Lactase Market Size, Share, Trends & Industry Analysis Report

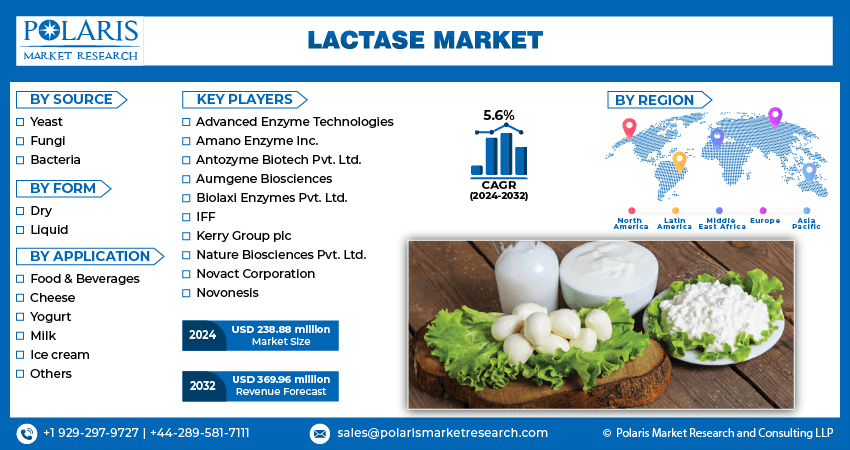

By Source (Yeast, Fungi, Bacteria), By Form (Dry, Liquid), By Application, and By Region – Market Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM1880

- Base Year: 2024

- Historical Data: 2020-2023

The global lactase market was valued at USD 238.88 million in 2024 and is expected to grow at a CAGR of 5.70% from 2025 to 2034. Market growth is fueled by rising lactose intolerance awareness and demand for dairy-free products.

The lactase market is focused on the production, distribution, and sale of the enzyme lactase. Lactase is used to break down lactose, the sugar found in milk and dairy products, into simpler sugars that are more easily digestible.

The lactase market is experiencing robust growth driven by increasing advancements in product development and innovations in various sectors, such as pharmaceuticals, dietary supplements, and infant nutrition.

Further, the technological advancements in devices have led to the development of lactose biosensor test kits for industrial applications such as the food and beverage sector. These biosensor test kit analyzes the lactose concentration across all dairy applications, enabling real-time monitoring of the lactase content, thus boosting lactase market growth.

To Understand More About this Research:Request a Free Sample Report

The key players are expanding their product offerings in the lactase market owing to an increase in awareness of lactose intolerance among individuals globally. Further, companies are investing in research and development to innovate new lactase products that cater to varying consumer needs.

Strategic expansions into new markets and distribution channels are enabling companies to meet the rising demand for lactase. For instance, in May 2022, Kerry Group plc. expanded its taste manufacturing facility in Africa. This expansion enabled the group to develop sustainable nutrition solutions and enhance its food, beverage, and pharmaceutical activities in the region by facilitating the company's growth of its lactase enzyme portfolio in the markets.

Lactase Market Trends:

Increasing Demand for Lactose-Free Products

Market CAGR for lactase is being driven by the increasing demand for lactose-free products such as milk, ice cream, cheese, and more due to rising consumer awareness and preferences for lactose intolerance-friendly options. Lactose intolerance affects a substantial portion of the global population, creating a market demand for products that cater to dietary needs without compromising taste or nutritional value.

The lactase market is experiencing significant growth, driven by the growing prevalence of lactose intolerance among individuals. Lactose intolerance is caused by insufficient levels of the enzyme lactase needed to digest lactose in dairy products.

The rising awareness and demand for lactase products, which aid in the digestion of lactose, are driving the lactase market revenue. Additionally, as more people recognize their lactose intolerance and are opting for lactose-free products, manufacturers are increasingly incorporating lactase into food and beverage formulations to cater to this expanding consumer base.

For instance, in February 2024, Breyers introduced a lactose-free chocolate ice cream crafted from dairy that is free from cows by utilizing a precise fermentation technique from Perfect Day, a startup in food technology. This dairy-free ice cream mimics the flavor and consistency of cow's milk yet is devoid of lactose and boasts a more eco-conscious profile.

Rising Demand from Dairy Manufacturers

Dairy producers are broadening their customer reach through the introduction of fresh products that are low in fat and sugar while being high in proteins, fibers, and vitamins. The increasing awareness regarding digestive health concerns is expected to boost the usage of lactase-based dietary supplements.

For instance, in February 2020, Jersey Dairy introduced a lactose-free milk option crafted from 100% authentic Jersey milk. This product is designed to provide a more digestible option for individuals with lactose intolerance while retaining all the natural vitamins and nutrients found in Jersey milk. The new lactose-free milk will have a fat content of 2.5%.

The launch of innovative delivery methods like strength caplets and fast-acting chewables to alleviate lactose digestion issues such as gas, bloating, nausea, stomach pain, and diarrhea drives the market expansion.

Lactase Market Segment Insights:

Lactase Source Insights:

The global lactase market segmentation, based on source, includes yeast, fungi, and bacteria. In 2023, the bacteria segment is anticipated to grow with the highest CAGR in the market due to the advancements in biotechnology and enzymology. Advancements have led bacteria-derived lactase enzymes such as Lactobacillus acidophilus, Enterococcus faecalis, and Bifidobacterium longum to be scalable, cost-effective, and environmentally sustainable.

For instance, according to the National Center for Biotechnology Information (NCBI), Lactobacillus acidophilus, Bifidobacterium longum, and Enterococcus faecalis exhibit robust performance across a wide range of pH and temperature conditions, making them versatile for various food and beverage applications.

Lactase Application Insights:

The global lactase market segmentation, based on application, includes food & beverages, pharmaceutical products, and dietary supplements. The food & beverages category dominated the market in 2023 attributed to the rising consumption of high-quality foods with natural flavor and taste. Hence, dairy producers are broadening their customer base through the introduction of new products that are lactose-free and low in fat and sugar while being high in proteins, fibers, and vitamins.

For instance, in April 2024, Prairie Farms Dairy introduced four new lactose-free dairy products, including cottage cheese, milk, sour cream, and others, with plans to expand the distribution of these products across the United States in June.

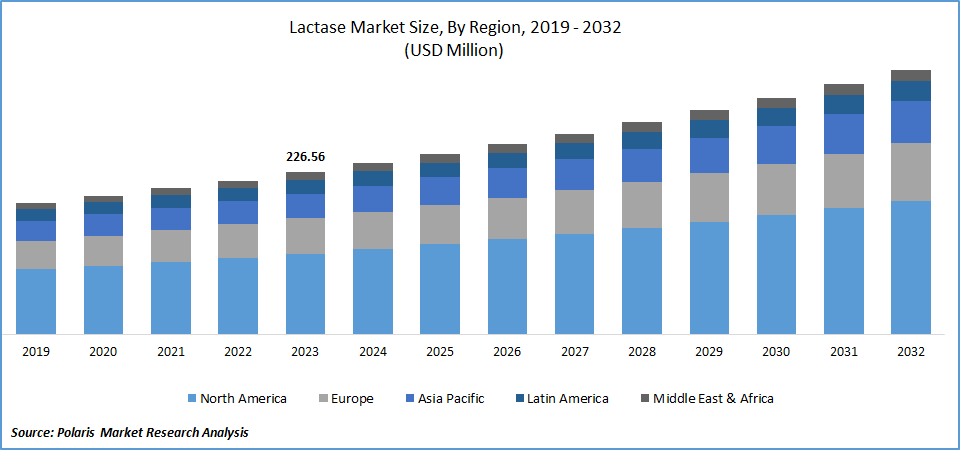

Global Lactase Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Lactase Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America region dominated the lactase market owing to the significant number of lactose-intolerant individuals in the region.

For instance, according to the National Library of Medicine, lactose intolerance is a prevalent condition among adults, with approximately 30 million American adults experiencing some level of lactose intolerance by the age of 20.

The rising health consciousness among consumers has led to substantial developments with increased nutritional composition in supplements, as well as food and beverage items.

For instance, in July 2020, DuPont Nutrition & Biosciences (N&B) launched Danisco Bonlacta, an innovative lactase enzyme solution designed to enhance the nutritional composition of lactose-free dairy products by adjusting fiber and sugar content, specifically developed for the North American market. This thermophilic lactase enzyme exhibits exceptional heat resistance, making it suitable for high-temperature processing techniques.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia-Pacific lactase market is expected to grow at the fastest CAGR from 2024 to 2032. This is because the lactase enzyme has gained economic significance owing to the rising demand from the food and beverage industry and rapid industrialization in the Asia-Pacific region, particularly in China, India, and Vietnam.

For instance, according to Invest India Dairy Sector, in the year 2021-22, India accounted for 24.64% of the world's milk production. Over the past nine years, from 2014-15 to 2022-23, India's milk production has seen a significant 58% increase, reaching 230.58 million tons in 2022-23. This rising demand has led to the development of new technologies in the Asia-Pacific region. For instance, in July 2019, Anand Agricultural University (AAU) indigenously developed a technology as part of the 'Make in India' initiative, which involves biologically producing lactase enzymes extracted from lactobacilli bacteria, which are allowed for enzymatic action in milk, resulting in the production of lactose-free milk.

Global Lactase Market Share, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Lactase Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the lactase market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the lactase industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global lactase industry to benefit clients and increase the market sector. In recent years, the lactase industry has offered some technological advancements. Major players in the lactase market, including Advanced Enzyme Technologies, Amano Enzyme Inc., Antozyme Biotech Pvt. Ltd., Aumgene Biosciences, Biolaxi Enzymes Pvt. Ltd., IFF, Kerry Group plc., Nature Biosciences Pvt. Ltd., Novact Corporation and Novonesis.

IFF (International Flavors & Fragrances Inc.) is a manufacturing company that specializes in producing chemical products for the food, beverage, health, and biosciences industries. The company's product portfolio includes flavors, fragrances, and ingredients. IFF also has a nutrition division that contributes to the development of functional and flavorful ingredients that support health and wellness initiatives. The company has a global presence in 65 countries, with over 110 manufacturing facilities and 100 R&D centers. In April 2021, IFF introduced Nurica in the United States, a dairy enzyme that utilizes the lactose found in milk to produce galacto-oligosaccharides (GOS) fibers, resulting in decreased levels of lactose and sugar.

Kerry Group plc is a company that provides functional and nutritional solutions to the food, beverage, and pharmaceutical industries. Kerry Group's product portfolio includes fermented ingredients, flavors, enzymes, lipids, protein fractions, bioactive compounds, bio-preservation, probiotics, and other nutritional and functional ingredients. The company also offers dairy flavor products, chilled foods, natural extracts, taste modulation, meat, cereals, and savory and sweet products. Kerry Group is headquartered in Ireland. In December 2023, Kerry Group PLC acquired a segment of the lactase enzyme business from Novozymes A/S and Chr. Hansen Holding A/S. This acquirement was subject to approval by the European Commission.

Key Companies in the Lactase Market Include:

- Advanced Enzyme Technologies

- Amano Enzyme Inc.

- Antozyme Biotech Pvt. Ltd.

- Aumgene Biosciences

- Biolaxi Enzymes Pvt. Ltd.

- IFF

- Kerry Group plc

- Nature Biosciences Pvt. Ltd.

- Novact Corporation

- Novonesis

Lactase Industry Developments

In June 2023, DSM-Firmenich launched Maxilact Next, a highly efficient lactase enzyme designed to optimize lactose-free dairy production. Maxilact Next reduced hydrolysis time by 25%, enhancing capacity, raw material efficiency, and taste without compromising quality.

June 2022: Koninklijke DSM N.V. merged with Firmenich, a key player in the fragrance and flavors industry, to enhance the company's presence in the nutrition, wellness, and beauty sectors.

February 2022: Kerry Group plc. completed the acquisition of the German biotechnology company c-LEcta, known for its expertise in enzyme manufacturing, precision fermentation, and bioprocessing of enzymes, to expand the company into the lactase enzymes market.

December 2023: Kerry Group announced a €150 million acquisition of the lactase enzymes business from Chr. Hansen and Novozymes. This includes NOLA Products and aimed to expand Kerry’s enzyme technology for lactose-free dairy, pending European Commission approval.

Lactase Market Segmentation:

Lactase Source Outlook

- Yeast

- Fungi

- Bacteria

Lactase Form Outlook

- Dry

- Liquid

Lactase Application Outlook

- Food & Beverages

- Cheese

- Yogurt

- Milk

- Ice cream

- Others

- Pharmaceutical Products

- Dietary Supplements

Lactase Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lactase Market Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 238.88 million |

|

Market size value in 2025 |

USD 251.97 million |

|

Revenue Forecast in 2034 |

USD 414.27 million |

|

CAGR |

5.70% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million/ Volume in tons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global lactase market size was valued at USD 251.97 million in 2025 and is projected to be valued at USD 414.27 million in 2034.

The global market is projected to grow at a CAGR of 5.70% during the forecast period, 2025-2034.

North America held the largest share of the global market.

The key players in the market are Advanced Enzyme Technologies, Amano Enzyme Inc., Antozyme Biotech Pvt. Ltd., Aumgene Biosciences, Biolaxi Enzymes Pvt. Ltd., IFF, Kerry Group plc., Nature Biosciences Pvt. Ltd., Novact Corporation, and Novonesis.

The bacteria category was the fastest growing in the market in 2023.

The food & beverage category held the largest share in the global market.