Low Rolling Resistance Tire Market Size, Share, & Industry Analysis Report

: By Application (On-Road and Off-Road), By Vehicle Type, By Sales Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5684

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

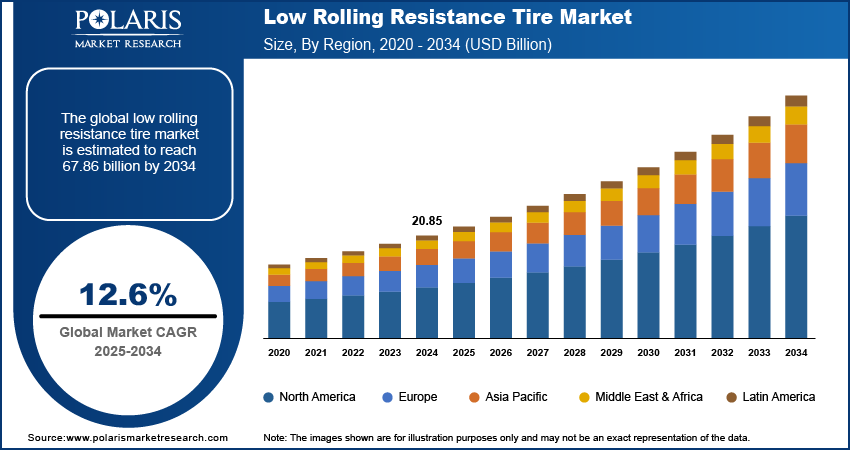

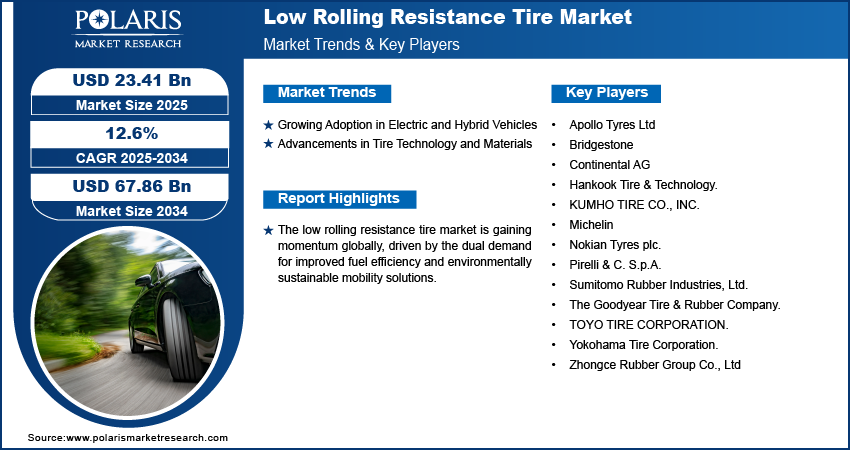

The global low rolling resistance (LLR) tire market was valued at USD 20.85 billion in 2024 and is expected to register a CAGR of 12.6% from 2025 to 2034. The growing adoption of consumer awareness of eco-friendly mobility is boosting growth opportunities in the field of low rolling resistance tires.

Low rolling resistance tires are specially designed tires that minimize energy loss as they roll, thereby enhancing fuel efficiency and reducing carbon emissions. Both commercial and passenger vehicle segments are increasingly adopting these tires as fuel economy becomes a top priority across transportation sectors. The rising demand for fuel efficiency and cost savings further expands the growth for low rolling resistance tires. A July 2022 consumer report found that reducing rolling resistance by 10% leads to approximately a 1% increase in fuel efficiency. Consumers and fleet operators are actively seeking solutions that deliver long-term savings, with fuel expenses accounting for a substantial share of vehicle operating costs. This supports cost-effective operations and also aligns with consumer preferences for environmentally conscious and economically viable mobility solutions.

The demand for low-rolling resistance tires is growing due to the influence of strict environmental regulations. Governments and regulatory bodies worldwide are enforcing tighter emission norms and sustainability targets aimed at reducing greenhouse gas emissions from the automotive sector. According to a report by the European Commission, in April 2023, the EU amended Regulation (EU) 2019/631 to tighten CO₂ standards for new cars and vans, aligning with the 2050 climate goals. It sets stricter 2030 targets and mandates 100% emission cuts for both vehicle types from 2035. These policies are driving automotive OEMs and tire manufacturers to develop technologies that align with regulatory frameworks. Low rolling resistance tires contribute to achieving lower carbon dioxide (CO₂) emissions by improving overall vehicle efficiency, making them a preferred choice in regulatory compliance strategies. Therefore, as global attention on sustainable transportation grows, these tires are seen as essential for meeting environmental and performance standards.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Growing Adoption in Electric and Hybrid Vehicles

The growing adoption of electric vehicles and hybrid vehicles further boosts the low rolling resistance tire demand, primarily due to the unique performance demands of these vehicles. For instance, IEA data 2024 stated that nearly 14 billion electric cars were sold in 2023, with China, Europe, and the US accounting for 95% of sales. Electric and hybrid powertrains are engineered for maximum efficiency, and tire performance plays a critical role in optimizing battery range and energy consumption. Low rolling resistance tires reduce the amount of energy lost through tire deformation and heat generation, thereby extending driving range, which is an essential metric for EV and hybrid vehicle users. Integrating these tires is a strategic choice for automotive manufacturers to improve vehicle efficiency, address range anxiety, and support sustainability goals.

Advancements in Tire Technology and Materials

Advancements in tire technology and materials are propelling the adoption of low rolling resistance tire by enabling manufacturers to strike a balance between efficiency, durability, and safety. Innovations in tread design, silica-based compounds, and lightweight construction techniques have greatly improved the rolling efficiency of tires without compromising on grip, wear resistance, or ride comfort. In February 2021, Apollo launched the Amazer XP, a low-rolling-resistance tire range for entry-level hatchbacks and sedans in India. Available in seven sizes (12–14 inches), these tires aim to improve fuel efficiency by 1–2%, potentially saving up to USD 72 annually on fuel. These technological enhancements allow low rolling resistance tires to perform best with conventional tires across various driving conditions, thereby increasing their appeal to a broader consumer base. Thus, as R&D investments continue to refine tire engineering, these advancements are expected to drive adoption across diverse vehicle categories further.

Segment Insights

Assessment by Vehicle Type

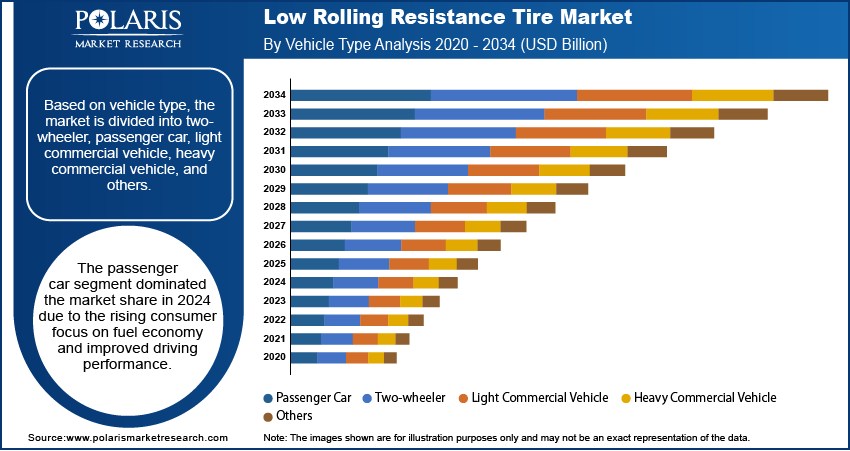

The global low rolling resistance tire market segmentation, based on vehicle type, includes two-wheeler, passenger car, light commercial vehicle, heavy commercial vehicle, and others. The passenger car segment dominated the market in 2024, primarily driven by the rising consumer focus on fuel economy and improved driving performance. Automakers have increasingly integrated low rolling resistance tires to meet evolving efficiency standards, with a growing number of fuel-efficient and eco-friendly models being introduced across this segment. Additionally, the high production volume and widespread usage of passenger cars across urban and suburban regions have further amplified demand. Consumers are also becoming more environmentally conscious, opting for vehicles and components that reduce carbon emissions and operating costs, thereby reinforcing the dominance of this segment.

Evaluation by Sales Channel

The global low rolling resistance (LLR) tire market segmentation, based on sales channel, includes OEM and aftermarket. The aftermarket segment is expected to witness the fastest growth during the forecast period due to the increasing consumer awareness and the rising need for replacement tires that improve fuel efficiency. Tire replacements become unavoidable, and buyers are increasingly opting for low rolling resistance options to improve mileage and reduce long-term fuel costs as vehicles age. The growing accessibility of these tires through diverse retail channels, coupled with an expanding base of environmentally conscious consumers, supports this trend. Furthermore, advancements in tire technology and marketing efforts by manufacturers are encouraging adoption outside the OEM segment, accelerating aftermarket growth.

Regional Analysis

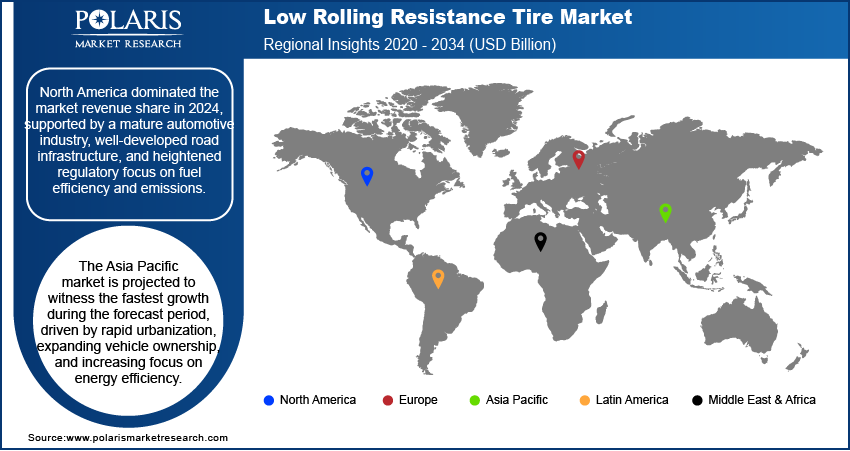

By region, the report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024, supported by a mature automotive segment, well-developed road infrastructure, and heightened regulatory focus on fuel efficiency and emissions. According to a June 2024 report by the US Federal Register, NHTSA finalized CAFE standards requiring 2% annual fuel economy improvements for passenger cars from 2027 to 2031 and light trucks from 2029 to 2031, with no increase for light trucks from 2027 to 2028. Heavy-duty pickups/vans face 10% 2030-32 and 8% 2033-35 yearly hikes. The region’s strong consumer preference for performance and sustainability has driven the adoption of advanced tire technologies, such as the low rolling resistance variants. Additionally, the presence of major automotive manufacturers and tire companies has facilitated widespread integration of these tires, both in OEM installations and aftermarket offerings. Policy incentives and strict environmental standards further propelled the North America low rolling resistance tire market expansion during the year.

The Asia Pacific low rolling resistance tire market is projected to witness the fastest growth during the forecast period, propelled by rapid urbanization, expanding vehicle ownership, and increasing focus on energy efficiency. Emerging economies within the region are witnessing a surge in demand for fuel-efficient vehicles, supported by evolving consumer preferences and government initiatives promoting sustainability. Local and international tire manufacturers are also scaling up production capabilities to cater to growing demand, further strengthening the momentum. Thus, as mobility patterns shift toward cost-effective and eco-conscious solutions, the adoption of low rolling resistance tires is expected to accelerate, especially in this region.

Key Players & Competitive Analysis

The low rolling resistance tire segment is witnessing robust growth, driven by rising demand for fuel-efficient and eco-friendly mobility solutions. Major players such as Michelin, Bridgestone, and Continental AG are leveraging competitive intelligence and strategy to strengthen their positions in developed markets, whereas emerging markets present untapped revenue opportunities. Strategic investments in sustainable value chains and disruptive technologies are reshaping the industry, with economic and geopolitical shifts influencing supply chain dynamics. Revenue growth analysis indicates strong potential in passenger cars and EVs, while expansion opportunities in Asia Pacific and Europe remain focal points. Expert insights highlight latent demand and opportunities in commercial vehicle segments, supported by technological advancements in compound formulations. Companies must align with future development strategies, including partnerships and sustainable value chains, to maintain a competitive positioning in this high-growth sector as the trends evolve.

Pirelli & C. S.p.A., founded in 1872 in Milan, Italy, is a tire manufacturing company renowned for its technological innovation and commitment to quality. Pirelli has consistently pushed the boundaries of tire technology with a legacy rooted in developing advanced rubber products and a focus on high-performance and premium automotive markets. The company’s flagship offering in the low rolling resistance segment is the Cinturato P7, its first “Green Performance” tire, specifically engineered to improve fuel efficiency and reduce environmental impact without compromising safety or driving pleasure. The Cinturato P7 achieves low rolling resistance through advanced tread compounds, an optimized tread pattern, and a unique structural design, resulting in improved fuel economy, lower CO₂ emissions, and extended tire life. Features such as four wide longitudinal grooves for aquaplaning resistance, compact central blocks for enhanced handling, and Pirelli’s Noise Cancelling System (PNCS) for reduced road noise contribute to a comfortable and safe driving experience. Additionally, technologies such as Run Flat and puncture-proof construction add safety and convenience. Pirelli’s continuous innovation cycle ensures regular updates to meet evolving emission and performance standards, positioning the company at the forefront of sustainable tire solutions for modern vehicles.

Yokohama Tire Corporation is a global tire manufacturer recognized for its commitment to innovation, quality, and environmental responsibility. Established in 1969 in the US, Yokohama has built a reputation for advanced tire technologies serving a broad range of vehicles, such as passenger cars, trucks, and commercial fleets. In the low rolling resistance tire market, Yokohama stands out with its BluEart series and SmartWay-verified commercial tires, designed to improve fuel efficiency and reduce carbon emissions. The company’s proprietary Maximized Conservation Concept (MC2) technology minimizes heat generation in the casing and tread, lowering rolling resistance by up to 10% and delivering significant cost-per-mile savings for fleets. Products such as the TY577 MC2 and 712L long-haul drive tires combine deep tread patterns for durability, advanced wear resistance, and optimized traction, all while meeting strict US EPA SmartWay standards for LRR performance. Yokohama’s ongoing research and development focus on eco-friendly materials and innovative design ensures its LRR tires deliver long tread life, superior handling, and environmental benefits.

List of Key Companies in Low Rolling Resistance Tire Market

- Apollo Tyres Ltd

- Bridgestone

- Continental AG

- Hankook Tire & Technology.

- KUMHO TIRE CO., INC.

- Michelin

- Nokian Tyres plc.

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire & Rubber Company.

- Toyo Tire Corporation.

- Yokohama Tire Corporation.

- Zhongce Rubber Group Co., Ltd

Low Rolling Resistance Tire Industry Developments

April 2024: Continental launched its fifth-generation Conti Eco tire line for freight transport, targeting EU Taxonomy compliance. The redesigned tires reduce fuel consumption, CO2 emissions, and costs while balancing rolling resistance and mileage.

September 2024: Michelin launched the X LINE ENERGY 3 and X MULTI ENERGY 2 tires, emphasizing fuel efficiency and lateral grip while maintaining balanced performance. The products integrate connected services for fleet needs, continuing Michelin’s century-long focus on durable, high-performance solutions.

March 2024: Goodyear launched the RangeMax RSA ULT and RTD ULT tires for regional delivery vehicles, compatible with electric and combustion engines. Designed for traction, efficiency, and durability, they address fleet demands for cost savings, sustainability, and low rolling resistance.

Low Rolling Resistance Tire Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- On-Road

- Off-Road

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Two-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

By Sales Channel Outlook (Revenue, USD Billion, 2020–2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Low Rolling Resistance Tire Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.85 Billion |

|

Market Size Value in 2025 |

USD 23.41 Billion |

|

Revenue Forecast by 2034 |

USD 67.86 Billion |

|

CAGR |

12.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 20.85 billion in 2024 and is projected to grow to USD 67.86 billion by 2034.

The global market is projected to register a CAGR of 12.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Apollo Tyres Ltd; Bridgestone; Continental AG; Hankook Tire & Technology; KUMHO TIRE CO., INC.; Michelin; Nokian Tyres plc; Pirelli & C. S.p.A.; Sumitomo Rubber Industries, Ltd.; The Goodyear Tire & Rubber Company; TOYO TIRE CORPORATION; Yokohama Tire Corporation; and Zhongce Rubber Group Co., Ltd.

The passenger car segment dominated the market share in 2024.

The aftermarket segment is expected to witness the fastest growth during the forecast period.