Lubricants Market Size, Share, Trends, Industry Analysis Report

: By Application, Base Oil (Mineral Oil, Synthetic Oil, and Bio-Based Oil), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1056

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

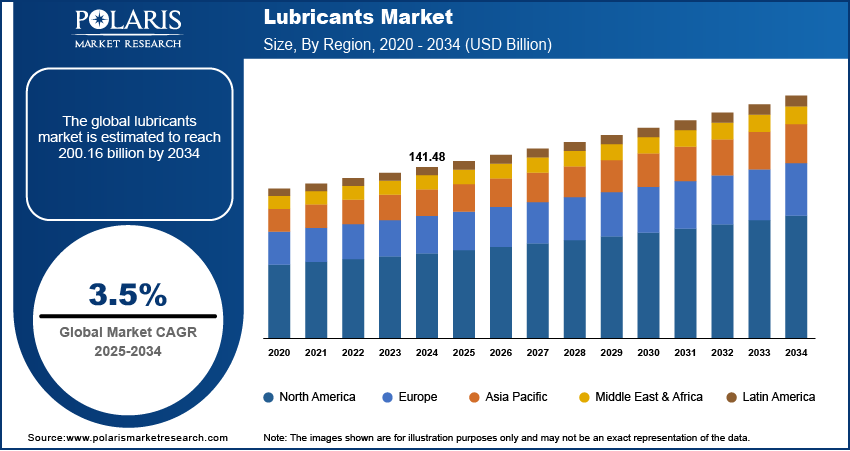

The global lubricants market size was valued at USD 141.48 billion in 2024, exhibiting a CAGR of 3.5% from 2025 to 2034. The market is growing due to rising demand from heavy industries and the need for high-performance engine oils in modern vehicles.

Key Insights

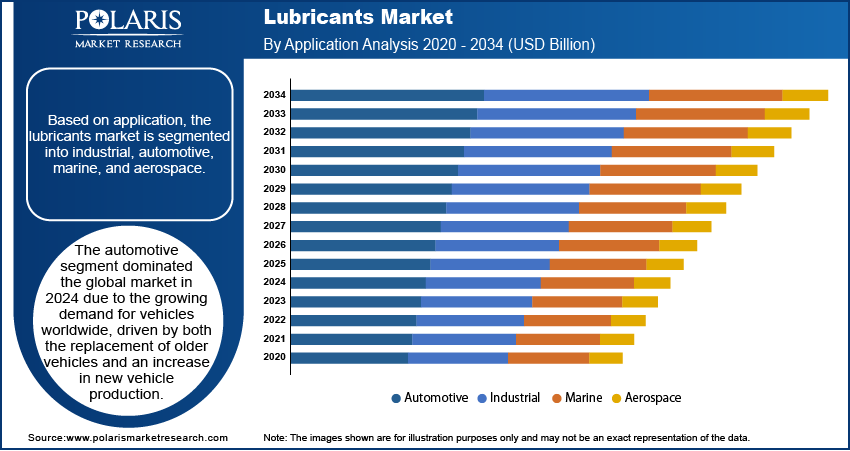

- The automotive industry led the global market in 2024, driven by a surge in demand for cars, including both replacements for older vehicles and new car production.

- Between 2025 and 2034, the synthetic oil category is expected to expand the most due to its higher performance, with improved thermal stability, resistance to oxidation, and enhanced engine protection under harsh conditions.

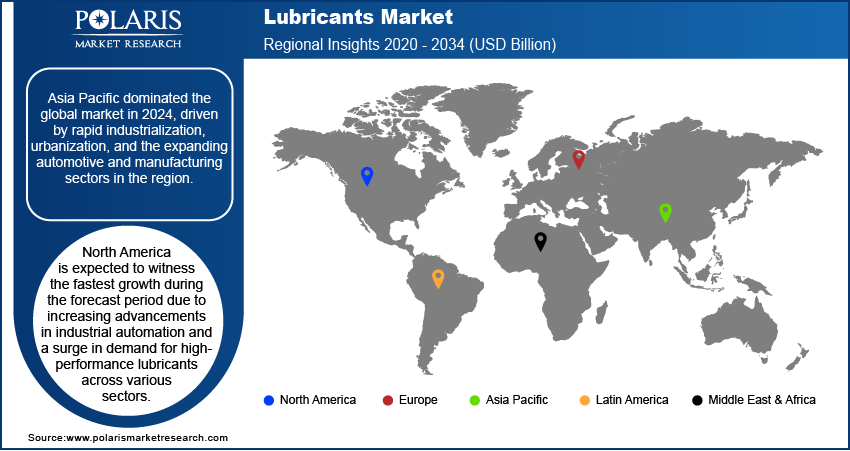

- In 2024, Asia Pacific led the market, driven by industrialization, urbanization, and the expansion of the manufacturing and automotive sectors in the region.

- North America is expected to have the highest growth rate over the forecast period, driven by advancements in industrial automation and the growing demand for high-performance lubricants across a wide range of industries.

Industry Dynamics

- The emergence of bio-based oils as environmentally friendly options to petroleum-derived lubricants is a sign of the industry's increased focus on eco-friendly practices. It serves to fuel further expansion in the lubricants market.

- The demand for high-performance lubricants, designed to enhance machinery functionality and reduce downtime, is increasing, driven by rising industrial activity, which in turn further boosts demand for lubricants.

- The increased uptake of complex engine technologies is driving a greater demand for high-performance lubricants that provide efficiency, minimize wear, and meet the requirements of new, fuel-efficient vehicles.

- Strict environmental policies and the volatility in raw material prices are the major restraints keeping the growth of the lubricants market in check.

Market Statistics

2024 Market Size: USD 141.48 billion

2034 Projected Market Size: USD 200.16 billion

CAGR (2025-2034): 3.5%

Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Lubricants are substances applied between surfaces in motion to reduce friction, wear, and heat generation, enhancing efficiency and performance in machinery and engines.

Lubricants play a vital role in reducing friction and heat between moving surfaces, thereby minimizing wear and preventing corrosion. They are essential for applications such as power transmission, gas sealing, and various industrial processes, including the use of engine oils and hydraulic fluids. Industries such as automotive, manufacturing, and mining are significant drivers of lubricants market demand. Additionally, the growing focus on eco-friendly lubricants and advancements in technology are fostering innovation. For instance, in February 2024, Kraton introduced SylvaSolve, a new line of bio-based oils derived from renewable sources, which are designed for a range of industrial applications such as coatings, adhesives and sealants, and personal care products. These oils offer a sustainable alternative to traditional petroleum-based lubricants, highlighting the increasing demand for environmentally friendly solutions in the market. This shift towards bio-based products underscores the industry's commitment to sustainability, further supporting lubricants market expansion.

Market Dynamics

Growing Demand from Mining, Construction, Agriculture, and Marine Industries

The mining, construction, agriculture, and marine industries rely heavily on machinery and equipment that operate under extreme conditions, requiring high-performance lubricants to ensure optimal efficiency and minimize wear and tear. In the mining and construction industries, heavy machinery such as excavators, crawlers & dozers, and trucks necessitate durable lubricants to withstand high pressure and temperatures. Similarly, in agriculture, lubricants are essential for tractors, harvesters, and other farming equipment to ensure smooth operations. The marine industry also depends on lubricants for vessels operating in harsh oceanic conditions. For instance, in February 2024, Chevron launched Rykon, a high-performance grease designed specifically for heavy-duty applications in industries such as mining, construction, agriculture, and marine. Made with a calcium sulfonate complex, it offers an alternative to lithium-based greases, enhancing equipment longevity and reducing costs. As these industries expand globally, particularly in emerging markets, the demand for specialized lubricants to enhance machinery performance and reduce downtime is expected to grow. Consequently, the increasing activity in these industries drives the lubricants market demand.

Increased Demand for High-Performance Engines in Vehicles

The need for specialized, high-performance lubricants has grown as vehicles incorporate advanced engine technologies, such as turbocharging and direct fuel injection. These lubricants are essential for enhancing engine efficiency, reducing wear, and maintaining performance under high stress and temperature conditions. The demand for premium engine oils and lubricants is expected to increase in response to the continued push for more powerful, fuel-efficient engines. For instance, in June 2024, Castrol India launched new variants in its Castrol EDGE line, offering up to 30% improved performance. The range includes EDGE Hybrid for hybrid engines, EDGE Euro Car for European OEMs, and EDGE SUV for high-performance SUVs, all formulated to meet the latest OEM specifications. This trend is particularly pronounced in markets with a strong preference for high-performance and luxury vehicles.

Segment Insights

Assessment Based on Application

The global lubricants market, based on application, is segmented into industrial, automotive, marine, and aerospace. The automotive segment dominated the global market in 2024 due to the growing demand for vehicles worldwide, driven by both the replacement of older vehicles and an increase in new vehicle production. The rising number of internal combustion engines (ICE) and electric vehicles (EVs) on the road leads to a higher demand for engine oils, transmission fluids, and other automotive lubricants. Additionally, advancements in engine technology, stricter fuel efficiency standards, and growing awareness of vehicle maintenance further contribute to the growing consumption of lubricants in this sector. The demand for high-performance lubricants, designed to meet stringent regulations and environmental standards, also propels the lubricants market revenue as the automotive sector continues to evolve.

Evaluation Based on Base Oil

The global lubricants market, based on base oil, is segmented into mineral oil, synthetic oil, and bio-based oil. The synthetic oil segment is expected to witness the fastest growth from 2025 to 2034 due to its superior performance characteristics, including better thermal stability, oxidation resistance, and enhanced engine protection under extreme conditions. The rising demand for fuel-efficient and high-performance vehicles, coupled with stringent environmental regulations, has increased the adoption of synthetic lubricants. Additionally, the longer drain intervals and lower environmental impact of synthetic oils as compared to mineral oils make them a preferred choice across various industries. Rising consumer awareness and technological advancements further propel the demand for synthetic oil-based lubricants.

Regional Analysis

By region, the study provides the lubricants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the lubricants market in 2024, driven by rapid industrialization, urbanization, and the expanding automotive and manufacturing sectors in the region. Countries like China and India have a pivotal role due to their high demand for industrial and automotive lubricants, supported by robust infrastructure projects and rising vehicle ownership. The presence of major lubricant manufacturers and advancements in refining technology further fuel the regional market growth. For instance, in February 2024, Seqens partnered with KK India Petroleum Specialties Pvt. Ltd. to distribute lubricant additives across India, Bangladesh, Sri Lanka, and Nepal. The collaboration aims to assist Indian customers with lubricant formulation, characterization, and troubleshooting. Additionally, rising investments in renewable energy and eco-friendly lubricants aligned with global sustainability trends contributed to this dominance. The region’s strong economic growth and focus on technological innovations have established it as a leader in the lubricants market.

The North America lubricants market is expected to witness the fastest growth during the forecast period due to advancements in industrial automation and a surge in demand for high-performance lubricants across various sectors. The region's strong automotive industry, coupled with the rising adoption of electric and hybrid vehicles, is fueling the need for specialized lubricants. Additionally, the growing focus on energy efficiency and sustainability is driving the demand for synthetic and bio-based lubricants. Investments in infrastructure development and the presence of major market players further accelerate market growth in North America.

Key Players and Competitive Insights

The competitive landscape of the lubricants market features global leaders and regional players aiming to capture market share through innovation, strategic collaborations, and regional expansion. Prominent players such as Exxon Mobil Corporation, Shell, Chevron Corporation, and TotalEnergies leverage extensive R&D capabilities and robust distribution networks to deliver advanced lubricants tailored for diverse applications, including automotive, industrial, and marine sectors. Market trends highlight the increasing demand for high-performance synthetic lubricants and bio-based solutions driven by stringent environmental regulations and a focus on sustainability. According to market insights, the lubricants market is set for significant growth, fueled by rapid industrialization, expanding automotive production, and the rising need for efficient machinery maintenance. Competitive strategies include mergers and acquisitions, partnerships with OEMs, and the launch of innovative, environmentally friendly lubricant products to cater to evolving consumer demands. These factors emphasize the importance of technological advancements, sustainability initiatives, and regional adaptability in shaping the market’s growth trajectory. A few key major players are Exxon Mobil Corporation; Idemitsu Kosan Co., Ltd.; China Petrochemical Corporation; Shell; Phillips 66 Company; Chevron Corporation; BP p.l.c.; AMSOIL INC.; Zeller+Gmelin; Quaker Chemical Corporation d/b/a Quaker Houghton; FUCHS; TotalEnergies; and LUKOIL.

Exxon Mobil Corporation is a multinational oil and gas corporation. It was formed in 1999 through the merger of Exxon Corporation and Mobil Corporation, two of the most prominent oil companies in the US. ExxonMobil is headquartered in Irving, Texas. The company is primarily engaged in the exploration, production, refining, and marketing of oil and natural gas, as well as the manufacturing and marketing of petrochemicals and other chemical products. Its core operations span the entire energy value chain. Exxon Mobil is a global energy company with operations in over 70 countries. It has a significant presence in both upstream (exploration and production) and downstream (refining and marketing) activities worldwide. The company explores and produces crude oil and natural gas in various regions, including the United States, Europe, Africa, Asia, and the Middle East.

TotalEnergies Corbion is a producer in Poly Lactic Acid (PLA) production, a renewable and biodegradable polymer. Their Luminy PLA line includes recycled content, offering versatility for applications in fresh food packaging, consumer goods, automotive, and 3D printing. PLA reduces carbon emissions, making it an eco-friendly alternative in various industries. The company offers their solutions for various application such as rigid food packaging, flexible packaging, food serviceware, durable goods, non-wovens, and 3D-printing. Total and Corbion established a 50/50 joint venture to produce and market polylactic (PLA) polymers, constructing a plant in Thailand, operational from 2017. TotalEnergies is a global energy company, employing 100,000 people, dedicated to providing affordable, reliable, and clean energy solutions across 130+ countries. Their focus is on accessible and responsible energy production, emphasizing low-carbon electricity, fuels, and natural gas. Corbion, market player, specializes in lactic acid derivatives, emulsifiers, enzymes, and algae ingredients. Utilizing fermentation expertise, Corbion delivers sustainable solutions for food preservation, health, and bioplastics, contributing significantly to various industries.

List of Key Companies

- Exxon Mobil Corporation.

- Idemitsu Kosan Co.,Ltd.

- China Petrochemical Corporation.

- Shell

- Phillips 66 Company.

- Chevron Corporation.

- BP p.l.c.

- AMSOIL INC.

- Zeller+Gmelin

- Quaker Chemical Corporation d/b/a Quaker Houghton

- FUCHS

- TotalEnergies

- LUKOIL

Lubricants Industry Developments

In July 2024, AMSOIL INC. introduced a new line of synthetic blend motor oils tailored for professional installers. The newly launched Synthetic-Blend Motor Oil features a formulation with over 50% synthetic content and is engineered to deliver superior performance and protection compared to traditional motor oils. Crafted with premium components, the oil is specifically designed to safeguard modern engines, including those with direct injection and turbocharging technology. The product line is available in three viscosity grades: 5W-20, 5W-30, and 0W-20.

In July 2024, Indian Oil launched STORM-X Racing Fuel, delivering 55 barrels from Paradip Refinery to the Madras International Circuit for the 3rd round of the Indian National Racing Championship.

In December 2024, Shell Helix Ultra introduced API SQ-ready products designed to enhance engine performance and protection. These products offer 100% power retention over extended use. They address challenges such as Low-Speed Pre-Ignition (LSPI) and high-pressure conditions, making them suitable for Turbocharged Gasoline Direct Injection (TGDI) engines.

In July 2022, ExxonMobil Lubricants Pvt. Ltd. launched its latest range of advanced lubricants for passenger vehicles in New Delhi, which feature cutting-edge technology and comply with the Indian government's BS-VI specifications. The new lubricants provide notable fuel economy benefits and offer enhanced wear protection and engine cleanliness via their Mobil Super All-In-One Protection and Mobil Super Friction Fighter series.

Lubricants Market Segmentation

By Application Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Industrial

- Process Oils

- General Industrial Oils

- Metalworking Oils

- Industrial Engine Oils

- Greases

- Others

- Automotive

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Marine

- Engine oil

- Hydraulic oil

- Gear oil

- Turbine oil

- Greases

- Others

- Aerospace

- Gas turbine oil

- Piston engine oil

- Hydraulic fluids

- Others

By Base Oil Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Regional Outlook (Volume – Kilotons, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 141.48 billion |

|

Market Size Value in 2025 |

USD 146.37 billion |

|

Revenue Forecast by 2034 |

USD 200.16 billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in kilotons, revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market was valued at USD 141.48 billion in 2024 and is projected to grow to USD 200.16 billion by 2034.

The global market is projected to register a CAGR of 3.5% from 2025 to 2034.

Asia Pacific dominated the global market in 2024

A few of the key players in the market are Exxon Mobil Corporation; Idemitsu Kosan Co., Ltd.; China Petrochemical Corporation; Shell; Phillips 66 Company; Chevron Corporation; BP p.l.c.; AMSOIL INC.; Zeller+Gmelin; Quaker Chemical Corporation d/b/a Quaker Houghton; FUCHS; TotalEnergies; and LUKOIL.

The automotive segment dominated the market in 2024

The synthetic oil segment is expected to witness the fastest growth in the global lubricants market during the forecast period.