Liquid Embolic Agent Market Size, Share, & Industry Analysis Report

By Product Type (Ethylene Vinyl Alcohol Copolymer (EVOH), Cyanoacrylates, Others), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6327

- Base Year: 2024

- Historical Data: 2020-2023

Overview

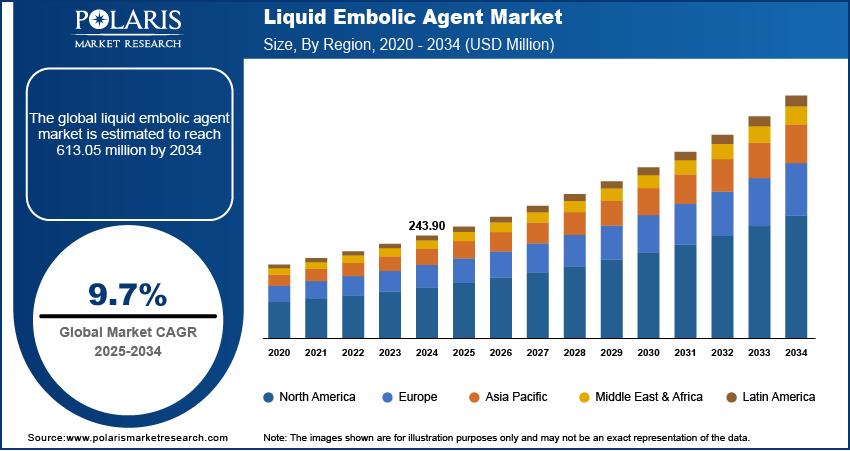

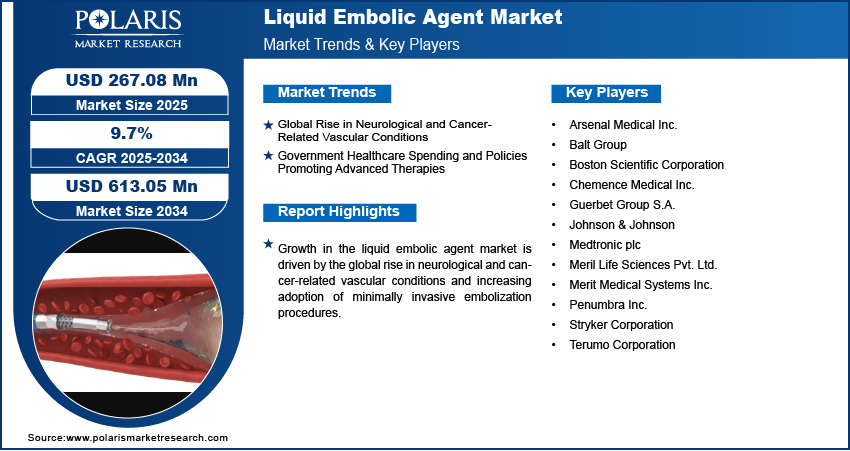

The global liquid embolic agent market size was valued at USD 243.90 million in 2024, growing at a CAGR of 9.7% from 2025–2034. The global rising neurological and cancer-related vascular conditions coupled with government healthcare spending and policies promoting advanced therapies is driving demand for liquid embolic agents.

Key Insights

- The EVOH segment dominated the global liquid embolic agent market share in 2024.

- The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR during the forecast period, fueled by demand for cost-effective outpatient embolization and advancements in microcatheter delivery.

- The North America liquid embolic agent market dominated the global share in 2024, fueled by strong clinical adoption, favorable reimbursement policies, and presence of established healthcare infrastructure.

- The U.S. liquid embolic agent market accounted for the largest regional share in North America in 2024, driven by high procedure volumes, early adoption of novel embolics and concentration of key market players.

- The Asia Pacific liquid embolic agent market is projected to grow at the fastest CAGR during the forecast period, fueled by rising incidence of neurovascular disorders, healthcare infrastructure expansion, and government investment in advanced medical technologies.

- The China liquid embolic agent market is expanding rapidly, propelled by increasing adoption of minimally invasive embolization procedures, local production of liquid embolics, and supportive regulatory initiatives.

Industry Dynamics

- Global rise in neurological and cancer-related vascular conditions is driving demand for liquid embolic agents in neurovascular and oncology applications.

- Government healthcare spending and supportive policies for advanced therapies are accelerating adoption of minimally invasive embolization procedures.

- Technological advancements including non-adhesive and bioresorbable liquid embolics along with integration of AI-assisted imaging is creating market opportunities.

- High procedure cost, limited reimbursement coverage and shortage of skilled interventional radiologists in developing regions are restraining market growth.

Market Statistics

- 2024 Market Size: USD 243.90 Million

- 2034 Projected Market Size: USD 613.05 Million

- CAGR (2025–2034): 9.7%

- North America: Largest Market Share

AI Impact on Liquid Embolic Agent Market

- AI enhances procedural planning by analyzing patient scans to predict vessel behavior and optimize the delivery volume and injection strategy for embolization.

- It enables personalized medicine by helping customize agent selection and dosage based on individual patient anatomy and specific lesion characteristics.

- AI aids in outcome prediction by modeling how an agent will flow and solidify, allowing physicians to anticipate efficacy and potential complications.

- It accelerates clinical research by analyzing treatment data to identify patterns of success and refine next-generation embolic agent formulations.

The liquid embolic agent industry focuses on the development and use of liquid-based embolization products for the treatment of vascular abnormalities, tumors and uncontrolled bleeding. These agents are widely applied across neurology, oncology and interventional radiology to block abnormal blood flow and support minimally invasive treatment outcomes. The market is shaped by product categories such as cyanoacrylate-based agents, polymer-based formulations and newer non-adhesive embolics. Clinical use is expanding due to the rising demand for targeted therapies, shorter recovery times and reduced surgical complications.

In clinical practice, liquid embolic agents are used to treat arteriovenous malformations, aneurysms, gastrointestinal bleeding and hypervascular tumors. Advancements in delivery systems, including microcatheters and image-guided navigation, improve precision and procedural safety. Growing availability of training programs and specialized centers is also strengthening physician adoption. For instance, in July 2025, Medtronic introduced the PELE IDE trial to evaluate its Onyx Liquid Embolic System for treating peripheral arterial hemorrhage. The study will enroll up to 119 patients across 25 U.S. sites to support potential FDA approval.

The liquid embolic agent market is expanding as healthcare systems adopt minimally invasive surgery procedures and prioritize cost-efficient treatment approaches. Regulatory approvals for new formulations, along with investments in clinical research, are driving the introduction of next-generation agents. Rising prevalence of neurological disorders and cancer-related vascular complications is creating sustained demand across hospitals and specialty clinics. In addition, strategic partnerships between device manufacturers and healthcare providers are supporting product accessibility in developed and emerging markets. Industry growth is further driven by innovations in bioresorbable embolics, combination therapies, and AI in medical imaging guidance, which are expected to enhance treatment outcomes and drive long-term market expansion.

Drivers & Opportunities

Global Rise in Neurological and Cancer-Related Vascular Conditions: The rising global burden of neurological disorders such as brain aneurysms, arteriovenous malformations, and stroke is creating significant demand for liquid embolic agents. The Global Burden of Disease (GBD) study indicates that the number of people living with brain-related diseases is projected to double by 2050. Currently, more than 40% of the world’s population is affected by some form of neurological condition. Cancer-related vascular complications, including tumor hypervascularity and gastrointestinal bleeding, further expand the scope of clinical applications. The higher prevalence of these conditions are increasing the need for effective minimally invasive procedures that reduce risks associated with open surgeries. According to the American Cancer Society, excluding non-melanoma skin cancers, more than 2 million new cancer cases are expected to be diagnosed in the US in 2025. The disease is also projected to cause over 618,000 deaths, which equals approximately 1,700 deaths per day. Also, the growing aging population is contributing to the incidence of vascular abnormalities. According to the World Health Organization (WHO), one in six people worldwide will be aged 60 years or older by 2030, and the number of older adults will reach 2.1 billion by 2050, doubling from 2020 levels. Nearly 80% of this population will live in low- and middle-income countries. Moreover, greater disease awareness and improved diagnostic capabilities are expanding patient pools. In addition, hospital adoption of advanced embolization therapies supports steady market growth.

Government Healthcare Spending and Policies Promoting Advanced Therapies: Government healthcare spending is strengthening access to advanced treatment options, creating opportunities for the adoption of liquid embolic agents. Public programs and policy initiatives are focusing on expanding minimally invasive interventions to improve outcomes and reduce long-term costs. Also, reimbursement frameworks and funding support in developed economies are pushing hospitals to integrate new embolization products. Moreover, favorable regulatory pathways are enabling faster product approvals, allowing companies to introduce innovative formulations. In addition, government-driven infrastructure upgrades in emerging markets are improving access to specialized care facilities. These combined measures are driving demand for advanced neurovascular and oncology solutions.

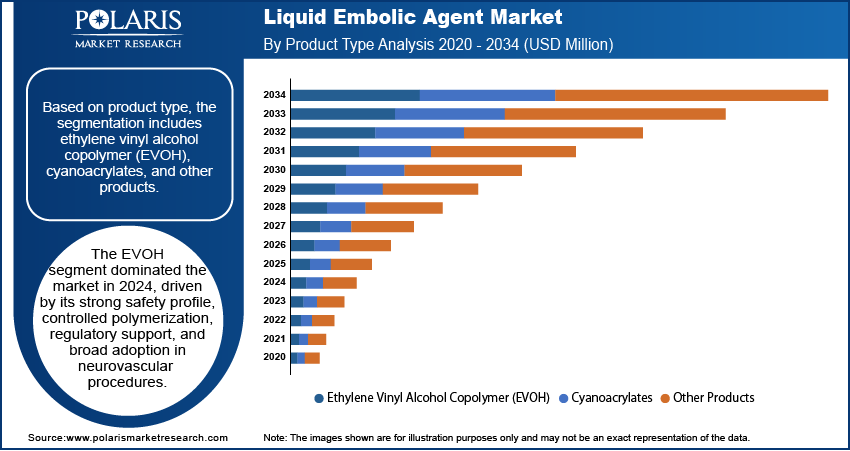

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes ethylene vinyl alcohol copolymer (EVOH), cyanoacrylates, and other products. The ethylene vinyl alcohol copolymer (EVOH) segment dominated the market in 2024, driven by its proven safety profile, non-adhesive characteristics and reliable performance in neurovascular procedures. EVOH agents are widely used in the treatment of arteriovenous malformations and aneurysms due to their superior penetration and controlled polymerization. Also, regulatory approvals and growing physician familiarity fueled its position as the preferred embolic material across hospitals and specialized clinics. Moreover, integration with advanced delivery catheters further enhanced treatment precision. In addition, widespread adoption across developed healthcare systems contributed to the segment’s strong market share.

The cyanoacrylates segment is projected to grow at the fastest CAGR during the forecast period, due to their rapid polymerization and strong adhesive properties, which are highly effective in acute bleeding management. Cyanoacrylate embolics are gaining adoption in oncology and gastrointestinal procedures where immediate vessel occlusion is critical. Also, their lower cost compared to other embolic agents is supporting adoption in emerging markets. Moreover, technological improvements in formulation reduced the risk of catheter adhesion. In addition, expanding use in peripheral vasculature applications is expected to strengthen demand and drive significant growth.

Application Analysis

Based on application, the segmentation includes arteriovenous malformations (AVM), hypervascular tumors, peripheral vasculature hemorrhage, and other applications. The arteriovenous malformations (AVM) segment dominated the liquid embolic agent market in 2024, driven by the high prevalence of arteriovenous malformations and the growing clinical preference for liquid embolization as a minimally invasive treatment option. As an example, in April 2024, Cerenovus, a Johnson & Johnson MedTech company launched the TRUFILL n-BCA Liquid Embolic System Procedural Set in the U.S. The FDA-cleared kit combines all required components into one sterilized pack, streamlining preparation for hemorrhagic stroke and AVM procedures. EVOH and other liquid agents provide targeted occlusion of abnormal vessels, reducing risks associated with open surgery. Also, advancements in neuroimaging and catheter navigation are improving success rates in AVM procedures. Moreover, favorable reimbursement policies in developed economies are supporting treatment adoption. In addition, the availability of specialized neurointerventional centers fueled demand for embolization therapies, making AVM the leading application segment in the industry.

The hypervascular tumors segment is projected to grow at the fastest CAGR during the forecast period, due to the rising prevalence of liver, kidney, and other cancers requiring embolization to restrict tumor blood supply. Tumor embolization reduces intraoperative bleeding and improves treatment outcomes in oncology care. Also, growing clinical evidence on improved survival rates is strengthening physician adoption. Moreover, hospitals are integrating embolization into multimodal cancer therapy strategies alongside surgery and chemotherapy. In addition, rising cancer incidence in Asia-Pacific and Latin America is expected to accelerate demand for tumor embolization procedures.

End User Analysis

Based on end user, the segmentation includes hospitals, specialty clinics, ambulatory surgical centers (ASCs), and other end users. The hospitals segment dominated the market in 2024, driven by the availability of advanced imaging facilities, trained specialists, and reimbursement coverage for embolization procedures. Hospitals remain the primary setting for neurovascular and oncology interventions, where liquid embolics are used for complex cases requiring high precision. Also, the integration of hybrid operating rooms enhanced procedural efficiency. Moreover, hospitals are witnessing increasing patient inflow due to rising awareness of minimally invasive therapies. In addition, growing partnerships with medical device companies for product training and trials are further driving the adoption of liquid embolic agents in hospitals.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR during the forecast period, due to the rising demand for cost-effective and outpatient-based embolization procedures. ASCs are growing popular as they offer shorter waiting times, lower procedure costs, and faster recovery compared to hospitals. Also, regulatory approvals supporting embolization procedures in outpatient settings are boosting adoption. Moreover, advancements in microcatheter technology and safer liquid embolics are enabling complex procedures to be performed in ASCs. In addition, rising investments by private operators in specialized centers are expected to support rapid segment expansion.

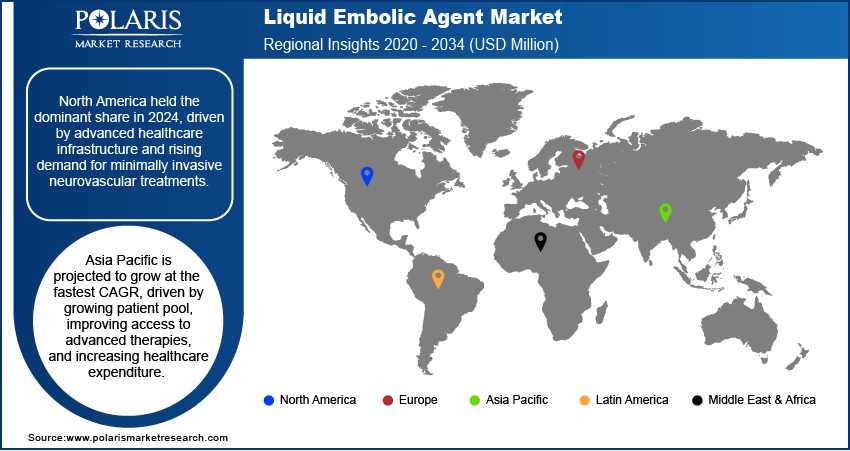

Regional Analysis

North America liquid embolic agent market dominated the global market in 2024. This is fueled by the high prevalence of neurological disorders such as brain aneurysms and arteriovenous malformations. Moreover, the region benefits from well-established neurovascular centers and the presence of leading medical device companies that actively invest in research and development. In addition, favorable reimbursement frameworks in the U.S. push hospitals and clinics to adopt advanced embolization therapies. Furthermore, growing clinical trials and regulatory approvals are driving the region’s position as the largest revenue-generating market.

The U.S. Liquid Embolic Agent Market Insight

The U.S. held a dominating market share in the North America liquid embolic agent landscape in 2024, driven by the high burden of neurological disorders and wide availability of trained interventional radiologists. Moreover, strong insurance coverage and regulatory support for advanced therapies push hospitals to adopt liquid embolic agents for neurovascular and oncology procedures. For instance, in July 2025, Arsenal Medical’s NeoCast liquid embolic showed positive results in the EMBO-02 trial for chronic subdural hematoma. The study reported 100% vessel occlusion, strong hematoma resolution, no major safety concerns, and pain-free administration under conscious sedation. In addition, the presence of leading companies such as Medtronic and Stryker, which continuously launch innovative embolization products, strengthens market competitiveness. Furthermore, the well-established clinical trial hub, advancing evidence-based use of embolics and fueling its position as the largest contributor to North America’s market.

Europe Liquid Embolic Agent Market

The liquid embolic agent landscape in Europe is projected to hold a substantial share in 2034. This is owing to the rising incidence of neurovascular and cancer-related vascular complications. Moreover, healthcare systems in countries such as Germany, France, and the UK are focusing on expanding access to minimally invasive procedures. In addition, government funding for research collaborations between hospitals, medical universities, and device manufacturers is advancing clinical innovation. Furthermore, the presence of a skilled workforce in interventional radiology is strengthening adoption, positioning Europe as a key hub for liquid embolic agent development and adoption.

Asia Pacific Liquid Embolic Agent Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is expanding due to the rising cancer prevalence, particularly liver and kidney cancers that require embolization procedures. According to the Indian Council of Medical Research (ICMR), around 20 million new cancer cases and 9.7 million deaths were reported globally in 2022. In India, approximately 100 out of every 100,000 people are diagnosed with cancer. It is also estimated that more than 1.4 million new cancer cases were recorded in the country in 2023. Moreover, rapid hospital infrastructure expansion in China and India is improving access to advanced interventional therapies. In addition, government healthcare spending and awareness programs are enabling faster adoption of minimally invasive treatments in emerging economies. Furthermore, rising partnerships between global manufacturers and regional healthcare providers are pushing training and product availability, making Asia-Pacific the most dynamic growth market in the industry.

China Liquid Embolic Agent Market Overview

The market in China is expanding due to rising incidence of cancer and neurological conditions requiring embolization. Moreover, hospital modernization fueled by government healthcare reforms is improving accessibility to advanced neurointerventional procedures. In addition, increasing collaborations between domestic manufacturers and international players are accelerating product introduction and physician training. Furthermore, growing investments in oncology-focused care and large patient pools are driving procedure volumes, positioning China as a major growth engine within Asia-Pacific and an important destination for global companies seeking to expand in emerging healthcare markets.

Key Players & Competitive Analysis Report

The liquid embolic agent market is moderately competitive, with leading players focusing on innovative embolization products and advanced delivery systems to strengthen clinical outcomes in neurovascular and oncology procedures. Companies are expanding their portfolios with non-adhesive formulations, bioresorbable agents, and microcatheter-based delivery platforms to improve precision and safety. Moreover, rising collaborations between medical device manufacturers, hospitals and research institutions are supporting clinical trials and accelerating regulatory approvals. In addition, region-specific strategies and partnerships are enhancing product accessibility, driving long-term competitiveness across hospitals, specialty clinics and ambulatory surgical centers worldwide.

Major companies operating in the liquid embolic agent industry include Medtronic plc, Johnson & Johnson, Stryker Corporation, Terumo Corporation, Balt Group, Boston Scientific Corporation, Penumbra Inc., Merit Medical Systems Inc., Guerbet Group S.A., Arsenal Medical Inc., Meril Life Sciences Pvt. Ltd., and Chemence Medical Inc.

Key Players

- Arsenal Medical Inc.

- Balt Group

- Boston Scientific Corporation

- Chemence Medical Inc.

- Guerbet Group S.A.

- Johnson & Johnson

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Merit Medical Systems Inc.

- Penumbra Inc.

- Stryker Corporation

- Terumo Corporation

Industry Developments

- August 2025: Instylla received FDA premarket approval for its Embrace Hydrogel Embolic System, the first liquid embolic cleared in the U.S. for treating hypervascular tumors in peripheral arteries up to 5 mm.

- July 2025: Arsenal Medical’s NeoCast liquid embolic showed promising results in the EMBO-02 trial for treating chronic subdural hematoma. The study reported 100% vessel occlusion, high hematoma resolution rates and no injection-related pain, highlighting its potential as a safe, pain-free alternative to surgery.

Liquid Embolic Agent Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Ethylene Vinyl Alcohol Copolymer (EVOH)

- Cyanoacrylates

- N-BCA (n-Butyl Cyanoacrylate)

- N-HCA (n-Hexyl Cyanoacrylate)

- Other Products

By Application Outlook (Revenue, USD Million, 2020–2034)

- Arteriovenous Malformations (AVM)

- Hypervascular Tumors

- Peripheral Vasculature Hemorrhage

- Other Applications

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Other End Users

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Liquid Embolic Agent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 243.90 Million |

|

Market Size in 2025 |

USD 267.08 Million |

|

Revenue Forecast by 2034 |

USD 613.05 Million |

|

CAGR |

9.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 243.90 million in 2024 and is projected to grow to USD 613.05 million by 2034.

The global market is projected to register a CAGR of 9.7% during the forecast period.

North America dominated the liquid embolic agent market in 2024, driven by high incidence of neurological disorders, strong adoption of advanced interventional therapies, and favorable reimbursement policies.

A few of the key players in the market are Medtronic plc, Johnson & Johnson, Stryker Corporation, Terumo Corporation, Balt Group, Boston Scientific Corporation, Penumbra Inc., Merit Medical Systems Inc., Guerbet Group S.A., Arsenal Medical Inc., Meril Life Sciences Pvt. Ltd., and Chemence Medical Inc.

The EVOH segment dominating the market in 2024 due to its safety profile, controlled polymerization, regulatory approvals and widespread adoption in neurovascular procedures.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR during the forecast period, driven by demand for cost-effective outpatient embolization, regulatory support and increasing investments in specialized centers.