Laparoscopic Power Morcellators Market Share, Size, Trends, Industry Analysis Report

By Application (Hysterectomy, Myomectomy, Others); By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 102

- Format: PDF

- Report ID: PM1955

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

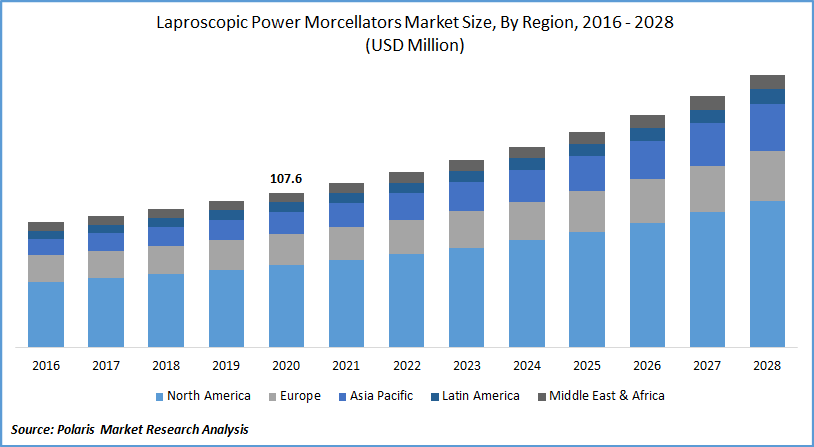

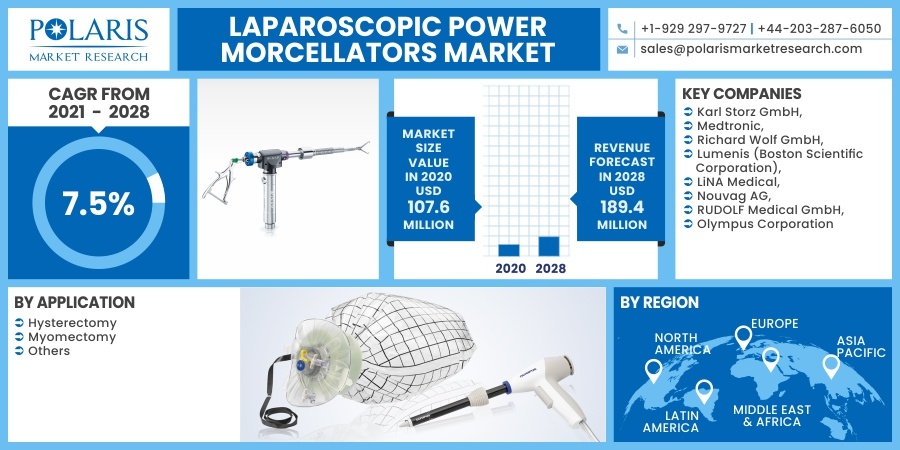

The global laparoscopic power morcellators market was valued at USD 107.6 million in 2020 and is expected to grow at a CAGR of 7.5% during the forecast period. An upsurge in the number of patients with uterine fibroids and endometriosis is anticipated to fuel the growth of the power morcellators market.

The uterine fibroids symptoms are not observed in all the women, and around 50 to 75% of cases remain asymptomatic and often go undiagnosed. As a result, as per estimation, approximately 77% of women of childbearing age may have uterine fibroids. Thus, surging prevalence will increase myomectomy and hysterectomy procedures, thereby boosting the power morcellators market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The growing technological advancements in surgical instruments, increasing aging population, and rising awareness have led to increasing preference for minimally invasive procedures. These are some of the additional factors that drive the laparoscopic power morcellators market's growth.

Laparoscopic procedures are gaining popularity worldwide, with more than 15 million laparoscopic procedures are being conducted every year, globally, and in the U.S. alone, 4.8 million laparoscopic procedures are performed. These procedures will decrease the post-operative recovery time with minimal complications when compared to traditional surgeries.

By using laparoscopic power morcellators, minor incisions will be made to break fibroids into pieces. In recent years, robot-assisted laparoscopic procedures are being conducted with the rapid improvement in technology.

COVID-19 is expected to slightly hamper the power morcellators industry growth due to the postponement of elective surgeries that includes laparoscopic procedures across the globe. Over 30 million elective surgeries were postponed due to the pandemic due to the lack of beds and healthcare infrastructure.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The global industry was driven by the factors such as an increasing case of uterine fibroids and endometriosis, along with a growing preference for minimally invasive surgical procedures. Globally procedures such as myomectomy and hysterectomy are being conducted more in number, which will also contribute to the growth of the global laparoscopic power morcellators market.

Laparoscopic procedures are the preferred type of treatment for uterine fibroids. Uterine fibroids are non-cancerous tumor growth in the uterus. Uterine fibroids are common in women in their child-bearing years. Globally, uterine fibroids affect more than 21% of women.

Every year, approximately 200,000 hysterectomies and 30,000 myomectomies are conducted across the globe. Thus, an increase in uterine fibroid cases is one of the major factors driving the growth of the industry for laparoscopic power morcellators.

The incidence of uterine cancer worldwide is approximately 28 per 100,000 women per year, and in the U.S. alone, 66,570 new cases of uterine cancer were diagnosed in 2019. Laparoscopic hysterectomy is one of the forms of treatment procedure used in early-stage uterine cancer, and hence increasing uterine cancer will contribute to the growth of the global market for laparoscopic power morcellators.

Recently FDA issued new guidelines for the use of the product in surgical procedures. According to the guidelines, power morcellators can be employed in few gynecological surgeries such as hysterectomies and myomectomies but only in selected patients and by using tissue containment systems legally approved in the industry for laparoscopic power morcellators.

However, the new guidelines barred physicians from using the product to treat uterine malignancy as the procedure may spread cancer to other areas of the body. The latest FDA guideline will help in the increasing adoption of the product in gynecological surgeries such as myomectomies and hysterectomies, which will drive the growth of the industry for laparoscopic power morcellators.

Laparoscopic Power Morcellators Market Report Scope

The market is primarily segmented on the basis of application and region.

|

By Application |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Application

The hysterectomy segment dominated the market and generated the highest revenue in 2020. This procedure is the most common and well-proven permanent treatment for uterine fibroids. Uterine fibroids may be permanently removed with this treatment. Pregnancy is not possible after this treatment. According to the Journal of Obstetrics and Gynecology Canada (JOCG) statistics, more than 41,000 hysterectomies are conducted in Canada annually.

The myomectomy procedure is proved to be the standard treatment for removing fibroids while maintaining the uterus and allowing patients to remain fertile. Unlike hysterectomy, this method will retain fertility. The myomectomy procedures are performed in a number of ways on the basis of the position and size of the fibroids.

Several surgeons across the world now conduct one-incision laparoscopic and robotic myomectomies. Small incisions may remove more significant fibroids by cutting them into parts, a procedure is known as morcellation. As a result, a rise in patient choice for non-invasive care is anticipated to push market growth for laparoscopic power morcellators rapidly during the projected period.

Geographic Overview

North America power morcellators market will be the most significant region in the global market during the forecast period, owing to the rising gynecological surgical processes and increasing government policies in the region. In addition, the existence of key market players and the availability of technologically innovative products also boosting the region’s growth. The modern health care infrastructure and availability of advanced medical devices in the region will further aid in the market growth of laparoscopic power morcellators.

Asia Pacific is expected to be the fastest-growing region for the market during the forecast period, owing to the enormous investment by public and private sectors in improving healthcare infrastructure in countries like China and India. The increasing patient base suffering from endometritis, uterine fibroids, abnormal bleeding, and the rise in the number of hysterectomy and myomectomy surgeries in Asia Pacific region is anticipated to fuel the market for laparoscopic power morcellators over the coming years.

Competitive Insight

The major players in the global power morcellators market are investing heavily in research and development to bring new products to the market owing to technological development and favorable regulatory approvals for these kinds of devices. The companies are also involved in acquisitions and partnerships to expand their portfolio of products.

Some of the major players operating in the power morcellators market include Karl Storz GmbH, Medtronic, Richard Wolf GmbH, Lumenis (Boston Scientific Corporation), LiNA Medical, Nouvag AG, RUDOLF Medical GmbH, and Olympus Corporation.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 107.6 million |

|

Revenue forecast in 2028 |

USD 189.4 million |

|

CAGR |

7.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies |

Karl Storz GmbH, Medtronic, Richard Wolf GmbH, Lumenis (Boston Scientific Corporation), LiNA Medical, Nouvag AG, RUDOLF Medical GmbH, and Olympus Corporation |