Kyphoplasty Market Share, Size, Trends, Industry Analysis Report

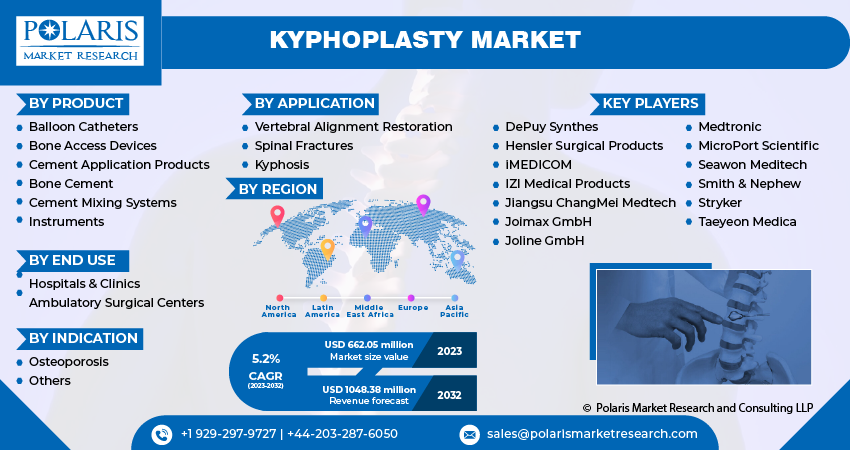

By Product (Balloon Catheters, Bone Access Devices, Cement Application Products, Bone Cement, Cement Mixing Systems, Instruments), By Application, By Indication, By End-use, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Oct-2023

- Pages: 119

- Format: PDF

- Report ID: PM3821

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

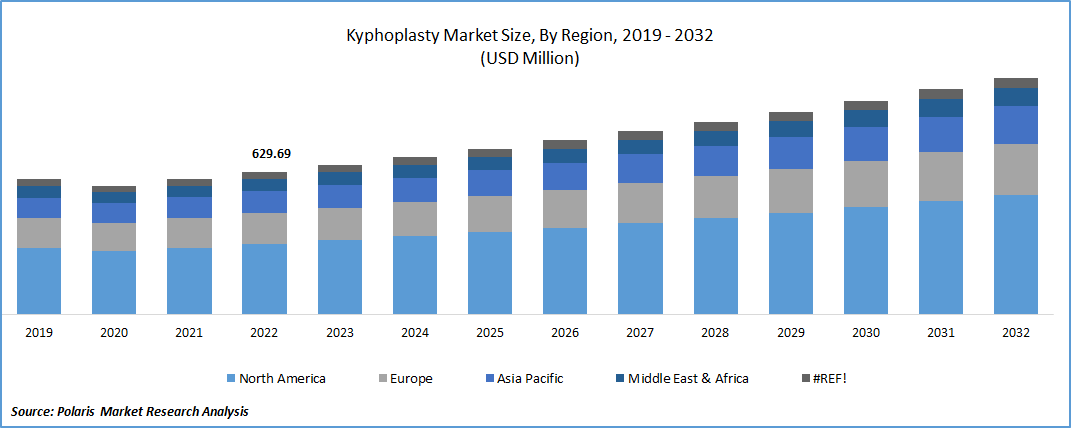

The global kyphoplasty market was valued at USD 629.69 million in 2022 and is expected to grow at a CAGR of 5.2% during the forecast period.

Market is experiencing growth due to the growing number of elderly individuals and the increasing prevalence of osteoporosis. The International Osteoporosis Foundation predicts that globally, 1 in 5 men & 1 in 3 women above the age of 50 will suffer from osteoporosis fractures during their remaining years. Neglecting treatment for vertebral compression fractures can lead to severe clinical consequences and have a significant impact on the quality of life for both patients and caregivers. As non-surgical methods have limited effectiveness in managing these fractures, medical professionals are increasingly accepting kyphoplasty procedures as a means of stabilizing fractures and controlling pain.

To Understand More About this Research: Request a Free Sample Report

The National Library of Medicine reports that in the United States alone, there will be an annual occurrence of approximately 1 to 1.5 million vertebral compression fractures (VCFs). When considering factors such as age and gender, it is estimated that 25% of women over the age of 50 will experience at least one VCF. Additionally, it is believed that 40% to 50% of individuals over the age of 80 have encountered a VCF either acutely or incidentally while receiving treatment for another health condition. To improve patient outcomes, vertebral augmentation procedures like balloon kyphoplasty have shown a mortality reduction of up to 55% compared to non-surgical management methods.

Due to the COVID-19 pandemic, non-urgent elective surgeries were canceled or postponed. For instance, a study published in the Asian Spine Journal revealed that in France, surgical procedures decreased by about 50% during the first month of lockdown. In the short term, the pandemic is expected to have a relatively moderate impact on the market. However, as the effects of the pandemic decrease over time, there will be an increased acceptance of innovative devices and continued expansion of dedicated infrastructure for spinal interventions. This will drive strong growth in the market throughout the forecast period.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

Advancements in Technologies

The growth of the kyphoplasty market is being propelled by the introduction of new technologies and innovations, which are the result of research activities conducted by manufacturers. For example, Stryker established a research and development (R&D) lab in Australia, in October 2021. This lab builds upon existing partnerships with researchers, hospitals, & universities to transform research into practical & commercially accessible technology. The R&D lab collaborates with Stryker's divisions in CMF instruments, endoscopy, medical, joint replacement, spine, trauma, and extremities. Their focus is on conducting research that drives the development of technology platforms applicable across different medical fields in the years to come.

For over two decades, the balloon kyphoplasty procedure has been utilized in the treatment of more than one million fractures. Clinical studies have consistently shown that compared to non-surgical methods, balloon kyphoplasty effectively restores vertebral body height and improves vertebral body deformity. In addition to reducing back pain, this procedure offers advantages such as enhanced mobility, improved quality of life, and the ability to engage in daily activities. This favorable outcome contributes to the growth of the market. Currently, a wide range of bone cement options have been approved for clinical use, with many being employed in balloon kyphoplasty procedures.

Report Segmentation

The market is primarily segmented based on product, application, indication, end use, and region.

|

By Product |

By Application |

By Indication |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Bone Access Device Segment Accounted for the Largest Market Share in 2022

Bone access devices segment held the largest share. Segment’s growth is primarily due to growing demand for the real-time flow visualization during the cement injection in kyphoplasty & vertebroplasty surgeries. Needles play an important role in delivering bone cement in the treatment of vertebral compression fractures, offering control & flexibility. The global prevalence of spine fractures and back pain is experiencing a significant increase. Annually, around 2% of American workers suffer from compensable back injuries, resulting in approximately 500,000 cases. In the United States, low back pain accounts for 19% of all labor compensation claims.

Ballon catheters segment is anticipated to gain substantial growth rate. This growth is primarily attributed to the increasing number of technological advancements in the field, particularly with the introduction of next-generation kyphoplasty balloons. These advancements have facilitated more efficient procedures in the market, leading to the anticipated segment’s growth.

By Application Analysis

Spinal Fractures Segment Held the Largest Share

Spinal fractures segment garnered the largest share. This growth is primarily driven by the widespread adoption of kyphoplasty procedures for the treatment of spinal fractures. The market is experiencing an increase in the incidence of compressed spine bones caused by factors such as cancer and trauma. People with cancer and older individuals are particularly susceptible to easily fracturing their bones with minimal force, leading to a rise in cases and subsequently driving the demand for kyphoplasty procedures.

Compression fractures have a significant impact on many individuals globally. Among fractures occurring in osteoporosis patients, vertebral compression fractures (VCFs) are the most prevalent, affecting approximately 750,000 individuals each year. The incidence of VCFs tends to increase gradually with age, with an estimated 40% of women aged 80 and older being affected by this condition. As a result, the prevalence of VCFs among the elderly population provides strong support for the overall growth of the market.

By Indication Analysis

Osteoporosis Segment Held the Largest Share in 2022

Osteoporosis segment garnered the largest share. This dominance can be attributed to the growing prevalence of osteoporosis. According to the National Osteoporosis Foundation, there is an elevated risk for approximately 44 million individuals in the United States who have inadequate bone density, and an estimated 10 million Americans have been diagnosed with osteoporosis. These statistics highlight the significant market presence of the osteoporosis segment within the industry.

Additionally, around 54 million individuals, which accounts for half of the adult population aged 50 and above, face an increased risk of bone fractures and should prioritize their bone health accordingly. Osteoporosis poses a significant concern, as one out of every two women and one out of every four men may experience a bone fracture at some point in their lives. The prevalence of osteoporosis-related fractures in women surpasses that of heart attacks, strokes, and breast cancer combined.

Regional insights

North America Region Dominated the Global Market in 2022

North America held the largest share. Region’s growth is primarily due to high levels of awareness among the population and the presence of well-developed healthcare infrastructure. The region's leading position is further supported by the rise in cases of osteoporosis, back pain, & spine fractures, which have primarily affected females in this area. Rise in cases of vertebral compression fractures & surge in adoption of kyphoplasty procedures contribute significantly to the market's growth.

Asia Pacific region is anticipated to emerge as fastest growing region. This is primarily due to increasing elderly population and the growing acceptance of kyphoplasty procedures also contribute to the market's growth. Additionally, the availability of advanced fracture stabilization methods, the limitations of conventional approaches, and rising incidence of vertebral compression fractures favored region’s expansion.

Key players & Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share

Some of the major players operating in the global market include

- DePuy Synthes

- Hensler Surgical Products

- iMEDICOM

- IZI Medical Products

- Jiangsu ChangMei Medtech

- Joimax GmbH

- Joline GmbH

- Medtronic

- MicroPort Scientific

- Seawon Meditech

- Smith & Nephew

- Stryker

- Taeyeon Medical

Recent Developments

- In October 2021, in Queensland, Australia, Stryker established a research and development (R&D) lab to further strengthen its collaborations with researchers, hospitals, universities, and local governments. The primary objective of this R&D lab is to facilitate the translation of research into practical and commercially viable precision medical device technology.

Kyphoplasty Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 662.05 million |

|

Revenue forecast in 2032 |

USD 1048.38 million |

|

CAGR |

5.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Application, By Indication, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in kyphoplasty market are Stryker, Hensler Surgical Products, Medtronic, Smith & Nephew.

The global kyphoplasty market is expected to grow at a CAGR of 5.2% during the forecast period.

The kyphoplasty market report covering key segments are product, application, indication, end use, and region.

key driving factors in industrial kyphoplasty market are Increasing Aging Population.

The global kyphoplasty market size is expected to reach USD 1.04 billion by 2032.