Lavatory Service Vehicles Market Share, Size, Trends, Industry Analysis Report

By Vehicle Type (Trucks, Carts); By Capacity; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM1724

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

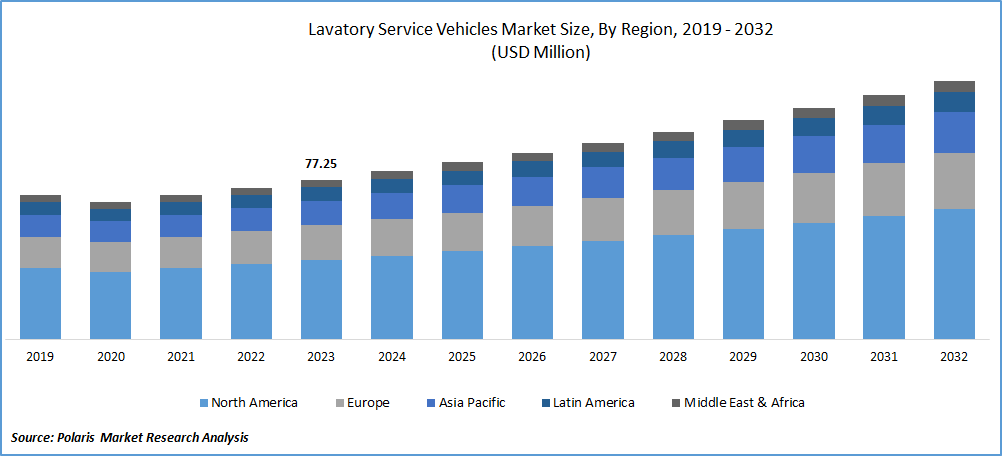

The global lavatory service vehicles market was valued at USD 77.25 million in 2023 and is expected to grow at a CAGR of 5.5% during the forecast period.

The Lavatory Service Vehicles, a heavily used part of the aviation industry, are witnessing dynamic growth fueled by several driving factors, such as the surge in air travel demand globally. Airlines face a significant need for quick and efficient response times for their vehicles as the number of passengers continues to rise. Consequently, the demand for lavatory service vehicles, which play an important role in maintaining aircraft hygiene, has experienced a rise in demand.

Emerging markets and increased connectivity are driving airlines to expand their operations, demanding a reliable fleet of lavatory service vehicles to ensure the flawless functioning of their aircraft. The stringent hygiene and safety regulations imposed by aviation authorities further elevate the importance of these vehicles. Compliance with these regulations orders airlines to invest in effective lavatory service solutions to meet the prescribed standards for cleanliness and waste disposal. In addition to regulatory pressures, technological advancements play a crucial role in propelling the market forward. Ongoing innovations in waste disposal systems, vehicle automation, and the integration of smart technologies are enhancing the efficiency and effectiveness of lavatory service vehicles.

To Understand More About this Research: Request a Free Sample Report

High initial costs associated with the acquisition and maintenance of these vehicles pose a considerable challenge. For airlines and service providers, the investment in these types of vehicles may act as an obstacle, slowing down the adoption of these essential vehicles. The shift to more advanced lavatory service vehicles may require additional personnel training and could disrupt existing workflows within airports and airlines. Economic downturns or crises within the aviation industry can also impact market dynamics, with airlines potentially delaying or scaling back investments in new equipment, including lavatory service vehicles.

Growth Drivers

- Rising demand for air travel around the globe boosts the market growth.

The escalating demand for air travel on a global scale stands as a driving factor for market growth. This surge in demand is associated with the rise in the number of air passengers, driven by factors such as increasing disposable income, greater affordability of air travel, and increased connectivity between regions. As more individuals choose air transportation for both business and tour purposes, airlines are directed to maintain efficient and timely operations. In this context, lavatory service vehicles play an important role in ensuring the cleanliness and functionality of aircraft lavatories during the crucial turnaround periods between flights. The growing demand for air travel not only creates a need for expanded fleets and more frequent flights but also emphasizes the essential role of lavatory service vehicles in supporting the rapid and effective servicing of aircraft, thereby contributing significantly to the overall efficiency and seamless functioning of the aviation industry.

Report Segmentation

The market is primarily segmented based on vehicle type, capacity, application, and region.

|

By Vehicle Type |

By Capacity |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Vehicle Type Analysis

- The truck segment held the largest market share in 2023

The dominance of the truck segment in the market is because of several factors. Trucks offer a versatile and mobile solution capable of servicing aircraft across various locations within an airport. This flexibility is particularly crucial in scenarios where aircraft parking arrangements vary or when servicing is required at remote stands. The truck-based lavatory service vehicles can cater to these concerns with relative ease, providing a comprehensive and adaptable solution for aviation operators.

Along with this, the scalability of truck-based systems allows for different capacities, accommodating the varied needs of airlines and airports. The ability to carry and manage larger volumes of lavatory waste, water, and cleaning supplies positions trucks as ideal choices for high-traffic airports. The ease of maintenance, relatively lower upfront costs, and widespread familiarity with truck-based systems in airport operations make them a preferred choice for many aviation stakeholders. Owing to these factors, the truck segment held the highest market share in 2023.

By Application Analysis

- The commercial segment is estimated to dominate the market over the forecasted period.

The dominance of the commercial segment in the market is due to several key factors. The commercial aviation sector, which includes airlines and airports, is witnessing sustained growth globally. As air travel continues to rise, there is an increasing demand for efficient ground support services, including lavatory services for aircraft. Commercial airlines and airports heavily depend on lavatory service vehicles to maintain hygiene and operational preparedness of aircraft between flights. These specialized vehicles play an important role in emptying and servicing the lavatories of parked or landed aircraft, ensuring a quick turnaround time for departing flights. Also, stringent regulations and standards imposed by aviation authorities regarding sanitation and hygiene further drive the adoption of lavatory service vehicles in the commercial aviation sector. The emphasis on passenger safety and comfort confirms the need for reliable and efficient lavatory servicing, making these vehicles essential for airlines and airports.

Regional Insights

- North America region is projected to hold a substantial market share in 2023.

North America region held a substantial market share in the global lavatory service vehicles market in 2023 because the region boasts a mature and robust aviation industry, presented by a high volume of air traffic, a crowded network of airports, and a significant number of commercial airlines. The region's well-established aviation infrastructure, including major airports and hubs, demands advanced ground support equipment, including lavatory service vehicles, to cater to the growing demands of air travel. Also, the strict regulatory framework in North America regarding aviation safety and hygiene standards further propels the adoption of specialized vehicles like LSVs.

The Asia Pacific region is expected to witness substantial growth in the market due to several factors, such as the increasing demand for aircraft maintenance and repair services in countries such as China, India, Japan, South Korea, and Singapore. As air travel becomes more accessible and affordable, there has been a surge in passenger traffic, which has led to an increased need for efficient and effective aircraft maintenance services.

Another factor contributing to the growth of the market in the Asia Pacific region is the expansion of major airlines and airports. With the rise of low-cost carriers and the increase in flight frequencies, airports are under pressure to provide faster turnaround times and improved facilities. This creates a need for specialized vehicles that can quickly and efficiently service aircraft lavatories, ensuring that they meet strict safety and hygiene standards.

Key Market Players & Competitive Insights

Manufacturers in the global market are actively engaged in several activities to cater to the evolving needs of the aviation industry. Companies design, develop, and produce advanced Lavatory Service Vehicles that comply with international standards and regulations governing aviation hygiene and safety. Manufacturers focus on incorporating innovative technologies to enhance the efficiency and performance of their vehicles, such as advanced vacuum systems, waste disposal mechanisms, and environmentally friendly features. Customization is another important aspect of their activities, as they work closely with airlines and airports to tailor LSVs to specific requirements and fleet types.

Some of the major players operating in the global market include:

- ACCESSAIR Systems Inc.

- Aero Specialties Inc.

- Alberth Aviation Ltd.

- Charlatte of America Inc.

- Lift-A-Loft Engineered Aerial Solutions

- Mallaghan Engineering Ltd.

- TBD Owen Holland Ltd

- TLD Group

- Vestergaard Co Holding A/S

- Weihai Guangtai Airport Equipment Co. Ltd.

Recent Developments

- In July 2023, the United States Department of Transportation (DOT) announced a new rule on the occasion of the 33rd anniversary of the Americans with Disabilities Act (ADA) that requires airline lavatories to be more accessible to people with disabilities.

Lavatory Service Vehicles Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 81.34 million |

|

Revenue Forecast in 2032 |

USD 124.97 million |

|

CAGR |

5.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Vehicle Type, By Capacity, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

Lavatory Service Vehicles Market report covering key segments are vehicle type, capacity, application, and region

Lavatory Service Vehicles Market Size Worth USD 124.97 million By 2032

The global lavatory service vehicles market and is expected to grow at a CAGR of 5.5% during the forecast period.

North America is leading the global market.

The key driving factors in Lavatory Service Vehicles Market is stringent hygiene and safety regulations imposed by aviation authorities further elevate the demand for these vehicles