LED Packaging Market Share, Size, Trends, Industry Analysis Report

By Component (Bonding Equipment, Assembly and Packaging Equipment, Testing Equipment, Others (Metrology and Dicing)); By Barrier Type; By Coating Type; By End-Use; By Region.; Segment Forecast, 2024- 2023

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4639

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

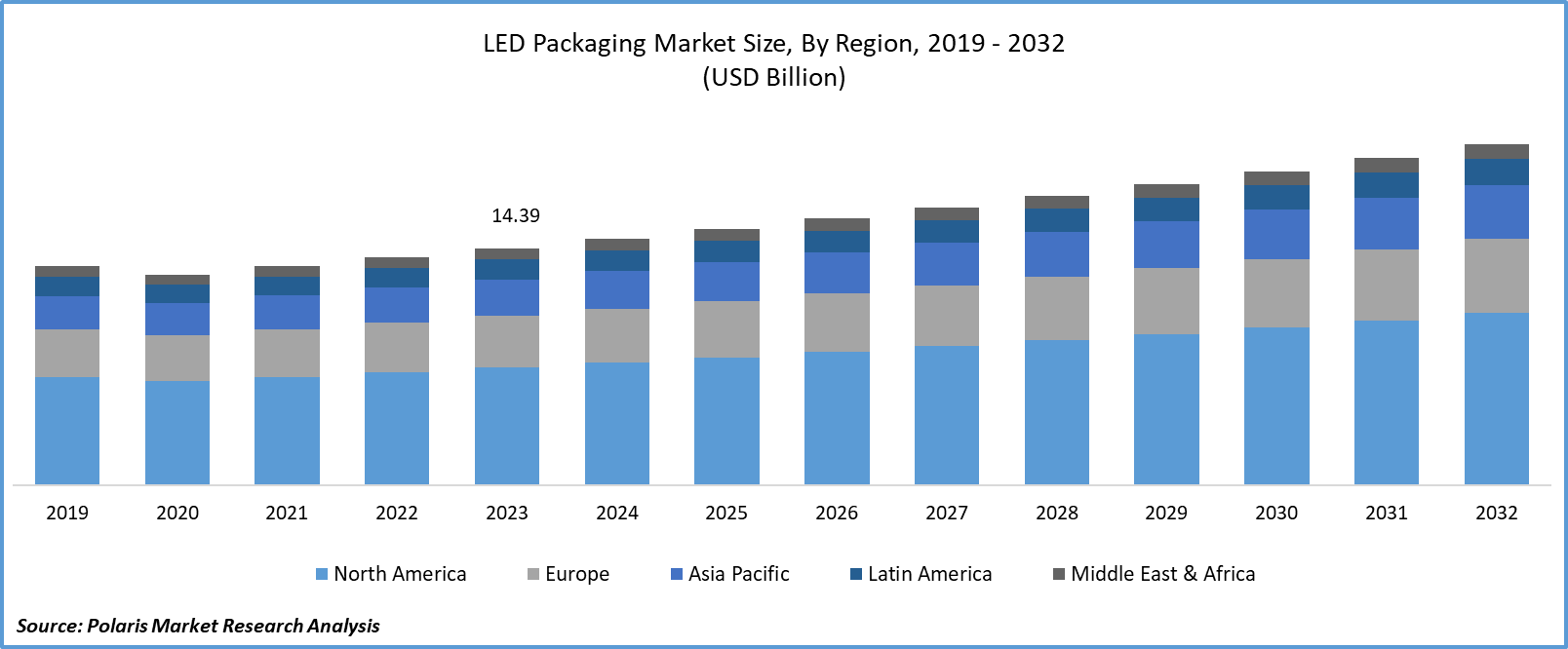

LED packaging market size was valued at USD 14.39 billion in 2023. The market is anticipated to grow from USD 14.98 billion in 2024 to USD 20.72 billion by 2032, exhibiting the CAGR of 4.1% during the forecast period.

Industry Trend

LEDs have garnered considerable attention due to their superior luminosity and color rendering properties, making them ideal for a range of solid-state lighting applications, including street illumination, display backlighting, and automotive lighting. The packaging of LEDs plays a crucial role in ensuring high luminous efficiency, controllable light patterns, and uniform color output.

The growth of the LED packaging market can be attributed to several factors. Firstly, there is a growing demand for LED packages in the display panel market, driven by advancements in display technology and increasing consumer demand for high-quality visual experiences. Moreover, favorable government initiatives and regulations promoting the adoption of LEDs for energy efficiency and environmental sustainability have further fueled market growth.

Additionally, the emergence of IoT-enabled lighting fixtures and smart lighting solutions is a significant driver of demand for LED packaging. These technologies offer enhanced control and connectivity, enabling users to optimize energy usage and customize lighting environments according to their preferences.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the LED packaging market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the ongoing COVID-19 pandemic has heightened the demand for efficient disinfection systems, leading to increased interest in UV LED packages. UV LEDs are effective in disinfection applications, offering advantages such as energy efficiency, long lifespan, and environmental safety compared to traditional disinfection methods.

The company has recently infused significant capital into a groundbreaking investment initiative, fostering collaboration and harnessing state-of-the-art technology to transform its operations. This visionary strategy seeks not only to improve current products and services but also to pioneer innovative solutions that will establish new benchmarks within the industry. With a comprehensive approach aimed at expanding market presence, appealing to new demographics, and fostering sustainable growth in a dynamic business environment, the company is poised for success. Through the synergy of investment, technology, innovation, and strategic planning, it is positioned to maintain competitiveness and emerge as a frontrunner in its field.

- For instance, In September 2023, ams-OSRAM AG and the Malaysian Investment Development Authority (MIDA) entered into a collaborative agreement with MIDA for advanced LED manufacturing in Malaysia.

In light of these factors, the LED industry is experiencing rapid growth, with manufacturers increasingly focusing on LED design to ensure optimal packaging and product viability. The choice of packaging material and design varies depending on the specific requirements of the LED and its intended application. Options range from plastic leaded chip carriers (PLCCs) and ceramic holders to flip glass substrates and printed circuit boards (PCBs), each offering unique benefits and functionalities.

Key Takeaway

- Asia Pacific region accounted for the largest market and contributed to more than 35% of share in 2023.

- North America region is expected to grow at the fastest CAGR during the forecast period.

- By package type category, surface mounted devices (SMD) held the largest market share in 2023.

- By application category, the industrial segment is expected to witness the fastest growing CAGR during the forecast period.

What are the market drivers driving the demand for the LED Packaging Market?

The increasing Need for Energy-Efficient Lighting Solutions is projected to spur product demand.

The global focus on energy efficiency has intensified due to concerns about environmental sustainability and the need to reduce energy consumption. In response, industries and consumers alike are seeking more sustainable alternatives to traditional technologies. LED lighting has emerged as a highly attractive option due to its significantly lower energy consumption and longer lifespan compared to conventional lighting sources such as incandescent and fluorescent bulbs. LEDs consume up to 80% less energy than traditional lighting technologies, making them a compelling choice for both residential and commercial applications. Additionally, their extended lifespan reduces the frequency of replacements, resulting in lower maintenance costs and reduced waste generation.

This increasing preference for LED lighting solutions is driving demand for LED packaging. LED packaging plays a crucial role in protecting the delicate semiconductor components of LEDs while ensuring optimal thermal management, light distribution, and durability. As the adoption of LED lighting continues to grow across various sectors, including residential, commercial, industrial, and outdoor lighting, the demand for high-quality LED packaging solutions is expected to rise correspondingly.

Moreover, government initiatives and regulations promoting energy efficiency, such as energy performance standards and incentives for energy-efficient lighting upgrades, further bolster the demand for LED lighting and, consequently, LED packaging.

Which factor is restraining the demand for LED Packaging?

Technological challenges are likely to impede the market growth.

LED packaging refers to the process of enclosing LED chips within protective casings or housings to enhance their performance, manage heat dissipation, and ensure reliability. This process involves intricate technologies and manufacturing processes to meet stringent performance requirements and industry standards. One of the primary challenges in LED packaging is managing thermal issues effectively. LED chips generate heat during operation, which can degrade their performance and lifespan if not managed properly. LED packaging designs must incorporate heat sinks, thermal interface materials, and efficient thermal pathways to dissipate heat away from the LED chip and prevent overheating. Color control mechanisms to achieve uniform color output and maintain consistency over time.

Furthermore, advancements in LED technology, such as higher power densities, smaller form factors, and increased efficiency, pose additional challenges for LED packaging. Manufacturers must continually innovate and develop new packaging materials, designs, and processes to keep pace with evolving LED chip technologies that may impact on market.

Report Segmentation

The market is primarily segmented based on component, package type, power range, wavelength, application, and region.

|

By Component |

By Package Type |

By Power Range |

By Wavelength |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Package Type Insights

Based on package type analysis, the market is segmented into surface-mounted devices (SMD), chip-on-board (COB), chip-scale packages (CSP), and others. Surface-mounted devices (SMD) held the largest market share in 2023. SMD technology offers versatility in terms of application and design. LED chips are directly mounted onto PCBs or substrates using SMT, allowing for compact and flexible designs suitable for a wide range of lighting and display applications. SMD packaging allows for high packing densities, meaning that a large number of LED chips can be densely arranged on a small surface area. This results in higher brightness levels and improved light output efficiency, making SMD LEDs attractive for various applications where brightness and efficiency are critical factors. SMD packaging facilitates efficient heat dissipation from the LED chips to the PCB or substrate. This helps in maintaining optimal operating temperatures for the LEDs, ensuring their longevity and reliability.

By Application Insights

Based on application analysis, the market has been segmented based on general lighting, automotive lighting, backlighting, flash lighting, industrial, and others. The industrial segment is expected to witness the fastest-growing CAGR during the forecast period. There is a growing trend towards automation and digitization across various industries, including manufacturing, automotive, and logistics. LED lighting plays a crucial role in industrial environments by providing efficient and reliable illumination for production floors, warehouses, and logistics centers. As industrial automation continues to expand, the demand for LED lighting solutions tailored to industrial applications is expected to rise, driving growth in the LED packaging market. Industries are increasingly focused on reducing energy consumption and improving sustainability. LED lighting offers significant energy savings compared to traditional lighting technologies, making it an attractive choice for industrial facilities looking to minimize operational costs and environmental impact. As regulations and standards for energy efficiency become more stringent, industrial players are likely to invest in LED lighting upgrades, fueling demand for LED packaging solutions. Proper lighting is essential for maintaining a safe and productive work environment in industrial settings. LED lighting provides bright, uniform illumination that enhances visibility and reduces glare, helping to prevent accidents and improve productivity.

Regional Insights

Asia Pacific

In 2023, the Asia Pacific region accounted for the largest market share. The rapid economic growth and industrialization witnessed in several Asia Pacific countries have fueled the demand for packaging solutions across various industries. Asia Pacific, particularly countries like China, Taiwan, South Korea, and Japan, has emerged as a manufacturing hub for LED packaging due to its robust infrastructure, skilled labor force, and supportive government policies. These countries host numerous LED packaging manufacturers, suppliers, and OEMs, driving the region's dominance in the global market. Asia Pacific offers cost-competitive manufacturing solutions, including lower labor costs and access to raw materials, components, and production equipment. This cost advantage has attracted LED companies from around the world to establish manufacturing facilities in the region, further consolidating its dominance in the LED packaging market.

North America

North America region is expected to grow at the fastest CAGR during the forecast period. North America has been witnessing a steady increase in the adoption of LED lighting across various sectors, including residential, commercial, industrial, and automotive. This trend is driven by factors such as energy efficiency initiatives, sustainability goals, and the phase-out of inefficient lighting technologies. As more businesses and consumers in the region transition to LED lighting solutions, the demand for LED packaging is expected to grow rapidly. North America is home to several leading LED technology companies, research institutions, and innovation hubs that are driving advancements in LED packaging technologies. These advancements include developments in thermal management, materials science, optical design, and manufacturing processes, resulting in more efficient, reliable, and cost-effective LED packaging solutions. The region's strong focus on innovation and technology leadership is expected to contribute to its rapid growth in the LED packaging market. Governments at the federal, state, and local levels in North America have implemented supportive policies, regulations, and incentives to promote the adoption of energy-efficient lighting technologies, including LEDs. These initiatives aim to reduce energy consumption, lower greenhouse gas emissions, and enhance energy security.

Competitive Landscape

The LED packaging market exhibits fragmentation, with competition stemming from a multitude of players. Key service providers within this sector continuously enhance their technologies to maintain a competitive edge, emphasizing efficiency, reliability, and safety. Striving for substantial market presence; these entities emphasize the significance of strategic partnerships, ongoing product enhancements, and collaborative endeavors to surpass industry counterparts.

Some of the major players operating in the global market include:

- ams-OSRAM AG.

- Everlight Electronics Co. Ltd.

- Foshan NationStar Optoelectronics Co. Ltd

- Global Holdings, Inc.

- LITE-ON Technology, Inc

- MLS CO, LTD

- Nichia Corporation

- Samsung, Lumileds Holding B.V.

- Seoul, Semiconductor Co., Ltd.

- SMART

Recent Developments

- In May 2023, Lumileds Holding B.V. expanded its Chip-on-Board (CoB) product range by presenting LUXEON CX and LUXEON Core, along with new LUXEON CS board sizes to provide enhanced design flexibility, despite the numerous standards existing in the LED industry.

- In September 2022, Samsung unveiled a new outdoor lighting LED solution known as 5050 LED, featuring improved reliability, performance, and cost efficiency.

Report Coverage

The LED Packaging Market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, package type, power range, wavelength, wavelength, and their futuristic growth opportunities.

LED Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.98 Billion |

|

Revenue forecast in 2032 |

USD 20.72 billion |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By package type, By power range, By wavelength, By Application and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the LED packaging market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

FAQ's

The global LED Packaging Market size is expected to reach USD 20.72 billion by 2032

Key players in the market are ams-OSRAM AG., NICHIA corporation, Samsung, Seoul, Semiconductor Co., Ltd., Lumileds Holding B.V

North America contribute notably towards the global LED Packaging Market

LED packaging market exhibiting the CAGR of 4.1% during the forecast period.

The LED Packaging Market report covering key segments are component, package type, power range, wavelength, application, and region.