Japan Ocean Economy Market Size, Share, Trends, Industry Analysis Report

By Industry Type (Marine Transport and Shipping, Marine Tourism and Recreation, Fisheries and Aquaculture) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6163

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

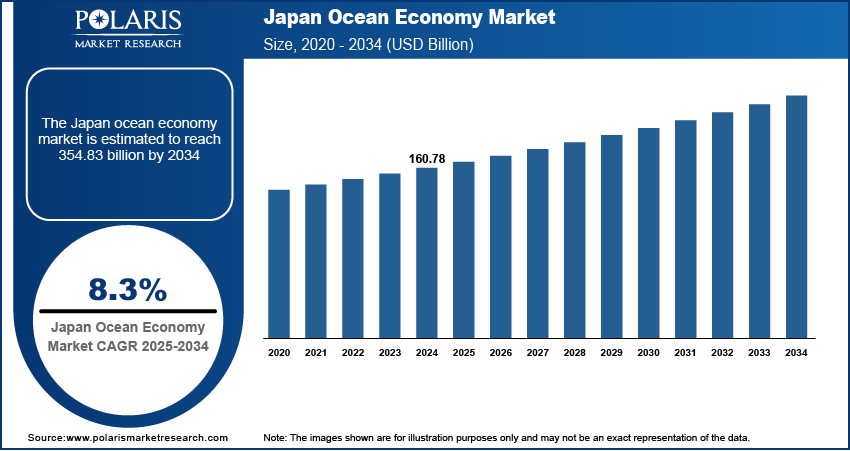

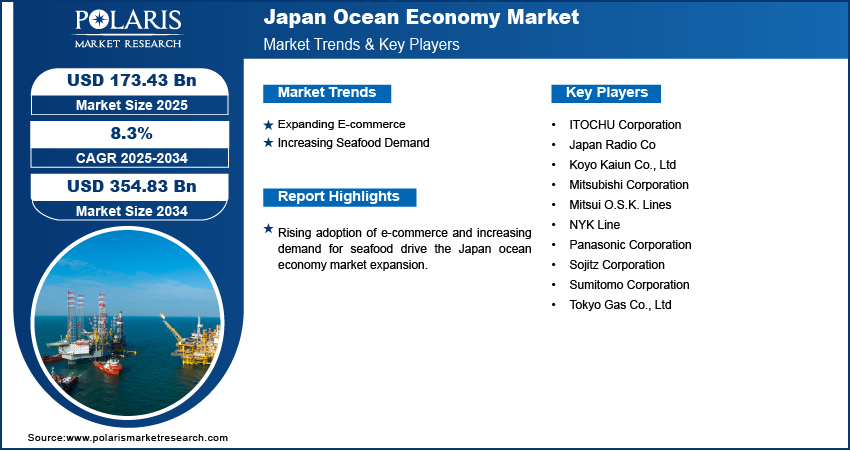

The Japan ocean economy market size was valued at USD 160.78 billion in 2024, growing at a CAGR of 8.3% from 2025 to 2034. Key factors driving market growth in Japan include rising penetration of e-commerce and increasing demand for seafood.

Key Insights

- The marine tourism and recreation segment accounted for 36.93% of revenue share in 2024 due to the expanding coastal tourism industry.

- The offshore oil and gas segment is projected to register a CAGR of 8.9% from 2025 to 2034. This is attributed to Japan’s push for energy security and diversification.

Industry Dynamics

- Expanding e-commerce is propelling the growth of the Japan ocean economy market by fueling investments in port infrastructure, shipping fleets, and maritime services.

- Increasing seafood demand is encouraging investments in sustainable fishing technologies and marine resource management, leading to market growth.

- High capital investment requirements in infrastructure development restrain the market growth.

- Growing international trade is projected to create a lucrative market opportunity during the forecast period.

Market Statistics

- 2024 Market Size: USD 160.78 Billion

- 2034 Projected Market Size: USD 354.83 Billion

- CAGR (2025–2034): 8.3%

To Understand More About this Research: Request a Free Sample Report

Japan's ocean economy encompasses the economic activities directly or indirectly linked to the ocean, including marine transport and shipping, fisheries and aquaculture, offshore oil and gas, marine tourism, and emerging sectors such as marine biotechnology. Japan relies heavily on ocean-based industries for trade, energy, food, and recreation. A key trend in Japan’s ocean economy is the integration of digital technologies and green innovations, such as autonomous vessels and offshore wind farms, to enhance efficiency and sustainability. Major drivers include strong government support for maritime infrastructure, increasing demand for seafood and clean energy, and Japan's strategic geographic location in the Asia Pacific trade routes. Opportunities are emerging in renewable ocean energy, eco-friendly shipping, and sustainable aquaculture practices, driven by the country’s commitment to carbon neutrality and marine conservation.

Drivers & Opportunities

Expanding E-commerce: Businesses in Japan are increasingly relying on container ships and port operations to handle the higher volumes of imports and exports, driven by expanding e-commerce. This surge in trade is fueling the investments in port infrastructure, shipping fleets, and maritime services, creating jobs and boosting ocean economies. Additionally, e-commerce platforms often source products internationally, further intensifying the demand for reliable ocean freight and supply chain solutions, which, in turn, leads to the Japan ocean economy market growth. The rise of cross-border online transactions is also driving innovations in maritime technology and sustainable shipping practices, which aim to meet consumer expectations for faster and greener deliveries, thereby propelling market development.

Increasing Seafood Demand: Increasing seafood demand in Japan is encouraging investments in sustainable fishing technologies, marine resource management, and aquaculture innovations to meet global needs. This surge is also strengthening related industries such as seafood export logistics, cold storage, and port facilities, further stimulating economic activity in the ocean. The U.S. Department of Agriculture (USDA) offices in Japan, in their report, stated that Japan is one of the world’s leading consumers of seafood. In 2022, it imported $15 billion of seafood products, making it the world’s third-largest importer. Additionally, rising consumer interest in traceable and eco-friendly seafood is pushing companies in the country to adopt responsible practices, fostering long-term ocean ecosystem health and economic resilience.

Segmental Insights

Industry Type Analysis

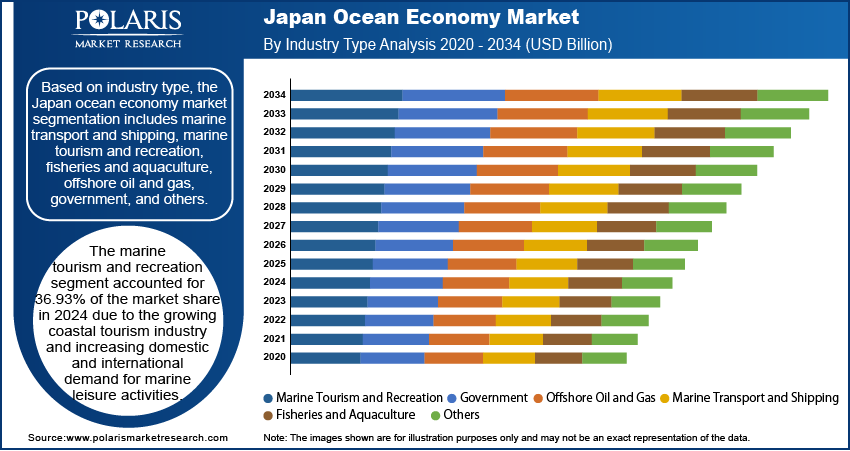

Based on industry type, the segmentation includes marine transport and shipping, marine tourism and recreation, fisheries and aquaculture, offshore oil and gas, government, and others. The marine tourism and recreation segment accounted for 36.93% of the Japan ocean economy market share in 2024 due to the growing coastal tourism industry and increasing domestic and international demand for marine leisure activities. The country’s scenic coastlines, UNESCO-listed sites such as Okinawa’s coral reefs, and government-promoted initiatives such as the "Blue Tourism" campaign attracted millions of visitors in 2024. Cruise tourism also reported a significant growth, with major ports such as Yokohama and Kobe expanding their facilities to accommodate larger vessels. Additionally, the increased travel and rising interest in sustainable ecotourism after the COVID-19 pandemic fueled the segment’s expansion.

The offshore oil and gas segment is projected to register a CAGR of 8.9% from 2025 to 2034. This is attributed to Japan’s push for energy security and diversification, coupled with advancements in offshore drilling technologies. The discovery of new gas reserves in the East China Sea, combined with the government’s investments in floating LNG terminals, is further supporting the growth of the segment. Moreover, the shift toward renewable offshore energy, including wind and hybrid systems, is enhancing the segment’s expansion.

Key Players & Competitive Analysis

The Japan ocean economy competitive landscape is dominated by major corporations with diversified interests in shipping, logistics, energy, and marine technology. Major players such as Mitsui O.S.K. Lines (MOL), NYK Line, and Koyo Kaiun control significant portions of the maritime logistics sector, specializing in bulk shipping, container transport, and LNG carriers. Trading giants such as Mitsubishi Corporation, ITOCHU, Sumitomo Corporation, and Sojitz Corporation play crucial roles in offshore renewable energy, port infrastructure, and marine resource development. Tokyo Gas Co., Ltd is expanding into offshore wind and LNG, aligning with Japan’s decarbonization goals. Meanwhile, Japan Radio Co. contributes to maritime communication and navigation technologies, supporting safer and more efficient operations. Panasonic Corporation enhances the sector through advanced marine electronics and sustainable energy solutions. The industry is also witnessing increased collaboration between public and private entities to boost blue economy initiatives, including aquaculture and seabed mining. Competition remains intense in the industry as firms invest in green shipping technologies, automation, and digitalization to maintain global leadership in the evolving ocean economy.

A few major companies operating in the Japan ocean economy market include ITOCHU Corporation; Japan Radio Co; Koyo Kaiun Co., Ltd; Mitsubishi Corporation; Mitsui O.S.K. Lines; NYK Line; Panasonic Corporation; Sojitz Corporation; Sumitomo Corporation; and Tokyo Gas Co., Ltd

Key Companies

- ITOCHU Corporation

- Japan Radio Co

- Koyo Kaiun Co., Ltd

- Mitsubishi Corporation

- Mitsui O.S.K. Lines

- NYK Line

- Panasonic Corporation

- Sojitz Corporation

- Sumitomo Corporation

- Tokyo Gas Co., Ltd

Japan Ocean Economy Industry Developments

July 2025: ITOCHU Corporation signed a shipbuilding contract for the construction of a 5,000 m3 ammonia bunkering vessel with Sasaki Shipbuilding Co., Ltd., and an agreement regarding the construction of an ammonia tank plant that will be loaded onto the Vessel with Izumi Steel Works Ltd.

February 2025: Mitsui O.S.K. Lines (MOL) launched BLUE ACTION NET-ZERO ALLIANCE to help companies reduce Scope 3 greenhouse gas (GHG) emissions by offering and enhancing low-emission marine transportation services using alternative fuels.

Japan Ocean Economy Market Segmentation

By Industry Type Outlook (Revenue, USD Billion, 2021–2034)

- Marine Transport and Shipping

- Marine Tourism and Recreation

- Fisheries and Aquaculture

- Offshore Oil and Gas

- Government

- Others

Japan Ocean Economy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 160.78 Billion |

|

Market Size in 2025 |

USD 173.43 Billion |

|

Revenue Forecast by 2034 |

USD 354.83 Billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 160.78 billion in 2024 and is projected to grow to USD 354.83 billion by 2034.

The market is projected to register a CAGR of 8.3% during the forecast period.

A few of the key players in the market are ITOCHU Corporation; Japan Radio Co; Koyo Kaiun Co., Ltd; Mitsubishi Corporation; Mitsui O.S.K. Lines; NYK Line; Panasonic Corporation; Sojitz Corporation; Sumitomo Corporation; and Tokyo Gas Co., Ltd.

The marine tourism and recreation segment dominated the market share in 2024.

The offshore oil and gas segment is expected to witness the fastest growth during the forecast period.