Lewy Body Dementia Treatment Market Size, Share, Trends, Industry Analysis Report

: By Drug Type (Modafinil, Cholinesterase Inhibitors, Benzodiazepine, Antipsychotic Drugs, Antidepressants, and Carbidopa-Levodopa), Indication, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 112

- Format: PDF

- Report ID: PM1742

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

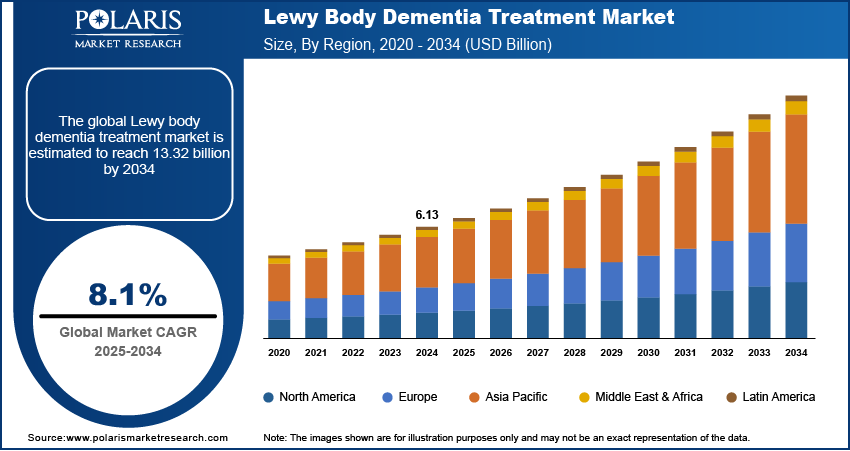

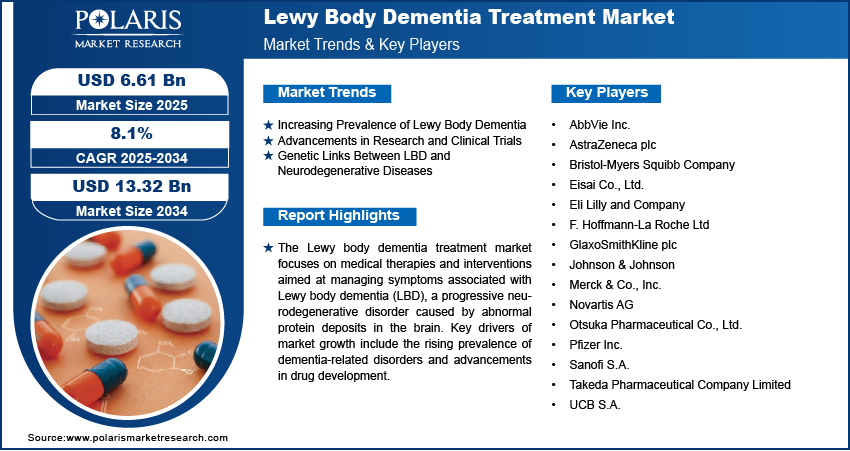

The global Lewy body dementia treatment market size was valued at USD 6.13 billion in 2024, exhibiting a CAGR of 8.1% during 2025–2034. The growing prevalence of dementia-related disorders and rising healthcare expenditure globally are the key factors driving market expansion.

Key Insights

- The cholinesterase inhibitors segment accounted for the largest market share in 2024. The efficacy of cholinesterase inhibitors in the management of cognitive decline contributes to the segment’s dominant position.

- The dementia with Lewy bodies (DLB) segment is witnessing significant growth. The high recognition of the diagnosis of DLB has resulted in increased demand for targeted therapies.

- North America accounts for the largest market share. This is primarily due to a significant patient population and the presence of advanced healthcare infrastructure.

- Asia Pacific is registering rapid growth due to the region’s rising healthcare expenditure and increased awareness of dementia-related conditions.

Industry Dynamics

- The growing incidence of LBD is significantly fueling the need for effective treatments, thereby contributing to market development.

- Advancements in research and the initiation of clinical trials have expanded the therapeutic landscape of LBD, driving market expansion.

- Strategic collaborations among pharmaceutical companies, healthcare providers, and research institutions are expected to provide several market opportunities.

- Lack of effective disease-modifying therapies may present market challenges.

Market Statistics

2024 Market Size: USD 6.13 billion

2034 Projected Market Size: USD 13.32 billion

CAGR (2025-2034): 8.1%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The Lewy body dementia treatment market focuses on therapies and medications designed to manage the symptoms of Lewy body dementia (LBD), a progressive neurodegenerative disorder characterized by cognitive decline, motor dysfunction, and psychiatric symptoms. Current treatment options primarily include cholinesterase inhibitors, dopaminergic agents, and antipsychotic medications, alongside non-pharmacological interventions such as cognitive therapy and lifestyle modifications. However, no disease-modifying treatments are available, creating a strong demand for novel therapeutic approaches. The market is influenced by ongoing clinical research, increased awareness, and growing investments in neurodegenerative disease treatment.

Key drivers of the Lewy body dementia treatment market growth include the rising prevalence of dementia-related disorders, advancements in drug development, and increasing healthcare expenditures worldwide. Additionally, an aging population is contributing to higher diagnosis rates, fueling market development. Regulatory approvals for new treatment options and the expansion of healthcare infrastructure in emerging economies also support market expansion. The market is expected to witness strategic collaborations among pharmaceutical companies, research institutions, and healthcare providers to address these challenges and advance treatment solutions.

Market Dynamics

Increasing Prevalence of Lewy Body Dementia

The rising incidence of LBD significantly propels the demand for effective treatments. According to American Brain Foundation, LBD is recognized as the second most common cause of dementia in the elderly, affecting over 1.4 million individuals in the United States alone. This substantial patient population underscores the urgent need for advanced therapeutic interventions, thereby driving the Lewy body dementia treatment market growth.

Advancements in Research and Clinical Trials

Progress in scientific research and the initiation of clinical trials have been pivotal in expanding the therapeutic landscape for LBD. In 2022, the National Institutes of Health (NIH) awarded a USD 10.7 million grant to the Cleveland Clinic to enhance a national research consortium focused on improving LBD diagnosis and treatment. Additionally, in 2023, the NIH's National Institute on Aging allocated USD 21 million for a clinical trial investigating neflamapimod, a potential treatment for dementia with Lewy bodies. These investments facilitate the development of novel therapies, thereby stimulating Lewy body dementia treatment market expansion.

Genetic Links Between LBD and Neurodegenerative Diseases

Emerging genetic studies have revealed associations between LBD and other neurodegenerative disorders, such as Alzheimer's and Parkinson's diseases. A 2021 NIH-led study identified five genes that may play critical roles in LBD, supporting its ties to these conditions. These insights enhance our understanding of LBD's pathogenesis and open new avenues for targeted treatments, thereby influencing the dynamics of the Lewy body dementia treatment market.

Market Segment Insights

Market Assessment by Drug Type

The Lewy body dementia treatment market, by drug type, is segmented into modafinil, cholinesterase inhibitors, benzodiazepine, antipsychotic drugs, antidepressants, and carbidopa-levodopa. The cholinesterase inhibitors segment dominated the Lewy body dementia treatment market share in 2024. These medications, including donepezil, rivastigmine, and galantamine, function by inhibiting the enzyme cholinesterase, thereby increasing acetylcholine levels in the brain. This mechanism helps alleviate cognitive symptoms such as memory loss and confusion associated with Lewy body dementia. The widespread adoption of cholinesterase inhibitors is attributed to their efficacy in managing cognitive decline and their relatively favorable side effect profile. Healthcare professionals often prefer these drugs as first-line treatments, contributing to their dominant market share.

Antipsychotic drugs represent the second most utilized medications in the Lewy body dementia treatment market. These drugs are prescribed to manage behavioral symptoms such as hallucinations and delusions, which are common in patients with Lewy body dementia. However, the use of antipsychotic drugs in this patient population requires careful consideration due to potential adverse effects, including an increased risk of mortality. Despite these concerns, the demand for effective management of neuropsychiatric symptoms sustains the significant market presence of antipsychotic drugs.

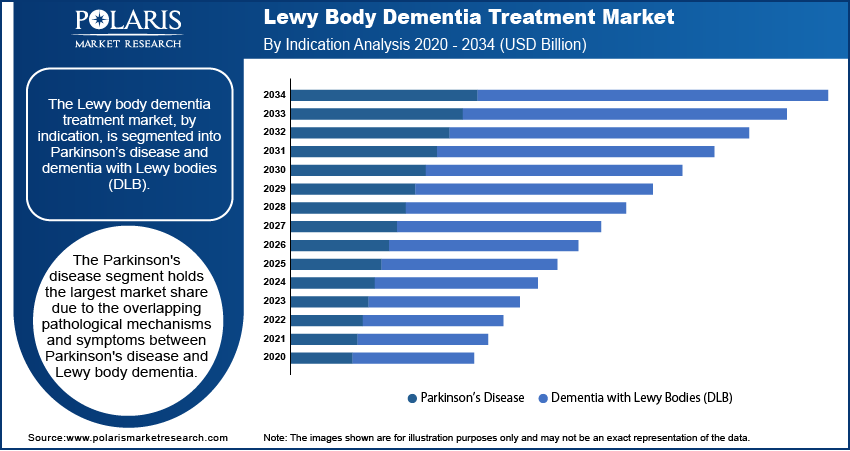

Market Evaluation by Indication

The Lewy body dementia treatment market, by indication, is segmented into Parkinson’s disease and dementia with Lewy bodies (DLB). The Parkinson's disease segment accounted for a major market share in 2024. This dominance is primarily due to the overlapping pathological mechanisms and symptoms between Parkinson's disease and Lewy body dementia, leading to a higher demand for treatments addressing both conditions. The increasing geriatric population, advancements in treatment options, and growing awareness of Parkinson's disease treatment among people are majorly supporting the expansion of the segment.

The dementia with Lewy bodies (DLB) segment is experiencing significant growth in the Lewy body dementia treatment market. This growth is driven by increased recognition and diagnosis of DLB, leading to a higher demand for targeted therapies. Additionally, advancements in diagnostic techniques and a better understanding of DLB's clinical presentation have contributed to the expansion of this segment.

Market Outlook by Distribution Channel

The Lewy body dementia treatment market, by distribution channel, is segmented into drug stores, hospitals pharmacies, online pharmacies, and retail pharmacies. Online pharmacies emerged as a dominant distribution channel in the Lewy body dementia treatment market in 2024. This shift is largely attributed to the convenience and accessibility they offer, enabling patients and caregivers to procure medications from their homes. The COVID-19 pandemic further accelerated the adoption of online platforms for healthcare needs, fostering a reliance on digital channels for purchasing medications, including those for chronic conditions like Lewy body dementia. Online pharmacies often provide competitive pricing, discounts, and a broader range of products compared to traditional brick-and-mortar establishments, appealing to patients seeking cost-effective and tailored solutions. The ease of obtaining prescriptions and the availability of informational resources on these platforms have enhanced the overall patient experience, contributing to their market prominence.

Hospital pharmacies continue to play a significant role in the distribution of Lewy body dementia treatments. The presence of specialized healthcare professionals, the availability of a comprehensive range of medications, and the necessity for hospital-based diagnostic and treatment services drive the prominence of hospital pharmacies. A substantial proportion of Lewy body dementia patients receive their diagnoses and initial treatments in hospital settings, underscoring the critical role of hospital pharmacies in ensuring timely access to necessary medications and integrated care.

Market Regional Analysis

By region, the study provides the Lewy body dementia treatment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the Lewy body dementia treatment market, primarily due to a significant patient population, increased awareness, and the availability of advanced healthcare infrastructure. The region's dominance is further supported by substantial investments in neurological research and development, with both government and private sectors actively involved. These factors collectively contribute to North America's leading position in the market.

The Europe Lewy body dementia treatment market is experiencing significant growth, driven by an aging population and increasing awareness of neurodegenerative disorders. The region's advanced healthcare infrastructure and strong emphasis on research and development have facilitated the adoption of innovative therapeutic approaches. Notably, Norway is expected to register the highest compound annual growth rate (CAGR) from 2025 to 2034 reflecting the country's proactive healthcare strategies and investment in dementia care.

Asia Pacific is emerging as a rapidly growing market for Lewy body dementia treatments. Factors contributing to this growth include a large and aging population, increasing healthcare expenditure, and heightened awareness of dementia-related conditions. India, in particular, is anticipated to exhibit the highest CAGR from 2025 to 2034, driven by improvements in healthcare infrastructure and a greater focus on neurological disorders.

Key Players and Competitive Insights

In the Lewy body dementia treatment market, several key players are actively contributing to advancements in therapeutic options. These companies include Eisai Co., Ltd.; Novartis AG; Pfizer Inc.; GlaxoSmithKline plc; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Johnson & Johnson; Sanofi S.A.; AbbVie Inc.; AstraZeneca plc; Bristol-Myers Squibb Company; Eli Lilly and Company; Takeda Pharmaceutical Company Limited; UCB S.A.; and Otsuka Pharmaceutical Co., Ltd.

Each of these companies brings unique strengths to the market. For instance, Eisai Co., Ltd. has been at the forefront of neurological research, focusing on developing treatments for various forms of dementia. Novartis AG and Pfizer Inc. have leveraged their extensive research and development capabilities to explore novel therapeutic avenues for neurodegenerative diseases. GlaxoSmithKline plc and F. Hoffmann-La Roche Ltd have also been instrumental in advancing clinical trials aimed at improving patient outcomes in dementia care.

The competitive landscape is characterized by strategic collaborations, research partnerships, and a shared commitment to addressing the unmet medical needs of patients with Lewy body dementia. These companies continually invest in innovative research, aiming to enhance the efficacy and safety profiles of available treatments. Their collective efforts contribute significantly to the evolving therapeutic landscape, offering hope for improved management of Lewy body dementia.

Eisai Co., Ltd. is a Japanese pharmaceutical company specializing in the research, development, and marketing of treatments for neurological disorders, including dementia. Their commitment to addressing unmet medical needs has positioned them as a key player in the field of neurodegenerative diseases.

Novartis AG is a global healthcare company based in Switzerland, engaged in the development and manufacturing of pharmaceuticals across various therapeutic areas. Their focus on innovation and strategic acquisitions has strengthened their portfolio in treating neurological conditions.

List of Key Companies

- AbbVie Inc.

- AstraZeneca plc

- Bristol-Myers Squibb Company

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- UCB S.A.

Lewy Body Dementia Treatment Industry Developments

- October 2022: Pfizer Inc., acquired Biohaven Pharmaceuticals Inc. for USD 11.6 billion. This strategic acquisition aims to enhance Pfizer's potential to offer new treatment options globally. Biohaven Pharmaceuticals Inc. is a pharmaceutical company focused on developing drugs for the treatment of Parkinson's disease, which is related to Lewy body dementia.

Market Segmentation

By Drug Type Outlook (Revenue – USD Billion, 2020–2034)

- Modafinil

- Cholinesterase Inhibitors

- Benzodiazepine

- Antipsychotic Drugs

- Antidepressants

- Carbidopa-Levodopa

By Indication Outlook (Revenue-USD Billion, 2020–2034)

- Parkinson’s Disease

- Dementia with Lewy Bodies (DLB)

By Distribution Channel Outlook (Revenue-USD Billion, 2020–2034)

- Drug Stores

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.13 billion |

|

Market Size Value by 2025 |

USD 6.61 billion |

|

Revenue Forecast by 2034 |

USD 13.32 billion |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The Lewy body dementia treatment market has been segmented into detailed segments of drug type, indication, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the Lewy body dementia treatment market focuses on expanding research and development efforts, securing regulatory approvals, and forming strategic collaborations to enhance treatment accessibility. Companies invest in clinical trials to develop innovative therapies while leveraging partnerships with healthcare institutions to strengthen their market presence. Increasing awareness campaigns and physician education programs help drive early diagnosis and treatment adoption. Additionally, expanding distribution networks, particularly in emerging markets, supports broader patient access. Digital marketing initiatives and patient support programs further contribute to market growth.

FAQ's

The Lewy body dementia treatment market size was valued at USD 6.13 billion in 2024 and is projected to grow to USD 13.32 billion by 2034.

The market is projected to register a CAGR of 8.1% during the forecast period.

North America had the largest share of the market in 2024.

A few of the key market players include Eisai Co., Ltd., Novartis AG, Pfizer Inc., GlaxoSmithKline plc, F. Hoffmann-La Roche Ltd, Merck & Co., Inc., Johnson & Johnson, Sanofi S.A., AbbVie Inc., AstraZeneca plc, Bristol-Myers Squibb Company, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, UCB S.A., and Otsuka Pharmaceutical Co., Ltd.

The online pharmacies segment accounted for the largest share of the market in 2024.

Lewy body dementia (LBD) treatment refers to the medical interventions and therapeutic approaches used to manage the symptoms of Lewy body dementia, a progressive neurodegenerative disorder characterized by cognitive decline, movement issues, sleep disturbances, and psychiatric symptoms such as hallucinations. While there is no cure, treatment focuses on symptom management through medications, lifestyle adjustments, and supportive therapies.