H.U. Group/Fujirebio launched the Lumipulse G GFAP assay (RUO) for automated LUMIPULSE G systems. This CLEIA-based test quantifies GFAP in plasma/serum in 35 minutes and is available in Japan/the U.S., with plans for expansion to Europe/other regions. These innovations are particularly valuable in addressing the country’s evolving healthcare needs, such as the management of chronic diseases and support for aging populations. Moreover, the integration of digital technologies with immunoassay systems, such as cloud-based data management and connectivity features, has streamlined laboratory operations and improved diagnostic workflows. Innovation in immunoassay technology remains a crucial factor in driving market growth as healthcare providers in Japan increasingly prioritize advanced and reliable testing solutions.

Segmental Insights

Product Analysis

Based on product, the segmentation includes reagents & kits, analyzers/instruments, and software & services. The reagents & kits segment accounted for USD 1.01 billion revenue share in 2024 due to their frequent use in diagnostic laboratories and research environments. These consumables are integral to various immunoassay techniques, such as ELISA, lateral flow assays, and chemiluminescent immunoassay tests. The increasing burden of infectious and chronic diseases in Japan has led to a sustained need for routine diagnostics, thereby ensuring consistent demand for reagents and kits. Moreover, the development of advanced reagent formulations and the availability of Japan-specific disease detection kits have further reinforced their critical role in laboratory workflows.

Technology Analysis

In terms of technology, the segmentation includes enzyme immunoassays (EIA), rapid tests, radioimmunoassay (RIA), and others. The rapid test segment is projected to register a CAGR of 5.0% during the forecast period, fueled by Japan’s increasing focus on decentralized and preventive healthcare solutions. These point-of-care tests are especially relevant in outpatient surroundings, elderly care facilities, and during emergency scenarios where quick diagnostic insights are crucial. Their simple operation, minimal infrastructure requirements, and fast turnaround times align well with Japan’s aging population and its need for accessible, home-based, or near-patient testing solutions. This shift toward immediate and localized diagnostic is expected to accelerate the adoption of rapid immunoassays across various regions in Japan.

Key Players and Competitive Analysis

The Japan immunoassay market is characterized by strategic investments from players, such as FUJIFILM Wako Pure Chemical Corporation, Fujirebio, and Kyowa Hakko Kiri, alongside agile small and medium-sized businesses specializing in niche diagnostics. The market is driven by technological advancements in automation and multiplex testing, with chemiluminescence immunoassays (CLIA) dominating due to their precision in managing chronic diseases. Revenue growth is driven by Japan’s aging population and latent demand for early detection of cancer and cardiac biomarkers. However, supply chain disruptions and strict regulations pose challenges for market entry strategies. Competitive intelligence reveals a shift toward sustainable value chains, with vendors localizing reagent production to mitigate risks. Major strategic developments include partnerships between domestic firms and international players to leverage AI-driven analytics. Pricing insights suggest a premium positioning for high-throughput systems, while emerging technologies, such as digital immunoassays, create expansion opportunities in rural healthcare.

A few major companies operating in the Japan immunoassay industry include FUJIFILM Wako Pure Chemical Corporation; Fujirebio (H.U. Group Holdings/Fujirebio Inc.); Hitachi, Ltd.; Kyowa Hakko Kirin (Kyowa Kirin Co., Ltd.); LSI Medience Corporation; Nihon Kohden Corporation; Nippon Kayaku Co., Ltd.; Shimadzu Corporation; Sysmex Corporation; and Tosoh Corporation (Tosoh Bioscience).

Key Players

- FUJIFILM Wako Pure Chemical Corporation

- Fujirebio (H.U. Group Holdings/Fujirebio Inc.)

- Hitachi, Ltd.

- Kyowa Hakko Kirin (Kyowa Kirin Co., Ltd.)

- LSI Medience Corporation

- Nihon Kohden Corporation

- Nippon Kayaku Co., Ltd.

- Shimadzu Corporation

- Sysmex Corporation

- Tosoh Corporation (Tosoh Bioscience)

Japan Immunoassay Industry Developments

March 2025: Sysmex (Kobe) launched its HISCL C-Peptide Assay Kit for diabetes testing in Japan. The new parameter expands the HISCL-5000/800 system's diabetes panel alongside existing insulin tests, addressing broader lab needs.

March 2023: Sysmex and Fujirebio expanded their CDMO partnership to include neurodegenerative disease testing for Sysmex's HISCL-Series, building on their October 2023 immunoassay collaboration agreement.

Japan Immunoassay Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Reagents & Kits

- ELISA Reagents & Kits

- Rapid Test Reagents & Kits

- Western Blot Reagents & Kits

- ELISPOT Reagents & Kits

- Other Reagents & Kits

- Analyzers/Instruments

- Open Ended Systems

- Closed Ended Systems

- Software & Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Enzyme Immunoassays (EIA)

- Chemiluminescence Immunoassays (CLIA)

- Fluorescence Immunoassays (FIA)

- Rapid Test

- Radioimmunoassay (RIA)

- Others

By Specimen Outlook (Revenue, USD Billion, 2020–2034)

- Blood

- Urine

- Saliva

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Infectious Disease Testing

- Cardiology

- Oncology

- Endocrinology

- Autoimmune Diseases

- Therapeutic Drug Monitoring

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Laboratories

- Others

Japan Immunoassay Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.52 Billion |

|

Market Size in 2025 |

USD 1.61 Billion |

|

Revenue Forecast by 2034 |

USD 2.61 Billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.52 billion in 2024 and is projected to grow to USD 2.61 billion by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

A few of the key players in the market are FUJIFILM Wako Pure Chemical Corporation; Fujirebio (H.U. Group Holdings/Fujirebio Inc.); Hitachi, Ltd.; Kyowa Hakko Kirin (Kyowa Kirin Co., Ltd.); LSI Medience Corporation; Nihon Kohden Corporation; Nippon Kayaku Co., Ltd.; Shimadzu Corporation; Sysmex Corporation; and Tosoh Corporation (Tosoh Bioscience).

The reagents & kits segment accounted for USD 1.01 billion revenue share in 2024.

The rapid test segment is projected to register a CAGR of 5.0% during the forecast period.