Levulinic Acid Market Share, Size, Trends, Industry Analysis Report

By Technology (Biofine, Acid Hydrolysis); By End-Use (Agricultural, Medical and Healthcare, Personal Care, Petrochemical, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 118

- Format: PDF

- Report ID: PM2614

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

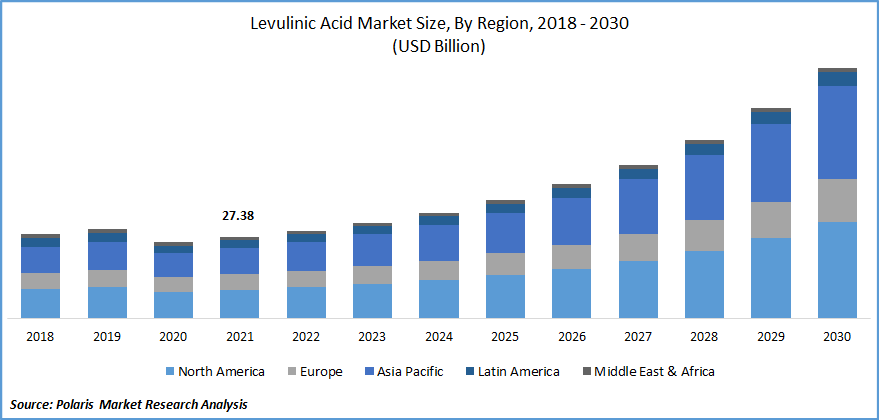

The global levulinic acid market was valued at USD 27.38 Billion in 2021 and is expected to grow at a CAGR of 14.0% during the forecast period. The demand for levulinic acid is expected to increase during the forecast period owing to its use as a potential platform chemical across various industries.

Know more about this report: Request for sample pages

It can be obtained through carbohydrates, wood, starch, and agricultural waste to produce fuel additives, specialty chemicals, and liquid fuels. It has a low melting point and offers solubility in water and organic solvents. It has acid carboxyl and keto carbonyl functional groups, which offer the ability for conversion to several commercial derivatives.

It is increasingly being used as a platform chemical in green industrial chemical processes. It is a platform chemical with the ability to substitute petroleum-based products in chemical and biofuel applications. The shift toward sustainable and green chemicals has increased the demand for levulinic acid.

It uses biomass as raw material and reduces dependency on non-renewable fossil sources. The versatility of levulinic acid has increased its application as a plasticizer, resin, animal feed, and antifreeze. It is also used in applications such as pharmaceuticals and cosmetics.

It is increasingly being used as a plasticizer. Increasing inclination toward renewable and phthalate-free plasticizers is expected to drive the demand during the forecast period. Levulinic acid esters and ketals also find application as solvents for numerous applications.

They are used in metal cleaning and industrial plant cleaning on account of their high degreasing and stain removal abilities. They offer superior solvating power and reduced vapor pressure. Waterborne coatings based on levulinic acid accelerate the crosslinking process and can be used as a partial replacement for bisphenol A (BPA) in epoxy resins.

The COVID-19 outbreak has affected the levulinic acid market through several restrictions on operations and transportation. The availability of raw materials and limited manufacturing activities hampered the market growth. The decline in demand for the industry from industries such as agriculture, transportation, and chemicals also contributed to restricted industry growth. Supply chain disruptions, limited workforce, and regulations on import and export activities further led to a decline in the market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The application of levulinic acid has increased in the production of medicines, agricultural chemicals, and cosmetics. It is being used in the production of perfumes, plastics, paints, and lubricating oils. It offers several advantages, such as greater conversion yields, high productivity, and feedstock flexibility.

Increasing population and industrial growth support the growth of the market. The rise in application in industries such as agriculture, transportation, and chemicals has increased over the years. Supportive government regulations and the growing adoption of sustainable solutions further promote market growth. Increasing trends and advancements in green chemistry to overcome the depletion of fossil fuels has increased the demand for the industry.

Increasing environmental concern introduction of initiatives to support renewable energy and decarbonization boost the growth of this market. Technological innovations, investments in research and development, and advancements in the use of sustainable feedstock are factors expected to provide growth opportunities during the forecast period.

Report Segmentation

The market is primarily segmented based on technology, application, end-use, and region.

|

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Biofine segment accounted for a significant share

On the basis of technology, the global market has been segmented into biofine and acid hydrolysis. The biofine segment accounted for a major share of the market in 2021. The biofine process makes use of dilute sulfuric acid for the conversion of five- and six-carbon sugars, respectively, to furfural and hydroxymethyl furfural. The popularity of this process is attributed to its higher production efficiency.

The demand for levulinic acid from cosmetics segment is expected to increase during the forecast period

On the basis of application, the market is segmented into pharmaceuticals, cosmetics, flavors & fragrances, resins & coatings, agrochemicals, polymers & plasticizers, and others. The demand for the industry from the cosmetics sector is expected to increase during the forecast period. Levulinic acid and its derivatives are increasingly being used in the development of organic and natural cosmetic compositions. It is used in products such as perfumes, skin moisturizers, and creams for pH regulation, skin conditioning, and preventing wrinkles.

The increasing population and greater awareness associated with natural and organic skincare products support the growth of this segment. Rising inclination toward beauty trends and concerns, changing lifestyles, and growing disposable income of consumers further drives the growth of this segment. The rise in demand for levulinic acid coupled with the growth of e-commerce platforms are factors contributing to increased demand.

Agriculture sector is expected to hold considerable share

Based on end-user, the global levulinic acid market has been segmented into agricultural, medical and healthcare, personal care, petrochemical, and others. The demand for the industry from the agriculture sector is high. It is being used as an alternative to traditional herbicides and pesticides. Levulinic acid improves the effectiveness of pesticides in eliminating unwanted pests.

The rise in demand for high-quality food products, increase in food demand from emerging economies, and growth in population drives the growth of this segment. There has been an increasing inclination toward the use of sustainable and bio-based agricultural products to maintain the quality of crops. The rise in the production of organic crops, improving living standards, rapid urbanization, and growing economy are factors that have increased the demand for levulinic acid in agricultural products.

Asia Pacific region is expected to witness significant growth

The Asia Pacific levulinic acid is expected to experience growth during the forecast period. The rise in population, industrial growth, and increasing urbanization are some factors boosting market growth. There has been a rise in demand for levulinic acid from the pharmaceutical, agriculture, and personal care sectors. Growth in awareness regarding the use of sustainable and environmentally friendly products has been observed in the region. The rise in environmental concerns and supportive government regulations further boosts market growth. Introduction of initiatives and programs to decrease the dependence on fossil fuels has increased the demand for levulinic acid across various industries.

Greater demand from the transportation sector and increasing application in agrochemicals have boosted the market growth in the region. Increasing investment in research and development activities, expansion of global players in the region, and technological advancements are factors expected to provide growth opportunities in Asia Pacific during the forecast period.

Competitive Insight

Some major players operating in the global levulinic acid market include Anhui Herman Impex Co Ltd, Apple Flavor & Fragrance Group Co. Ltd., Biofine Technology LLC, China Shijiazhuang Pharmaceutical Group Co. Ltd, GF Biochemicals Ltd., Godavari Biorefineries Ltd, Great Chemicals Co. Ltd, Hebei Langfang Triple Well Chemicals Co. Ltd, Hefei TNJ Chemical Industry Co., Ltd, Heroy Chemical Industry Co. Ltd, Parchem Fine & Specialty Chemicals, Segetis Inc, Simagchem Corporation, Tokyo Chemical Industry Co. Ltd, and Toyota Chemical Co. Ltd.

The leading market players are investment in research and development of advanced technologies and materials to introduce new products in the market. Partnerships and collaborations further enables these companies to strengthen market presence and cater to a wider customer base.

Recent Developments

In May 2022, BTC Europe GmbH collaborated with NXTLEVVEL Biochem for distribution of biobased and biodegradable solvents derived from levulinic acid in Europe. The development is aimed at strengthening presence in the European market. Levulinic acid can be used in a wide range of applications owing to its high solvency, low volatility, and biodegradability.

In February 2020, GF Towell Engineering Group partnered with GF Biochemicals Ltd. To expand offerings in the levulinic acid industry. The development enabled the companies to strengthen their position in bio-solvents and bio-plasticizers sectors. It offered opportunity to cater to a wider customer base in industrial cleaning, coatings home and personal care, and and agriculture sectors.

Levulinic Acid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 27.38 billion |

|

Revenue forecast in 2030 |

USD 83.83 billion |

|

CAGR |

14.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Technology, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Anhui Herman Impex Co Ltd, Apple Flavor & Fragrance Group Co. Ltd., Biofine Technology LLC, China Shijiazhuang Pharmaceutical Group Co. Ltd, GF Biochemicals Ltd., Godavari Biorefineries Ltd, Great Chemicals Co. Ltd, Hebei Langfang Triple Well Chemicals Co. Ltd, Hefei TNJ Chemical Industry Co., Ltd, Heroy Chemical Industry Co. Ltd, Parchem Fine & Specialty Chemicals, Segetis Inc, Simagchem Corporation, Tokyo Chemical Industry Co. Ltd, and Toyota Chemical Co. Ltd. |