Light Switches and Electrical Sockets Market Size, Share, Trends, & Industry Analysis Report

By Type (Light Switches, Electrical Sockets, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5872

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

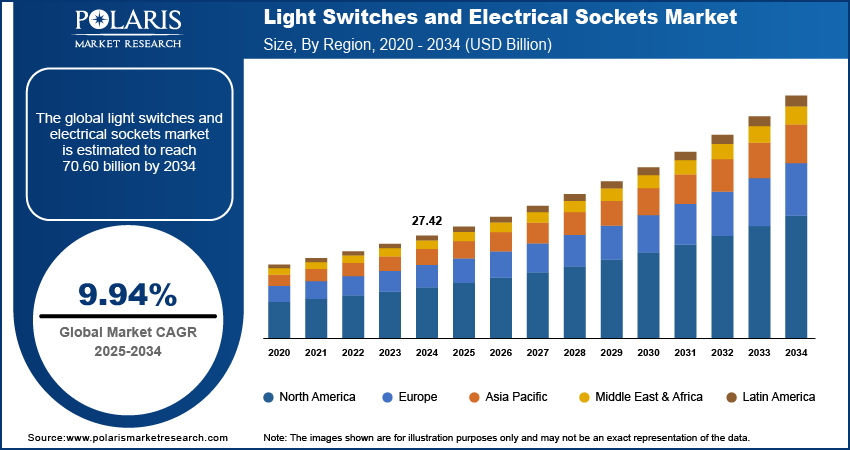

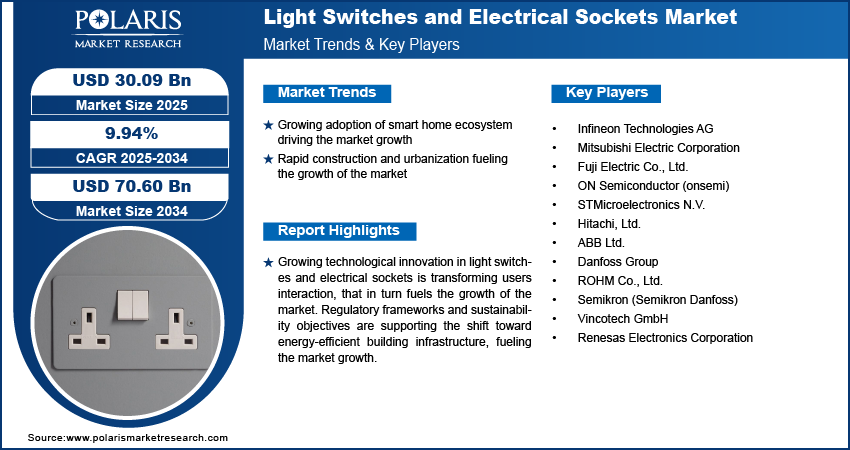

The global light switches and electrical sockets market size was valued at USD 27.42 billion in 2024, growing at a CAGR of 9.94% during 2025–2034. Growing adoption of smart home ecosystem, construction activities and rapid urbanization fueling the market growth.

Light switches and electrical sockets are essential components of residential, commercial, and industrial electrical systems that provides control over power distribution and access to electricity across various environments. These products are crucial in interior electrical infrastructure, enabling users to operate lighting, appliances, and connected devices efficiently and safely. The industry includes a wide range of switch types such as rocker, toggle, push-button, dimmer, and smart switches and socket designs suited to different voltage requirements, installation standards, and user needs.

This market is increasingly shaped by technological advancements that integrate smart functionality, such as universal remote control, motion detection, voice activation, and programmable timers. These features enhance user convenience, support energy efficiency, to meet the growing adoption of smart home and smart building systems. In addition to standard residential applications, light switches and electrical sockets are widely used in commercial buildings, industrial complexes, healthcare facilities, educational institutions, and public infrastructure.

Growing technological innovation in light switches and electrical sockets is transforming user’s interaction that fuels the growth of the market. The integration of features such as voice activation, wireless control, touch-sensitive surfaces, and USB ports is improving product functionality and design relevance across residential, commercial, and hospitality sectors. For instance, in March 2024, ABB introduced the Busch-art linear light switch series. The new product range combines sensor-based control, minimalist styling, and the use of sustainable materials to deliver an eco-conscious solution. These advancements address the growing need for convenience, automation, and aesthetic integration in modern interiors.

Additionally, regulatory frameworks and sustainability objectives are supporting the shift toward energy-efficient building infrastructure, thus fueling the market growth. Energy-saving policies and updated building standards in various countries are propelling the use of light switches and sockets that include dimmers, timers, and motion sensors. These features help reduce electricity usage and support long-term cost savings. Builders and facility owners are increasingly choosing such products to meet green building requirements and improve overall energy performance. This trend is strengthening market demand across new construction projects as well as renovation work in homes, offices, and public infrastructure.

Industry Dynamics

Growing Adoption of Smart Home Ecosystem Driving the Market Growth

The rising adoption of smart home ecosystems is driving demand for advanced light switches and electrical sockets equipped with app control, voice activation, and programmable settings. These products allow homeowners to personalize lighting schedules, automate energy use, and manage connected devices remotely. According to a recent report by the Association for Smart Home Professionals, the US smart home industry surpassed USD 29 billion in value and is expected for further expansion. The demand is high in urban households where convenience, security, and energy management are key priorities. This strong market growth reflects how digital living is becoming mainstream, prompting manufacturers and real estate developers to incorporate smart-enabled switches and sockets as standard features in modern housing. The growing awareness of energy conservation and user convenience is pushing more consumers to invest in intelligent lighting solutions, further driving market demand.

Smart switches and sockets help manage home energy use efficiently by using features such as occupancy sensors, dimmers, and programmable timers to adjust lighting based on time of day or room activity. These technologies comply with global sustainability goals, encouraging builders and households to install energy-saving devices. Governments and energy agencies are supporting this transition through building codes and incentives focused on reducing power consumption and carbon emissions. This creates long-term market opportunities for manufacturers offering eco-efficient and automated lighting products.

Rapid Urbanization and Ongoing Construction Activities Boost the Market

The ongoing expansion of global infrastructure, including residential, commercial, and industrial construction projects, is boosting the demand for light switches and electrical sockets. Rapid urban development, in developing regions is resulting in extensive housing, commercial complexes, industrial parks, and mixed-use developments which require modern and durable electrical fittings. Urban expansion and the construction of new buildings to support rising population densities are increasing the demand for high-quality, efficient, and technologically advanced electrical hardware across all segments of the construction industry.

According to a United Nations report, urban areas are projected to add 2.5 billion more residents by 2050, driven by the sustained global shift from rural to urban living. This large-scale population migration is accelerating construction activity and driving upgrades in core infrastructure worldwide. Developers, real estate investors, and construction firms are now placing greater focus on installing electrical systems that meet evolving safety policies, deliver long-term reliability, and support integration with smart and energy-efficient technologies. This growing focus on quality, safety, and future-readiness is significantly boosting demand for modern light switches and sockets across both new construction and renovation projects in urban regions.

Segmental Insights

Type Analysis

The global segmentation, based on type includes, light switches and electrical sockets The light switches segment is projected to reach substantial share by 2034. This growth is driven by rising demand for modern lighting control solutions in residential, commercial, and industrial applications. Increasing consumer inclination toward aesthetics, smart home technologies, and user-friendly controls propelled the demand for touch-sensitive and remote-operated light switches. Manufacturers are continuously innovating in design and functionality to meet evolving customer expectations. The growing trend toward minimalistic designs and integration with voice and mobile app controls is further accelerating the segment’s steady growth.

The electrical sockets segment is projected to grow at a robust pace in the coming years, owing to the increasing connectivity requirements in households and commercial establishments. Growing reliance on digital gadgets, small home appliances, and hybrid work environments is pushing consumers to upgrade to multi-functional sockets with features such as USB ports, surge protection, and energy monitoring. The expanding infrastructure in smart offices and public spaces is also contributing to the deployment of intelligent sockets to manage electricity consumption effectively. Enhanced safety standards, compact design innovations, and compatibility with modular wiring systems are positioning electrical sockets as essential components in smart building designs globally.

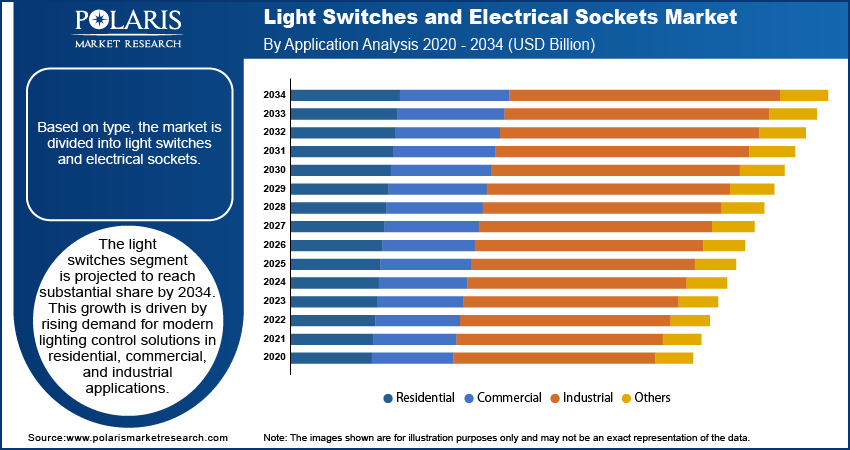

Application Analysis

The global segmentation, based on application includes, residential, commercial, industrial, and others. The residential segment dominated the market, in 2024. This dominance is driven by the rising adoption of smart home technologies, increasing renovation activity, and the growing need for modern electrical infrastructure across urban and semi-urban households. Consumers are increasingly seeking safety, design aesthetics, and convenience in home installations, pushing demand for innovative switches and sockets to meet the evolving lifestyle preferences. The widespread popularity of smart home ecosystems, across technologically advanced regions such as North America and Western Europe, is boosting the deployment of wireless-enabled, voice-activated, and app-controlled switch and socket systems. Government-backed programs promoting energy-efficient construction and home electrification are further boosting the adoption of light switches and electrical sockets. For instance, the Indian government Eco-Niwas Samhita (ENS) initiative to promote energy-efficient residential buildings. This strong growth is expected to drive electricity consumption in India from approximately 500 billing unit (BU) in 2025 to nearly 700 BU by 2030. It provides technical support to builders, conduct training programs to improve skills in energy-efficient construction, and offer financial incentives for using sustainable methods and materials.

The commercial segment is projected to grow at a robust pace during the forecast period. This growth is due to the consistent investments in smart office buildings, co-working environments, public healthcare infrastructure, and modern retail spaces. Enterprises and developers are increasingly integrating intelligent light switches and sockets with automation features to enhance energy management, improve facility performance, and meet global building standards. Additionally, the growing enforcement of green building codes and environmental certification programs is pushing commercial developers to adopt future-ready electrical solutions that reflect operational and regulatory objectives. For instance, the 2024 International Green Construction Code (IgCC) introduced a comprehensive systems-based approach for the design, construction, and operation of buildings. This code emphasizes enhanced indoor environmental quality, reduced resource consumption, improved neighborhood integration, and better walkability.

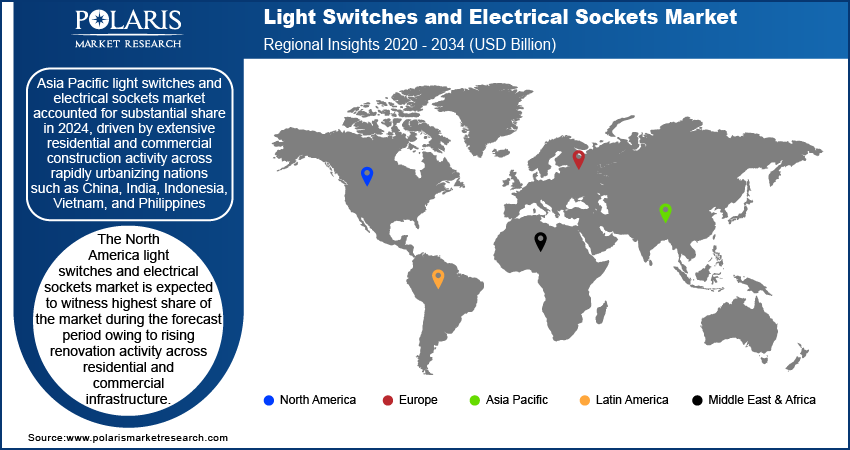

Regional Analysis

Asia Pacific light switches and electrical sockets market accounted for substantial share in 2024, driven by extensive residential and commercial construction activity across rapidly urbanizing nations such as China, India, Indonesia, Vietnam, and Philippines. As new housing developments and infrastructure projects scale up across these countries, the demand for reliable and aesthetically versatile electrical fittings continues to rise. Also, tourism-driven construction activity is further playing a strong role in expanding the market across Thailand, Malaysia, and Australia. These facilities are increasingly deploying advanced switches and sockets that blend form with function. Rising adoption of decorative, touch-sensitive, and sensor-enabled switches in the commercial sector further fuels the market growth in the region.

China Light Switches and Electrical Sockets Market Insight

China light switches and electrical sockets market growth is driven by the government’s aggressive push toward smart city infrastructure and the enforcement of green building codes. New residential and commercial buildings are being developed with energy efficiency standards that require high-quality, intelligent electrical systems. For instance, in May 2024, China released new guideline aimed at advancing smart city development and accelerating urban digital transformation. The directive sets a goal of achieving substantial progress by 2027, with plans to establish several smart cities that are more livable, efficient, and resilient. The growing volume of high-rise construction projects and modernization efforts across urban centers is leading to large-scale procurement of smart switches and modular sockets.

North America Light Switches and Electrical Sockets Market Trend

The North America light switches and electrical sockets market is expected to witness highest share of the market during the forecast period owing to rising renovation activity across residential and commercial infrastructure. In countries such as the US and Canada, there is a consistent trend toward home remodeling and infrastructure modernization, driven by aging electrical systems in older buildings. According to the Leading Indicator of Remodeling Activity (LIRA), homeowners spent USD 463 billion on renovation projects during the first quarter of 2024. Homeowners are increasingly upgrading their living spaces to meet modern safety standards and design preferences, which is driving demand for advanced, modular, and visually cohesive switches and sockets. These upgrades increasingly include smart features such as voice control, app connectivity, and energy monitoring, aligning with the growing smart home adoption across the region.

Commercial expansion is further influencing the demand for light switches and electrical sockets. The ongoing development of co-working spaces, tech parks, and urban commercial hubs is creating significant requirements for durable, modular electrical fittings that can easily configured and scaled. Construction companies are seeking high-performance switches and sockets that integrate seamlessly with modern building management systems, offering better control over lighting, energy usage, and load distribution. This evolving preference for smarter, design-forward solutions is propelling the growth of the market.

Europe Light Switches and Electrical Sockets Market Overview

Europe light switches and electrical sockets market is fueled by strong regulatory emphasis on energy efficiency and modernization of existing building stock. Countries such as Germany, France, and the UK are implementing policies to comply with the European Green Deal, requiring improvements in energy performance across residential and commercial properties. These policies are fuelling the adoption of advanced electrical fittings that reduce power wastage and support building management systems.

Retrofit projects across Western and Northern Europe are accelerating, as governments and private developers upgrade older infrastructure with smart, modular electrical components. There is a strong preference for energy-efficient devices with programmable features and integration capabilities is evident in both commercial and residential segments. Moreover, growing consumer awareness regarding product safety, operational convenience, and compliance with EU standards is influencing purchasing behavior. The region’s shift toward stricter building codes and environmental targets is driving steady growth in demand for next-generation light switches and sockets, supported by continuous product innovation and wider distribution networks.

Key Players & Competitive Analysis Report

The light switches and electrical sockets market is highly competitive, marked by strong rivalry among established global players and regional manufacturers. Companies are actively focused on broadening their product portfolios, integrating advanced features, and enhancing their global manufacturing and distribution capabilities. Strategic moves such as mergers, acquisitions, and joint ventures are increasingly being adopted to strengthen market presence, expand into new geographies, and meet the growing demand from residential, commercial, and industrial sectors. With the evolving consumer preferences, manufacturers are investing in smart home technologies, energy-efficient solutions, and modular construction product designs that align with modern architectural trends. The competitive landscape is further shaped by the integration of digital technologies such as IoT, wireless control, and touch-based interfaces.

Prominent players in the light switches and electrical sockets market include Legrand SA, Hubbell Incorporated, Schneider Electric SE, Feidiao Electrical Co., Ltd., Siemens AG, T&J Electric Co., Ltd., Leviton Manufacturing Co., Inc., ABB Ltd., Simon, S.A., SOBEN Electric Co., Ltd., Panasonic Holdings Corporation, and Vimar S.p.A.

Key Players

- Legrand SA

- Hubbell Incorporated

- Schneider Electric SE

- Feidiao Electrical Co., Ltd.

- Siemens AG

- T&J Electric Co., Ltd.

- Leviton Manufacturing Co., Inc.

- ABB Ltd.

- Simon, S.A.

- SOBEN Electric Co., Ltd.

- Panasonic Holdings Corporation

- Vimar S.p.A.

Industry Developments

July 2025: ABB Vietnam launched three new switch and socket ranges ORIGEN, INORA, and ZENIT in Ho Chi Minh City. This product delivers smart, safe, and stylish wiring solutions such as LED backlights, USB charging, child-safety shutters, modular frames, and KNX integration enhancing user experience and modern building compatibility.

October 2024: Schneider Electric launched the Miluz ZeTa home range, introducing switches and sockets featuring an industry-first air quality indicator (AQI), space-saving switch-sockets, voltage surge protection, LED foot lamps, USB A + C charging ports, and seamless integration with the Wiser smart-home system.

September 2024: Clipsal by Schneider Electric launched the Solis range, a premium collection of light switches and electrical sockets featuring industrial ceramic finishes, playful asymmetrical design, and ultra-slim covers across two series matte black/white and Solis T in brushed brass, anodized aluminum, and white ceramic.

Light Switches and Electrical Sockets Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Light Switches

- Electrical Sockets

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Light Switches And Electrical Sockets Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 27.42 Billion |

|

Market Size in 2025 |

USD 30.09 Billion |

|

Revenue Forecast by 2034 |

USD 70.60 Billion |

|

CAGR |

9.94% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 27.42 billion in 2024 and is projected to grow to USD 70.60 billion by 2034

The global market is projected to register a CAGR of 9.94% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Legrand SA, Hubbell Incorporated, Schneider Electric SE, Feidiao Electrical Co., Ltd., Siemens AG, T&J Electric Co., Ltd., Leviton Manufacturing Co., Inc., ABB Ltd., Simon, S.A., SOBEN Electric Co., Ltd., Panasonic Holdings Corporation, and Vimar S.p.A.

The residential segment dominated the market, in 2024.

The light switches segment is projected to reach substantial share by 2034.